Textile Fabrics Market Outlook:

Textile Fabrics Market size was over USD 659.5 billion in 2025 and is anticipated to cross USD 1.29 trillion by 2035, witnessing more than 6.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of textile fabrics is assessed at USD 700.45 billion.

The textile fabrics market is expanding mainly due to the fashion industry's constant need for clothing and the explosive rise of e-commerce platforms. According to a 2021 UN Trade & Development (UNCTAD) report, the percentage of total retail sales from online retail sales jumped from 16% to 19% in 2020 due to the sharp expansion in e-commerce under the COVID-19 mobility restrictions. According to the most recent figures, e-commerce revenues increased by 4% worldwide from 2018 to USD 26.7 trillion in 2019.

The fashion and lifestyle sectors are seeing a rise in millennial demand for materials to produce classic, timeless designs as e-commerce gains traction. To meet this demand, online fabric retailers import high-quality textiles from around the globe, driving demand for the textile fabrics market.

Key Textile Fabrics Market Insights Summary:

Regional Highlights:

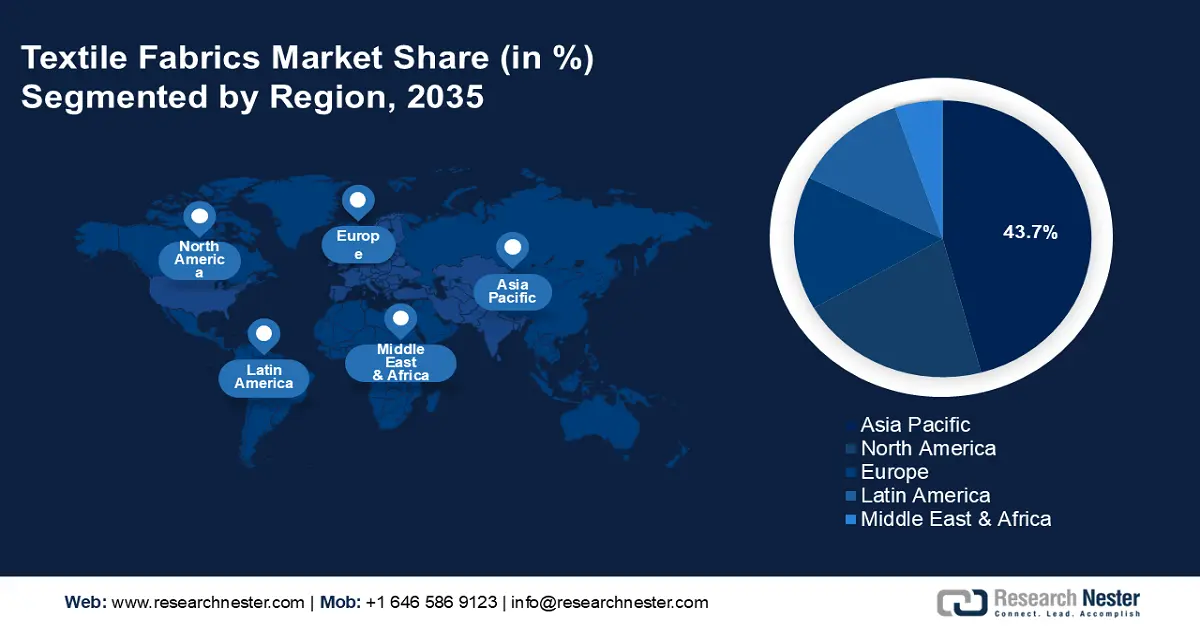

- Asia Pacific leads the textile fabrics market with a 43.7% share, fueled by the growing population, rising disposable incomes, and demand for higher-quality textile items, ensuring strong growth through 2035.

Segment Insights:

- The polyester segment is projected to hold over 53.2% market share by 2035 due to the superior qualities of polyester over natural fibers.

- The t-shirt segment is set for substantial growth from 2026-2035, due to widely adopted by professional landscapers and large property owners.

Key Growth Trends:

- Increased demand for natural fibers

- Advances in recycling technologies

Major Challenges:

- Fluctuating raw material prices

- Exposure to hazardous chemicals

- Key Players: Wolfin Textiles Ltd., Bombay Rayon Fashions Limited, Premier Textiles Limited, Stratasys Ltd., Klopman International S.r.l., TJX Companies, Inc., Zalando SE, Philips-Van Heusen Corporation, VF Corporation, Ralph Lauren Corporation.

Global Textile Fabrics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 659.5 billion

- 2026 Market Size: USD 700.45 billion

- Projected Market Size: USD 1.29 trillion by 2035

- Growth Forecasts: 6.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (43.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, Italy

- Emerging Countries: China, India, Japan, South Korea, Bangladesh

Last updated on : 13 August, 2025

Textile Fabrics Market Growth Drivers and Challenges:

Growth Drivers

- Increased demand for natural fibers: Since natural fiber composites are stronger and relatively lighter than conventional fibers, they are widely used in the automotive industry for exterior and interior purposes. Natural fibers from plants and animals include cashmere, hemp, jute, cashmere, silk, linen, cotton, and wool. These fibers are widely utilized to make apparel, accessories, building materials, medical treatments, and car interiors.

Due to the abundance of natural fibers, especially cotton, in China and India, the global textile industry is growing significantly. The National Bureau of Statistics of China reported that 5,977 thousand tons of cotton were produced overall, representing a 4.3% increase or a 246-thousand-ton gain over 2021. Moreover, IBEF stated that India is the world's top producer with 23% of the world's total cotton production. Also, more than 13.06 million hectares of cotton are grown, compared to 33.1 million hectares worldwide. - Advances in recycling technologies: The textile industry's rapid fashion practices have increased fiber consumption and waste production. According to a 2023, published article by Earth.Org Ltd. Reported that the annual production of textile waste is 92 million tons. The environmental damage caused by the production and disposal of textiles has accelerated the demand for effective recycling methods. According to the European Parliament, about 20% of the world's clean water pollution is caused by the dyeing and finishing of textiles.

To effectively address the end-of-life of textiles, research efforts have been driven toward more sustainable recycling alternatives due to growing environmental concerns. For instance, in January 2024, BASF and Inditex announced a breakthrough in promoting textile recyclability. BASF has launched loopamid, a polyamide 6 derived from 100% textile waste. This is the first circular solution for nylon garments. - Emergence of smart textiles: Smart textiles integrate electronics into fabrics, provide interactive capabilities, and are gaining popularity in fitness, healthcare, and fashion. With advancements like wearable sensors for ongoing vital sign monitoring, health condition tracking, and smart bandages that promote wound healing, the healthcare industry is among the biggest users of smart textiles. The growing need for individualized healthcare solutions is accelerating the widespread adoption of these textiles. Moreover, Activewear that tracks physical activity, muscular tension, and hydration levels incorporates smart textiles into items like shirts and sneakers.

Challenges

- Fluctuating raw material prices: Raw commodity prices, such as cotton, have risen dramatically over the previous five years as a result of global supply and demand. Due to the strain on profit margins, some textile makers have turned to other materials, such as polyester, since cotton has become more expensive to grow.

- Exposure to hazardous chemicals: The textile industry uses a variety of ionic chemicals, acids, industrial enzymes, and alkaline solutions in its daily operations. Various gases are combined with the surrounding air during the burning or singeing process (to eliminate floating fibers). Many of these substances have the potential to be extremely harmful to one's health (cancer risks). Wearing the appropriate safety gear is crucial to preventing such risks. Therefore, this factor may hinder the textile fabrics market.

Textile Fabrics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.9% |

|

Base Year Market Size (2025) |

USD 659.5 billion |

|

Forecast Year Market Size (2035) |

USD 1.29 trillion |

|

Regional Scope |

|

Textile Fabrics Market Segmentation:

Type (Cotton, Polycottons, Polyester)

Polyester segment is expected to hold over 53.2% textile fabrics market share by the end of 2035. The segment is growing due to the superior qualities of polyester over natural fibers. Polyester is a strong, crease-resistant, quick-drying, and reasonably priced fabric. It is extensively utilized in industrial applications, household furnishings, and clothing. In emerging countries, customers' increasing disposable income and rapid urbanization are growing sales of polyester-based clothing and home furnishings. The United Nations Organization stated that by 2050, it is anticipated that 68% of the world's population will reside in urban regions, up from 55%. These days, polyester fiber is crucial for transforming aging infrastructure into contemporary, sustainable, and efficient spaces. Its ease of installation potential for long-term cost savings and fewer maintenance requirements escalates its demand.

Application (T-shirts, Sportswear, Outdoor Clothing Performance Wear)

The t-shirt segment in textile fabrics market is estimated to garner a notable share in the forecast period. The segment growth can be attributed to the growing global appeal of athleisure and casual clothing. Customers are choosing comfy clothes that are adaptable to various settings. More than eight out of ten people (81%) prioritize comfort over price or fashion. Additionally, consumers can access a large selection of products and designs at reasonable costs due to the growing popularity of print-on-demand services and e-commerce platforms.

Our in-depth analysis of the textile fabrics market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Textile Fabrics Market Regional Analysis:

APAC Market Statistics

Asia Pacific textile fabrics market is projected to hold revenue share of over 43.7% by the end of 2035. The market is majorly expanding in the region due to the growing population, rising disposable incomes, and the increased need for higher-quality textile items. According to the United Nations Population Fund, approximately 4.3 billion people, or 60% of the world's population, live in the region, home to China and India, the two most populous nations on Earth. Furthermore, some of the biggest textile fabric producers in the world, including China, India, and Pakistan, are located in the region.

In India, the government’s proactive initiatives and policies are one of the primary factors propelling textile fabrics market growth. For instance, with an approved expenditure of USD 12.60 billion, the government launched the Production Linked Incentive (PLI) Scheme in 2020 to encourage the nation's production of MMF apparel, MMF fabrics, and technical textile products, allowing the textile industry to grow and become competitive. Moreover, the nation is enhancing its textile manufacturing capabilities through the adoption of e-commerce and ongoing machinery upgrades, which has helped the textile industry grow and become more competitive.

China is the world's largest textile exporter with yearly export earnings of USD 293.6 billion in 2023 and an annual GDP share of 8.7%. The textile sector employs about 8 million people. National marketplaces supply the majority of the raw materials. A significant portion of the manufacturing is for the domestic textile fabrics market, in addition to the export of primarily higher-quality goods. Also, textile companies are increasingly accelerating their digital transformation through advances in artificial intelligence (AI), 5G, and industrial internet. Additionally, the nation is seeing a greater degree of sector consolidation.

North America Market Analysis

North America will hold a significant share of the textile fabrics market in 2035. The growing demand for outdoor clothing and fabric t-shirts significantly supports the market's growth. It is also well known for its apparel, yarns, furniture, textiles, and raw materials.

In the U.S., automation, artificial intelligence (AI), and 3D printing are technological innovations transforming the textile manufacturing sector. These advancements provide higher-quality products, lower production costs, and greater efficiency. AI and automation make the industrial process, accurate and reliable, reducing waste and maximizing resource utilization. Furthermore, customers can easily acquire a wide range of textile products, including home textiles and apparel, through online retailing. Direct-to-consumer sales methods, effective inventory management, and customized shopping experiences are all made possible by the digital transition.

Technical textiles are developing in Canada in a business climate that is bolstered by scholarly research and solid industry expertise, which is favorable to the sector's continued expansion. Due to developments in the global textile industry, textiles are now more competitive with other materials, such as metals, wood, and plastics, for uses that have historically been reserved for these other materials.

Key Textile Fabrics Market Players:

- Wolfin Textiles Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bombay Rayon Fashions Limited

- Premier Textiles Limited

- Stratasys Ltd.

- Klopman International S.r.l.

- TJX Companies, Inc.

- Zalando SE

- Philips-Van Heusen Corporation

- VF Corporation

- Ralph Lauren Corporation

The textile fabrics market has been driven to create new, innovative items due to shifting consumer preferences and the need for new products. The industry is growing due to strategies such as global expansions, mergers, acquisitions, and strategic collaborations. Several government trade partnerships with online retailers such as Amazon, Flipkart, and others have helped them increase their sales.

Recent Developments

- In July 2024, Premier Textiles, a leading supplier of specialist fabrics, joins the Better Cotton Initiative (BCI) to promote eco-friendly practices and support sustainable cotton farming. The Better Cotton Initiative is an international endeavor to improve the livelihoods of cotton farmers and lessen environmental stress to make cotton production more sustainable.

- In April 2024, Stratasys Ltd. launched the Direct-to-Garment (D2G) solution for the J850 TechStyle printer, the latest addition to the Stratasys 3DFashion direct-to-textile printing technology.

- Report ID: 6837

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Textile Fabrics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.