Temperature Sensor Market Outlook:

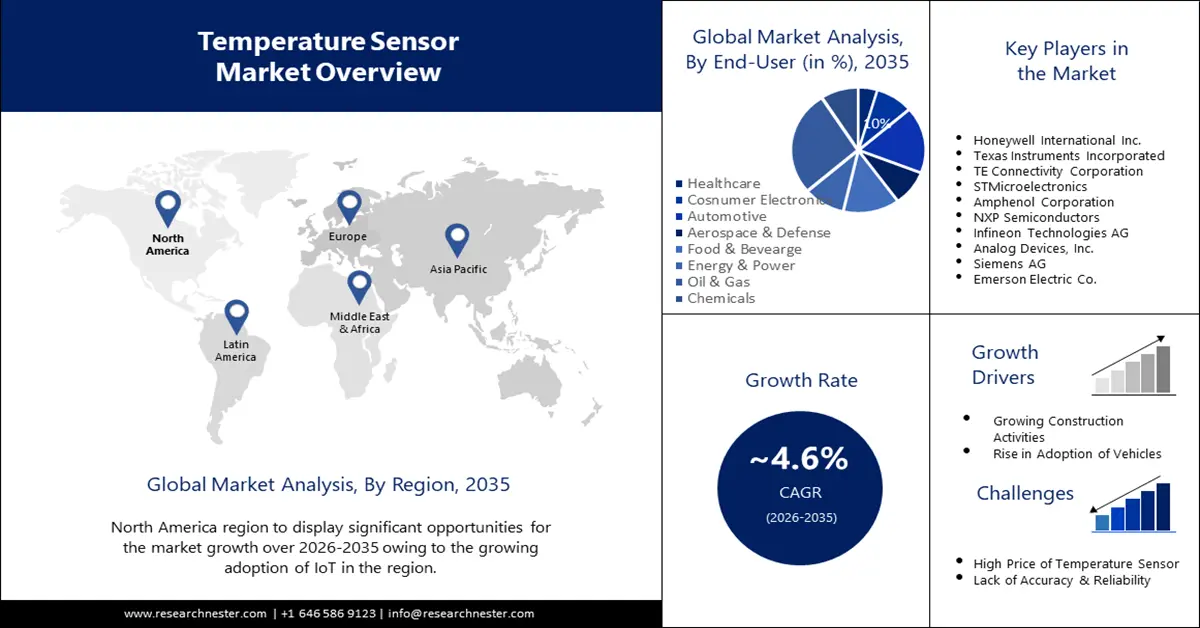

Temperature Sensor Market size was valued at USD 7.93 billion in 2025 and is likely to cross USD 12.43 billion by 2035, registering more than 4.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of temperature sensor is assessed at USD 8.26 billion.

Moreover, temperature sensors are widely employed in environmental monitoring for measuring temperature and offer vital information about the environment under observation. Hence, there usage is growing in weather stations.

Furthermore, with growing demand for food the need for temperature monitoring is also growing. The world would need to increase food production by approximately 59–69% by 2050 in order to feed more than 10 billion people. Also, temperature sensors are used in agriculture to measure soil temperatures to determine the best time to plant crops and to measure greenhouse temperatures to provide the best growing conditions.

Key Temperature Sensor Market Insights Summary:

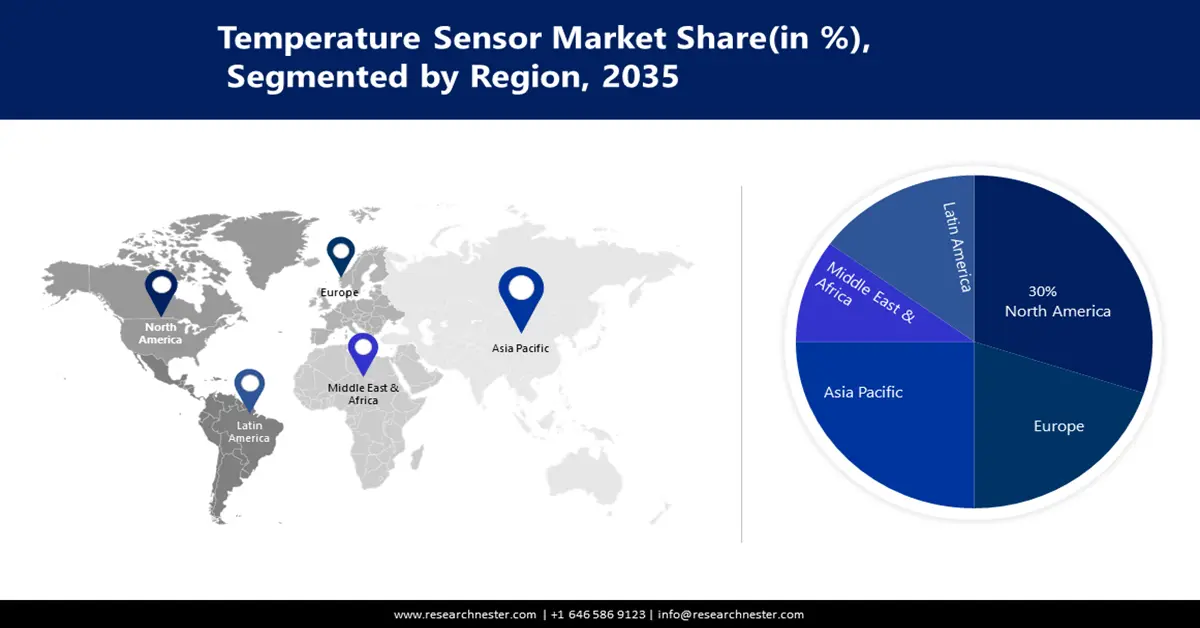

Regional Highlights:

- North America temperature sensor market holds the largest share by 2035, driven by growing adoption of IoT and stringent laws for temperature monitoring in pharmaceuticals and food safety.

- Asia Pacific market will achieve significant revenue share by 2035, driven by industrialization, automation, and demand from consumer electronics and agriculture.

Segment Insights:

- The thermocouple type segment in the temperature sensor market is expected to experience significant growth during 2026-2035, driven by thermocouples’ broad temperature range and durability in various environments.

- The oil & gas end-user segment in the temperature sensor market is projected to experience the highest CAGR over 2026-2035, driven by growing production of oil and gas requiring temperature monitoring.

Key Growth Trends:

- Growing Construction Activities

- Rise in Adoption of Vehicles

Major Challenges:

- High Price of Temperature Sensor

- Lack of Accuracy & Reliability

Key Players: Honeywell International Inc., Texas Instruments Incorporated, TE Connectivity Corporation, STMicroelectronics, Amphenol Corporation, NXP Semiconductors, Infineon Technologies AG, Analog Devices, Inc., Siemens AG, Emerson Electric Co.

Global Temperature Sensor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.93 billion

- 2026 Market Size: USD 8.26 billion

- Projected Market Size: USD 12.43 billion by 2035

- Growth Forecasts: 4.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, Japan, South Korea, India, Taiwan

Last updated on : 11 September, 2025

Temperature Sensor Market Growth Drivers and Challenges:

Growth Drivers

- Growing Construction Activities

As construction activity increases, so does the number of new structures being built. To keep the inside climate acceptable in these buildings, reliable and effective HVAC systems are needed. To monitor and manage the building's temperature, humidity, and air quality, temperature sensors are employed in these systems.

- Rise in Adoption of Vehicles

The temperature of the exhaust gases from automobiles is tracked by temperature sensors, which is crucial for regulating emissions and guaranteeing compliance with environmental laws.

- Surge in Demand for Smartphones

In smartphones, temperature sensors are used to track the battery's temperature in order to prevent overheating and lower the possibility of battery failure or damage.

- Growth in Number of Data Centers

In the entire world, there are about 7,999 data centers. Approximately 32% of the data centers among them are situated in the US. Hence, in order to monitor and regulate the facility's temperature and humidity levels, temperature sensors are frequently employed in data centers. In order to guarantee the dependable and effective operation of servers, networking hardware, and other crucial infrastructure in data centers, it is essential to maintain the right temperature and humidity levels.

- Upsurge in Production of Aerospace

Between 2019 and 2041, it is anticipated that the worldwide number of airplanes would grow from about 24,000 to approximately 47,000 aircrafts. In aerospace and aviation, temperature sensors are used to monitor vital components and make sure they are operating within acceptable temperature limits.

Challenges

- High Price of Temperature Sensor - In particular in price-sensitive industries or applications, the high cost of temperature sensors may function as a barrier to their adoption. The type of sensor, the degree of accuracy required, the range of temperatures monitored, and the features and functionality supplied may all impact the price of temperature sensors. Also, some temperature sensors may cost more since they need to adhere to particular industry standards or laws. Costly certification and compliance testing may be passed on to customers by manufacturers.

- Lack of Accuracy & Reliability

- Challenges Regarding Integration

Temperature Sensor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.6% |

|

Base Year Market Size (2025) |

USD 7.93 billion |

|

Forecast Year Market Size (2035) |

USD 12.43 billion |

|

Regional Scope |

|

Temperature Sensor Market Segmentation:

End-User

The oil & gas end-use segment in the temperature sensor market is anticipated to register highest revenue by 2035. The growth of the segment can be attributed to growing production of oil and gas. Monitoring the temperature of machinery, pipelines, and other elements involved in the production of oil and gas may assist with maintain safe operations. Temperature sensors have the ability to sound alarms or initiate automatic shutdowns when temperatures exceed safe limits, protecting against equipment failure or accidents.

Additionally, underground reservoir temperatures are monitored by temperature sensors, which may offer important information on oil and gas resources. Operators may optimize production operations and make educated judgements by observing variations in reservoir temperature since these changes may additionally be seen in fluid characteristics, pressure, and other parameters.

Type

The thermocouple segment is expected to have significant growth till 2035. From extremely low temperatures (-200°C or below) to extremely high temperatures (up to 2,300°C), thermocouples are capable of tracking temperatures over a very broad range. They are therefore perfect for use in a variety of situations, including as industrial, academic, and laboratory ones.

Additionally, thermocouples are strong and resistant to shock, vibration, and other environmental variables since they are quite simple to build and don't have any moving components. Thermocouples are reasonably priced in comparison to other kinds of temperature sensors, such as thermistors and RTDs (Resistance Temperature Detectors). They are therefore a sensible choice financially for many applications.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Temperature Sensor Market Regional Analysis:

North American Market Insights

North America, amongst all the other regions, is projected to have the highest temperature sensor market growth through 2035, backed by growing adoption of IoT along with surge in urban population. With a wide variety of devices being connected to the internet, the Internet of Things (IoT) is becoming more common in North America. For instance, in smart homes and buildings, many of these gadgets require temperature sensors to monitor and regulate temperature.

Moreover, in North America, there are stringent laws governing pharmaceuticals and food safety, necessitating precise temperature monitoring all throughout the supply chain.

APAC Market Insights

The Asia Pacific temperature sensor market is estimated to gain significant revenue share during the forecast timeframe. With an emphasis on automation and manufacturing, Asia Pacific is going through a massive industrialization process. Given their critical role in automated systems' accurate temperature monitoring and control, temperature sensors are in high demand at present in this region.

Additionally, consumer electronics, such as smartphones, computers, and other devices, have a significant market in Asia Pacific. The need for temperature sensors is fueled by the fact that these devices need them for precise temperature monitoring and management.

In developing countries, agriculture is a key industry. To monitor temperature and humidity levels in greenhouses and other agricultural areas, temperature sensors are employed in agriculture. Also, with several nations in the region investing in renewable energy sources, Asia Pacific is seeing considerable expansion in the energy and power sector.

Europe Market Insights

Europe market is estimated to grow at moderate CAGR in the coming years. Extreme weather, including hot summers and chilly winters, may be found in Europe. Given the need for precise temperature measurement and control in HVAC (heating, ventilation, and air conditioning) systems, there is an increasing demand for temperature sensors in this region.

Furthermore, the need for energy-efficient and intelligent appliances is driving the expansion of the home appliances industry in Europe. Appliances in the house, such refrigerators and ovens, employ temperature sensors to detect and regulate temperature precisely. Further, the demand for temperature sensors in various applications is rising as a result of initiatives and investments made by several European nations in infrastructure and technology development.

Temperature Sensor Market Players:

- Honeywell International Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Texas Instruments Incorporated

- TE Connectivity Corporation

- STMicroelectronics

- Amphenol Corporation

- NXP Semiconductors

- Infineon Technologies AG

- Analog Devices, Inc.

- Siemens AG

- Emerson Electric Co.

Recent Developments

- Emerson Electric Co. has introduced its new ASCO Series 641, 642 and 643 Aluminium Filter Regulators, which improve workflow effectiveness and decrease unscheduled downtime in a variety of process applications. These tough, aluminium filter regulators have the highest flow rates of any in their class, and they give accurate pressure regulation to instruments farther down the line.

- To complement its high performance AIROC CYW5459x Wi-Fi and Bluetooth combination portfolio, Infineon Technologies AG announced the addition of five new platform and module partners. Module partners Murata Electronics, AzureWave, and Quectel Wireless are other partners, as are platform partners NVIDIA and Rockchip Electronics Co. End users could shorten the time it takes for their finished products to reach the market thanks to these new partners.

- Report ID: 4935

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Temperature Sensor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.