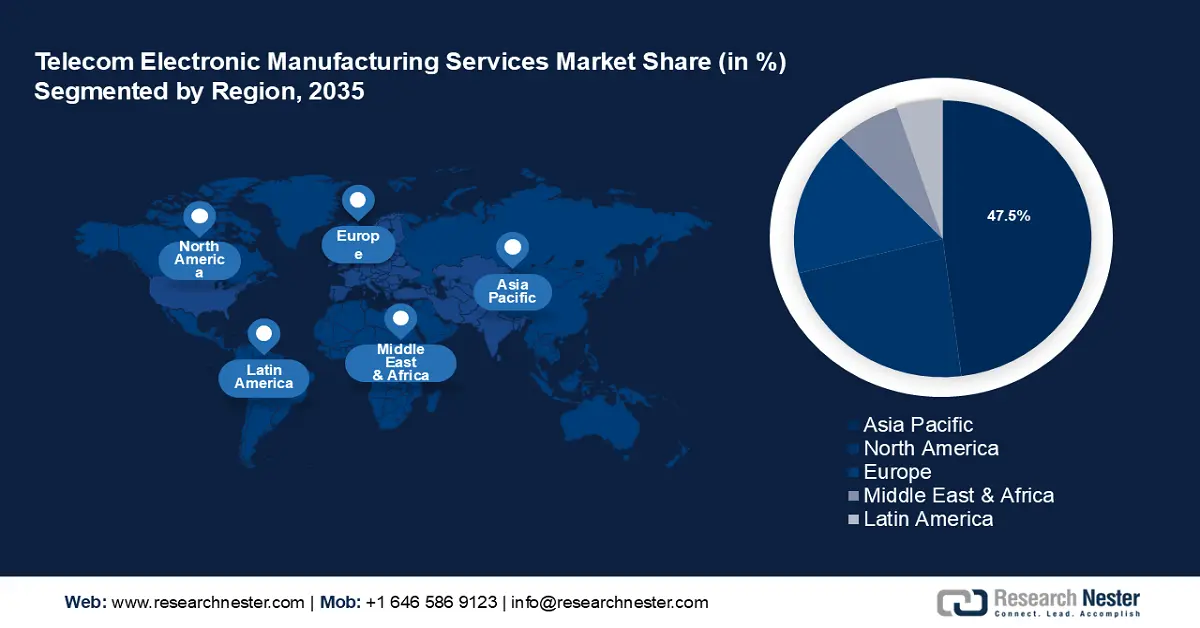

Telecom Electronic Manufacturing Services Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is predicted to dominate majority revenue share of 47% by 2035. The increasing number of mobile subscribers and the rise in internet penetration across Asia Pacific countries boost the need for advanced telecom equipment and services. In 2023, the region's unique mobile subscriber penetration rate was 63%, excluding Greater China. This value is expected to reach 70% by 2030.

Japan's telecommunications industry is expected to grow rapidly by 2030 propelled by an increasing number of 5G subscriptions and higher government investments in the development standardization of 6G networks.

The Asia Pacific telecom electronic manufacturing services market is foreseen to be controlled by the market in China, since the country is a global center for foreign electronic manufacturers and commands a leading position in the market for electronic manufacturing services worldwide.

Moreover, the presence of prominent electronic manufacturers in South Korea such as SK Hynix, Hanwha Techwin, LG Electronics, Samsung Electronics, Partron Corporation, and Simmtech, which consistently introduce cutting-edge products to the market and place a high priority on research and development may boost market demand for telecom electronic manufacturing services.

North American Market Insights

The North America telecom electronic manufacturing services market is projected to experience a significant rise in revenue encouraged by the surging investments by the government. The government has designated future telecommunications as one of its five essential priority technologies, which will help the market for telecom electronic manufacturing services to expand in the region. EMS providers discover a favorable climate for growth in areas where governments support investment and development which is essential for both economic expansion and competitiveness.

Companies in the U.S. may invest significantly in digital transformation, which will raise the demand for robust telecom infrastructure to support reliable connectivity. Moreover, leading EMS providers in the U.S. include companies such as Flex Ltd., Jabil Inc., and Sanmina Corporation. These companies offer a range f services from design and prototyping to full-scale manufacturing and logistics.

Furthermore, Canada boasts a strong and varied manufacturing industry that includes automobiles, telecommunications, and healthcare, which may create a greater need for telecom electronic manufacturing services (EMS). Investment in 5G infrastructure is a significant driver for the telecom electronic manufacturing services market , with increasing demand for high-speed network equipment.