Technology Licensing Market Outlook:

Technology Licensing Market size was over USD 2.1 billion in 2025 and is estimated to reach USD 5.6 billion by the end of 2035, expanding at a CAGR of 11.7% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of technology licensing is assessed at USD 2.3 billion.

The international technology licensing market is an essential engine for the modernized progressive economy, which has facilitated the commercialization of intellectual property (IP), encompassing the legal transfer of rights to utilize software platforms, patented advancements, and proprietary know-how from developers. According to an article published by the UK Government in July 2023, the concept of IP is extremely crucial for the UK economy, with an increase in intangible assets by 3.3%, amounting to an estimated £169.2 billion. Additionally, its utilization has been associated with a surge in corporate performance by effectively owning IP rights with optimized economic performance.

Furthermore, the sudden transition from platform to API-based licensing, along with a rise in patent pooling and non-practicing entities, tactical collaboration and cross-licensing, and focus on green tech licensing and sustainability, are also driving the market globally. As per the March 2023 HM Government report, an estimated 1/3rd of Europe’s carbon dioxide storage capacity is located in the UK, and the opportunity of the carbon capture, utilization and storage (CCUS) is projected to account for the international market for storage and transport components of £54 billion and £181 billion per year by the end of 2050. This is a massive contribution towards maintaining green licensing, which is suitable for uplifting the overall market.

Key Technology Licensing Market Insights Summary:

Regional Highlights:

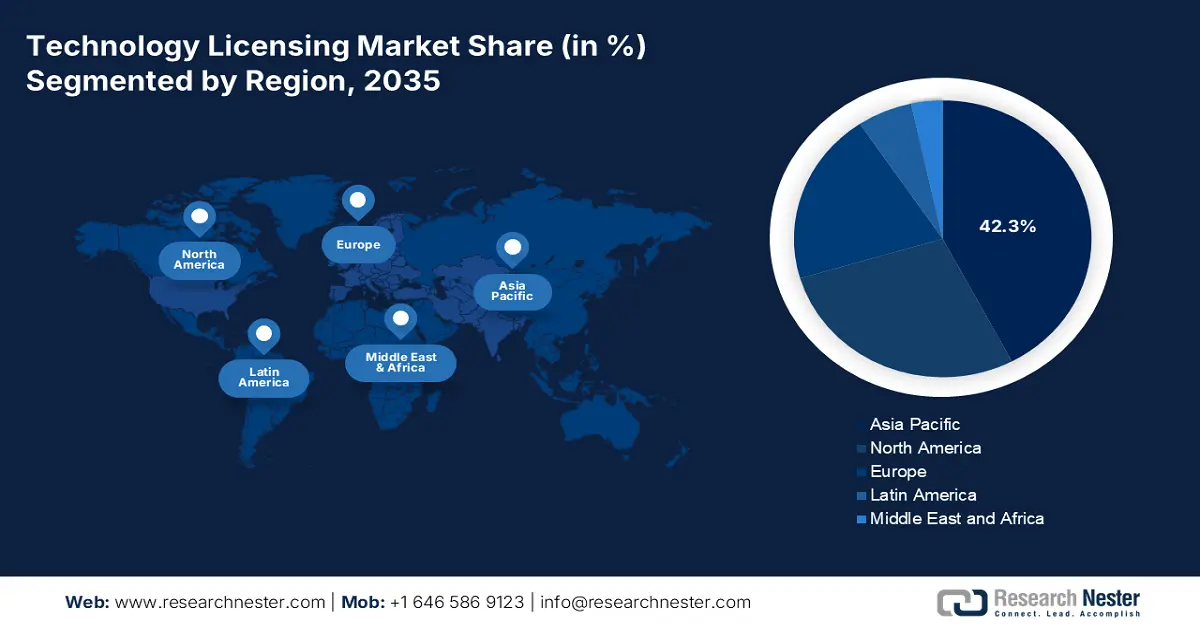

- By 2035, Asia Pacific in the technology licensing market is expected to secure a 42.3% share, due to strong government-led innovation, large-scale manufacturing capacity, and rapid digital-economy expansion.

- Europe is anticipated to emerge as the fastest-growing region through 2026-2035, supported by a robust start-up ecosystem, industrial manufacturing strength, and rising demand for technological resilience and digital sovereignty.

Segment Insights:

- By 2035, the enterprise (large and SME) segment in the technology licensing market is projected to account for a 55.8% share, bolstered by its ability to leverage licensing as a tactical tool to accelerate advancement, gain competitive advantages, de-risk R&D, and enable SMEs to adopt progressive technologies including specialized software, AI algorithms, and cloud platforms.

- Over 2026-2035, the long-term strategic partnerships (>5 years) segment is anticipated to attain the second-highest share, owing to effective collaboration involving co-development, co-investment, and access to foundational IP essential for long-lasting product cycles.

Key Growth Trends:

- Expansion of the Internet of Things (IoT)

- Rise in digital economy

Major Challenges:

- Antitrust litigation and administrative scrutiny

- IP transfer and geopolitical fragmentation gaps

Key Players: IBM (U.S.), Microsoft (U.S.), Qualcomm (U.S.), Google (Alphabet Inc.) (U.S.), Intel Corporation (U.S.), Samsung Electronics (South Korea), Sony Group Corporation (Japan), Canon Inc. (Japan), Telefonaktiebolaget LM Ericsson (Sweden), Nokia Corporation (Finland), Siemens AG (Germany), BASF SE (Germany), Philips (Netherlands), Taiwan Semiconductor Manufacturing Company (TSMC) (Taiwan), Hitachi, Ltd. (Japan), Toshiba Corporation (Japan), General Electric (GE) (U.S.), Texas Instruments (U.S.), CSL (Australia), Infosys (India).

Global Technology Licensing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.1 billion

- 2026 Market Size: USD 2.3 billion

- Projected Market Size: USD 5.6 billion by 2035

- Growth Forecasts: 11.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42.3% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Brazil, Singapore, United Arab Emirates, Israel

Last updated on : 4 November, 2025

Technology Licensing Market - Growth Drivers and Challenges

Growth Drivers

- Expansion of the Internet of Things (IoT): The proliferation of connected devices requires interoperability and heavily depends on standardized technologies, which is driving the technology licensing market internationally. According to an article published by the NIST Government in October 2024, the international GDP for these devices accounts for an estimated USD 100 trillion, which caters to 25% of the overall economy. In addition, adjacent and IoT technologies can add USD 1.3 to USD 3.1 trillion to the U.S.-based GDP, thus bolstering the market’s growth globally.

- Rise in digital economy: The aspect of a vibrant international startup ecosystem is considered a powerful dual-specific driver for the technology licensing market by leveraging established platforms and rapidly upscaling without the need for huge capital spending. For instance, as per the September 2024 ITA data report, there exist more than 650 million smartphones and 950 million internet users as of 2024, which has readily expanded the adoption of digitalized payments, e-commerce, and fintech. Therefore, this denotes a huge growth opportunity for the overall market in the worldwide scenario.

- Robust governmental support: The presence of substantial public funding and national reforms for promoting research in areas such as advanced manufacturing, quantum computing, and artificial intelligence is proactively uplifting the overall technology licensing market across different countries. This has further developed an ongoing pipeline for notable and licensable technologies from public research institutions as well as universities, thus creating an optimistic outlook for the overall market.

IP Process Phases Boosting the Technology Licensing Market Through Innovation (2022)

|

Research Phase |

% of Established Firm Cases |

% of New Venture Cases |

% of University Cases |

|

In-house |

82 |

10 |

- |

|

University research |

- |

30 |

91 |

|

Collaborative research |

18 |

20 |

9 |

|

Independent research |

- |

40 |

- |

Source: Journal of Cleaner Production

Challenges

- Antitrust litigation and administrative scrutiny: The technology licensing market witnesses complicated antitrust risks and regulatory scrutiny, especially regarding Standards-Essential Patents (SEPs). For instance, administrators in the majority of jurisdictions, such as China, the U.S., and Europe, are increasingly focused on providing licensing practices for technologies that are non-discriminatory, reasonable, and fair. This has resulted in protracted legalized battles over royalty rates, thus developing effective expenses and uncertainty for both licenses and licensors.

- IP transfer and geopolitical fragmentation gaps: The aspect of rising geopolitical tensions is directly impeding the IP and free flow of technology across different borders. Besides, national security concerns have readily prompted stringent controls on the cross-border and export transfer of severe technologies, especially in industries such as cybersecurity, AI, and semiconductors. This has deliberately pressured organizations to navigate a web of diversified national regulations, including the U.S. CHIPS Act and different Europe-based administrations, which can limit or prohibit licensing deals with entities in numerous nations.

Technology Licensing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

11.7% |

|

Base Year Market Size (2025) |

USD 2.1 billion |

|

Forecast Year Market Size (2035) |

USD 5.6 billion |

|

Regional Scope |

|

Technology Licensing Market Segmentation:

End user Segment Analysis

The enterprise (large and SME) segment in the technology licensing market is anticipated to garner the highest share of 55.8% by the end of 2035. The segment’s growth is extremely uplifted by its ability to collectively leverage technology licensing as the ultimate tactical tool to escalate advancement, achieve competitive benefits, and de-risk research and development, particularly among rapid industries, such as semiconductors, automotive, and software. Besides, small and medium-sized enterprises (SMEs) are successfully bolstering the demand, using licensing as a capital-efficient strategy to implement progressive technologies, including specialized software, AI algorithms, and cloud platforms.

Contract Duration Segment Analysis

The long-term strategic partnerships (>5 years) segment in the technology licensing market is projected to cater to the second-highest share during the predicted period. The segment’s exposure is fueled by effective collaboration, which frequently involves combined development, co-investment, and road mapping in futuristic technologies. In addition, this particular segment offers licensors with in-depth market integration, recurring revenue streams, and predictions, while licensees are able to gain stabilized accessibility to evolving and foundational IP, which is essential for long-lasting product cycles.

Type Segment Analysis

The software and platform licensing segment in the technology licensing market is expected to account for the third-largest share by the end of the forecast duration. The segment’s development is highly driven by its importance for both creators and users since it readily protects intellectual property, mitigates security and legal risks, manages expenses, and generates revenue. According to an article published by the GAO Government in January 2024, software vendors with the highest license quantity include Microsoft with 31.3%, followed by 10.4% for Adobe, 8.7% for Salesforce, 6.9% for Oracle, 5.2% for ServiceNow, and 4.3% for International Business Machines, thus uplifting the overall segment.

Our in-depth analysis of the technology licensing market includes the following segments:

|

Segment |

Subsegments |

|

End user |

|

|

Contract Duration |

|

|

Type |

|

|

Licensing Model |

|

|

Technology Maturity |

|

|

Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Technology Licensing Market - Regional Analysis

APAC Market Insights

Asia Pacific in the technology licensing market is anticipated to garner the largest share of 42.3% by the end of 2035. The market’s growth in the overall region is highly attributed to the effective combination of strong government-based innovation, huge manufacturing scale, and a rapid expansion in the digitalized economy. According to an article published by the UN Trade and Development in July 2024, Japan’s Ministry of Economy, Trade, and Industry published the DX Report 2.1, which projected to increase the country’s gross domestic product (GDP) by almost JPY 150 trillion, along with productivity to almost 30% by the end of 2030, thereby making it suitable for the market’s upliftment.

The technology licensing market in China is growing significantly, owing to the aspect of administrative expenditure on research and development, guidance from the Ministry of Industry and Information Technology (MIIT), and continuous growth across telecommunications and semiconductors. As per an article published by the State Council Information Office in January 2023, the country’s R&D expenditure surged to 3.0 trillion YUAN (USD 456 billion). This resulted in a 10.4% upsurge on a year-over-year (YoY) basis, resulting in a 2.5% R&D intensity, denoting 0.1% point more than 2021. This has created an optimistic approach for skyrocketing the overall market in the country.

The technology licensing market in India is also growing due to the government’s contribution to technology and science, which has witnessed a continuous increase in consistency. This has deliberately resulted in the Department of Science and Technology (DST) budget witnessing a generous growth rate, which is suitable for boosting the market’s exposure in the overall nation. Besides, suitable initiatives, such as the National Deep Tech Startup Policy (NDTSP) is particularly designed to provide standard support to startup organizations in the country, with the objective of creating licensable and protectable IP, thus driving the market’s future development.

Europe Market Insights

Europe in the technology licensing market is projected to emerge as the fastest-growing region during the predicted timeline. The market’s development in the region is propelled by a robust industrial base for start-ups, industrial manufacturing, and an automotive ecosystem, strategic demand for technological resilience, and digitalized sovereignty. According to the Europe 2030 initiative, almost 81% of 5G coverage is currently on track, while improvements, such as network capacity, are provided to almost 55% of rural households, whereas 9% are not served with such a network. In addition, the spectrum band allocation was 100% missed, for which initiatives need to be undertaken, thereby uplifting the market’s development.

The technology licensing market in the UK is gaining increased traction, owing to the presence of notable research-based universities, AI, and fintech industries, public investment for research and development, and governmental funding. As per a data report published by the UK Government in November 2023, there has been a surge in yearly public investment in R&D, amounting to £22 billion, with the intention of diminishing complications for advanced organizations by creating a progressive center and developing online finance. In addition, the £200 million investment through the British Business Bank’s Life Sciences Investment Programme is suitable for targeting the funding barrier, thus making it suitable for the market’s upliftment.

The technology licensing market in Germany is also developing due to the existence of leading industrial and automotive engineering corporations, and generous government spending to support the German Federal Ministry for Economic Affairs and Climate Action (BMWK). According to a data report published by the Federal Ministry for the Environment, Climate Action, Nature Conservation and Nuclear Safety in September 2025, the country’s global climate finance accounted for 11.8 billion euros, out of which 6.1 billion euros derived from the federal budget. Therefore, this positively caters to bolstering the market’s exposure in the overall country.

North America Market Insights

North America in the technology licensing market is growing steadily by the end of the forecast duration. The market’s exposure in the overall region is driven by standard research and developmental corporations creating ongoing intellectual property, active venture capital, and strategic cross-licensing. According to a data report published by the Obama White House, part of OECD in 2023, there has been expansion in commercialization of almost USD 148 billion in yearly federal fund for R&D in the region, leading to the generation of advanced startups and new sectors. Additionally, the U.S. Small Business Administration (SBA) provided USD 1 billion in funding to initiate growth capital in organizations, thus making it suitable for the market’s upliftment.

Historical Data for Venture Deal Activity in the U.S.

|

Years |

Deal Value (USD Billion) |

Deal Count |

Estimated Deal Count |

|

2013 |

49.7 |

10,058 |

- |

|

2014 |

74.0 |

11,171 |

- |

|

2015 |

86.6 |

11,863 |

- |

|

2016 |

84.3 |

10,962 |

- |

|

2017 |

90.3 |

11,807 |

- |

|

2018 |

147.1 |

12,506 |

- |

|

2019 |

150.9 |

13,616 |

- |

|

2020 |

172.9 |

13,593 |

- |

|

2021 |

347.3 |

18,926 |

- |

|

2022 |

244.5 |

- |

17,670 |

|

2023 |

125.9 |

- |

11,935 |

Source: NVCA

The technology licensing market in the U.S. is gaining increased exposure, owing to the tactical consolidation patent portfolios by both non-practicing entities and operational organizations, an increase in platform-specific licensing, especially for artificial intelligence (AI) models and application programming interfaces (APIs). Besides, in August 2022, the Congress passed the Creating Helpful Incentives to Produce Semiconductors (CHIPS) Act, which provided USD 500 million to the Department of State. This accounted to USD 100 million each year for more than 5 years, which commenced from the fiscal year 2023, creating huge opportunities for the market to flourish in the country.

The technology licensing market in Canada is also growing due to the presence of national strategy to uplift cleantech and AI industries and commercialize public fund for research, technology transfer offices formalization within research hospitals and universities, and federal strategies through regional Artificial Intelligence Strategy. As per an article published by the ISED in September 2025, the AI Compute Access Fund tends to support suitable projects with compute expenses ranging from USD 100,000 to nearly USD 5 million. This is possible by covering 2/3rd and ½ of eligible costs of cloud-specific AI computer services, thereby bolstering the market’s opportunity.

Key Technology Licensing Market Players:

- IBM (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Microsoft (U.S.)

- Qualcomm (U.S.)

- Google (Alphabet Inc.) (U.S.)

- Intel Corporation (U.S.)

- Samsung Electronics (South Korea)

- Sony Group Corporation (Japan)

- Canon Inc. (Japan)

- Telefonaktiebolaget LM Ericsson (Sweden)

- Nokia Corporation (Finland)

- Siemens AG (Germany)

- BASF SE (Germany)

- Philips (Netherlands)

- Taiwan Semiconductor Manufacturing Company (TSMC) (Taiwan)

- Hitachi, Ltd. (Japan)

- Toshiba Corporation (Japan)

- General Electric (GE) (U.S.)

- Texas Instruments (U.S.)

- CSL (Australia)

- Infosys (India)

- IBM is one of the world’s most diversified and valuable patent portfolios, emerging as the topmost recipient among U.S. patents for years. The organization has actively monetized its IP through direct licensing and cross-licensing deals of its very own foundational technologies. Besides, as per its 2024 annual report, the company successfully generated USD 62.8 billion in revenue, denoting a 3% increase in continuous currency, along with USD 12.7 billion in free cash flow.

- Microsoft is one of the most dominating forces in platform and software licensing, usually through its internationally implemented Microsoft 365 suite and Windows OS. Its tactical acquisitions, including GitHub, also extended its ecosystem, thus developing massive networks of enterprises and developers, depending on its licensed APIs and technologies.

- Qualcomm has emerged as the leader in wireless technology, originating from an effective portion of its revenue from licensing its expanded patent portfolio to 3G, 4G, and 5G policies. Based on this, in 2024, revenues from Xiaomi, Samsung, and Apple each accounted for more than 10% of the organization’s consolidated revenues. Besides, its standard business model has successfully monetized research and development through licensed deals with increasing smartphone manufacturers globally.

- Google (Alphabet Inc.) has readily shaped the market through the aspect of open-source licensing of its Android mobile operating system, which has strategically uplifted traffic to its actual advertising business. Beyond Android, the company has licensed notable enterprise-based technologies, which include Chrome OS, AI tools, and a cloud platform.

- Intel Corporation’s Intel x86 microprocessor architecture is one of the most effective licensed technologies for the computing industry, creating the formulation of the modernized PC and server markets. While strongly protecting its actual chip designs, the organization has also engaged in tactical cross-licensing with rivals to ensure technological interoperability, as well as combat protracted legalized disputes.

Here is a list of key players operating in the global market:

The international technology licensing market is considered an oligopolistic landscape, which is readily dominated by R&D-based firms from the software, telecommunications, and semiconductor sectors. Notable players, such as Ericsson, IBM, and Qualcomm, successfully leveraged massive patent portfolios, especially in suitable essential technologies, including 5G, to significantly generate recurring revenue. Besides, tactical strategies, such as strong portfolio extension through R&D investment and development of suitable patent pools, are driving the market’s growth. For instance, in April 2024, Sumitomo Chemical and KBR declared their alliance-based agreement to make KBR the outstanding licensing partner for Sumitomo’s state-of-the-art propylene oxide by cumene (POC) technology.

Corporate Landscape of the Technology Licensing Market:

Recent Developments

- In February 2025, Fujitsu announced the unveiling of the Fujitsu Cloud Service Generative AI Platform for combining data confidentiality with easy cloud utilization for availability in Japan.

- In May 2024, Murata Manufacturing Co., Ltd. declared a significant licensing deal with Michelin for permitting the cutting of radio frequency identification (RFID) integration tire tags in automotive tires, thus assisting in advancing tire management.

- In March 2024, Accenture Federal Services partnered with Microsoft to introduce the first-ever migration and cloud modernization factory on Microsoft Azure Government to cater to strict security standards for national security space.

- Report ID: 8210

- Published Date: Nov 04, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Technology Licensing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.