Technical Insulation Market Outlook:

Technical Insulation Market size was valued at USD 10.36 billion in 2025 and is likely to cross USD 16.09 billion by 2035, expanding at more than 4.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of technical insulation is assessed at USD 10.78 billion.

The market's progression of technological breakthroughs reveals the many uses for technical insulation. Its fire protection, thermal regulation, noise reduction, and corrosion-free behavior make it a suitable choice for floor ceilings, internal wall insulation, roof, HVAC, and acoustic insulation applications. Ongoing efforts to encourage the use of electric vehicles and electric airplanes is expected to help the technical insulation industry expand at higher levels. In April 2024, Huntsman announced the launch of new polyurethane systems, Shokless to protect electric vehicle batteries.

Moreover, increasing research and development projects on smart insulation systems is another key factor expected to increase sales of technical insulation across several sectors, especially modern infrastructure. For instance, in July 2023, Recticel Group announced the launch of a new range of polyurethane insulation solutions containing 25% biocircular raw materials that help in reducing on average 43% of the CO2 emissions compared to the conventional insulation boards.

Key Technical Insulation Market Insights Summary:

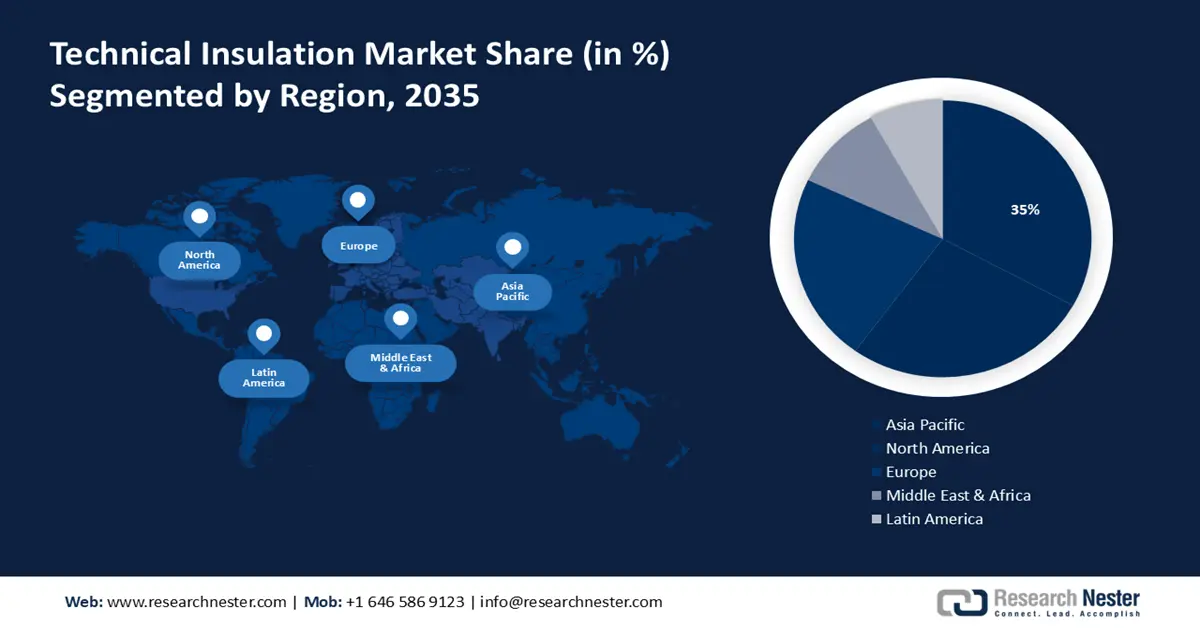

Regional Highlights:

- The Asia Pacific technical insulation market is anticipated to capture 35% share by 2035, driven by increasing infrastructural activities, fire safety awareness, and investments in novel products.

- The North America market grows rapidly with a strong CAGR during 2026-2035, driven by rising energy efficiency awareness, CO₂ emission regulations, and presence of key players.

Segment Insights:

- The hot insulation segment in the technical insulation market is expected to achieve significant growth till 2035, fueled by rapid industrialization, efforts to lower CO2 emissions, and growing energy conservation demand.

- The heating and plumbing segment in the technical insulation market is forecasted to achieve a 30% share by 2035, influenced by increasing use of insulated pipes and equipment in industrial heating and plumbing applications to prevent heat loss.

Key Growth Trends:

- Rising environmental concerns

- High usage of technical insulation for industrial applications

Major Challenges:

- Fluctuating prices of raw materials

Key Players: GlassRock, Dyplast Products, Cabot Corporation. Beijing New Building Material (Group) Co., Ltd., HOLCIM Group, Huntsman Corporation.

Global Technical Insulation Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.36 billion

- 2026 Market Size: USD 10.78 billion

- Projected Market Size: USD 16.09 billion by 2035

- Growth Forecasts: 4.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 18 September, 2025

Technical Insulation Market Growth Drivers and Challenges:

Growth Drivers

- Rising environmental concerns: The rising consumption of energy as a result of growing population and industrial sector has resulted in concerns about rising carbon footprint. The demand for energy-efficient solutions, including technical insulation to cater to these issues has significantly increased lately. There has also been an increase in green building certifications globally, driving the need for high-performance and safe insulating materials.

Companies are heavily investing in R&D activities to develop products that meet environmental standards and contribute to the overall sustainability of buildings. In September 2023, Knauf Insulation announced its plan to launch new sustainable building standards for new sites following the certification of plant offices in France given by the independent Green Building System Haute Qualité Environnementale (HQE). - High usage of technical insulation for industrial applications: Technical insulation solutions are widely used in industrial applications, including oil and gas, chemical and power generation to reduce heat transfer, energy loss, and overall pollution. It helps to maintain a stable environment where temperature control is critical. In September 2023, ROCKWOOL came up with an advanced insulation solution to cater to the common industry problem of water intrusion, ProRox with WR-Technology.

Challenges

- Lack of awareness: One of the biggest challenges in the technical insulation market is the lack of awareness of the benefits of technical insulation, especially in the residential sector or remote areas. This can result in its low adoption, hampering market growth. Moreover, the installation of these systems and solutions requires specific skills and knowledge. Lack of expertise in many areas can restrain technical insulation market growth going ahead.

- Fluctuating prices of raw materials: The raw materials such as fiberglass, foams, and petrochemicals used in insulation products can fluctuate due to supply chain disruptions or oil price fluctuations. This in turn can affect the profitability of manufacturers, and hamper overall market growth.

Technical Insulation Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.5% |

|

Base Year Market Size (2025) |

USD 10.36 billion |

|

Forecast Year Market Size (2035) |

USD 16.09 billion |

|

Regional Scope |

|

Technical Insulation Market Segmentation:

Material Type Segment Analysis

The hot insulation segment in the technical insulation market will account for a revenue share of 40.1% by 2035. The growth of this segment can be attributed to rapid industrialization across the globe, growing efforts to lower CO2 emissions, and rising demand for energy conservation. Hot insulation stops heat from escaping from systems or equipment, which enhances machine performance.

Many manufacturers are developing advanced hot insulation solutions to cater to these issues. For instance, in October 2023, APL Aeroflex announced the launch of next-generation hot insulation, Aerocell Rail suitable for high-speed modern rail and metro rail coaches. The company announced that it is 100% recyclable and has passed all stringent fire rating tests by railways.

Application Segment Analysis

In terms of application, the heating and plumbing segment in the technical insulation market is anticipated to hold a share of 30% by 2035. The demand for technical insulation in heating and plumbing applications is expected to increase as insulated pipes and equipment are used more frequently in industrial settings to prevent heat loss. For instance, in May 2022, Armcell launched two residential products for connecting the indoor and outdoor components of external heat pumps and air-conditioners.

Our in-depth analysis of the technical insulation market includes the following segments:

|

Material Type |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Technical Insulation Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is set to dominate majority revenue share of 35% by 2035. In March 2023, the International Energy Agency (IEA) stated that China, India, and Southeast Asia will account for 70% of the increase in global electricity demand between 2023 and 2025. Other factors such as increasing infrastructural activities, growing awareness about fire safety, and rising investments to develop novel products are expected to boost market growth in APAC.

The market in India is expected to account for a substantial market share during the forecast period owing to increasing industrialization and urbanization, rapid adoption of advanced insulation systems across several sectors, and stringent regulatory norms. In March 2022, ACC Ltd. announced the launch of a climate-control concrete insulation system, ACC Airium in India. This unique concrete system becomes a long-lasting roofing solution that insulates the surface at the time of construction.

China technical insulation market will encounter significant revenue growth between 2024 and 2035 owing to the rising need for electricity to cater to the large population and increasing infrastructural projects such as airports, power plants, and railways. Moreover, many international companies are launching advanced insulating products in China. One such example is when BASF partnered with Zhengming in June 2020 to develop high-quality insulating panels for constructing refrigerators used in the cold chain industry in China.

North America Market Insights

The technical insulation market in North America is expected to register rapid revenue growth during the forecast period owing to rising awareness about energy efficiency, stringent regulations about Co2 emissions, and presence of leading key players. In June 2022, the Bide-Harris administration announced an initiative to modernize building codes, reduce energy costs, and improve climate resilience. It also states the importance of insulation solutions in construction in terms of resistance and reduction in heating and cooling costs.

In the U.S, the technical insulation market is expected to witness substantial growth during the forecast period owing to stringent energy efficiency norms, high usage of advanced technical insulation solutions across several industries, and rising investments in developing advanced insulation technology and solutions. For instance, in January 2024, Whirlpool Corporation announced its plan to feature SlimTech insulation in a refrigerator in the North America market. The thickness of SlimTech insulation walls reduces thermal conductivity, allowing the refrigerator to be 50% more energy efficient than usual.

The technical insulation market in Canada is anticipated to grow at a steady pace between 2024 and 2035. This growth can be attributed rising usage of technical insulation for several industrial applications and government efforts to reduce the overall environmental footprint. In February 2020, the Government of Canada collaborated with small businesses to develop greener insulation products.

Technical Insulation Market Players:

- Arabian Fiberglass Insulation Company Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- INSULCON B.V.

- HUTCHINSON

- Rockwell International A/S

- GlassRock

- Armacell International S.A

- Saint-Gobain Isover

- Dyplast Products

- Cabot Corporation

- Beijing New Building Material (Group) Co., Ltd.

- HOLCIM Group

- Huntsman Corporation

The technical insulation market is highly competitive, comprising key players operating at global and regional levels. Key players in the market are focusing on developing novel solutions and materials to control temperature, noise, and energy efficiency across industrial and commercial settings. Rockwell International A/S, Owens Corning, Saint-Gobain Isover, and Knauf Insulation are some of the leading players that use several strategies to maintain their market position and enhance their product base. Here is a list of key players dominating the global technical insulation market:

Recent Developments

- In June 2023, Armacell, a global player in the flexible foam for insulation market announced the launch of its latest acoustic insulation solution, ArmaComfort ABJ. These are easy to install multi-layer acoustic system solution designed to reduce noise in drainage pipes.

- In June 2022, Holcim announced the acquisition of SES Foam LLC, the largest US-based independent spray foam insulation company to enhance its roofing and insulation business.

- Report ID: 6367

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Technical Insulation Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.