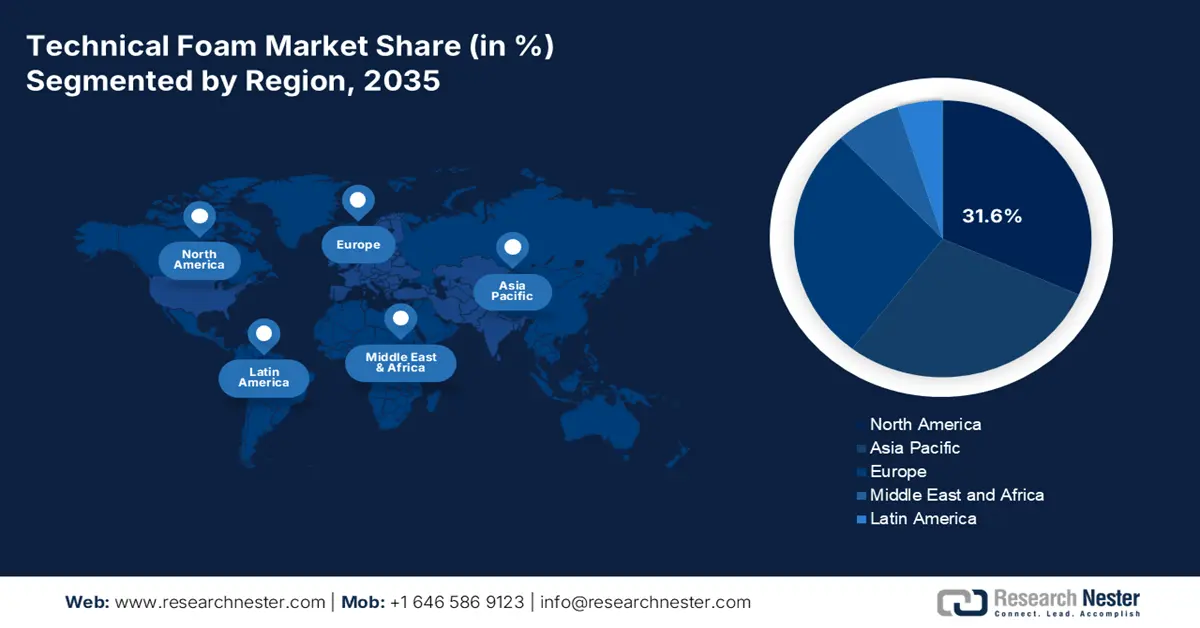

Technical Foam Market - Regional Analysis

North America Market Insights

The North America technical foam market is expected to hold 31.6% of the global revenue share through 2035, driven by high demand from automotive, construction, and packaging applications. The region’s strong industrial base and adoption of high-performance materials are creating a profitable environment for technical foam manufacturers. The insulation foams in residential and commercial projects are gaining traction, owing to their lightweight and versatility. The shift toward bio-based and recyclable foams is expected to drive innovations in the technical foam market in the years ahead.

The U.S. leads the sales of technical foams, due to its diversified industrial ecosystem and advanced R&D capabilities. Construction is a core driver for the technical foam market in the country. The push for green buildings is fueling a high demand for polyurethane and polystyrene foams in insulation and soundproofing. The report from the Census Bureau states that construction spending during June 2025 stood at USD 2136.3 billion. The rising construction activities are anticipated to double the revenues of technical foam companies. The healthcare sector is also contributing to the high sales of technical foams, owing to their high use in bedding, wound care, and prosthetics.

Asia Pacific Market Insights

The Asia Pacific technical foam market is anticipated to account for 28.8% of the global revenue share, due to rapid industrialization and urbanization activities. The strong demand for technical foams is also registered from the automotive, construction, and electronics industries. China dominates the market due to its scale in automotive, electronics, and construction. The know-how tactics and innovation leadership are boosting investments in Japan and South Korea. Further, India is emerging as a hotspot owing to swift infrastructure expansion and a rapidly expanding healthcare sector.

The India technical foam market is estimated to increase at the fastest CAGR from 2026 to 2035, due to massive construction activities and rising automotive production. The Ministry of Information and Broadcasting reveals that the infrastructure investment is registering a boom, owing to aggressive public-private partnerships. The total infrastructure spending grew by around USD 120.4 billion in FY 2023-24. The expanding healthcare demand and innovations, coupled with increasing early adoption rates, are poised to fuel the consumption of technical foams.

Europe Market Insights

The Europe technical foam market is foreseen to expand at a high pace between 2026 and 2035, owing to the advanced manufacturing practices and stringent regulatory standards. The polyurethane, polyethylene, and polystyrene foam grades are widely consumed across automotive, construction, aerospace, healthcare, and packaging sectors. The EU directives on energy efficiency and building performance mandates are boosting the demand for insulation and acoustic foams. Furthermore, the EV trends in the U.K., France, Germany, and Spain are opening high-earning opportunities for technical foam producers.

The technical foam sales in Germany are set to be driven by the strong automotive and advanced manufacturing base. The county’s large OEM network, including Volkswagen, BMW, and Mercedes-Benz, is propelling the technical foam consumption. These automakers are heavily dependent on lightweight foams for NVH control, thermal management, and safety components. The data from the European Commission highlights that the battery electric vehicle registrations increased by 54% in April 2025. Investing in Germany is likely to double the returns.

|

Strong Growth in Electric and Plug-in Hybrid Segments |

|||

|

Segment |

Registrations (Units) |

YoY Growth |

Market Share |

|

BEV (Battery Electric Vehicles) |

45,535 |

+53.5% |

18.8% (up from 13.3% in Apr 2024) |

|

PHEV (Plug-in Hybrid Electric Vehicles) |

24,317 |

+60.7% |

10% |

Source: European Commission