TBR Tire Market Outlook:

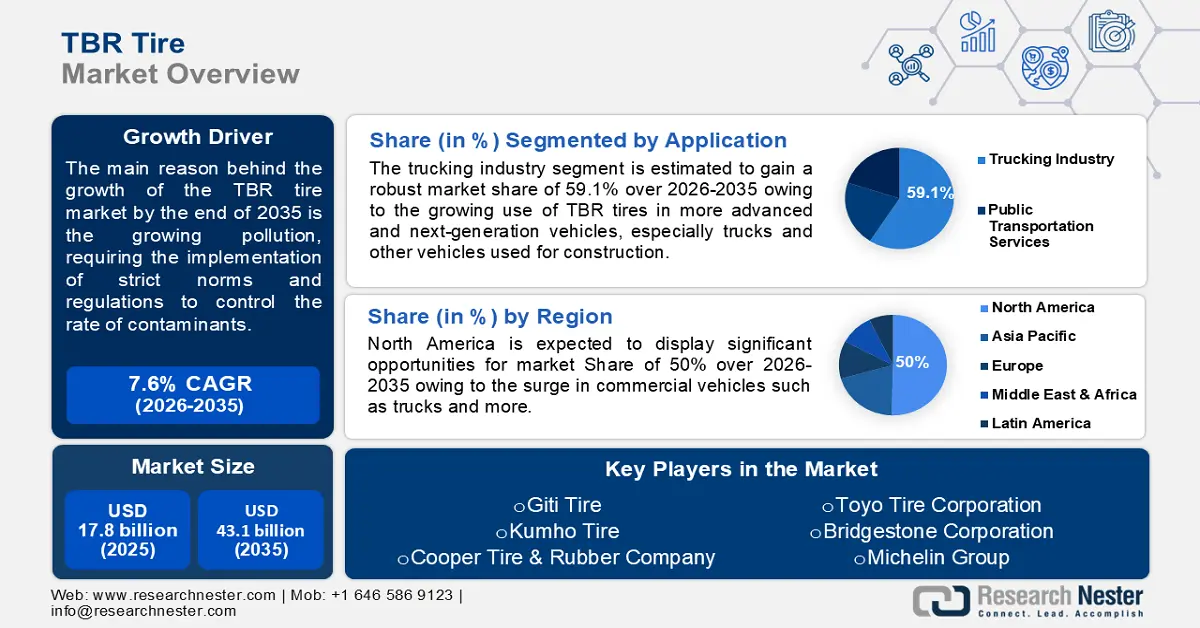

TBR Tire Market size was valued at USD 19.49 billion in 2025 and is set to exceed USD 37.28 billion by 2035, registering over 6.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of TBR tire is estimated at USD 20.67 billion.

Growing industrialization has led to an alarming increase in pollution, requiring the implementation of strict norms and regulations to control the rate of contaminants. According to the Natural Resources Defence Council (NRDC) in December 2023, tires contribute a significant share in releasing pollutants in ecosystems, making them the second largest oceanic microplastic source. Furthermore, to reduce the amount of carbon emissions from vehicles, the governments of several regions have imposed fuel efficiency standards. It was estimated by NRDC in 2023, that about 27% of non-exhaust emissions could be reduced by the implementation of zero-emission vehicles. This acts as a growth factor for the TBR tire market worldwide.

A recent report by the U.S. Department of Transportation’s National Highway Traffic Safety Administration in April 2022 announced New Vehicle Fuel Economy Standards for Model Year 2024-2026. These Corporate Average Fuel Economy (CAFÉ) standards require about an average of 49 mpg in industry-wide fleets from light trucks and passenger cars. This model is predicted to decrease fuel consumption by 200 billion gallons by 2050.

Key TBR Tire Market Insights Summary:

Regional Highlights:

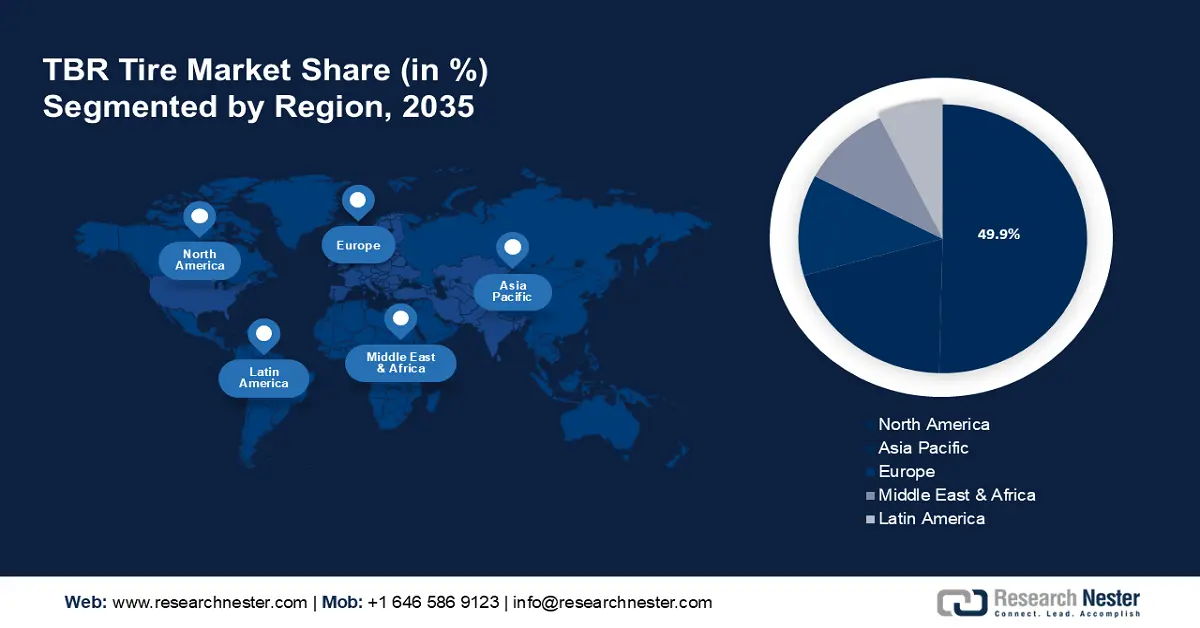

- The North America TBR tire market will secure over 50% share by 2035, driven by the surge in commercial vehicle sales and increased transportation sector activity.

- The Asia Pacific market will exhibit huge growth during the forecast timeline, driven by increasing sales of commercial vehicles and presence of major TBR tire manufacturers.

Segment Insights:

- The trucking segment in the tbr tire market is projected to hold a 59.10% share by 2035, fueled by the rise in next-gen vehicle use and infrastructure investment.

- The aftermarket segment in the tbr tire market is expected to grow rapidly by 2035, influenced by cost advantages and service variety offered by retailers.

Key Growth Trends:

- Expanding logistics and transportation

- Better auxiliary quality

Major Challenges:

- Demand for tires other than radial

- High cost of advanced materials

Key Players: Continental AG, Hankook, Goodyear Tire & Rubber Company, ChemChina - Pirelli, Giti Tire, Kumho Tire, Cooper Tire & Rubber Company, Toyo Tire Corporation, Bridgestone Corporation, Michelin Group.

Global TBR Tire Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 19.49 billion

- 2026 Market Size: USD 20.67 billion

- Projected Market Size: USD 37.28 billion by 2035

- Growth Forecasts: 6.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (50% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 17 September, 2025

TBR Tire Market Growth Drivers and Challenges:

Growth Drivers

- Expanding logistics and transportation: The need for commercial vehicles like trucks and buses fuels TBR tire demand in e-commerce and goods transportation. About 3 million, 26 million, and 165 million tires were predicted to be replaced and sold each year in Germany, Europe, and worldwide respectively, as estimated by Continental in 2020. According to the International Trade Administration 2024, an expected growth rate of 14.4% in the e-commerce revenue share was predicted, surpassing USD 5.5 trillion by 2027. Moreover, it was surveyed by the researchers at Research Nester in 2024 that about 33% of the global population shop online using e-commerce, this is an increase of 5% when compared with 2022. The commercial vehicle share has increased, augmented by the rising e-commerce and demand for goods vehicles.

- Better auxiliary quality: In comparison to several other tire types such as touring and spare tires, TBR tires have better auxiliary quality, handling control, improved engine performance, and less weight, causing comparatively fewer mishaps and accidents. Hankook Tire & Technology in February 2024, announced that Hino Canada and Hino Trucks have considered Hankook’s long-haul DL11 and regional AH37 tires for their medium-duty trucks. In turn, this is anticipated to influence the sales of TBR tires in the near future.

Challenges

- Demand for tires other than radial: The increasing popularity of electric and autonomous vehicles requires the usage of tires that are different from standard TBR tires. It is poised that truck and bus radial tire adoption would be slow in various segments such as construction and mining due to the shift to alternative power systems and self-driving capabilities, which could hinder the TBR tire sales growth.

- High cost of advanced materials: Manufacturer margins have been pressed down by the sharp increase in raw material costs over the past year. For the same reason, several Original Equipment Manufacturers (OEMs) are unwilling to fit TBR tires on their cars. Moreover, R&D expenses are rising as a result of stricter emission regulations that demand lower rolling resistance. This is anticipated to act as a restraining factor for the market growth.

TBR Tire Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.7% |

|

Base Year Market Size (2025) |

USD 19.49 billion |

|

Forecast Year Market Size (2035) |

USD 37.28 billion |

|

Regional Scope |

|

TBR Tire Market Segmentation:

Application Segment Analysis

The trucking segment in the TBR tire market is poised to capture a share of 59.1% in the coming years. Significant growth in the revenue share is anticipated as a result of the growing usage of TBR tires in advanced and next-generation vehicles, especially trucks and other vehicles that are used for construction. Moreover, the primary reason for the segment's growth is the increased funding that is being allocated to the advancement of public transportation to meet the growing demand for cutting-edge transportation options. For instance, the Department of Transportation 2024, estimated an investment of USD 20.5 billion attributed to Biden-Harris Administration in the public transportation sector. Furthermore, a rise in construction activity worldwide and a surge in the need for specialized trucks and cargo vehicles are anticipated to boost the market share of this segment during the projected period.

Sales Channel Segment Analysis

The aftermarket segment in the TBR tire market is set to be a faster-growing segment with a lucrative size by the end of the forecast period. The presence of various tire brands in this sector such as Michelin Group, Bridgestone Corporation, and Continental AG is set to contribute to the growth of this sector. They provide TBR tires at an affordable price when compared with Original Equipment Manufacturers (OEMs). Due to features like increased tread depth that are appropriate for a range of loads and road conditions, customers prefer to replace their older tires through aftermarket channels. Moreover, there are several available options for various truck models.

This adaptability encourages both independent fitters and well-known retail chains to offer repeat business. Aftermarket retailers offer cost transparency, in contrast to OEMs who group tire prices with the vehicle. Based on distinct technical features and costs, customers can select particular tires. Commercial fleet owners are drawn to aftermarket players because they offer value-added services like wheel alignment, balancing, and fitting. Growth in this sector will boost the tire cord value in the near future.

Our in-depth analysis of the TBR tire market includes the following segments:

|

Application |

|

|

Sales Channel |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

TBR Tire Market Regional Analysis:

North America Market Insights

North America industry is estimated to hold largest revenue share of 50% by 2035. The surge in commercial vehicles such as trucks drives the growth of TBR tires in this region. According to the National Automobile Dealers Association 2022, it was witnessed that the sales of commercial trucks gained 3.8% from 2021 to 2022. The gain in this sector will augment the tire material value in the near future.

In the U.S. there is an increase in the transportation sector along with rapid industrial development is acting as a growing factor for the TBR tires market revenue. The U.S. Energy Information Administration estimated that about 27% of U.S. energy consumption was used by transportation in 2022. While American Public Transportation Association in 2024 propelled that the public transport ridership surpassed 16% between 2022 and 2023.

The demand for battery and electric vehicles in Canada is projected to fuel the TBR tires in the near future. The transportation industry benefits from electric vehicles as they reduce vehicle emissions, which will encourage the use of these vehicles in the upcoming years. Régie de l'énergie du Canada in 2024, propelled the registration of 86,032 electric vehicles in Canada in 2021. This consists of about 5.3% of the whole registrations of vehicles in that year.

APAC Market Insights

Asia Pacific will also encounter huge growth in the TBR tire market value during the forecast period with a notable size. This region will account for the second position in this landscape owing to the growth in sales of commercial vehicles. According to The Global Economy 2023, the sale of commercial vehicles was about 428,875 in 2023.

The prevalence of TBR tire manufacturers such as Zhongce Rubber Group Co., Ltd., Giti Tire, and Sailun Jinyu Group Co., Ltd. in China showed an increase in the production and exports of TBR tires for global usage. For instance, Qingdao Keter Tyre Co., Ltd. in September 2023 showcased their TBR, AGR, OTR, and PCR under the KETER, NEOTERRA, and GREENTRAC product line.

The growth in the purchase of connected & electric vehicles in Japan owing to their benefits is increasing the demand for more TBR tires in this country. International Energy Agency 2024, in Japan the sales of electric vehicles increased by 3.5 million in 2023 compared to 2022, a 35% annual increase. Such demand for EVs and radial tires in this country will fuel the revenue share.

TBR Tire Market Players:

- Continental AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Hankook

- Goodyear Tire & Rubber Company

- ChemChina – Pirelli

- Giti Tire

- Kumho Tire

- Cooper Tire & Rubber Company

- Toyo Tire Corporation

- Bridgestone Corporation

- Michelin Group

TBR tire market expansion is estimated to witness a lucrative share during the forecast period. The competitive environment is attributed to the tremendous spike in investments in the automation sector globally. More companies are entering this sector owing to the potential growth opportunities. In the forecast period, the market will observe emerging competitors and a growing demand for TBR tires around the world.

Some of the key players include:

Recent Developments

- In October 2022, The Smart iON AU06+, Hankook's first radial truck and bus tire in the iON range, was introduced. With Hankook's EV tire technology, the tire is made for high-end electric vehicles in the Korean market and offers enhanced fuel efficiency, quick torque response, and high load support.

- In July 2020, a new truck tire was introduced by Continental AG. The new Conti Scandinavia HS3 ED steer-axle tire was developed especially for the winter mixed on/off-road freight transportation conditions.

- Report ID: 6339

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

TBR Tire Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.