Tachycardia Market Outlook:

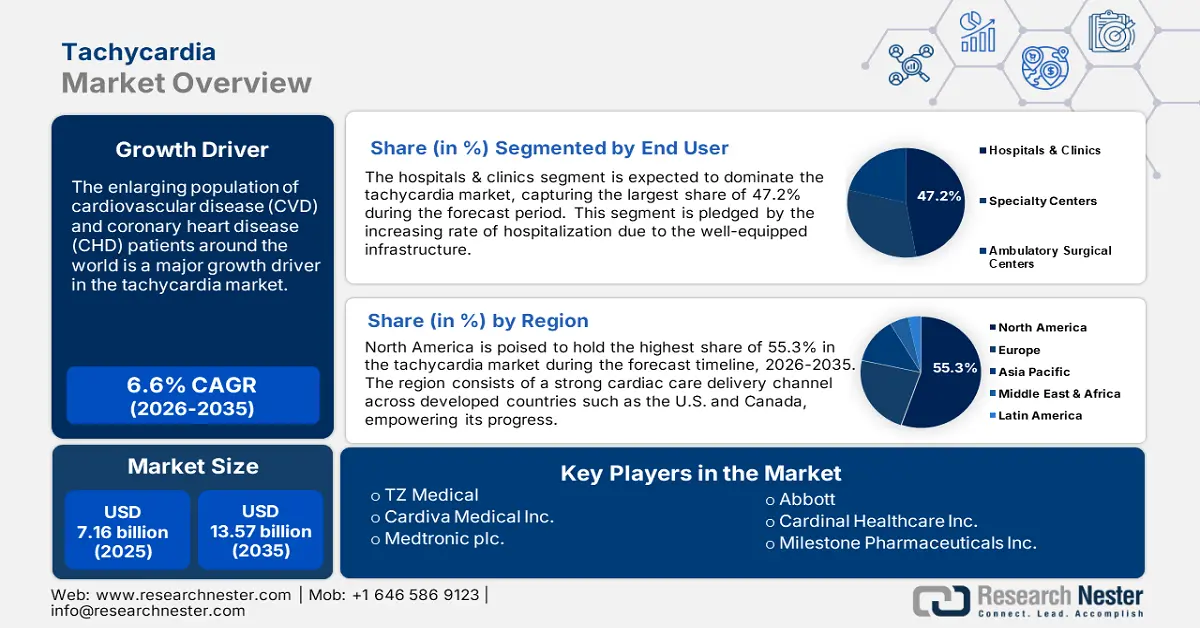

Tachycardia Market size was over USD 7.16 billion in 2025 and is anticipated to cross USD 13.57 billion by 2035, growing at more than 6.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of tachycardia is assessed at USD 7.59 billion.

The enlarging population of cardiovascular disease (CVD) and coronary heart disease (CHD) patients around the world is a major growth driver in the tachycardia market. According to a study report, published by NLM in July 2023, around 300,000 mortality cases are registered in the U.S. each year due to ventricular tachycardia (VT) and ventricular fibrillation. The results further revealed that approximately 50% of the total cardiac fatalities are caused by ventricular tachyarrhythmias, where VT was identified among 15% of the CHD patients. The rising prevalence of these heart-related disorders has dragged the focus of the healthcare industry to expand its territory in this sector.

Further, the significant impact on normal lifestyle and growing mortality cases are boosting the demand for proven solutions in the tachycardia market. With the developments in the cardiovascular treatment industry, more categorized solutions are being introduced such as catheter ablation to address specific conditions. Associated methods and tools are now increasingly being preferred by many healthcare professionals.

Key Tachycardia Market Insights Summary:

Regional Highlights:

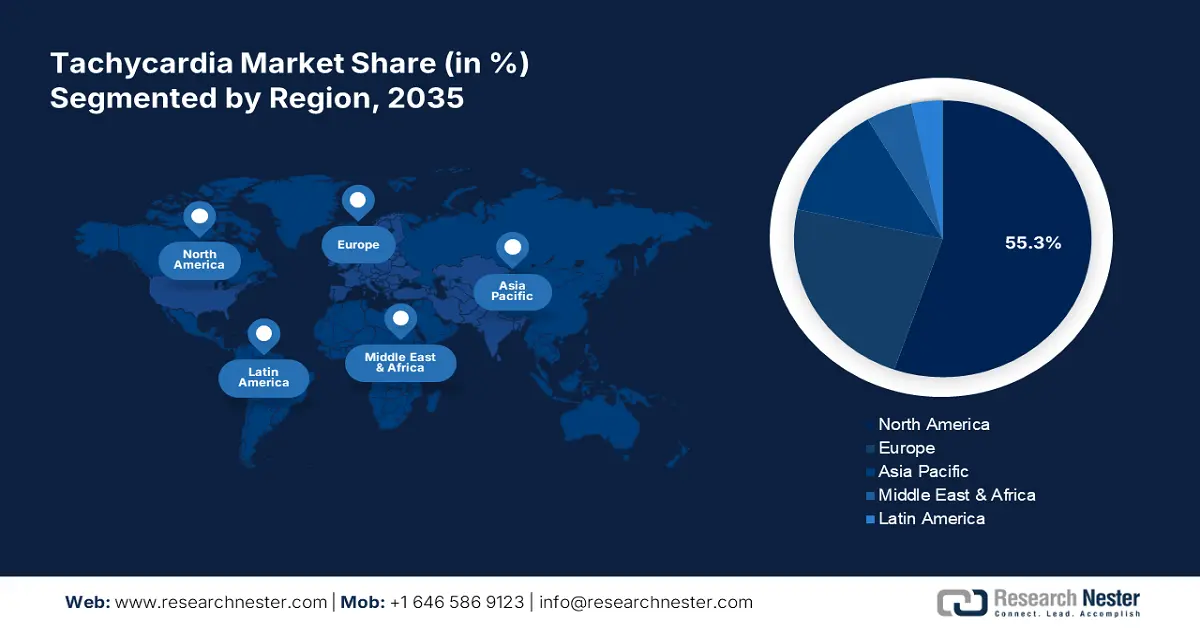

- North America dominates the Tachycardia Market with a 55.3% share, supported by strong cardiac care infrastructure, rapid drug approvals, and R&D investments, ensuring robust growth through 2035.

- The Asia Pacific tachycardia market is projected to grow rapidly through 2035, driven by the rising burden of CVD, infrastructure development, and early diagnosis awareness.

Segment Insights:

- Hospitals & Clinics segment are expected to hold a 47.2% share by 2035, driven by increasing hospitalization rates due to well-equipped healthcare infrastructure.

Key Growth Trends:

- Technological advancement in cardiac care

- Increasing support from government bodies

Major Challenges:

- Expensive cardiac treatment and diagnosis

- Limitation in complete healthcare access

- Key Players: TZ Medical, Cardiva Medical Inc., Medtronic plc., Abbott, Cardinal Healthcare Inc., Vasorum Ltd., Milestone Pharmaceuticals Inc..

Global Tachycardia Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.16 billion

- 2026 Market Size: USD 7.59 billion

- Projected Market Size: USD 13.57 billion by 2035

- Growth Forecasts: 6.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (55.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 13 August, 2025

Tachycardia Market Growth Drivers and Challenges:

Growth Drivers

-

Technological advancement in cardiac care: Better patient outcomes from innovative solutions have significantly inspired consumers to invest more in the tachycardia market. This sector has introduced a range of effective treatment and diagnostic tools and techniques such as ablation technologies, pacemakers, surgical patches, and defibrillators, broadening the product pipeline. In addition, many medical suppliers are now enforcing AI and ML capabilities into their offerings to elevate patient care. For instance, in the May 2023 annual Congress of Hearth Rhythm Society, Philips presented an AI module, demonstrating the potential to predict ventricular tachycardia.

-

Increasing support from government bodies: Financial and regulatory support is a highly influential factor in the expansion of the tachycardia market. Many governing authorities are taking initiatives to promote advanced cardiac care by educating patients about available treatment and early diagnostic options. Thus, the increasing awareness due to these campaigns is inflating the demand for disease prevention and management solutions. For instance, in December 2023, COMBINE-CT, a consortium built with the coordination of Philips, earned an Innovative Health Initiative (IHI) grant of USD 6.6 million. This funding was for the improvement of treatment and diagnosis in CAD care facilities.

Challenges

-

Expensive cardiac treatment and diagnosis: Affording advanced treatment such as ablation, pacemakers, and other implantable becomes challenging for many patients. This economic barrier can further limit adoption in the tachycardia market. In addition, the absence of insurance coverage for a range of CVD and CAD categories may restrict their access to care. On the other hand, producing cost-effective solutions without hampering the quality and performance is difficult for manufacturers. Moreover, a lack of adequate financial backup or subsidies can hinder the optimum expansion of the sector.

-

Limitation in complete healthcare access: Considering the complexity of treatment and diagnosis can be a refraining factor for small healthcare organizations due to the shortage of skilled operators and surgeons. Many of these institutions may fail to accommodate their premises to support the integration of such advanced infrastructure, particularly in low-income countries. Thus, inadequate facilities with lagging medical technologies can prevent them from investing in the tachycardia market, as they fear mishandling such expensive products.

Tachycardia Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.6% |

|

Base Year Market Size (2025) |

USD 7.16 billion |

|

Forecast Year Market Size (2035) |

USD 13.57 billion |

|

Regional Scope |

|

Tachycardia Market Segmentation:

End user (Hospitals & Clinics, Specialty Centers, Ambulatory Surgical Centers)

In tachycardia market, hospitals & clinics segment is set to capture revenue share of over 47.2% by 2035. This segment is pledged by the increasing rate of hospitalization due to the well-equipped infrastructure of these healthcare organizations. The adaptive nature and wide consumer base are some of the major contributors to the growing expenditure in hospitals for CVD care. As per the NLM study, published in January 2022, the inpatient cost constituted 70% of the total CVD hospitalization expenses, where the share of equipment was 50% in India. It further, accounted for the patient cost in treating such heart-related diseases to be USD 3842. Thus, the tendency and frequency of investing in this sector for these multi-specialty hospitals is higher.

Type (Supraventricular Tachycardia, Ventricular Tachycardia, Sinus Tachycardia)

Based on type, the supraventricular tachycardia (SVT) segment is projected to secure a remarkable income for the tachycardia market by the end of 2035. With a high prevalence rate and severity, this type of cardiac condition is experiencing a surge in associated treatments and management therapies. The broadened spectrum of target age groups, from adults to children is also a matter of concern, forcing healthcare service providers to acquire sufficient supplies for early prevention and intervention. For instance, in March 2021, the Arrhythmia Alliance published the Arrhythmia Alliance Healthcare Pioneers Report to attain best practices in caring for SVT. It was also intended to inspire more medical centers to adopt innovative solutions such as atrial fibrillation (AF) and syncope.

Our in-depth analysis of the global tachycardia market includes the following segments:

|

End user |

|

|

Type |

|

|

Treatment |

|

|

Diagnosis |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Tachycardia Market Regional Analysis:

North America Market Analysis

By 2035, North America tachycardia market is expected to capture over 55.3% share. The region consists of a strong cardiac care delivery channel across developed countries such as the U.S. and Canada, empowering its progress in this sector. In addition, the presence of reputed research institutions and pharma companies helps these forefronts bring diversity and improvement in offerings. The speedy allowances for market distribution act as an additional support system for regional development. For instance, in November 2024, a beta-adrenergic blocker, RAPIBLYK (landiolol) for injection was approved in the U.S. to be used in managing supraventricular tachycardia. The injectable indicates the short-term reduction of ventricular rate.

The U.S. is augmenting its domestic tachycardia market with medical advancements and increased healthcare expenditure. In addition, the growing population of high-risk CVD patients is fostering a fruitful trading environment for global leaders, encouraging them to participate in this scenario. For instance, in May 2024, Adagio Medical, Inc. started the FULCRUM-VT Early Feasibility (EFS IDE) study on its recently marketed vCLAS technology. The company shares its plans to utilize the FDA approval, based on the results of this study to expand the product reach of its VT Cryoablation System in this country.

Canada is marking its leading position in the tachycardia market with supportive government initiatives and funding. Its public health authorities are heavily investing in R&D to bring new solutions to offer a complete set of prevention, treatment, and diagnosis across the country, which feedstocks innovation in this sector. For instance, in May 2022, the government of Canada released a grant of USD 5.0 million to leverage the national research capabilities on heart failure. The funding was allocated to 100 researchers from this country to magnify the efforts in improving healthcare services.

APAC Market Statistics

The Asia Pacific tachycardia market is anticipated to garner the fastest growth in the global landscape during the forecast period. The growing economic burden due to a steady rise in CVD prevalence is the major driving factor of this region. According to the NM report, published in July 2024, crude cardiovascular fatality in Asia is predicted to grow by 91.2% between the period, 2025-2050. It further mentioned the volume of CVD death cases to account for 60% of the global amount in 2019. Developing countries including Japan, China, and India are meticulously working on the enhancement of healthcare infrastructure to avail maximum amenities to the patients. Their promotional activities to spread knowledge about early detection and treatment have notably contributed to the enlargement of this sector.

India is one of the emerging leaders in the tachycardia market of this region. The country has shown continuous improvement in delivering better medical services in the last decade. It plans to create a lucrative investment opportunity for both domestic and international companies to emphasize its cardiac care industry. According to the 2023 World Integrated Trade Solutions report, the total value of imported pacemakers in India was registered at USD 53,071.75 thousand. It purchased 87,642 items of the same product from Malaysia, Singapore, Germany, Switzerland, the U.S., Ireland, Mexico, the Dominican Republic, Uruguay, China, Belgium, and the Czech Republic in 2023.

China is a large supplier of the tachycardia market, backed by its excellent manufacturing capabilities and recent developments in healthcare. Despite being a production house of many crucial components and products related to this sector such as pacemakers, it has founded good import-export relationships with foreign forces to ensure a profitable business flow. According to 2022 OEC data, China was marked among the top importers of pacemakers with a value of USD 359.0 million. On the other hand, another 2022 OEC report states, that the export of medical instruments in the country was valued at USD 12 billion, making it the 4th largest exporter in the world.

Key Tachycardia Market Players:

- TZ Medical

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cardiva Medical Inc.

- Medtronic plc.

- Abbott

- Cardinal Healthcare Inc.

- Vasorum Ltd.

- Milestone Pharmaceuticals Inc.

Key players in the tachycardia market are now focused on extensive clinical trials to establish the effectiveness of their offerings. Considering the growing demand for early prevention, they are also extending their diagnostic portfolio to solidify their position in this sector. For instance, in July 2023, Biosense Webster, Inc. launched OPTRELL Mapping Catheter with TRUEref Technology in the U.S. market. The high-density diagnostic catheter is equipped with the CARTO 3 System, delivering quality visuals in electrophysiological mapping of complex cardiac arrhythmia such as tachycardia. In addition, they are engaging in strategic partnerships and investments for globalization. Such dynamic leaders include:

Recent Developments

- In March 2024, Milestone Pharmaceuticals resubmitted its New Drug Application (NDA) to the FDA for etripamil. The company aims to market the investigational product globally for the treatment of paroxysmal supraventricular tachycardia after acquiring approval from the U.S. regulatory framework.

- In February 2023, Abbott gained approval from both the U.S. and Europe to distribute its electrophysiology products worldwide. The approved pipeline includes TactiFlex Ablation Catheter, Sensor Enabled, and FlexAbility Ablation Catheter, which is effective in treating abnormal heart rhythms and complex heart conditions.

- Report ID: 7009

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Tachycardia Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.