Systemic Lupus Erythematosus Treatment Market Outlook:

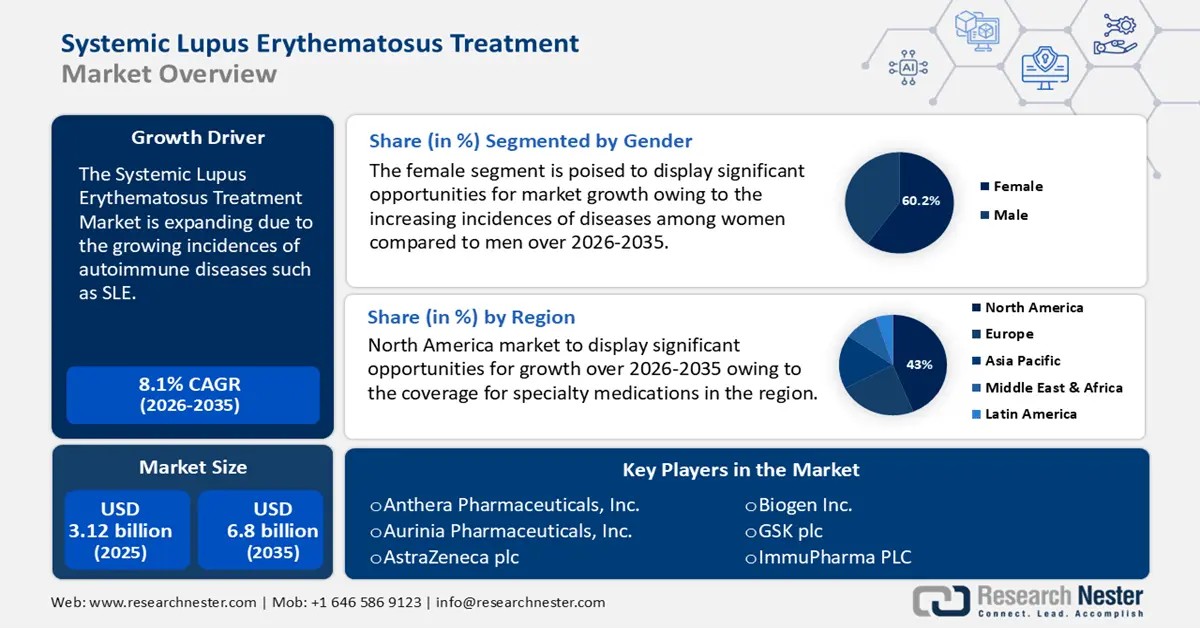

Systemic Lupus Erythematosus Treatment Market size was valued at USD 3.12 billion in 2025 and is expected to reach USD 6.8 billion by 2035, registering around 8.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of systemic lupus erythematosus treatment is evaluated at USD 3.35 billion.

The SLE treatment market is expanding mainly due to the increased prevalence of autoimmune diseases such as systematic lupus erythematosus, which necessitates enhanced awareness and support. According to the Lupus Foundation of America, at least five million people globally and 1.5 million people in the U.S. suffer from various types of lupus.

Additionally, innovations in biologics and targeted therapies, along with ongoing clinical research, are also significantly contributing to systemic lupus erythematosus treatment market expansion. Furthermore, the rise in healthcare expenditure and improved diagnosis techniques are enhancing patient access to treatment.

Key Systemic Lupus Erythematosus Treatment Market Insights Summary:

Regional Highlights:

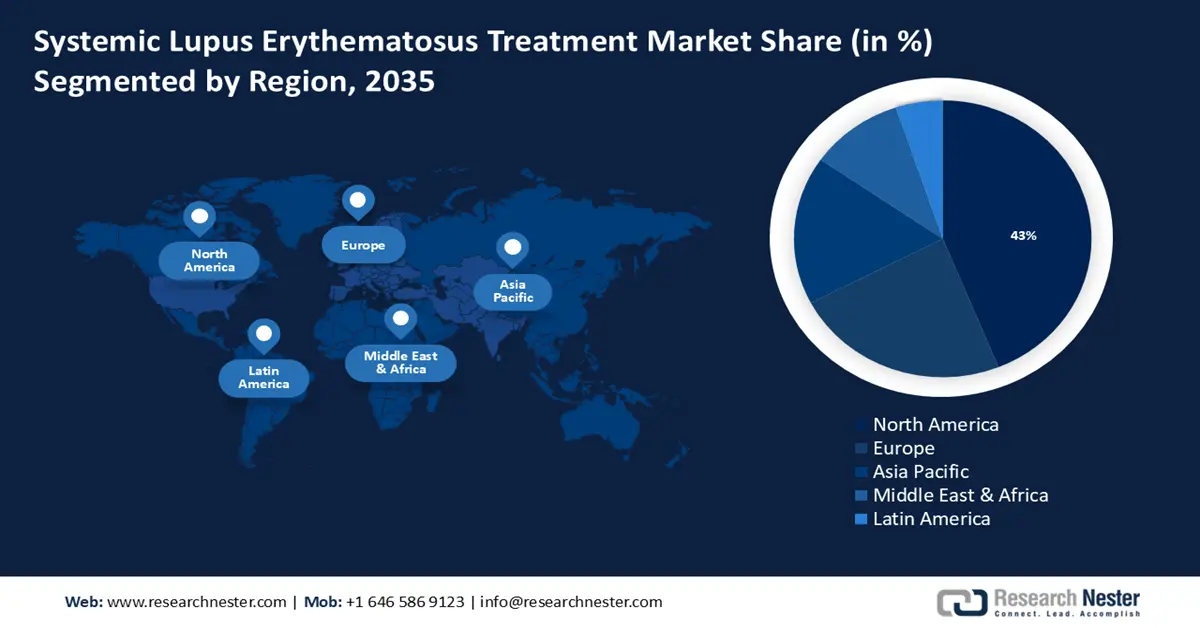

- North America systemic lupus erythematosus (SLE) treatment market will account for 43% share by 2035, driven by improved healthcare infrastructure and coverage for specialty medications.

Segment Insights:

- The female segment in the systemic lupus erythematosus treatment market is projected to attain a 60.20% share by 2035, fueled by the increased prevalence of SLE among women, particularly those of childbearing age.

- The oral segment in the systemic lupus erythematosus treatment market is projected to hold a 46.20% share by 2035, attributed to the convenience, safety, and cost-effectiveness of oral medications for chronic management.

Key Growth Trends:

- Advancements in targeted biologic solutions

- Increased R&D funding

Major Challenges:

- Medication-related complications

- High treatment costs

Key Players: GlaxoSmithKline plc, AstraZeneca plc, Bristol-Myers Squibb Company, Pfizer Inc., Merck & Co., Inc., Roche Holding AG, Sanofi S.A., Eli Lilly and Company, UCB S.A., AbbVie Inc.

Global Systemic Lupus Erythematosus Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.12 billion

- 2026 Market Size: USD 3.35 billion

- Projected Market Size: USD 6.8 billion by 2035

- Growth Forecasts: 8.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 18 September, 2025

Systemic Lupus Erythematosus Treatment Market Growth Drivers and Challenges:

Growth Drivers

- Advancements in targeted biologic solutions: Targeted biologics, such as monoclonal antibodies, focus on specific pathways involved in the autoimmune response, leading to better management of symptoms and disease progression. New biologics often show enhanced efficacy compared to traditional therapies, with improved safety profiles that reduce the risk of adverse effects. Moreover, biologics are increasingly tailored to individual patient needs, improving treatment adherence and outcomes.

Additionally, the approval of new biologic therapies by regulatory agencies has expanded treatment options for patients, fostering market growth. For instance, in May 2024 GSK plc. stated that Benlysta (belimumab), a monoclonal antibody that inhibits B-lymphocyte stimulator (BLyS) specifically, was approved for administration by the U.S. Food and Drug Administration (FDA) in 200 mg subcutaneous doses to patients five years of age and older with active systemic lupus erythematosus (SLE) on standard therapy. - Increased R&D funding: International organizations are investing in research and development, leading to the discovery of new therapies, including innovative biologics and targeted treatments. Partnerships between pharmaceutical companies, research institutions, and healthcare organizations are fostering the development of novel treatments and expanding clinical trials. The number of clinical trials for SLE treatments has significantly increased. Several clinical trials are conducted globally, reflecting a strong investment in R&D. According to Lupus Foundation of America, for the fiscal year 2024, the government effectively advocated for USD 47.08 billion in National Institutes of Health (NIH) funding, an increase over the previous fiscal year. It is projected that USD 138 million will go toward lupus research.

- Growing support for treat-to-target approach: Setting specific, measurable treatment goals, such as achieving remission or low disease activity, allows clinicians to tailor therapies to meet individual patient needs, leading to better management of SLE. The treat-to-target approach has spurred greater adoption of biologic therapies that can more effectively address specific disease pathways, enhancing overall efficacy. Moreover, the emphasis on personalized treatment strategies is driving demand for new therapies, particularly in biologics and targeted agents, which are projected to fuel market growth.

Challenges

- Medication-related complications: The physical health and daily activities of patients are usually negatively impacted by SLE medications, which are also commonly linked to unfavorable effects and tolerability problems that may even worsen the disease itself. Particularly high-dose corticosteroids cause morbidities such as weight gain, infections, diabetes, hypertension, osteoporosis, changes in appearance, and cataracts.

- High treatment costs: Higher SLE severity was linked to higher expenses for every type of healthcare service, including inpatient stays, ED visits, clinic/office visits, and prescription fees. Patients with severe SLE have 2.5 times the total mean yearly healthcare costs than those with moderate SLE. Therefore, the higher cost of the treatment may hinder the market growth.

Systemic Lupus Erythematosus Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.1% |

|

Base Year Market Size (2025) |

USD 3.12 billion |

|

Forecast Year Market Size (2035) |

USD 6.8 billion |

|

Regional Scope |

|

Systemic Lupus Erythematosus Treatment Market Segmentation:

Drug Class Segment Analysis

The immunosuppressants segment is poised to capture a 35% systemic lupus erythematosus (SLE) treatment market share by 2035. Immunosuppressants, such as corticosteroids and drugs that include azathioprine, mycophenolate mofetil, and cyclophosphamide, have a long history of effectiveness in managing SLE symptoms and preventing flares. Immunosuppressants are often used in combination with newer biologics and targeted therapies, enhancing overall treatment efficacy and driving market growth. Moreover, the chronic nature of SLE necessitates long-term treatment strategies, and immunosupressants are essential for managing the disease over time, ensuring sustained demand.

Gender Segment Analysis

The female segment in the SLE treatment market is poised to garner the largest share of 60.2% in the forecast period. The segment growth can be attributed to the increased prevalence of SLE among women, particularly those of childbearing age. According to the Lupus Foundation of America, 90% of lupus patients are females, creating a substantial patient population that requires ongoing treatment. Growing awareness of SLE among healthcare providers and patients, especially regarding its impact on women, leads to earlier diagnosis and more proactive management, driving demand for treatments. Additionally, the gender disparity in SLE prevalence has prompted targeted research and development of therapies aimed at addressing the unique pathophysiology in females, fostering innovation in treatment options.

Route of Administration Segment Analysis

The oral segment in the systemic lupus erythematosus treatment market is estimated to gain a market share of 46.2% by 2035. The segment growth can be attributed to factors such as convenience and compliance, improved safety, and cost-effectiveness. Self-administration of these drugs improves patient compliance and reduces hospital visits. Additionally, SLE is a chronic condition and often requires long-term management. Oral medications facilitate easier integration, encouraging consistent use.

Our in-depth analysis of the systemic lupus erythematosus treatment market includes the following segments:

|

Drug Class |

|

|

Gender |

|

|

Route of Administration |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Systemic Lupus Erythematosus Treatment Market Regional Analysis:

North America Market Insights

The systemic lupus erythematosus treatment market in North America is anticipated to hold the largest with a share of 43% by the end of 2035. The market is growing due to the improved healthcare infrastructure and coverage for specialty medications. The region benefits from a well-developed healthcare system facilitating access to a variety of treatment options, including innovative therapies and clinical trials.

In the U.S., the availability of novel and efficient medicines is facilitated by the presence of major pharmaceutical corporations and significant investments in biopharmaceutical research are expanding the systemic lupus erythematosus treatment market. According to the Center for Strategic & International Studies, from 2015 to 2020, U.S. companies filed about 38% of all biotechnology patents worldwide, strengthening the country's lead in this field. Pharmaceutical companies are heavily investing in R&D to discover new therapies, supported by a strong network of clinical trials and a favorable regulatory environment.

In Canada, favorable government regulations, rising healthcare costs, growing cases of SLE, and rising public awareness of autoimmune illnesses are accelerating the systemic lupus erythematosus treatment market expansion. For instance, an estimated 15,000 people in Canada, or 1 in 2,000, have been reported with SLE. Organizations such as Lupus Canada play a vital role in advocating for patient rights, raising awareness, and providing education, which enhances treatment adherence and support.

Europe Market Insights

Europe's systemic lupus erythematosus treatment market is anticipated to grow significantly during the forecast period. The market is growing due to the increasing incidence of SLE. According to a 2020 survey report published by the National Library of Health (NLM), it was reported that in Europe, SLE incidence ranges from 0.3 to 5.1 cases per 100,000 people annually. This yields an estimated 200 000–250 000 prevalent cases of SLE across Europe. Also, countries such as Sweden, Iceland, and Spain have the greatest sales of medications for SLE.

The UK government's favorable regulatory policies and growing measures to foster biotechnology and pharmaceutical advancements are driving the SLE treatment market. In December 2023, the government announced that it would invest USD 2.2 billion in engineering biology for the next ten years and lower the cost of engineering biological innovation at the early and scale-up stages.

The systemic lupus erythematosus treatment market in Germany is expected to increase significantly due to the country's strong healthcare system and a pharmaceutical industry that highly prioritizes R&D, encouraging innovation and the uptake of novel treatments.

Systemic Lupus Erythematosus Treatment Market Players:

- Anthera Pharmaceuticals, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Aurinia Pharmaceuticals, Inc.

- AstraZeneca plc

- Biogen Inc.

- GSK plc

- Bristol-Myers Squibb Company

- F. Hoffmann-La Roche Ltd.

- ImmuPharma PLC

- Johnson & Johnson Services, Inc.

- Novartis AG

There is intense competition in the systemic lupus erythematosus treatment market, with major worldwide players including smaller and medium-sized businesses fighting for market share. A crucial aspect of marketing strategy involves the introduction of novel products that leverage diverse technology.

Recent Developments

- In October 2022, Biogen Inc. reported that the first patient had been dosed in AMETHYST, a global clinical investigation. The Phase 2/3 study will compare litifilimab (also known as BIIB059), a first-in-class, humanized IgG1 monoclonal antibody (mAb) targeting blood dendritic cell antigen 2 (BDCA2), to a placebo in participants with cutaneous lupus erythematosus (CLE).

- In August 2021, AstraZeneca’s Saphnelo (anifrolumab-fnia) was licensed in the United States for the treatment of adult patients with moderate to severe systemic lupus erythematosus (SLE) who are currently receiving conventional therapy.

- Report ID: 6495

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Systemic Lupus Erythematosus Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.