System Infrastructure Software Market Outlook:

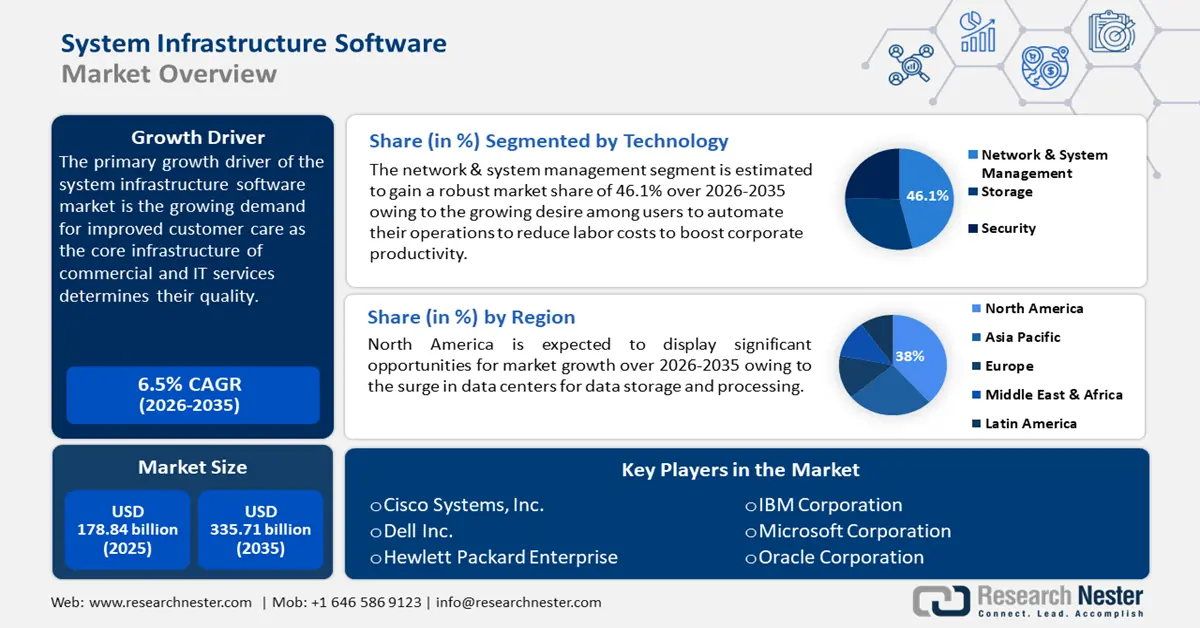

System Infrastructure Software Market size was valued at USD 178.84 billion in 2025 and is expected to reach USD 335.71 billion by 2035, expanding at around 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of system infrastructure software is evaluated at USD 189.3 billion.

The growing demand for improved customer care has boosted the requirement for system infrastructure software. The core infrastructure of commercial and IT services determines their quality, as the well-known components in customer services are raising user and customer satisfaction using faster provisioning and improved IT infrastructure performance. A report in 2024 estimated that more than 80% of companies use customer scores to analyze and improve their services, while improvement in customer services has increased by 19% since 2019. Additionally, this impact is anticipated by the boosted usage of digital tools, software, hardware, and systems along with social media. Our World Data published a report in 2023 estimating that the social media usage of US adults grew from 5% in the early 20s to 79% by 2020.

Key System Infrastructure Software Market Insights Summary:

Regional Highlights:

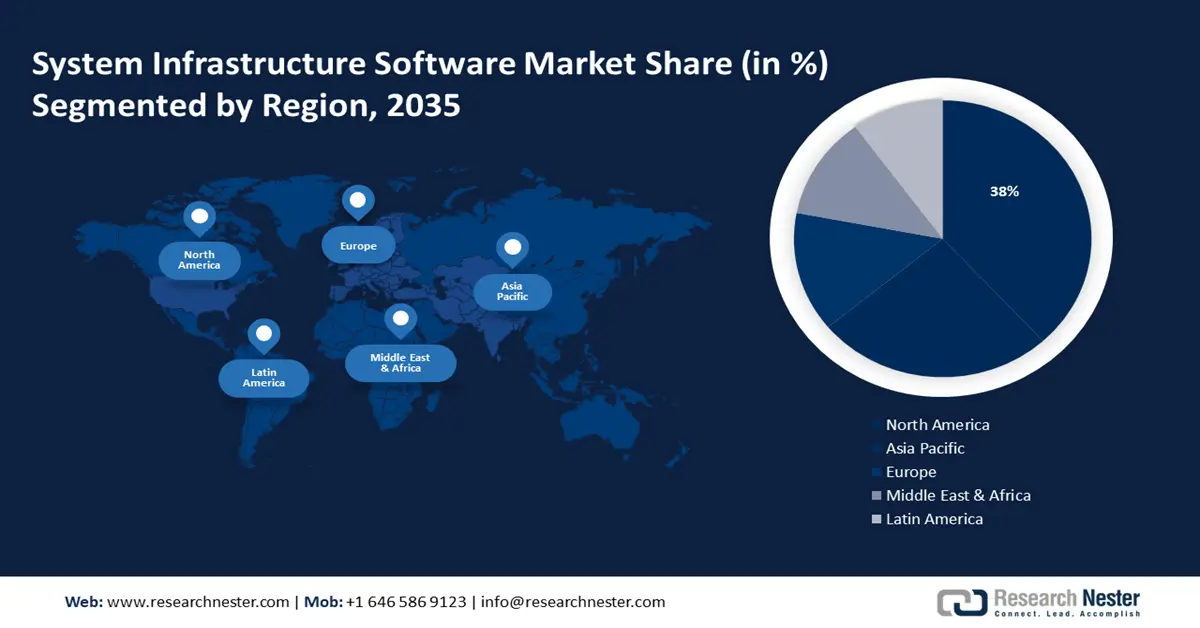

- North America’s system infrastructure software market will account for 38% share by 2035, driven by the increase in data center development across the region.

- Asia Pacific market will register substantial growth during the forecast timeline, driven by the expansion of the region’s data infrastructure market.

Segment Insights:

- The network & system management segment in the system infrastructure software market is projected to hold a 46.10% share by 2035, driven by growing automation desires to reduce labor costs and boost productivity.

- The data center infrastructure segment in the system infrastructure software market is anticipated to experience significant growth till 2035, influenced by the expansion of smart building infrastructure and demand for on-site IT data control.

Key Growth Trends:

- Increasing usage of graphical user interface (GUI)

Major Challenges:

- Limitations in management, purchase, and data storage

- High initial and ongoing expenses of system infrastructure software

Key Players: Broadcom, Amazon Web Services, BMC Software, Inc., Broadcom Inc. (CA Technologies), Cisco Systems, Inc., Dell Inc., Hewlett Packard Enterprise, IBM Corporation, Microsoft Corporation, Oracle Corporation.

Global System Infrastructure Software Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 178.84 billion

- 2026 Market Size: USD 189.3 billion

- Projected Market Size: USD 335.71 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Singapore, Japan, South Korea

Last updated on : 18 September, 2025

System Infrastructure Software Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing usage of graphical user interface (GUI): Servers, storage, and network switches can be managed using a single GUI. Moreover, GUI offers automation, allowing the devices to easily copy and deploy any information or data to another device. Consumers prefer system infrastructure software over traditional IT infrastructure as there is a high demand for digital frameworks to manage data storage. Furthermore, there is an increase in technological adoption as organizations rely largely on technological solutions for operations, and services. Research Nester surveyed in 2024 estimated that more than 85% of organizations worldwide believe they could get a competitive edge attributed to AI technologies.

In addition, there is high adoption of cloud-based services credited to the growing need for digital frameworks to manage data storage and the growing adoption of cloud services for improved organizational workflow. The growing adoption of cloud computing in industries like automation, healthcare, telecom, and BFSI has boosted market expansion. A report estimated in 2023 that, 60% of manufacturers will rely on digital platforms by 2020, which could result in a 30% drive in their overall bottom line. The cloud backup share has increased, augmented by the rising GUI usage and cloud computing.

Challenges

-

Limitations in management, purchase, and data storage: The complexity of data storage management acts as a limitation for this market. Several businesses have reported data loss as a result of inadequate storage. Losing data in the corporation is accounted as a catastrophic consequence of data storage. Additionally, other features such as data collection, handling of vast volumes of data, and scalability are predicted to hinder the revenue shared.

-

High initial and ongoing expenses of system infrastructure software: The scarcity of highly qualified developers is expected to restrain the market growth as the operational cost is at a surge. The base cost of infrastructure software rises with the inclusion of more functionality, impacting clients' overall budgets. Sensitive data housed on cloud infrastructure is also extremely vulnerable to data breaches, denial of service (dos) assaults, and emerging computer viruses. Market participants concentrate on creating budget-friendly, custom-tailored solutions and investing in research & development to enhance the security of their infrastructure software to address these issues.

System Infrastructure Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 178.84 billion |

|

Forecast Year Market Size (2035) |

USD 335.71 billion |

|

Regional Scope |

|

System Infrastructure Software Market Segmentation:

Technology Segment Analysis

Network & system management segment is poised to account for around 46.1% system infrastructure software market share by 2035. Significant growth in the revenue share is anticipated as a result of the growing desire among users to automate their operations to reduce labor costs while boosting their corporate productivity. A report based on workflow automation in 2024 projected that about 94% of the companies perform time-consuming and repetitive tasks, additionally, after adopting automation productivity and jobs have been improved for 66% and 90% of the workers respectively.

Growth in this sector will boost the workflow automation value in the near future. Furthermore, a network management system that collects data in real-time from network devices and gives administrators a single point of control over the network from which they can manage resource allocation, security protocols, and other activities.

Application (Building Management, Integrated Communications, Data Center Infrastructure, Data Center Infrastructure, Cloud Integration)

The data center infrastructure segment in the system infrastructure software market is poised to register a significant growth rate till 2035. This tremendous gain is credited to the growing infrastructure of smart buildings in urban areas across the globe. A report done by Research Nester in 2023 predicted that by 2025, about 57% of homes will have a smart home device in the U.S.

Furthermore, there is an increasing demand for infrastructure software for the IT and data that are hosted on-site using this data center strategy as users feel that they have more control over information security and can easily adhere to regulations like the General Data Protection Regulation (GDPR) of the European Union or the Health Insurance Portability and Accountability Act (HIPAA) of the United States, which is why many businesses choose to establish their own on-site data centers.

End use Segment Analysis

In system infrastructure software market, IT & telecom segment is poised to grow at lucrative CAGR through 2035 and is likely to remain a booming segment in the end user category of the system infrastructure software sector. This is attributed to the growing demand for 5G connectivity, coupled with the increasing number of internet users, edge computing, and IoT services. Research published in 2024 estimated that by 2029 about 51% of the population will be able to access 5G connection, and by the end of this decade, this growth rate might cross 56%.

In addition, telecommunications companies are modernizing their network infrastructure to enhance coverage and connectivity and draw in new business clients. Moreover, system infrastructure software is being integrated by IT companies into their business models to automate their core functions, manage their workforce, and optimize the use of both virtual and physical resources.

Our in-depth analysis of the system infrastructure software market includes the following segments:

|

Type |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

System Infrastructure Software Market Regional Analysis:

North America Market Insights

The North America industry is predicted to dominate majority revenue share of 38% by 2035. The surge in data centers for data storage and processing is expected to boost the revenue share. A report published by Research Nester in 2024 concluded that out of 11 countries, North America is considered the top 3 in terms of data centers, which represents about 40% of the global landscape.

In the U.S., there is a tremendous boost in the emergence of startups, which will act as a growth factor for the system infrastructure software industry. The Center for American Progress in 2024 estimated an influence in the growth rate of about 16% between 2019 and 2023 in the number of startups and firms.

Digitization in Canada has been increasing and the Bank of Canada published a report in 2023 stating that digital products make up about 5.5% of Canadian GDP in 2019. The gain in this sector will augment the data center construction value in the near future.

Asia Pacific Market Insights

Asia Pacific region is poised to witness substantial growth through 2035. This region will account for the second position in this landscape owing to the surge in the data infrastructure market in this region. A report published by the Asia Development Bank estimated that the data and statistics showed substantial growth in developing Asia at 5% in 2023.

In China, investments from private and government sectors in digital infrastructure. According to a report by Research Nester in 2024, the spending on cloud infrastructure in China surpassed USD 9.2 billion in 2023, which is about 12% of worldwide cloud spending.

Japan is predicted to have a high rise in technology along with several advancements and innovations in storage management software. A report in 2023 concluded that in Japan there were about 92 million social media users in 2023 which was poised to be about 74.5% of the total population of Japan.

System Infrastructure Software Market Players:

- Broadcom

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Amazon Web Services

- BMC Software, Inc.

- Broadcom Inc. (CA Technologies)

- Cisco Systems, Inc.

- Dell Inc.

- Hewlett Packard Enterprise

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

System infrastructure software market expansion is expected to witness a lucrative share during the forecast period. The competitive environment is attributed to the increasing usage of graphical user interfaces (GUIs). More companies are entering this sector owing to the potential growth opportunities. In the forecast period, the market will observe emerging competitors and a growing demand for gift cards around the world.

Some of the key players include:

Recent Developments

- In September 2023, Amazon Web Services teamed up with Kyndryl, one of the leading it infrastructure providers. By combining enterprise cloud services and solutions with an industry focus, the companies want to help clients improve their operations.

- In May 2022, Broadcom agreed to acquire VMware, a pioneer in corporate software innovation, was announced by Broadcom, by this acquisition, the merged company would meet the required information technology infrastructure needs and provide enterprise customers with an extended platform of vital infrastructure solutions to foster innovation.

- Report ID: 6392

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.