Synthetic Rubber Market Outlook:

Synthetic Rubber Market size was valued at USD 33.31 billion in 2025 and is set to exceed USD 54.78 billion by 2035, expanding at over 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of synthetic rubber is estimated at USD 34.84 billion.

The growth of the market can be attributed to the surging production of synthetic rubber owing to its rapidly escalating demand worldwide as well as increasing utilization in the manufacturing of various industrial goods and consumer goods. It was found that, compared to the year 2000, only about 10.9 million metric tons of synthetic rubber was produced globally, whereas the amount produced in 2020 reached more than 14.4 million metric tons.

In addition to these, factors that are believed to fuel the growth of market include the increasing demand for these products from the automotive industry to produce tier owing to its unmatchable properties such as greater durability and longevity than natural rubber. These qualities are a result of the material's resistance to damage and degradation from chemicals, high and low temperatures, ozone, sunlight, and weathering. Additionally, the growing number of wheels as well as increasing sales of tires worldwide is predicted to present the potential for market expansion over the projected period. It was observed that the total sales of tires amounted to USD 64 billion worldwide in 2021, with a total of around 2.35 billion tires produced.

Key Synthetic Rubber Market Insights Summary:

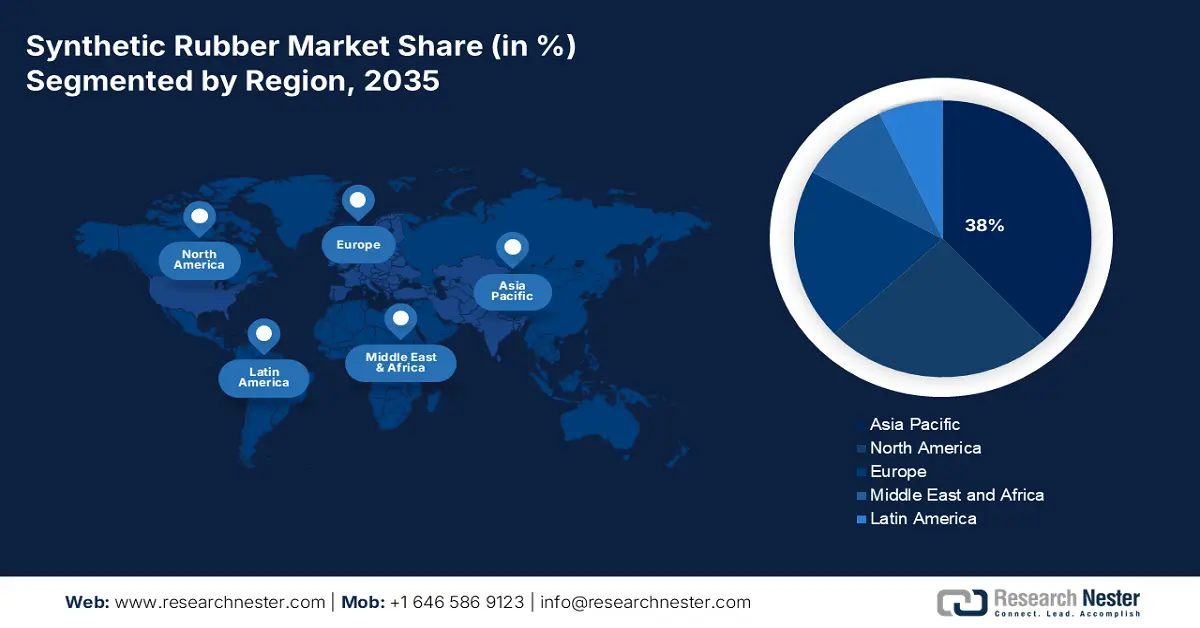

Regional Highlights:

- Asia Pacific synthetic rubber market will hold over 38% share by 2035, driven by rising industrial development in emerging nations like China and India, along with a prospering rubber industry.

- North America market will attain a 22% share by 2035, driven by the increasing GDP per capita and rising infrastructural development, alongside booming biomedical and biotechnology sectors.

Segment Insights:

- The automotive application segment in the synthetic rubber market is anticipated to capture a 48% share by 2035, driven by expanding automotive production, rising vehicle demand, and increasing electric vehicle adoption.

- The styrene-butadiene rubber (sbr) segment in the synthetic rubber market is forecasted to achieve a 35% share by 2035, attributed to widespread use in automotive parts and mechanical goods.

Key Growth Trends:

- Growing Automotive & Transportation Industry

- Surging Demand for Athletic Footwear

Major Challenges:

- Concern about negative impact on environment

- Ill-Effects on human health

Key Players: Arlanxeo, Agilyx AS, ExxonMobil Corporation, Kumho Petrochemical Co., Ltd., Saudi Arabian Oil Co., TSRC Corporation, China Petrochemical Corporation (Sinopec), The Dow Chemical Company, Dupont, Zeon Corporation.

Global Synthetic Rubber Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 33.31 billion

- 2026 Market Size: USD 34.84 billion

- Projected Market Size: USD 54.78 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 10 September, 2025

Synthetic Rubber Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Automotive & Transportation Industry – the increasing number of wheels with the growing production of motor vehicles worldwide is leading to the surging demand for tires and non-tires elastomer products. As per projections, there are more than 37 million wheels around the world. Moreover, the rising demand for lightweight vehicles as well as the growing production of electric vehicles (EVs) is further anticipated to boost the synthetic rubber market in the estimated time period. The physical and chemical properties of synthetic rubber polymers determine the overall tire performance in a vehicle including rolling resistance, wear, and traction.

-

Surging Demand for Athletic Footwear – backed by the uptrend of sports & fitness amongst the young as well as middle age population around the globe the demand for an appropriate athletic shoe for preventing injuries is increasing. As per research conducted with few a sports respondents playing varied sports, it was found that the percentage of injured subjects was ~40% in 2019. This as a result is anticipated to boost the market’s growth.

-

Emerging Demand for Healthcare & Medical Device Industry – The rapidly rising healthcare spending, as well as the growing medical device industry, is expected to boost the market growth as rubber in these industries is used to make various objects like surgical gloves, condoms, breathing bags, stoppers, cushioning materials, tubes, prosthetics, implants, catheters, and much more. The global health expenditure was found to reach ~9.8% of GDP in 2019. Additionally, the medical device industry in the United States is expected to generate ~USD 163 billion in 2023.

-

Prospering Construction Industry – the global construction sector is booming with the increasing infrastructural development as well as rising demand for residential and commercial spaces worldwide. For instance, in the United States (U.S.) 1,406,000 new housing units were completed in January 2023, exhibiting around a 12.8% increase from January 2022. As the construction industry demands synthetic rubber for their utilization in elevator belts, hoses, seismic bearings tubes, and others, the market is projected to expand with the flourishing construction industry.

Challenges

-

Concern about negative impact on environment – The stringent policies that govern the production and processing of synthetic rubber is anticipated to hamper the market growth. As per the Environmental Protection Agency (EPA), the primary sources of hazardous air pollutants (HAP) are sealants, rubber processing, and tire manufacturing facilities. Hence, there are a number of regulations for these industries, restraining the market growth.

-

Ill-Effects on human health

-

Availability of replacements such as polyurethanes

Synthetic Rubber Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 33.31 billion |

|

Forecast Year Market Size (2035) |

USD 54.78 billion |

|

Regional Scope |

|

Synthetic Rubber Market Segmentation:

Application Segment Analysis

The global synthetic rubber market is segmented and analyzed for demand and supply by application into automotive (tire and non-tire), footwear, textile, industrial goods, consumer goods, and others. Out of the given application of synthetic rubber, the automotive segment is estimated to gain the largest market share of about 48% in the year 2035. The growth of the segment can be attributed to the expanding automotive industry with growing production of vehicles as well as the augmenting demand for tires, clutches, and engine bearings, besides the increasing investment to develop lightweight vehicles to improve fuel economy. It was found that around 79 million motor vehicles were produced worldwide in 2021, depicting a rise of 1.3% compared to 2020. Moreover, the surging demand for electric vehicles is further anticipated to boost market growth.

Type Segment Analysis

The global synthetic rubber market is also segmented and analyzed for demand and supply by type styrene butadiene rubber (SBR), ethylene propylene diene rubber (EPDM), polyisoprene rubber (IR), polybutadiene rubber (BR), isobutylene isoprene rubber (IIR), and others. Amongst these three segments, the styrene-butadiene rubber segment is expected to garner a significant share of around 35% in the year 2035. The growth is backed by the widespread application of these types of synthetic rubber in automotive parts, gaskets, car tires, drive couplings, shoe soles and heels, and mechanical rubber goods. On the other hand, the EPDM segment is projected to witness a massive CAGR during the forecast period, owing to the growing demand for this product from the construction industry worldwide as it is used for roofing, sealants, garage door seals, pool liners, and many other applications in construction. This, as a result, is anticipated to create numerous opportunities for the growth of the segment in the coming years.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Synthetic Rubber Market Regional Analysis:

APAC Market Statistics

The market share of synthetic rubber in Asia Pacific, amongst the market in all the other regions, is projected to be the largest with a share of about 38% by the end of 2035. The growth of the market can be attributed majorly to the rising industrial development in emerging nations such as China and India as well as the prospering rubber industry along with the growing end-use industries in the region. It is a known fact that China leading the world in the production of synthetic rubber. It was found that in 2020, China’s synthetic rubber production accounted for nearly 22% of global production that year. Moreover, the presence of giant tire manufacturers as well as prospering automotive industry in the region is further anticipated to boost the synthetic rubber market growth in the region.

North American Market

The North American synthetic rubber market is estimated to be the second largest, registering a share of about 22% by the end of 2035. The growth of the market can be attributed majorly to the increasing GDP per capita of the general population as well as the rising infrastructural development in the region along with the growing volume of construction projects. According to research, the construction industry nearly accounts for 4.3% of the U.S. GDP in 2023. Moreover, as per estimations the construction industry of the U.S. creates around USD 1.8 trillion worth of structures each year. Moreover, the surging development in healthcare facilities as well as booming biomedical, biopharmaceuticals, and biotechnology in the region is further expected to boost the regional market growth.

Europe Market Insights

Europe region is set to witness significant growth till 2035. The market growth in the region is backed by the existence of some key market players in the region besides the presence of giant automotive and tire manufacturers who are the major consumer of synthetic rubber. According to data, there were almost 13 synthetic rubber-producing companies in Europe with a capacity amounting to 2.8 million tons.

Synthetic Rubber Market Players:

- Arlanxeo

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Agilyx AS

- ExxonMobil Corporation

- Kumho Petrochemical Co., Ltd.

- Saudi Arabian Oil Co.

- TSRC Corporation

- China Petrochemical Corporation (Sinopec)

- The Dow Chemical Company

- Dupont

- Zeon Corporation

Recent Developments

-

ARLANXEO a world-leading synthetic rubber company invested to strengthen its position as the world’s leading manufacturer of synthetic rubber. A hefty million amount will be invested to modernize its production sites in Triunfo, Brazil, and La Wantzenau, France.

-

Agilyx Corporation a wholly owned subsidiary of Agilyx AS and a pioneer in the advanced recycling of post-use plastics collaborated with Kumho Petrochemical Co., Ltd., a global leader in the manufacture of synthetic rubber, to explore the development and construction of a chemical recycling project in South Korea

- Report ID: 4838

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Synthetic Rubber Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.