Synthetic Gypsum Market Outlook:

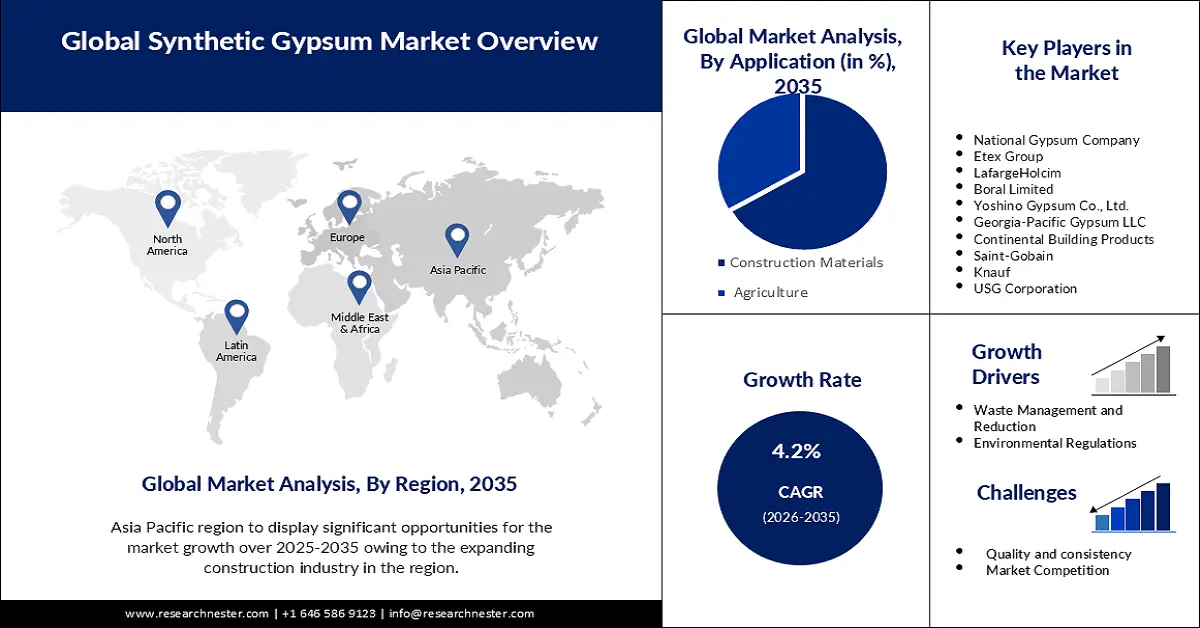

Synthetic Gypsum Market size was over USD 1.79 billion in 2025 and is anticipated to cross USD 2.7 billion by 2035, growing at more than 4.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of synthetic gypsum is assessed at USD 1.86 billion.

Synthetic gypsum finds applications in various industries. This is slated to propel the market growth. The major use of synthetic gypsum is in the construction industry. It is used as a substitute for natural gypsum in the production of gypsum boards, cement, and plaster. Synthetic gypsum is also used in agricultural applications as a soil amendment to improve soil structure and fertility.

Additionally, the increasing demand for sustainable construction materials and the strict regulations on emissions from power plants also drives market growth. The use of synthetic gypsum helps in reducing greenhouse gas emissions and conserving natural resources. It helps in reducing the environmental impact associated with gypsum mining. The rising concern for toxic mineral properties and the need to mitigate, and reduce air pollution is also credited to the market growth. Increasing research and investment opportunities also propel the market.

Key Synthetic Gypsum Market Insights Summary:

Regional Highlights:

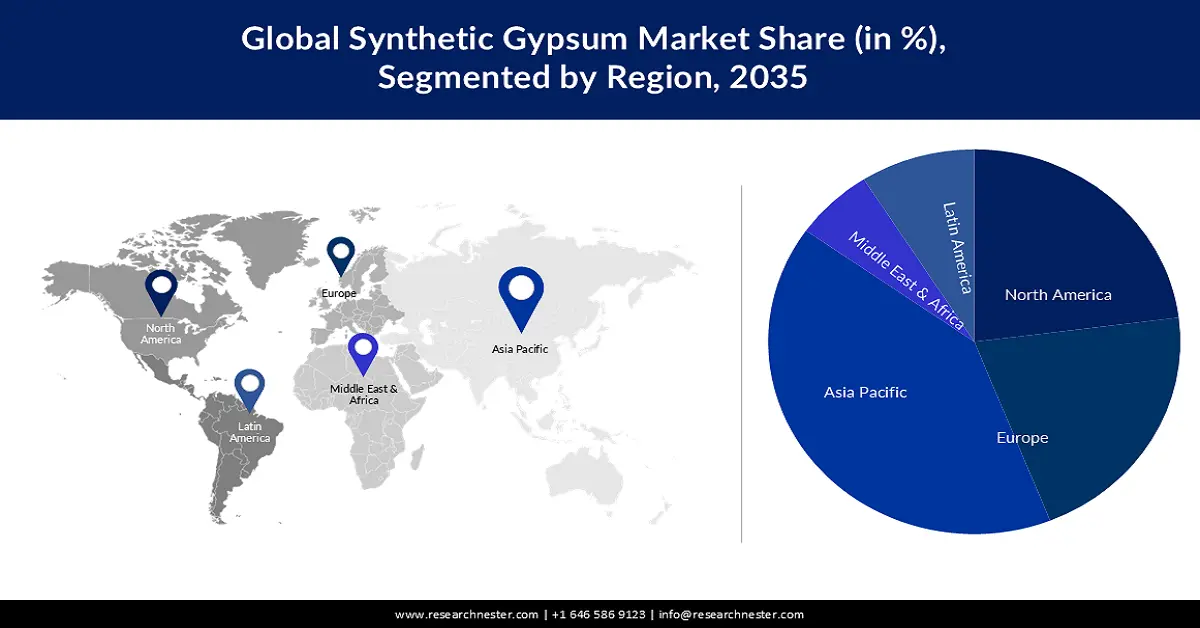

- The Asia Pacific synthetic gypsum market is projected to capture a 40.8% share by 2035, driven by growing construction industry in the region.

- The North America market is expected to secure the second largest share by 2035, attributed to environmental regulations and emission reduction.

Segment Insights:

- The construction segment segment in the synthetic gypsum market is expected to achieve significant share by 2035, fueled by cost efficiency and performance benefits in construction applications.

- The agriculture segment in the synthetic gypsum market is anticipated to maintain the largest share by 2035, propelled by increased awareness and education among farmers about the benefits of synthetic gypsum and sustainable farming.

Key Growth Trends:

- Helps in Waste Reduction

- Agricultural Benefits

Major Challenges:

- Quality and Consistency

- Transportation and Logistics

Key Players: Saint-Gobain, Knauf, USG Corporation (now part of Gebr. Knauf KG), National Gypsum Company, Etex Group, LafargeHolcim, Boral Limited, Yoshino Gypsum Co., Ltd., Georgia-Pacific Gypsum LLC, LafargeHolcim.

Global Synthetic Gypsum Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.79 billion

- 2026 Market Size: USD 1.86 billion

- Projected Market Size: USD 2.7 billion by 2035

- Growth Forecasts: 4.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 9 May, 2025

Synthetic Gypsum Market Growth Drivers and Challenges:

Growth Drivers

- Helps in Waste Reduction: Synthetic gypsum plays a crucial role in smart waste management and reduction. By using synthetic gypsum instead of natural gypsum, industries can reduce the amount of waste generated and minimize the environmental impact of waste disposal. In the United States, over 30 million tons of FGD gypsum were used in various applications, contributing to waste reduction.

- Agricultural Benefits: The use of synthetic gypsum in agricultural applications has helped mitigate soil erosion and nutrient leaching, leading to improved crop yields and reduced environmental impacts. Agricultural investments, and R & D by multiple market players will also propel the growth of the market.

- Environmental Regulations: Stricter environmental regulations aimed at reducing emissions from coal-fired power plants have been a significant growth driver for the synthetic gypsum sector.

Challenges

- Quality and Consistency: Ensuring consistent quality and purity of synthetic gypsum can be a challenge. The composition and properties of synthetic gypsum can vary depending on the source and the specific industrial process it is derived from. Maintaining consistent quality standards becomes crucial, especially when synthetic gypsum is used as a raw material in industries like construction, where specific requirements need to be met.

- Transportation and Logistics

- Market Competition

Synthetic Gypsum Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.2% |

|

Base Year Market Size (2025) |

USD 1.79 billion |

|

Forecast Year Market Size (2035) |

USD 2.7 billion |

|

Regional Scope |

|

Synthetic Gypsum Market Segmentation:

Application Segment Analysis

The agriculture segment is estimated to gain the largest market share in 2035. The segmental growth can be accredited to increased awareness and education. Growing awareness among farmers about the benefits of synthetic gypsum and education on sustainable farming practices have played a significant role in driving its adoption in the agriculture segment. Increased knowledge about soil health, conservation, and nutrient management practices has led to the recognition of synthetic gypsum's potential benefits.

End Use Industry Segment Analysis

The construction segment in the synthetic gypsum market is expected to register a significant share in 2035. The growth of the segment is propelled by the cost efficiency and performance benefits. Synthetic gypsum offers cost advantages and performance benefits in construction applications, contributing to its growing demand. A study by the U.S. Gypsum Association found that the use of synthetic gypsum in gypsum board manufacturing resulted in improved product performance and reduced manufacturing costs compared to natural gypsum.

Our in-depth analysis of the global market includes the following segments:

|

Application |

|

|

End Use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Synthetic Gypsum Market Regional Analysis:

APAC Market Insights

The synthetic gypsum market in the Asia Pacific region is projected to hold the largest market share by 2035. The regional growth is credited to the growing construction industry in the region. The expanding construction industry has created a strong demand for construction materials, including synthetic gypsum. Government initiatives and investments in infrastructure development, urban renewal, and affordable housing projects have played a significant role in driving the market in the Asia Pacific region. For example, India's government launched the "Housing for All by 2022" initiative, aiming to provide affordable housing to all citizens.

North American Market Insights

The synthetic gypsum market in the North American region is anticipated to hold the second-largest share during the forecast period. The growth of the market in this region can be ascribed to environmental regulations and emission reduction. Stricter environmental regulations and the need to reduce emissions from coal-fired power plants have led to the widespread adoption of flue gas desulfurization (FGD) systems, resulting in increased production of synthetic gypsum. The increasing focus on sustainable construction practices and green building certifications has driven the demand for synthetic gypsum in the construction industry.

Synthetic Gypsum Market Players:

- Saint-Gobain

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Knauf

- USG Corporation (now part of Gebr. Knauf KG)

- National Gypsum Company

- Etex Group

- LafargeHolcim

- Boral Limited

- Yoshino Gypsum Co., Ltd.

- Georgia-Pacific Gypsum LLC

- LafargeHolcim

Recent Developments

- In September 2021, Knauf announced the completion of its acquisition of USG Corporation. The merger between the two companies created a global leader in building materials, with a strong presence in the gypsum industry.

- LafargeHolcim announced in February 2023 that it has signed a deal to acquire Firestone Building Products (FSBP), a leading manufacturer of roofing and building envelope solutions. This acquisition strengthens LafargeHolcim's position in the construction industry and expands its product portfolio.

- Report ID: 5079

- Published Date: May 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Synthetic Gypsum Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.