Synthetic Aperture Radar Market Outlook:

Synthetic Aperture Radar Market size was valued at USD 5.19 billion in 2025 and is set to exceed USD 13.58 billion by 2035, registering over 10.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of synthetic aperture radar is estimated at USD 5.66 billion.

Synthetic aperture radar (SAR) is finding high applications in defense and national security for surveillance, reconnaissance, and target detection. Governments around the globe are investing heavily in advanced SAR technologies to enhance their defense and intelligence sectors, which is significantly augmenting the overall market growth. The evolving threat challenges such as cyberattacks and terrorism are further driving countries to adopt next-gen surveillance systems such as synthetic aperture radars.

Manufacturers are also receiving funding from defense sectors to develop start-of-art surveillance technologies. For instance, in September 2024, Capella Space received strategic funding of around USD 15 million from the U.S. Air Force to accelerate innovation in the development of its next generation of synthetic aperture radar satellites. Through such strategic private funding, the government is aiming to advance its defense systems. Thus, the manufacturers of synthetic aperture radar technologies are set to earn high profits through several public and private investments in the coming years.

Key Synthetic Aperture Radar Market Insights Summary:

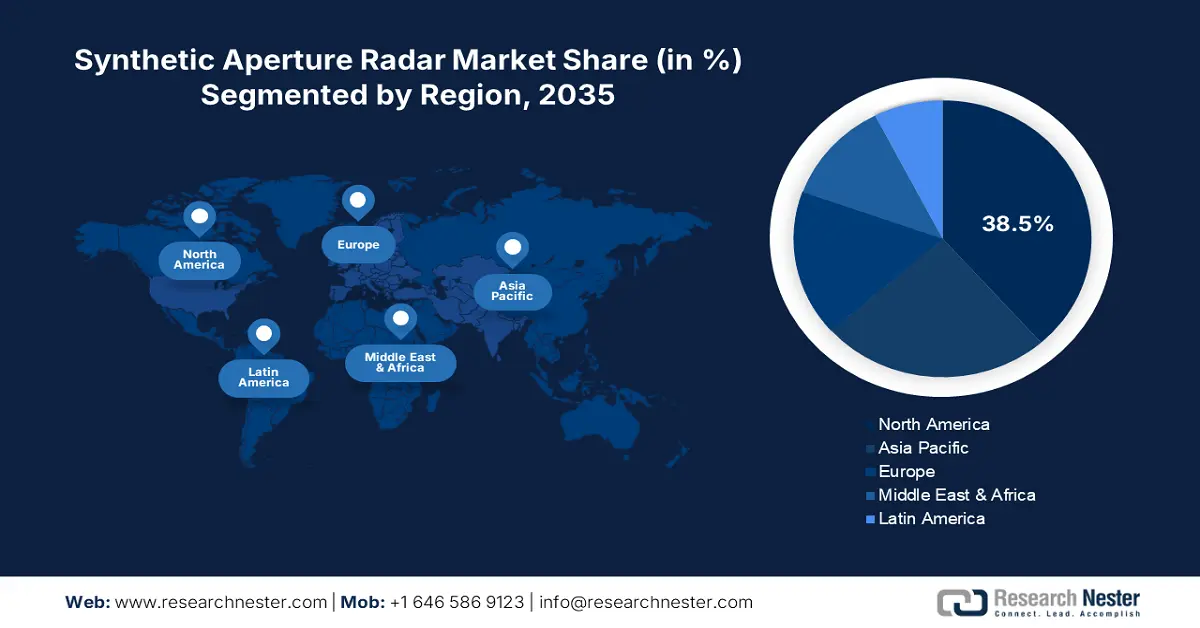

Regional Highlights:

- North America's 38.5% share in the Synthetic Aperture Radar Market is driven by increasing defense and security needs and technological advancements in space radar systems, ensuring leadership through 2035.

- Asia Pacific’s synthetic aperture radar market is expected to grow rapidly by 2035, driven by increasing government investments in defense and collaborations with international space agencies.

Segment Insights:

- Research & Commercial Applications segment are expected to grow significantly by 2035, fueled by SAR's role in infrastructure monitoring and smart city projects.

- Spacecraft segment is anticipated to hold a 57.10% share by 2035, driven by satellite advancements and rising demand for detailed Earth observation.

Key Growth Trends:

- Miniaturization trend

- Earth observation projects

Major Challenges:

- High initial costs

- Data overload & processing challenges

- Key Players: Airbus SE, The Boeing Company, Embraer S.A., Capella Space, Harris Corporation, and ICEYE.

Global Synthetic Aperture Radar Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.19 billion

- 2026 Market Size: USD 5.66 billion

- Projected Market Size: USD 13.58 billion by 2035

- Growth Forecasts: 10.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 13 August, 2025

Synthetic Aperture Radar Market Growth Drivers and Challenges:

Growth Drivers

- Miniaturization trend: The miniaturization trend is anticipated to positively influence the synthetic aperture radar market growth in the coming years. Innovations in semiconductor technology and engineering components are efficiently enabling the miniaturization of synthetic aperture radar systems. This compact advancement is set to make SAR more efficient, lighter, and cost-effective. This trend is further augmenting their integration into smaller platforms such as small satellites, drones, and handheld devices, leading to their increasing use cases and accessibility. For instance, in October 2024, Silicon Sensing revealed that its DMU30 inertial measurement unit (IMU) is finding applications in the control systems of Japan’s first X-band synthetic aperture radar (SAR) small satellite Izanagi of the Institute for Q-shu Pioneers of Space, Inc.

- Earth observation projects: The increasing importance of earth observation services to monitor climate change, environmental disasters, and agricultural practices is augmenting the synthetic aperture radar (SAR) market growth. The SAR’s ability to operate in extreme weather conditions both day and night is expanding its use in monitoring and mapping. National space agencies across the world are also collaborating for Earth Observation missions aimed at analyzing causes of land surface changes. For instance, the National Aeronautics and Space Administration (NASA) and the Indian Space Research Organisation (ISRO) have entered into a partnership to launch synthetic aperture radar-equipped spacecraft by March 2025. The satellite’s aim is to monitor and capture the measurements of the planet’s natural hazards such as volcanic unrest, landslides, and coastal subsidence, and most complex processes such as ice-sheet collapse and ecosystem disturbances.

Challenges

- High initial costs: The high cost associated with the development and deployment of synthetic aperture radar systems including the costs of satellite, ground stations, and radar equipment are major barriers for many organizations. The high Capex often limits the entry of new companies and the innovations of these technologies among smaller companies.

- Data overload & processing challenges: Synthetic aperture radar systems generate vast amounts of data, which creates challenges related to storage, processing, and analysis. This complexity of the processing of radar data and the need for highly specialized expertise limits the widespread adoption of SAR technologies, particularly in industries that are not traditionally involved in remote sensing.

Synthetic Aperture Radar Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.1% |

|

Base Year Market Size (2025) |

USD 5.19 billion |

|

Forecast Year Market Size (2035) |

USD 13.58 billion |

|

Regional Scope |

|

Synthetic Aperture Radar Market Segmentation:

Platform (Spacecraft, Aircraft, UAV)

In synthetic aperture radar market, spacecraft segment is expected to account for around 57.1% revenue share by 2035. The advancements in satellite technology coupled with the growing need for detailed and reliable Earth observation analysis are augmenting the use of synthetic aperture radar technologies in spacecraft. For instance, in July 2o24, Rocket Lab USA, Inc. announced the 51st Electron launch, a dedicated mission for American space tech company Capella Space. The Capella’s Acadia-3 SAR satellite effectively monitors and analyzes Earth imagery and observations. Governments worldwide are also increasingly investing in advancing their space intelligence, which is directly pushing the demand for advanced synthetic aperture radar spacecraft. The international space agencies are also collaborating to launch next-gen synthetic radar system spacecraft, one to be launched by NASA and ISRO in Q1 of 2025.

End use (Research & Commercial Applications, Defense)

The research & commercial application segment is forecast to hold a dominant synthetic aperture radar market share by 2035. The synthetic aperture radar system's ability to detect ground displacement with accuracy is finding wide applications in monitoring infrastructure such as dams, bridges, and buildings. In particular, the mining and oil & gas industries use SAR to monitor subsidence and changes in terrain that could signal potential risks to infrastructure and operations. Furthermore, SAR technologies are also highly used in urban planning and smart city projects to monitor urban expansion, track infrastructure conditions, and assess traffic congestion. For instance, in June 2021, Umbra Space announced the launch of its first synthetic aperture radar technology. This system with a unique imaging payload captures images with resolution down to 10 inches through clouds, smoke, and even total darkness. Furthermore, the collaboration between space intelligence companies is increasing the use of SAR systems for research purposes.

Our in-depth analysis of the global synthetic aperture radar market includes the following segments:

|

Frequency Band |

|

|

Component |

|

|

Platform |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Synthetic Aperture Radar Market Regional Analysis:

North America Market Forecast

North America synthetic aperture radar market is expected to capture revenue share of over 38.5% by 2035. The increasing defense and security needs for advanced monitoring technologies, technological advancements in space radar systems, and high demand for commercial applications are collectively contributing to the regional market growth. In both the U.S. and Canada, the increasing emphasis on military and satellite-based technologies is set to double the revenues of synthetic aperture radar market.

The U.S. is one of the biggest adopters of advanced monitoring technologies including synthetic aperture radar (SAR) market. The increasing investments in advancing military and defense segments of the country are anticipated to augment the sales of synthetic aperture technologies in the coming years. For instance, the House Committee on Appropriations revealed that around USD 824.3 billion is expected to be funded to the U.S. Department of Defense in FY25.

In Canada, the government is investing heavily in private firms to develop advanced synthetic aperture radar technologies for enhanced space explorations. For instance, in July 2021, SpaceAlpha Insights Corp. announced that the Canadian Space Agency (CSA) invested around USD 1.17 million for the production of advanced synthetic aperture radar technology to accelerate the country's space exploration projects. Such investments are driving the attention of market players to grab funding opportunities.

Asia Pacific Market Statistics

The Asia Pacific synthetic aperture radar (SAR) market is set to expand at the fastest pace during the anticipated period. The combination of factors such as increasing government investments in defense and security intelligence, environmental monitoring needs, and collaborations with international space agencies is uplifting Asia Pacific's position in the global SAR market. Japan, China, India, and South Korea are big profit pools for synthetic aperture radar system producers.

In India, the ISRO space agency is collaborating with NASA for the launch of an advanced SAR satellite for Earth observation. Such initiatives are driving key player's attention to expand their operations in the country. The India Brand Equity Foundation (IBEF) reveals that the government has opened doors to private sectors to participate in the defense industry to promote indigenous manufacturing. With a USD 74.7 billion budget, the India defense industry ranks 4th globally in 2024. Furthermore, the increasing emergence of start-ups in the aerospace innovation sector is anticipated to augment SAR industry growth. For instance, in May 2024, a Bengaluru-based start-up GalaxEye Space announced the successful testing of its synthetic aperture radar technology. The SAR technology was tested on a subscale High Altitude Pseudo-Satellite (HAPS) manufactured by the National Aerospace Laboratories (NAL). With this move, the company is efficiently aligning with the Aatmanirbhar Bharat initiative and became the first private firm to perform SAR trials on the HAPS platform, globally.

China’s strong emphasis on defense capabilities is set to drive the sales of synthetic aperture radar technologies in the foreseeable period. The increasing investment by the country in space-based SAR systems to enhance military operations, surveillance of its vast operations, and maritime patrols is augmenting the demand for advanced SAR systems. The rising infrastructure development projects in the country are further increasing the use of synthetic aperture radar systems in commercial applications.

Key Synthetic Aperture Radar Market Players:

- Airbus SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- The Boeing Company

- Embraer S.A.

- Capella Space

- Harris Corporation

- ICEYE

- Israel IAI

- OHB System AG

- Collins Aerospace

- Hanwha Systems

- GalaxEye Space

- Umbra Space

- Rocket Lab USA, Inc.

- Silicon Sensing

- Safran S.A.

- Raytheon Company

- Thales S.A.

- Lockheed Martin Corporation

- SpaceAlpha Insights Corp.

The global synthetic aperture radar market is characterized by the presence of industry giants and the emergence of start-ups. The ongoing innovations in the aerospace sector are generating lucrative opportunities for SAR technology manufacturers. The new companies are majorly focusing on expanding their product offerings for commercial applications to earn high gains and stand out in the niche market. Leading companies are collaborating with public space agencies to introduce next-gen synthetic aperture radar systems. The public funding trends are also aiding companies to stand out in the competitive landscape and account for remarkable profits.

Some of the key players are SAR market:

Recent Developments

- In June 2023, ICEYE, announced the launch of four new synthetic aperture radar (SAR) satellites. These next-gen satellites are equipped with the company’s Gen 3 technology and can capture Earth’s image with a ground range resolution of 50 cm.

- In July 2023, Hanwha Systems revealed the launch of ultra-small synthetic aperture radar satellites developed using proprietary technology at Pair Air Show 2023. Through such innovations, the company is significantly contributing to the South Korea market growth.

- Report ID: 6870

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Synthetic Aperture Radar Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.