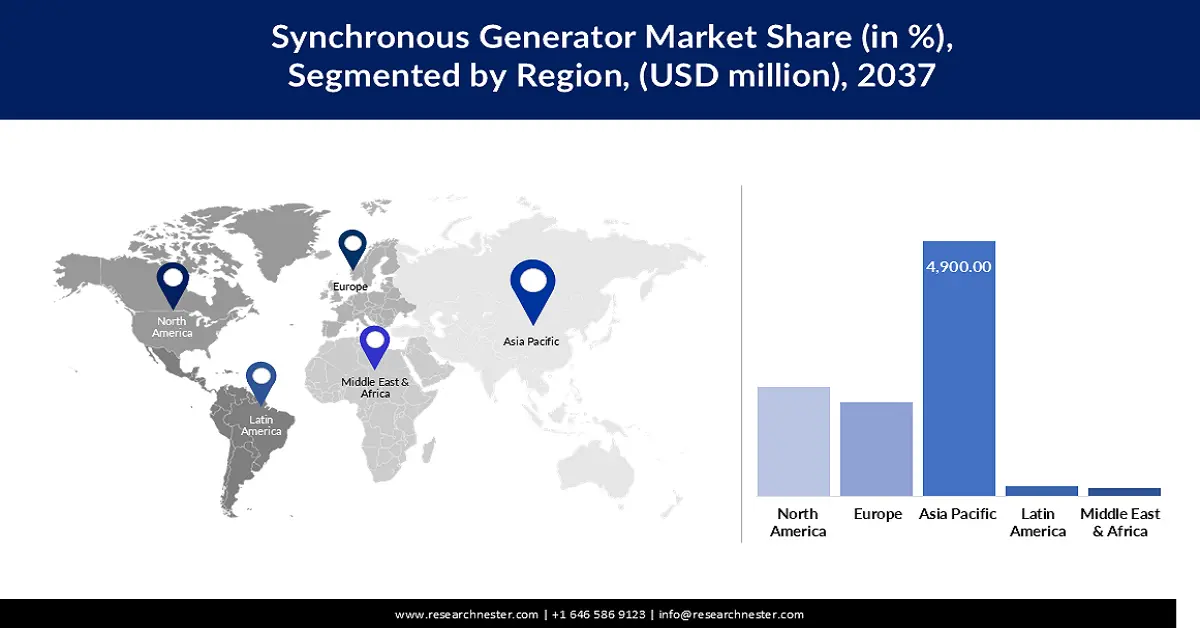

Synchronous Generator Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific is expected to lead the global synchronous generator market, holding around 46% share by 2037. Large infrastructure projects, industrial growth, and fast adoption of renewable energy contribute to growth. In November 2023, Shanghai Electric added more generators to its supply in Asia to aid multi-energy grid schemes. Industrial hubs in India and hybrid power systems in Southeast Asia are both experiencing high electricity demand. Regional administrations are helping to develop local factories and authorize technology use. Synchronous generators are preferable as they require stable voltage and are compatible with energy storage. The market is at different stages, but the overall trend is positive.

China plays a leading role in the synchronous generator market due to its domestic policies and export strategies. To achieve uniformity, China enforced the GB/T 7409.4-2023 standard in January 2024 to standardize the terminology used in excitation. The rule increases the compatibility of products, which is crucial for China’s plans to export more energy. Major companies in the region are increasing their output for projects that use wind, solar, and hydrogen together. China’s power to coordinate technical rules with the introduction of new technology helps it gain an advantage. It is also regularly exporting synchronous systems to nations in Africa and South America. The favorable policies allow China to be a dominant force in both manufacturing and using electronic products.

The need for synchronous generators in India is increasing due to expanding industry and the adoption of smart grids. In May 2023, CG Power’s Industrial Systems segment saw a 17.97% increase in revenue year on year, owing to higher demand in Asia. The country is experiencing a rise in demand for energy in cities and industry. National plans are now focused on ensuring both reliability and quality of energy in Tier-II cities. Synchronous generators play a major role in managing sudden changes in load and maintaining the voltage level. Local manufacturing of these units is encouraged by India’s Make-in-India initiative. The export potential increases as nearby countries purchase products from Indian OEMs.

North America Market Insights

The market for synchronous generators in North America is anticipated to rise at a CAGR of 4.5% from 2025 to 2037. The development is driven by better grids and increased spending on resilient power installations. To meet the increased demand, General Electric increased its production facility in the U.S. in April 2023. Utilities in North America are focusing more on local sources of energy to aid in recovery after disasters. Power redundancy is becoming increasingly important in hospitals and data centers, driving the growth of these markets further. At the same time, difficulties in sending electricity have resulted in utilities adding more distributed synchronous units. Industries are deploying new technologies more widely as a result of clear regulations.

In North America, the U.S. is driving economic expansion, owing to its commitment to both resilient infrastructure and clean energy. In June 2023, WEG Electric Machinery Company made its hydrogenerator line more efficient by introducing upgraded units. They are now commonly used in both municipal projects and on federal energy sites. Federal decarbonization grants are helping U.S. manufacturers introduce advanced synchronous products. In addition, the Energy Department’s efforts to modernize the grid are encouraging the use of frequency-sensitive equipment. New requirements for grid-connected equipment are also good news for local producers. The U.S. leads owing to its strong industrial base and export infrastructure.

The demand for synchronous generators in Canada is propelled by upgrading infrastructure and ensuring reliable energy in remote parts of the nation. In August 2023, Canada General Electric upgraded a 4,000 HP synchronous motor for industrial purposes. The retrofit demonstrated that Canada is strong in supporting legacy heavy-duty systems. Mining, pulp, and hydro sectors are still experiencing strong demand for power. Provinces are installing additional equipment to handle changes in energy needs throughout the year. There is also an increasing focus on low-speed, high-voltage systems that can handle the large areas in Canada. National regulations that require equipment upgrades help export-oriented OEMs. The trends indicate that the industry is growing steadily due to both ability and demand.