Global Synchronous Generator Market

- An Outline of the Global Synchronous Generator Market

- Market Definition and Segmentation

- Study Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- SPSS Methodology

- Data Triangulation

- Executive Summary

- Global Industry Overview

- Industry Supply Chain Analysis

- DROT

- Driver

- Restraint

- Opportunities

- Trends

- Government Regulation

- Competitive Landscape

- Atlas Copco AB

- DANFOSS A/S

- EBARA CORPORATION

- Hitachi Industrial Products, Ltd.

- IHI ASIA PACIFIC PTE. LTD.

- KOBE STEEL, LTD.

- Mitsubishi Heavy Industries, Ltd.

- Siemens Energy

- Sulzer Ltd.

- TMTV Industries Pvt. Ltd.

- Turbo-Tech Compressor Wuxi Co., Ltd

- Ongoing Technological Advancements

- Price Benchmarking

- SWOT Analysis

- Product Type Scenario

- Power Output Analysis

- Synchronous Generator Capacity Analysis

- Patent Evaluation

- Key Application

- Recent Developments

- Root Cause Analysis

- Industry Risk Assessment

- Global Synchronous Generator Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Global Synchronous Generator Market Segmentation Analysis (2024-2037)

- Prime Mover, Value (USD Million)

- Gas Turbine

- Steam Turbine

- Power Rating, Value (USD Million)

- 5 to 10 MVA

- 10 to 20 MVA

- 20 to 30 MVA

- 30 to 50 MVA

- Speed, Value (USD Million)

- 1500 RPM

- 3000 RPM

- End user, Value (USD Million)

- Waste-to-Energy Generation

- Biomass Power Generation

- Hydrogen & Ammonia Fuel Power Generation

- CO2 & Air Storage Power Generation

- Oil & Gas

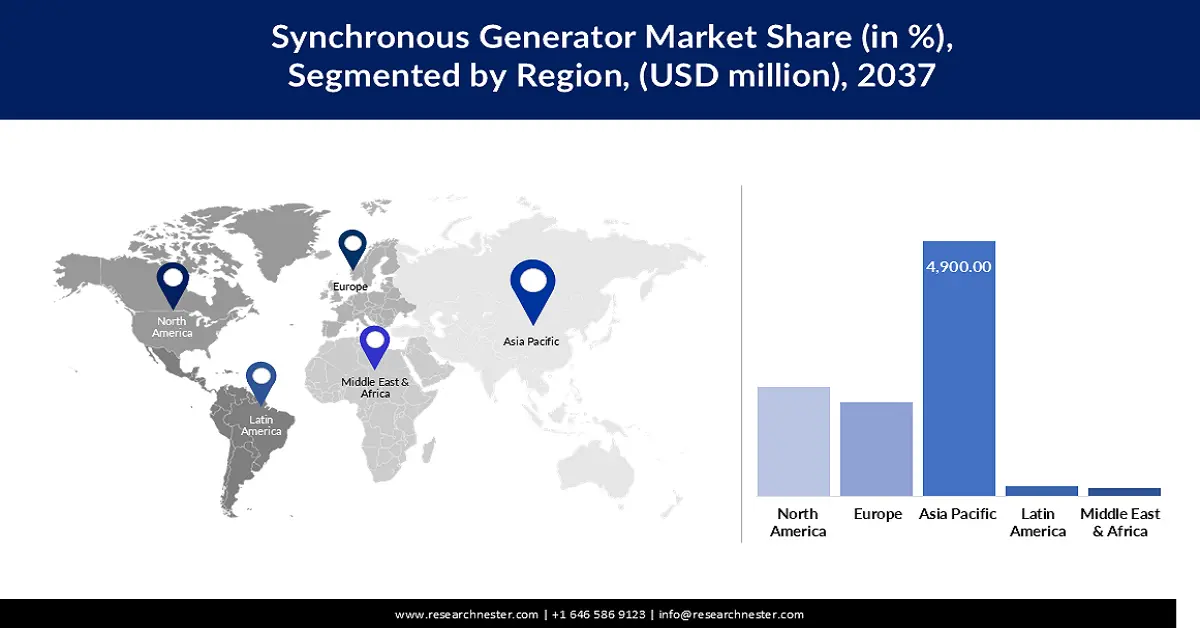

- By Region

- North America, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Europe, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Asia Pacific Excluding Japan, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Japan, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Latin America, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Middle East and Africa, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Prime Mover, Value (USD Million)

- Cross Analysis of Type w.r.t End user, 2024-2037 (USD Million)

- North America Synchronous Generator Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- North America Synchronous Generator Market Segmentation Analysis (2024-2037)

- Prime Mover, Value (USD Million)

- Gas Turbine

- Steam Turbine

- Power Rating, Value (USD Million)

- 5 to 10 MVA

- 10 to 20 MVA

- 20 to 30 MVA

- 30 to 50 MVA

- Speed, Value (USD Million)

- 1500 RPM

- 3000 RPM

- End user, Value (USD Million)

- Waste-to-Energy Generation

- Biomass Power Generation

- Hydrogen & Ammonia Fuel Power Generation

- CO2 & Air Storage Power Generation

- Oil & Gas

- By Country

- U.S., Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Canada, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Prime Mover, Value (USD Million)

- Cross Analysis of Type w.r.t End user, 2024-2037 (USD Million)

- Europe Synchronous Generator Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Europe Synchronous Generator Market Segmentation Analysis (2024-2037)

- Prime Mover, Value (USD Million)

- Gas Turbine

- Steam Turbine

- Power Rating, Value (USD Million)

- 5 to 10 MVA

- 10 to 20 MVA

- 20 to 30 MVA

- 30 to 50 MVA

- Speed, Value (USD Million)

- 1500 RPM

- 3000 RPM

- End user, Value (USD Million)

- Waste-to-Energy Generation

- Biomass Power Generation

- Hydrogen & Ammonia Fuel Power Generation

- CO2 & Air Storage Power Generation

- Oil & Gas

- By Country

- UK, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Germany, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- France, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Italy, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Spain, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Russia, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- BENELUX, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Poland, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Rest of Europe, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Prime Mover, Value (USD Million)

- Cross Analysis of Type w.r.t End user, 2024-2037 (USD Million)

- Asia Pacific Excluding Japan Synchronous Generator Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Asia Pacific Excluding Japan Synchronous Generator Market Segmentation Analysis (2024-2037)

- Prime Mover, Value (USD Million)

- Gas Turbine

- Steam Turbine

- Power Rating, Value (USD Million)

- 5 to 10 MVA

- 10 to 20 MVA

- 20 to 30 MVA

- 30 to 50 MVA

- Speed, Value (USD Million)

- 1500 RPM

- 3000 RPM

- End user, Value (USD Million)

- Waste-to-Energy Generation

- Biomass Power Generation

- Hydrogen & Ammonia Fuel Power Generation

- CO2 & Air Storage Power Generation

- Oil & Gas

- By Country

- China, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- India, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- South Korea, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Australia, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Indonesia, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Malaysia, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Vietnam, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Thailand, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Singapore, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- New Zealand, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Rest of APEJ, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Prime Mover, Value (USD Million)

- Japan Synchronous Generator Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Japan Synchronous Generator Market Segmentation Analysis (2024-2037)

- Prime Mover, Value (USD Million)

- Gas Turbine

- Steam Turbine

- Power Rating, Value (USD Million)

- 5 to 10 MVA

- 10 to 20 MVA

- 20 to 30 MVA

- 30 to 50 MVA

- Speed, Value (USD Million)

- 1500 RPM

- 3000 RPM

- End user, Value (USD Million)

- Waste-to-Energy Generation

- Biomass Power Generation

- Hydrogen & Ammonia Fuel Power Generation

- CO2 & Air Storage Power Generation

- Oil & Gas

- Prime Mover, Value (USD Million)

- Cross Analysis of Type w.r.t End user, 2024-2037 (USD Million)

- Latin America Synchronous Generator Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Latin America Synchronous Generator Market Segmentation Analysis (2024-2037)

- Prime Mover, Value (USD Million)

- Gas Turbine

- Steam Turbine

- Power Rating, Value (USD Million)

- 5 to 10 MVA

- 10 to 20 MVA

- 20 to 30 MVA

- 30 to 50 MVA

- Speed, Value (USD Million)

- 1500 RPM

- 3000 RPM

- End user, Value (USD Million)

- Waste-to-Energy Generation

- Biomass Power Generation

- Hydrogen & Ammonia Fuel Power Generation

- CO2 & Air Storage Power Generation

- Oil & Gas

- By Country

- Brazil, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Argentina, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Mexico, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Rest of Latin America, Market Value (USD Million), CAGR & Y-o-Y Growth Trend, 2024-2037F

- Prime Mover, Value (USD Million)

- Cross Analysis of Type w.r.t End user, 2024-2037 (USD Million)

- Middle East & Africa Synchronous Generator Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Middle East & Africa Synchronous Generator Market Segmentation Analysis (2024-2037)

- Prime Mover, Value (USD Million)

- Gas Turbine

- Steam Turbine

- Power Rating, Value (USD Million)

- 5 to 10 MVA

- 10 to 20 MVA

- 20 to 30 MVA

- 30 to 50 MVA

- Speed, Value (USD Million)

- 1500 RPM

- 3000 RPM

- End user, Value (USD Million)

- Waste-to-Energy Generation

- Biomass Power Generation

- Hydrogen & Ammonia Fuel Power Generation

- CO2 & Air Storage Power Generation

- Oil & Gas

- By Country

- GCC, Market Value (USD Million), Volume (Tons) and CAGR, 2024-2037F

- Israel, Market Value (USD Million), Volume (Tons) and CAGR, 2024-2037F

- South Africa, Market Value (USD Million), Volume (Tons) CAGR & Y-o-Y Growth Trend, 2024-2037F

- Rest of Middle East & Africa, Market Value (USD Million), Volume (Tons) and CAGR, 2024-2037F

- Prime Mover, Value (USD Million)

- About Research Nester

Synchronous Generator Market Outlook:

Synchronous Generator Market size was over USD 5 billion in 2024 and is anticipated to exceed USD 9.4 billion by the end of 2037, witnessing over 5% CAGR during the forecast period i.e., between 2025-2037. In 2025, the industry size of synchronous generator is evaluated at USD 5.2 billion.

The global synchronous generator market growth is being driven due to rising demands for reliable grids and more renewable energy. Investment from players is moving toward flexible and modular generation units designed for use in hybrid and microgrids. In July 2024, ABB introduced a 20 MW modular synchronous generator that can be equipped with a flywheel system to help stabilize the flow of electricity. This can help reduce the need to use expensive power at peak times. Businesses are adjusting their products to meet new regulations and efforts to reduce emissions. Meanwhile, developing countries are turning to synchronous generators to improve their old infrastructure. Such transitions demonstrate a wide range of opportunities for different regions and sectors.

Many countries are reviewing their electricity grid policies and standards to support the use of synchronous generators, mainly in small-scale power grids. In February 2023, ANDRITZ Hydro was awarded a contract by TEPCO Renewable Power, Inc. to supply a hydropower generation system for the Tashirogawa Daiichi Power Plant in Japan. With electrification advancing in maritime, rail, and industrial systems, more demand is being seen for compact, rugged, and fuel-neutral synchronous generators. At the same time, digital control technology and easy-to-maintain products are becoming common. At the international level, governments are updating regulations to help improve standards.

Key Synchronous Generator Market Insights Summary:

Regional Highlights:

- The Asia Pacific region is projected to command approximately 46% share of the Synchronous Generator Market by 2037, attributed to extensive infrastructure projects, industrial expansion, and rising renewable energy adoption.

- The North America region is anticipated to witness a CAGR of 4.5% from 2025 to 2037, owing to increasing investments in grid modernization and resilient power installations.

Segment Insights:

- The steam turbine segment in the Synchronous Generator Market is anticipated to hold a 55.9% share by 2037, propelled by its widespread application in thermal and nuclear power plants.

- The 5 to 10 MVA segment is projected to capture 35.4% of the market by 2037, driven by its extensive use across manufacturing, water treatment, and public infrastructure sectors.

Key Growth Trends:

- Need for constant electricity from industry is boosting demand

- Modernizing hydropower opens up new opportunities for businesses

Major Challenges:

- Stronger requirements for the grid bring design difficulties

- Performance monitoring mandates increase complexity

Key Players: ABB Ltd., Siemens Energy, General Electric Company, Cymbet Corporation, Caterpillar Inc., WEG S.A., Andritz.

Global Synchronous Generator Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2024 Market Size: USD 5 billion

- 2025 Market Size: USD 5.2 billion

- Projected Market Size: USD 9.4 billion by 2037

- Growth Forecasts: 5% CAGR (2025-2037)

Key Regional Dynamics:

- Largest Region: Asia Pacific (46% Share by 2037)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, India, Germany

- Emerging Countries: Indonesia, Vietnam, Brazil, Mexico, South Korea

Last updated on : 6 October, 2025

Synchronous Generator Market - Growth Drivers and Challenges

Growth Drivers

- Need for constant electricity from industry is boosting demand: The need for secure and constant electricity in industrial operations is pushing the market forward. The need for strong power in smart factories leads businesses to use synchronous generators, which are known for their inertia and stability. In April 2023, TMEIC introduced low-vibration and high-insulation generators that are designed for use in these applications. They are developed to meet the requirements of both API and IEC standards worldwide. Where power quality is a concern, countries now tend to choose synchronous units instead of asynchronous alternatives. More reliance on automation systems increases the need for strong governance. For this reason, high-load generators are now widely used in many industries.

- Modernizing hydropower opens up new opportunities for businesses: The upgrade of hydropower infrastructure is driving demand for synchronous generators in different countries, regardless of their development level. In May 2024, Končar Elektroindustrija tested a 2800 kVA vertical synchronous generator at the Shin Sakagami facility in Japan. The test helps support Japan’s efforts to modernize its infrastructure. Globally, utilities are modernizing their older equipment to comply with the current standards for grid frequency and voltage. Such improvements are often made possible by using high-performance synchronous machines. In addition, hydro-linked microgrids are being implemented in South Asia and Latin America. Such trends are encouraged by government subsidies and financial support.

- Rise in electric vehicles increases the demand for flexible sources of electricity: As countries make their transport and energy systems greener, they are turning to flexible power generators, with synchronous generators fitting well into these new systems. In September 2023, Nishishiba Electric boosted its production of marine synchronous units for use offshore. They are made to meet the rising demand for electric propulsion and energy systems at sea. As more people use hybrid vessels and offshore grids, synchronous units with permanent excitation are becoming more popular. Today, governments are urging manufacturers to follow plans for using electric transportation. Offering both fuel flexibility and the ability to stay in sync with the grid is why these systems are so important. As a result, they can work effectively in systems that use many types of energy.

Challenges

- Stronger requirements for the grid bring design difficulties: The standards for excitation systems in small-capacity plants are becoming more demanding due to rapid changes in grid codes. The IEEE 421.1-2021 standard has gained prominence as it outlines essential definitions and design practices for excitation systems in synchronous machines. Therefore, OEMs of synchronous generators have to redesign their low-output models to follow export rules. Limited research and development may make it difficult for small firms to adapt to these changes. The changes are being adopted by nearby Asia markets, adding more pressure to existing systems. Although the goal is to make grids safe, the immediate cost of compliance is high. Such standards are part of a worldwide effort to unify power equipment regulations.

- Performance monitoring mandates increase complexity: Another challenge in the sector is ensuring compliance with the performance monitoring requirements set by national grid authorities, especially in less developed countries. In June 2024, Sri Lanka enacted the Grid Code Regulation, requiring that all synchronous generators be monitored for efficiency. It is essential for these systems to come with both diagnostic and predictive maintenance tools. OEMs are now required to integrate digital technology into their existing systems. There is a strong need for industrial operators to invest in costly retrofits or even new systems. At the same time, governments are asking suppliers to provide more information about their energy sources. Although these standards make the system more reliable, it also makes it harder for new companies to enter the market. As a result, companies that produce equipment must invest more in aftermarket maintenance and repair services.

Synchronous Generator Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Period |

2025-2037 |

|

CAGR |

5% |

|

Base Year Market Size (2024) |

USD 5 billion |

|

Forecast Year Market Size (2037) |

USD 9.4 billion |

|

Regional Scope |

|

Synchronous Generator Market Segmentation:

Prime Mover Segment Analysis

The steam turbine segment is anticipated to be the largest, accounting for 55.9% of the market by 2037, mainly owing to its use in thermal and nuclear power plants. Their high inertia, provided by steam-driven synchronous generators, makes them perfect for base-load operations. In April 2023, General Electric revealed plans to invest USD 30 million in its Wisconsin facility to increase the production of synchronous generators. This category also covers models equipped with steam turbines. The segment is supported by durable equipment and existing connections with the grid. For high-efficiency and uninterrupted power, steam solutions are still the preferred option for many utilities. This technology is still vital in both fossil and hybrid renewable systems.

Power Rating Segment Analysis

The 5 to 10 MVA segment is projected to account for 35.4% of the market during the forecast period, due to its use in different sectors. They are used in manufacturing, water treatment, and public infrastructure for distributed generation. In February 2024, WEG introduced scalable synchronous generators in this range to help meet the goals for electrification. Such machines provide a good balance between how much space they need and their performance. For many emerging markets, medium-sized networks choose this segment as it is modular and provides load matching. Positive incentives also help encourage mid-scale renewable energy integration. These generators are easier to maintain than their high-capacity counterparts.

Our in-depth analysis of the synchronous generator market includes the following segments:

|

Segment |

Subsegments |

|

Prime Mover |

|

|

Power Rating |

|

|

Speed |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Synchronous Generator Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific is expected to lead the global synchronous generator market, holding around 46% share by 2037. Large infrastructure projects, industrial growth, and fast adoption of renewable energy contribute to growth. In November 2023, Shanghai Electric added more generators to its supply in Asia to aid multi-energy grid schemes. Industrial hubs in India and hybrid power systems in Southeast Asia are both experiencing high electricity demand. Regional administrations are helping to develop local factories and authorize technology use. Synchronous generators are preferable as they require stable voltage and are compatible with energy storage. The market is at different stages, but the overall trend is positive.

China plays a leading role in the synchronous generator market due to its domestic policies and export strategies. To achieve uniformity, China enforced the GB/T 7409.4-2023 standard in January 2024 to standardize the terminology used in excitation. The rule increases the compatibility of products, which is crucial for China’s plans to export more energy. Major companies in the region are increasing their output for projects that use wind, solar, and hydrogen together. China’s power to coordinate technical rules with the introduction of new technology helps it gain an advantage. It is also regularly exporting synchronous systems to nations in Africa and South America. The favorable policies allow China to be a dominant force in both manufacturing and using electronic products.

The need for synchronous generators in India is increasing due to expanding industry and the adoption of smart grids. In May 2023, CG Power’s Industrial Systems segment saw a 17.97% increase in revenue year on year, owing to higher demand in Asia. The country is experiencing a rise in demand for energy in cities and industry. National plans are now focused on ensuring both reliability and quality of energy in Tier-II cities. Synchronous generators play a major role in managing sudden changes in load and maintaining the voltage level. Local manufacturing of these units is encouraged by India’s Make-in-India initiative. The export potential increases as nearby countries purchase products from Indian OEMs.

North America Market Insights

The market for synchronous generators in North America is anticipated to rise at a CAGR of 4.5% from 2025 to 2037. The development is driven by better grids and increased spending on resilient power installations. To meet the increased demand, General Electric increased its production facility in the U.S. in April 2023. Utilities in North America are focusing more on local sources of energy to aid in recovery after disasters. Power redundancy is becoming increasingly important in hospitals and data centers, driving the growth of these markets further. At the same time, difficulties in sending electricity have resulted in utilities adding more distributed synchronous units. Industries are deploying new technologies more widely as a result of clear regulations.

In North America, the U.S. is driving economic expansion, owing to its commitment to both resilient infrastructure and clean energy. In June 2023, WEG Electric Machinery Company made its hydrogenerator line more efficient by introducing upgraded units. They are now commonly used in both municipal projects and on federal energy sites. Federal decarbonization grants are helping U.S. manufacturers introduce advanced synchronous products. In addition, the Energy Department’s efforts to modernize the grid are encouraging the use of frequency-sensitive equipment. New requirements for grid-connected equipment are also good news for local producers. The U.S. leads owing to its strong industrial base and export infrastructure.

The demand for synchronous generators in Canada is propelled by upgrading infrastructure and ensuring reliable energy in remote parts of the nation. In August 2023, Canada General Electric upgraded a 4,000 HP synchronous motor for industrial purposes. The retrofit demonstrated that Canada is strong in supporting legacy heavy-duty systems. Mining, pulp, and hydro sectors are still experiencing strong demand for power. Provinces are installing additional equipment to handle changes in energy needs throughout the year. There is also an increasing focus on low-speed, high-voltage systems that can handle the large areas in Canada. National regulations that require equipment upgrades help export-oriented OEMs. The trends indicate that the industry is growing steadily due to both ability and demand.

Key Synchronous Generator Market Players:

- ABB Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Siemens Energy

- General Electric Company

- Cymbet Corporation

- Caterpillar Inc

- WEG S.A

- Andritz

The market for synchronous generators is competitive, with companies offering a range of products that meet new grid regulations. Some of the leading companies in this sector are ABB Ltd., Siemens Energy, General Electric Company, Cymbet Corporation, Caterpillar Inc., WEG S.A., and Andritz. These companies are working on designs that are ready for hybrid vehicles, easy to change, and require little upkeep. They provide solutions that include large grid-connected systems as well as small off-grid systems. The pressure increases further as regulations are changing, and customers are seeking more digital services.

Product differentiation is now mainly based on how serviceable a car is, how well it meets emissions standards, and its adaptive control systems. In December 2023, Siemens Energy increased its production of synchronous generators to follow global trends towards reducing carbon emissions. The updated output is appropriate for both large utility projects and those connected to renewable sources. This shows that leading manufacturers are actively putting resources into high-demand parts of the industry. As governments focus on stricter regulations and support new technologies, these companies are ready to respond and meet the needs of the market.

Here are some leading companies in the synchronous generator market:

Recent Developments

- In January 2025, the U.S. Department of Energy awarded Hyliion a USD 6 million grant to install up to 2 megawatts of KARNO generators in the Permian Basin. This initiative targets methane emissions reduction in the oil and gas industry. The project exemplifies federal support for innovative energy solutions.

- In January 2025, CG Power expanded into France, targeting Benelux sectors like wastewater and green energy. The move supports industrial decarbonization and energy efficiency. CG leverages its electrical engineering capabilities. This marks its entry into new European energy markets.

- In June 2024, Marelli Motori introduced its MJH900LA8 synchronous generator, setting benchmarks for compact efficiency. It features a specialized cooling system enabling high output in tight spaces. This caters to industrial, commercial, and energy sectors. The innovation strengthens Marelli’s high-demand performance offerings.

- In February 2024, Koncar Elektroindustrija partnered with an Austrian turbine maker to build a compact generator for Japan's Shin Sakagami hydropower plant. The 2800 kVA unit operate at 6600 V and 428.6 RPM. Delivery was planned for late 2024. This reflects Koncar’s expanding global renewable footprint.

- Report ID: 5713

- Published Date: Oct 06, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Synchronous Generator Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.