Swarm Computing Market Outlook:

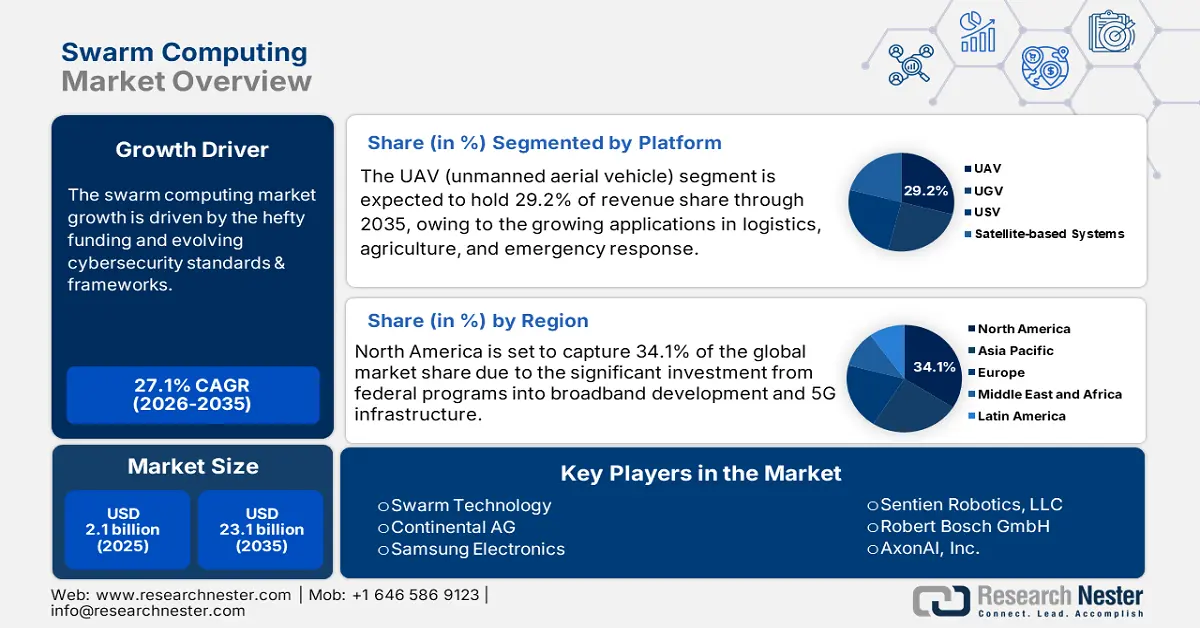

Swarm Computing Market size was valued at USD 2.1 billion in 2025 and is projected to reach USD 23.1 billion by the end of 2035, rising at a CAGR of 27.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of swarm computing is assessed at USD 2.6 billion.

The swarm computing market is booming, fueled by technology funding and changing supply chains. The U.S. National Science Foundation in July 2025 announced an investment of USD 100 million in AI. This is set to drive innovations and boost the U.S. position in global competitiveness. The boasting public-private investment strategies are likely to fuel the development of advanced swarm computing solutions in the years ahead. Further, the swarm computing production heavily relies on the incorporation of semiconductors and electronic components.

The U.S. Bureau of Labor Statistics (BLS) reported that the Producer Price Index (PPI) for computer and peripheral manufacturing stood at 59.739 in July 2025. Likewise, the Consumer Price Index (CPI) for information technology, hardware, and services amounted to a relative importance of 1.644 in December 2024. The trade flows reflect the U.S. as the center of activities for computers or computer peripherals. The price changes also indicate the stable trade routes and investment in technological resources to meet increasing B2B demand. Overall, the costs of raw materials and components have the potential to influence the trade of swarm computing solutions.

PPI Industry Group Data for Computer & Peripheral Equipment mfg, Not Seasonally Adjusted

|

Year |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

|

2022 |

57.485 |

57.998 |

58.417 |

58.432 |

58.811 |

58.602 |

58.036 |

58.264 |

58.030 |

57.982 |

57.996 |

58.652 |

|

2023 |

59.442 |

59.590 |

59.556 |

58.773 |

58.218 |

57.320 |

57.191 |

57.988 |

57.882 |

57.788 |

57.949 |

58.339 |

|

2024 |

58.355 |

58.286 |

58.194 |

58.434 |

58.005 |

57.963 |

57.786 |

58.307 |

58.447 |

58.459 |

58.565 |

58.573 |

|

2025 |

58.536 |

58.542 |

58.600 |

58.983(P) |

59.570(P) |

59.310(P) |

59.739(P) |

|

|

|

|

|

Source: U.S. BLS

|

Item |

Relative Importance (December 2024) |

|

Information technology, hardware, and services |

1.644 |

|

Computers, peripherals, and smart home assistant devices |

0.262 |

|

Computer software and accessories |

0.027 |

|

Internet services and electronic information providers |

0.926 |

|

Telephone hardware, calculators, and consumer information items |

0.421 |

|

Unsampled information and information processing |

0.009 |

Source: U.S. BLS

Key Swarm Computing Market Insights Summary:

Regional Insights:

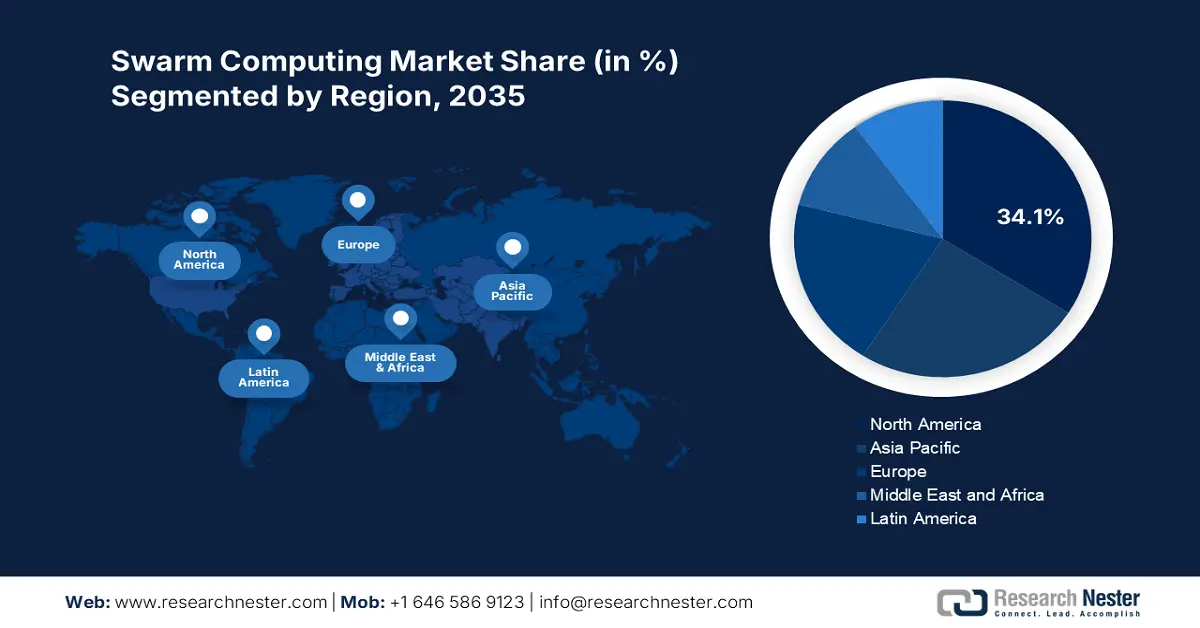

- By 2035, the North America region is projected to secure a 34.1% share of the swarm computing market, sustained by expanding federal investments in broadband and 5G infrastructure.

- The Asia Pacific region is estimated to command a 30.2% revenue share by 2035, underpinned by massive digital infrastructure spending and government-backed autonomous systems programs.

Segment Insights:

- The UAV (unmanned aerial vehicle) segment is expected to capture a 29.2% share of the swarm computing market by 2035, propelled by expanding logistics, agricultural, and emergency-response applications.

- The surveillance & reconnaissance segment is anticipated to hold a major share by 2035, reinforced by increasing defense investments in autonomous swarm systems and AI-enabled unmanned platforms.

Key Growth Trends:

- Cybersecurity standards & frameworks

- Autonomous robotics and UAVs

Major Challenges:

- Dearth of standardized protocols

- Regulatory fragmentation and market access barriers

Key Players: Sentien Robotics, LLC, Robert Bosch GmbH, AxonAI, Inc., Continental AG, Samsung Electronics, Unanimous A.I., Power-Blox, Hydromea SA, NTT Data, AGILOX, Wipro Limited, Reach Labs, MIMOS Berhad, Redtree Robotics.

Global Swarm Computing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.1 billion

- 2026 Market Size: USD 2.6 billion

- Projected Market Size: USD 23.1 billion by 2035

- Growth Forecasts: 27.1%

Key Regional Dynamics:

- Largest Region: North America (34.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: South Korea, India, Canada, France, Australia

Last updated on : 28 August, 2025

Swarm Computing Market - Growth Drivers and Challenges

Growth Drivers

-

Cybersecurity standards & frameworks: Security is a primary concern in swarm computing, as agents can be distributed and interconnected. Some cybersecurity standards to consider are the NIST Cybersecurity Framework documents and ENISA guidelines, which are essentially the standards for protecting these complex systems. The NIST framework Zero Trust Architecture (ZTA) is adopted to secure swarm networks as it enables reliable, continued authentication of swarm agents. Companies that follow some forms of compliance are set to reduce vulnerabilities and lead to building secure swarms in the public and private domains.

- Autonomous robotics and UAVs: Swarm computing is transforming the robotics and UAV sectors by facilitating the coordination of multiple autonomous agents collectively. The concept is especially beneficial in logistics, agriculture, disaster response, and defense applications. For instance, Amazon Robotics uses swarm algorithms in its fulfillment centers to improve the coordination and efficiency of the robot fleets. In June 2025, Amazon unveiled a new AI system to enhance its robotic fleet and deployed around 1 million robots. This AI technology is estimated to make the world’s largest group of industrial robots smarter and better at their jobs. Further, by decentralizing computation, robotic systems provide resilience and speed. Coordinated drones survey or deliver smaller packages over larger areas, and also have the potential to complete the same tasks as collaborative ground robots assigned to crop monitoring or transporting materials. As the costs of hardware decrease and autonomy improves, swarm robotics is expected to be an enabler in the next generation of automation strategies.

- Technological trends transforming swarm computing: Swarm computing is rapidly evolving by coupling with new technologies such as AI, edge computing, and 5G. These technologies enable digitally-enhanced, decentralized, and autonomous decision-making in all sectors, including manufacturing, defense, telecom, and logistics. AI-based swarm systems allow for adaptive learning and real-time responsiveness, particularly in robotic or drone fleets. 5G is now enabling high-bandwidth, low-latency transports in the telecom sector that facilitate engagements managed by swarm computing.

In addition, digital twins that simulate swarm behavior and optimize performance capabilities are becoming easily available for smarter factories. For example, in March 2025, OpenAI introduced its first set of tools to help developers and businesses create helpful and dependable AI agents. The company also enhanced its SWARM solutions, introduced last year.

Challenges

- Dearth of standardized protocols: As per NIST, the absence of globally accepted swarm computing interoperability standards contributes to high development costs and adds delays to new market entry. Suppliers have difficulty integrating into current ICT systems, and governments are unable to regulate unstandardized technology. In critical areas of defense, governments cannot require participants to use unstandardized technologies.

- Regulatory fragmentation and market access barriers: India's around 6% equalization levy on digital services and restrictions on imports of IT Hardware increase the costs of market entry. Fragmentation of regulations creates complexity in compliance, which also slows the time from product availability to credibility by stalling a launch. Furthermore, some Governments impose protectionist policies to restrict foreign suppliers, hampering the overall market growth.

Swarm Computing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

27.1% |

|

Base Year Market Size (2025) |

USD 2.1 billion |

|

Forecast Year Market Size (2035) |

USD 23.1 billion |

|

Regional Scope |

|

Swarm Computing Market Segmentation:

Platform Type Segment Analysis

The UAV (unmanned aerial vehicle) segment is expected to hold the largest revenue swarm computing market share of 29.2% by the end of 2035, owing to growing applications in logistics, agriculture, and emergency response. The U.S. Federal Aviation Administration (FAA) lifted restrictions on beyond-visual-line-of-sight (BVLOS) operations, permitting commercial deployment of drone swarms. Additionally, the National Institute of Standards and Technology (NIST) is establishing interoperability and advances in resilience standards for swarm platforms. These regulatory changes and increasing demand for real-time autonomous coordination have sparked interest in drone-focused autonomous systems using swarm methods in densely populated regions such as North America and Europe.

Application Segment Analysis

The surveillance & reconnaissance segment is anticipated to account for a major revenue share of the swarm computing market. The U.S. Department of Defense has made significant advances in its investments in swarm systems utilizing unmanned systems and AI technology. One of these systems, referred to as the Gremlins program, tested the capability of reusable unmanned aerial systems operating in a swarm for various end-uses. Additionally, the NATO Science and Technology Organization (STO) is pursuing high-priority projects in the area of autonomous swarm systems for real-time state-of-the-world awareness and target acquisition, persistence, and action.

End user Segment Analysis

The defense and security segment is anticipated to capture a significant swarm computing market share throughout the study period. Governments are channelling substantial funding into swarm-enabled unmanned aerial vehicles (UAVs), unmanned ground vehicles (UGVs), and autonomous maritime systems to enhance mission effectiveness, situational awareness, and battlefield resilience. Strategic public-private investments for the enhancement of border security, counter-drone defense, and disaster response operations are projected to fuel the deployment of swarm computing systems. For instance, in FY 2025, nearly USD 143.2 billion was invested in R&D for the enhancement of AI, ML, and 5G systems in the U.S. Such moves, coupled with advancements in the defense industrial base, are likely to propel the trade of swarm intelligence during the foreseeable period.

Our in-depth analysis of the swarm computing market includes the following segments:

|

Segment |

Subsegments |

|

Platform Type |

|

|

Application |

|

|

End user |

|

|

Component |

|

|

Deployment Mode |

|

|

Enterprises Size |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Swarm Computing Market - Regional Analysis

North America Market Insights

The swarm computing market in North America is expected to capture a share of 34.1% by 2035, supported by significant investment from federal programs into broadband development and 5G infrastructure. Swarm support is developing rapidly in multiple key sectors, including defense, logistics, and energy. These developing national R&D funding opportunities include a significant public-private partnership from the U.S. ICT Development Fund, as well as a Canadian R&D Partnership model leveraging their national ICT sector.

The swarm computing market in the U.S. is rising rapidly, led by the higher levels of federal funding, private sector innovation, and 5G rollout. The Digital Equity Act, signed into law, provides another USD 2.75 billion toward equity access for digital information. In addition, swarming technologies have potential in smart agriculture as well as manufacturing. The Department of Energy (DOE) is also putting funding efforts toward distributed swarm AI for better performance and operations regarding energy grid system management.

Asia Pacific Market Insights

The Asia Pacific swarm computing market is projected to hold 30.2% of the global revenue share throughout the study period, owing to the massive investments in digital infrastructure. Governments across the region are heavily funding large-scale autonomous systems programs, particularly in defense, disaster management, and smart city infrastructure, which is opening high-earning opportunities for key players. Furthermore, Japan, China, and South Korea are creating fertile ground for swarm-based applications, owing to the expanding drone economy and robotics clusters. The strong public-private partnerships and rising R&D expenditure in AI-enabled systems are further expected to drive the overall market growth.

China leads the sales of swarm computing solutions due to the strong government funding and industrial policies for digital transformation. Beijing, focused on becoming a global leader in AI and unmanned systems, with a worth of USD 100 billion industry by 2030, is expected to accelerate investments in swarm robotics and UAV development. The country’s defense sector is also heavily concentrated in swarm computing applications, with reported large-scale tests of drone swarms for surveillance, combat simulations, and electronic warfare. Thus, it is estimated that both the government and commercial sectors are set to boost the deployment of swarm computing technologies.

Europe Market Insights

The Europe swarm computing market is expected to be driven by the expanding digital sovereignty and advanced defense capabilities. The increasing demand for next-generation robotics is further increasing the application of swarm computing. The European Commission has been funding swarm intelligence research under Horizon Europe programs, with a focus on autonomous systems, smart manufacturing, and coordinated robotics for industry and defense, which is creating a lucrative environment for key players. The Industry 4.0 and green transition strategies are further boosting the deployment of swarm intelligence.

The sales of swarm computing systems in Germany are increasing at a high pace, due to its strong industrial robotics ecosystem and defense modernization programs. The country’s high focus on advanced manufacturing and Industry 4.0 is set to position swarm robotics as a tool to enhance efficiency in factories, warehouses, and logistics hubs. The defense authorities are also investing heavily in autonomous drone swarms for surveillance, battlefield support, and countermeasure systems, which is attracting numerous domestic and international players

Key Swarm Computing Market Players:

- Swarm Technology

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Sentien Robotics, LLC

- Robert Bosch GmbH

- AxonAI, Inc.

- Continental AG

- Samsung Electronics

- Unanimous A.I.

- Power-Blox

- Hydromea SA

- NTT Data

- AGILOX

- Wipro Limited

- Reach Labs

- MIMOS Berhad

- Redtree Robotics

The swarm computing market is highly competitive, owing to the strong presence of U.S. companies, including Swarm Technology and Sentien Robotics, which lead the advancements in AI and robotics. European companies such as Bosch and Continental both leverage automotive and IoT expertise. Likewise, Samsung (South Korea) and NTT Data (Japan) look to advance 5G and Edge Computing. The companies are investing in cybersecurity and R&D, NIST compliance, and updates to counter regulatory issues and boost revenues. Below is a table of the top manufacturers leading in the swarm computing market.

Recent Developments

- In January 2025, Softbank negotiated a USD 500 million investment in Skild AI. This is a software company building a financial model at a USD 4 billion valuation.

- In March 2024, Hylio secured pioneering FAA Approval for Drone Swarms. These technologies are set to be used in agriculture, paving the way for future innovations.

- Report ID: 1280

- Published Date: Aug 28, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Swarm Computing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.