Sustainable Electronics Manufacturing Market Outlook:

Sustainable Electronics Manufacturing Market size was over USD 16 billion in 2025 and is anticipated to cross USD 134.22 billion by 2035, growing at more than 23.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of sustainable electronics manufacturing is assessed at USD 19.41 billion.

The continual expansion of infrastructure for e-waste recycling enables a significant reduction of electronic waste in landfills while supporting green electronics production practices. Companies are actively investing in the development of formal recycling centers while utilizing innovative urban mining methods to retrieve valuable materials from old electronic devices. Precious metals, including gold, silver, and palladium, are being recovered through these initiatives, and the industry is reducing its use of new raw materials along with the environmental impact of electronic waste. Commercial recycling technologies, including automated sorting along with hydrometallurgical extraction, are also enhancing the scalability and effectiveness of e-waste material recovery in the electronics industry.

Various organizations are implementing strategies to reduce their need for new raw materials while working to minimize the environmental consequences of electronic waste disposal. For instance, in September 2024, the UK Royal Mint opened a modern waste recovery center at its Llantrisant complex in Wales, designed to extract valuable materials from electronic waste. The facility is built to handle 4,000 tons of circuit boards annually to obtain up to 500 kilograms of gold, 2.5 tons of silver, 1,000 tons of copper, and 50 kilograms of palladium. Apart from metal recovery, the facility is aimed at operating a system that transforms aluminum and plastic materials into sustainable products while lowering the carbon footprint.

Key Sustainable Electronics Manufacturing Market Insights Summary:

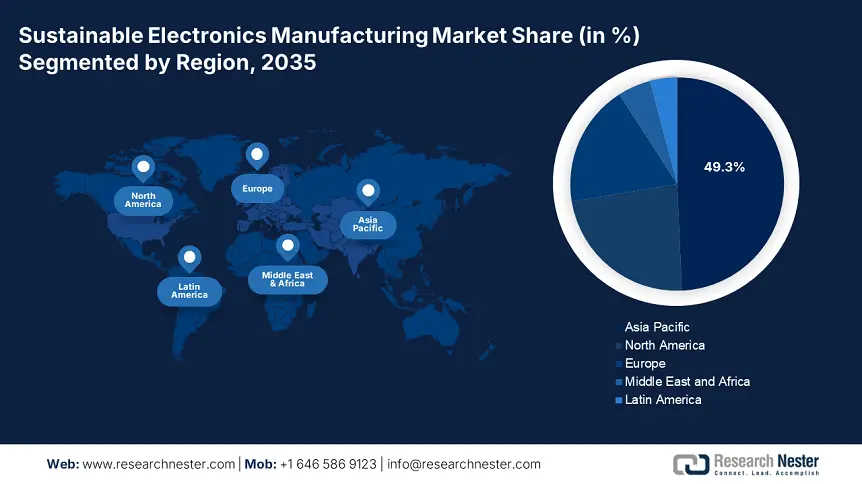

Regional Highlights:

- Asia Pacific dominates the Sustainable Electronics Manufacturing Market with a 49.3% share, driven by rising consumer awareness regarding sustainability and green practices, ensuring robust growth through 2026–2035.

Segment Insights:

- Electronic Manufacturing Services segment are projected to experience steady growth by 2035, driven by the deployment of sustainable battery manufacturing technologies.

- Lead Free segment is projected to hold over a 65% revenue share by 2035, driven by enforcement of regulations like RoHS to eliminate hazardous substances from electronics.

Key Growth Trends:

- Adoption of modular and repairable designs

- Increasing investments in electrified transport

Major Challenges:

- Limited availability of recycled and eco-friendly materials

- Consumer reluctance due to repairability challenges

- Key Players: Flex Ltd. Foxconn, Celestica, and Kimball International Inc.

Global Sustainable Electronics Manufacturing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 16 billion

- 2026 Market Size: USD 19.41 billion

- Projected Market Size: USD 134.22 billion by 2035

- Growth Forecasts: 23.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (49.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, South Korea, United States, Germany

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 12 August, 2025

Sustainable Electronics Manufacturing Market Growth Drivers and Challenges:

Growth Drivers

- Adoption of modular and repairable designs: Technological companies are deploying modular and repairable designs into their consumer electronics due to their ability to offer longer device lifespans and to support sustainability initiatives. Users are easily replacing components in modular smartphone designs, resulting in a reduction of electronic waste while creating a circular economy infrastructure.

Companies are also developing modular laptops with easy repair and customization features, driving consumers to enhance as well as maintain their devices over time. In December 2024, Framework launched a major modular update for its laptop 16 model through the Dual M.2 Adapter, introducing a USD 39, allowing users to add two extra M.2 slots for a maximum of four solid-state drives. The updated product enables users to insert various M.2 modules that can reach up to 26TB storage capabilities while supporting a maximum storage capacity of 38TB when users add SD card slots.

- Increasing investments in electrified transport: Governments, together with private enterprises, are investing in developing state-of-the-art power electronics, energy-saving chips, and eco-friendly materials to fuel the EV industry. According to a report from the International Energy Agency (2023), the clean energy transition received USD 1.7 trillion in 2023, including nuclear, renewable power, low-emission fuels, storage, grids, efficiency improvements, and end use renewables and electrification. This significant investment highlights the continually growing demand for sustainable electronics in producing electric vehicles.

Challenges

- Limited availability of recycled and eco-friendly materials: The limited availability of recycled and environmentally friendly materials is a critical barrier to sustainable electronics manufacturing. Globally, E-waste recycling systems are experiencing issues, leading to the loss of rare-earth metals and high-grade plastics alongside improper material processing. The scarcity of reused raw materials in the market is compelling manufacturers to depend on original resource supplies. The dependency results in high manufacturing prices and disrupts the circular economy development, slowing down the industry's move toward sustainability practices.

- Consumer reluctance due to repairability challenges: The reluctance of consumers can hinder the sustainable electronics manufacturing market due to high costs related to the devices and repairability concerns. Consumer awareness about sustainability is increasing, however, their preference is for products that combine economical cost and superior performance despite green features. Users spend extra for repairable and modular devices as these products exceed standard pricing targets. The repairability features of sustainable electronics systems result in design drawbacks, affecting the compactness and lightness of products, making the wide-scale adoption of sustainable electronics more difficult.

Japan's Home Appliance Recycling Performance (Fiscal Year 2021)

Appliance Type

Recycling Rate (%)

Legal Standard (%)

Air Conditioners

92

80

Cathode-ray Tube TVs

72

55

LCD/Plasma TVs

85

74

Refrigerators & Freezers

80

70

Washing Machines & Laundry Dryers

92

82

Source: Ministry of Economy, Trade and Industry

Sustainable Electronics Manufacturing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

23.7% |

|

Base Year Market Size (2025) |

USD 16 billion |

|

Forecast Year Market Size (2035) |

USD 134.22 billion |

|

Regional Scope |

|

Sustainable Electronics Manufacturing Market Segmentation:

Technology (Lead Free, Halogen Free)

By 2035, lead free sustainable electronics manufacturing market is set to capture over 65% revenue share. Globally, governments are enforcing stricter regulations to eliminate hazardous substances, including lead from electronic elements. The Restriction of Hazardous Substances (RoHS) directive from the European Union is compelling manufacturers to produce lead-free products. In December 2023, the European Chemicals Agency (ECHA) led a comprehensive enforcement project assessing consumer products for hazardous chemicals. Electrical devices such as headphones and chargers were found to be non-compliant by 52% of the sample population, mostly due to the presence of lead in their solders.

The regulatory authorities are extending their limitations on lead-based electronic manufacturing, thus creating a higher demand for lead-free manufacturing methods. Compliance with the policies prevents legal penalties, and brand recognition encourages companies to select eco-friendly materials while following lead-free soldering protocols. This is also expected to fuel segment growth during the forecast period.

Service (Electronic Manufacturing Services, Engineering Services, Test and Development Implementation Services, Logistics Services)

The electronic manufacturing services segment in sustainable electronics manufacturing market is expected to witness steady growth owing to the deployment of modern sustainable battery manufacturing technologies by companies. For instance, in December 2024, through the Kavian platform, Sakuu developed a system to print battery electrodes by avoiding liquid electrolytes, thus enhancing safety performance and efficiency. Modern manufacturing technology is meeting market requirements for green electronics production, driving EMS companies to adopt state-of-the-art solutions.

Our in-depth analysis of the global sustainable electronics manufacturing market includes the following segments:

|

Technology |

|

|

Service |

|

|

Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Sustainable Electronics Manufacturing Market Regional Analysis:

Asia Pacific Market Analysis

In sustainable electronics manufacturing market, Asia Pacific region is expected to capture over 49.3% revenue share by 2035. This growth is attributed to rising consumer awareness regarding sustainability. Consumers in the region are prioritizing energy-efficient devices and ethically sourced components, together with products containing recyclable materials, encouraging manufacturers to adopt greener production techniques. The market is also experiencing an increase due to sustainable supply chains, innovative recycling technologies, and biodegradable packaging solutions in the region.

Advanced manufacturing technologies for producing semiconductors and circuit boards are reducing environmental impacts with the incorporation of bio-based or recycled materials in the region. The smart manufacturing techniques using AI, as well as 3D printing for sustainable waste reduction, are fueling the market growth in the region. These technological advancements are driving manufacturers to adhere to environmental standards through cost-effective operations, accelerating the development of sustainable electronics in manufacturing.

The China sustainable electronics manufacturing market is experiencing rapid growth, as manufacturers are integrating renewable energy sources into their production operations. Manufacturers are adopting solar and wind energy systems to supply their manufacturing facilities without any dependence on fossil fuel sources. The production shift in China is reducing environmental emissions while delivering better operational performance at lower costs. Companies are deploying accessible energy-efficient technologies for clean energy adoption, enabling sustainable electronics production expansion.

The sustainable electronics manufacturing market in India is expanding at a steady pace, owing to the high reliance of electronics manufacturers on solar power and wind energy to run their manufacturing operations. Furthermore, renewable-powered industrial zones are providing long-lasting sustainability, improving the cost and environmental friendliness of electronics manufacturing. The shift is aligning with the country’s goals of pursuing green energy and carbon-neutral targets.

Local manufacturing operations are accepting sustainable materials for circuit boards and solders through the use of biodegradable components and lead-free compositions. Through local sourcing of raw materials, companies in India are also creating a dual advantage of reducing transportation pollution alongside encouraging innovation throughout their supply chain. The sector transition is developing an eco-conscious production ecosystem for India, enhancing industrial sustainability together with domestic industry.

North America Market

The sustainable electronics manufacturing market in North America is expected to witness a significant expansion during the forecast period, attributed to the rising extended producer responsibility (EPR) regulations. The governments are implementing strong policies, compelling the manufacturers to take accountability for the entire lifecycle of their products from the beginning of production till the disposal phase. Rising investments in environmentally friendly product formulations and recyclable material choices rely on efficient take-back programs, resulting in less environmental impact for electronic products, enhancing the circular economy in the industry.

The sustainable electronics manufacturing market is also gaining traction in the region, owing to the advancements in sustainable production techniques that support the industry. The region is witnessing major innovations to minimize material waste while optimizing energy usage through low-waste 3D printing, energy-efficient semiconductor fabrication processes, and AI-driven resource optimization systems. Sustainable electronics production is more achievable due to technological advancements, supporting businesses in fulfilling environmental standards and maintaining profitability.

The sustainable electronics manufacturing market in the U.S. is anticipated to increase at a fast pace due to the rising focus on a sustainable supply chain, which is fueling the demand for eco-friendly materials as well as energy-efficient production processes. Companies in the country are prioritizing suppliers based on their responsible sourcing practices, including conflict-free mineral sourcing and lowered carbon emission levels during logistics operations. Manufacturers are implementing this transition due to the sustainability requirement throughout the production lifecycle, from the early acquisition of raw materials to the final assembly of final products.

The sustainable electronics manufacturing market in Canada is witnessing steady growth, owing to the rising demand for eco-conscious trends. Manufacturers in the country prefer environmentally friendly alternatives, which is driving them to use recycled materials with energy-efficient designs and biodegradable packaging. The demand for electronics sustainable manufacturing is also increasing in the country due to the implementation of production systems following the circular economy. The electronics industry is developing modular hardware elements to replace and update individual components, making the products' shelf life longer while reducing electronic waste output.

Key Sustainable Electronics Manufacturing Market Players:

- Flex Ltd.

- Company Overview

- Business Strategy

- Key Technology Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Foxconn

- Celestica

- Kimball International, Inc.

- Benchmark Electronics

- Actia Group

- Key Tronic EMS

The competitive landscape of the sustainable electronics manufacturing market is rapidly evolving, attributed to the adherence of the key players to implementing lead-free manufacturing. They are focused on developing new strategies catering to the stringent regulatory norms and consumer demand. These key players are adopting several strategies, such as mergers and acquisitions, joint ventures, partnerships, and novel technology launches, to enhance their base and strengthen their market position. Here are some key players operating in the global sustainable electronics manufacturing market:

Recent Developments

- In February 2024, Nokia announced its commitment to achieve net-zero greenhouse gas emissions by 2040, accelerating its previous target by ten years. The company also reaffirmed its near-term goal to halve emissions across Scope 1, 2, and 3 by 2030. To align with climate science, Nokia has submitted its net-zero letter of commitment to the Science Based Targets initiative (SBTi).

- In February 2022, Foxlink announced a major expansion to its green energy manufacturing footprint in the U.S. By adding high-value jobs in green energy, the company is supporting the local economy and keeping next-generation innovation in the country.

- Report ID: 7411

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Sustainable Electronics Manufacturing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.