Surveillance Radar Market Outlook:

Surveillance Radar Market size was valued at USD 12 billion in 2025 and is set to exceed USD 31.41 billion by 2035, registering over 10.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of surveillance radar is evaluated at USD 13.09 billion.

The growth is driven by rising geopolitical tension, a growing defense budget, and increasing security concerns. Furthermore, the growing need for counter-drone, disaster management solutions, and space-based surveillance contributes to the market expansion significantly.

Moreover, the market is witnessing a significant number of developmental activities. For instance, in March 2023, DeTect, Inc. developed its largest and longest-range radar the HARRIER BAR300, with an extended range for aircraft detection of 30+ nautical miles. In November 2024, Sirius Insight announced a partnership with Cambridge Pixel to develop an AI-powered maritime surveillance and situational awareness solution, by integrating Cambridge Pixel’s radar tracking software. Furthermore, rising investments in smart city infrastructure, the growing focus on cybersecurity to protect critical assets, and the modernization of defense systems are the prominent factors driving the market growth further.

Key Surveillance Radars Market Insights Summary:

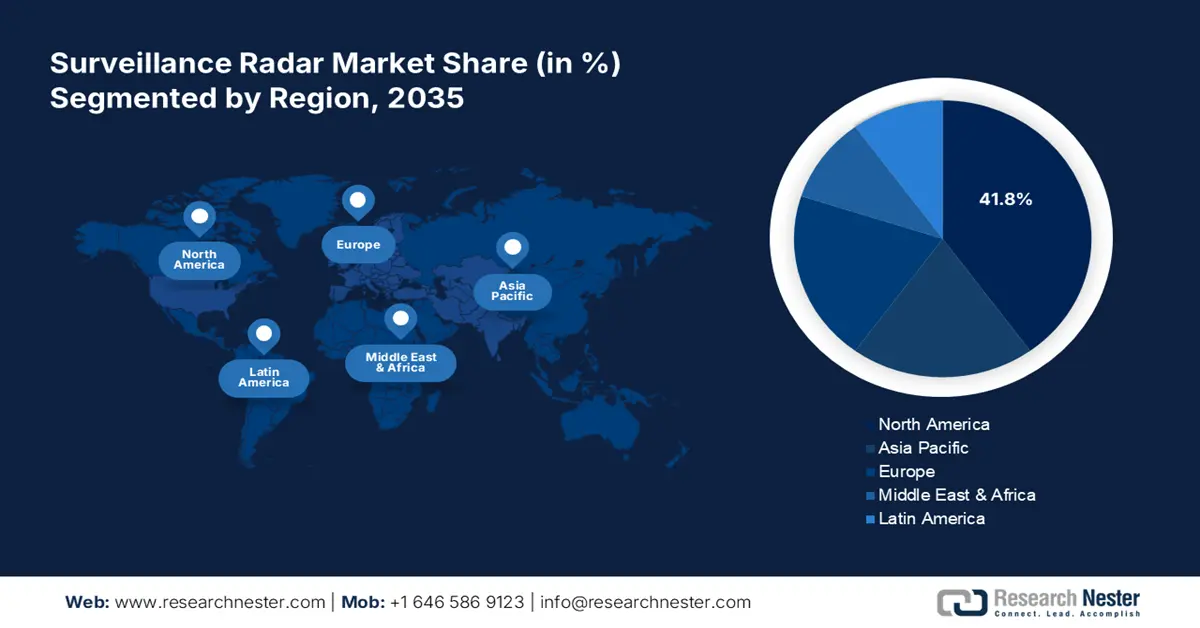

Regional Highlights:

- North America dominates the Surveillance Radar Market with a 41.8% share, propelled by high defense budgets, border surveillance needs, and tech advancement, fostering significant growth through 2026–2035.

- APAC's Surveillance Radar Market is anticipated to experience rapid growth by 2035, driven by geopolitical tensions, defense modernization, and smart city initiatives.

Segment Insights:

- The Hardware segment is projected to hold a significant share by 2035, fueled by advancements in phased-array antennas and energy-efficient designs.

- The Land Platform segment is projected to hold a significant share by 2035, driven by increasing demand for ground-based radar systems for border security, air defense, and infrastructure protection.

Key Growth Trends:

- Rising geopolitical tensions

- Demand for counter-drone systems

Major Challenges:

- High development costs

- Cybersecurity risks

- Key Players: Dassault Aviation, General Dynamics Corporation, Honeywell International Inc., Lockheed Martin Corporation.

Global Surveillance Radars Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 12 billion

- 2026 Market Size: USD 13.09 billion

- Projected Market Size: USD 31.41 billion by 2035

- Growth Forecasts: 10.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Russia, United Kingdom, France

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

Surveillance Radar Market Growth Drivers and Challenges:

Growth Drivers

- Rising geopolitical tensions: Territorial conflicts and disputes, particularly in regions including Asia Pacific, and the Middle East are driving the surveillance radar market demand. Nations are focusing on expanding their defense capabilities to secure borders, airspace, and maritime zones. According to the Stockholm International Peace Research Institute (sipri), in April 2024, the total global military expenditure reached USD 2443 billion in 2023, showcasing an increase of 6.8% from 2022. This increase was registered as the steepest year-on-year growth since 2009. Furthermore, the evolving nature of modern warfare, with an emphasis on pre-emptive surveillance and situational awareness, is prompting governments to invest further in the market.

- Demand for counter-drone systems: Drones pose unique challenges due to their small sizes, low altitude, and invulnerability, making them difficult to detect with traditional radar systems. This has led to an increased demand in the counter-drone market. Counter-drone radars are capable of detecting, tracking, and neutralizing UAV threats. Governments and private sectors are actively adopting these solutions to prevent unauthorized drone activity and potential security breaches. For instance, at Eurosatory 2024, Safran Electronics & Defense announced the launch of the Skyjacker counter-drone solution which is a C-UAS system, coupled with radar detection and optronic identification.

Challenges

-

High development costs: The advanced market requires significant investments in research, prototyping, and testing. Incorporating cutting-edge technologies such as AI, quantum computing, and phased-array antennas further escalates costs. These expenses pose challenges for smaller manufacturers and nations with limited defense budgets, creating a market dominated by well-funded global players. Additionally, the long development timelines and high costs of upgrading existing infrastructure make affordability a critical concern.

- Cybersecurity risks: Modern radar systems, often integrated with AI, IoT, and networked platforms, are increasingly vulnerable to cyberattacks. Hackers can exploit these systems to disrupt operations, steal sensitive data, or manipulate radar outputs, jeopardizing national security and critical infrastructure. The rising sophistication of cyber threats, coupled with inadequate cybersecurity measures in legacy systems, underscores the need for robust security protocols and real-time threat detection mechanisms in radar technology.

Surveillance Radar Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.1% |

|

Base Year Market Size (2025) |

USD 12 billion |

|

Forecast Year Market Size (2035) |

USD 31.41 billion |

|

Regional Scope |

|

Surveillance Radar Market Segmentation:

Component (Hardware, Software)

Hardware segment is anticipated to account for surveillance radar market share of more than 59.5% by the end of 2035. The segment growth is driven by the essential role of physical components such as antennas, transmitters, and receivers in radar systems. Advancements in hardware technologies, including phased-array antennas and compact, energy-efficient designs, are enhancing radar performance across military, aviation, and infrastructure applications. The growing demand for specialized hardware in counter-drone systems, space surveillance, and coastal monitoring further solidifies its leadership within the component segment. In May 2023, Indra announced the development of the new V2i version of the S3TSR radar, a civil and military radar, incorporating transmission elements (TX) up to quadruple its current power.

Platform (Land, Air, Naval, Space)

Based on platform, the land segment is anticipated to register a considerable share in the surveillance radar market during the forecast period. The segment growth is fueled by increasing demand for ground-based radar systems for border security, air defense, and infrastructure protection. The scalability of these systems in diverse terrains further strengthens their dominance in the market. In January 2021, HENSOLDT UK launched SPEXER 600 multi-mission, X-Band ground-based surveillance radar, designed to detect multiple threats in the modern battlefield or security environment. Rising developments to meet the increasing demand for security purposes is hence expected to boost the segment’s growth further.

Our in-depth analysis of the market includes the following segments:

|

Component |

|

|

Platform |

|

|

Radar Range Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Surveillance Radar Market Regional Analysis:

APAC Market Statistics

APAC surveillance radar market is growing rapidly, driven by increasing geopolitical tensions, defense modernization programs, and rising demand for advanced surveillance solutions. Increasing investments in smart city projects, and the rising need for civil infrastructure protection are major drivers of the region’s market. Furthermore, rising instances of natural disasters and climate-related challenges, in addition to civilian applications such as traffic monitoring have spurred demand for radar systems in disaster management and weather monitoring in Asia Pacific.

India surveillance radar market is projected to register considerable growth in the coming years. Domestic manufacturing under the Make in India program is boosting the region’s market, in addition to increasing the budget for defense, and cross-border security concerns. The military spending of India in 2023 was estimated at more than USD 80.0 billion. Protection of strategic assets, including offshore installations, and air traffic management systems is driving the demand further in the country.

China market is driven by its ambitions in space exploration and satellite-based surveillance, enhancing both civilian and military capabilities. The country’s Belt and Road Initiative (BRI) has increased the demand for infrastructure security, further boosting investments in radar systems. Moreover, advancements in drone technology and the integration radar for counter drone-solutions are gaining momentum, and strategically enhancing the market growth.

North America Market Analysis

North America surveillance radar market is anticipated to dominate with a share of 41.8% during the forecast period. The market is driven by high defense budgets, growing security concerns, and technological advancements. Growing demand for border surveillance and counter-drone solutions further fuels market growth. U.S. led the ranking of the countries with the highest military spending in 2023, with more than USD 900 billion dedicated to the military, over 40% of the total military spending worldwide. Such increasing investments and spending will boost the market during the forecast period significantly.

With a strong presence of leading manufacturers, the U.S. invests heavily in R&D to develop cutting-edge radar systems for military, aviation, and critical infrastructure applications. U.S. dominates the North America market owing to military and homeland security investments. The country prioritizes modernizing its defense infrastructure, adopting AI-integrated radar systems, and space-based surveillance. Strategic government initiatives and collaborations with private companies drive innovation and sustain market leadership.

Canada market focuses on maritime monitoring and Arctic sovereignty. The country invests in radar systems tailored to harsh environmental conditions and supports domestic production through government contracts. Collaborations with allied nations, particularly the U.S. enhance the country’s radar capabilities while ensuring compliance with international defense standards.

Key Surveillance Radar Market Players:

- BAE Systems

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Dassault Aviation

- General Dynamics Corporation

- Honeywell International Inc.

- Lockheed Martin Corporation

- L3 TECHNOLOGIES INC.

- Northrop Grumman Corporation

- Rockwell Collins Inc.

- Saab AB

Developing advanced radar systems with enhanced detection capabilities, leveraging AI and ML for improved accuracy, and focusing on miniaturization to cater to diverse applications are some of the key strategies adopted by the prominent players in the surveillance radar market. In April 2024, Mitsubishi Electric Corporation delivered a mobile air-surveillance radar system to the Philippine Air Force, ordered by the Department of National Defense of the Republic of the Philippines in August 2020. The system is the second air surveillance radar system and the first mobile unit manufactured and distributed by the Japan-based company to a foreign government.

Here is a list of the key market players:

Recent Developments

- In July 2024, Mitsubishi Electric partnered with Raytheon to commence the manufacture of critical radar components, marking the company's entry into the U.S. Navy's defense equipment supply chain.

- In September 2022, ICEYE partnered with BAE Systems to offer advanced Synthetic Aperture Radar (SAR) technology as part of BAE Systems’ new multi-sensor satellite cluster, Azalea.

- In September 2021, HENSOLDT launched a newly developed Quadome radar system, equipped with the latest technology. The system is intended for naval surveillance and target acquisition, and offers quick response and better precision, at an excellent price-performance ratio.

- Report ID: 6731

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Surveillance Radars Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.