Surgical Staplers Market Outlook:

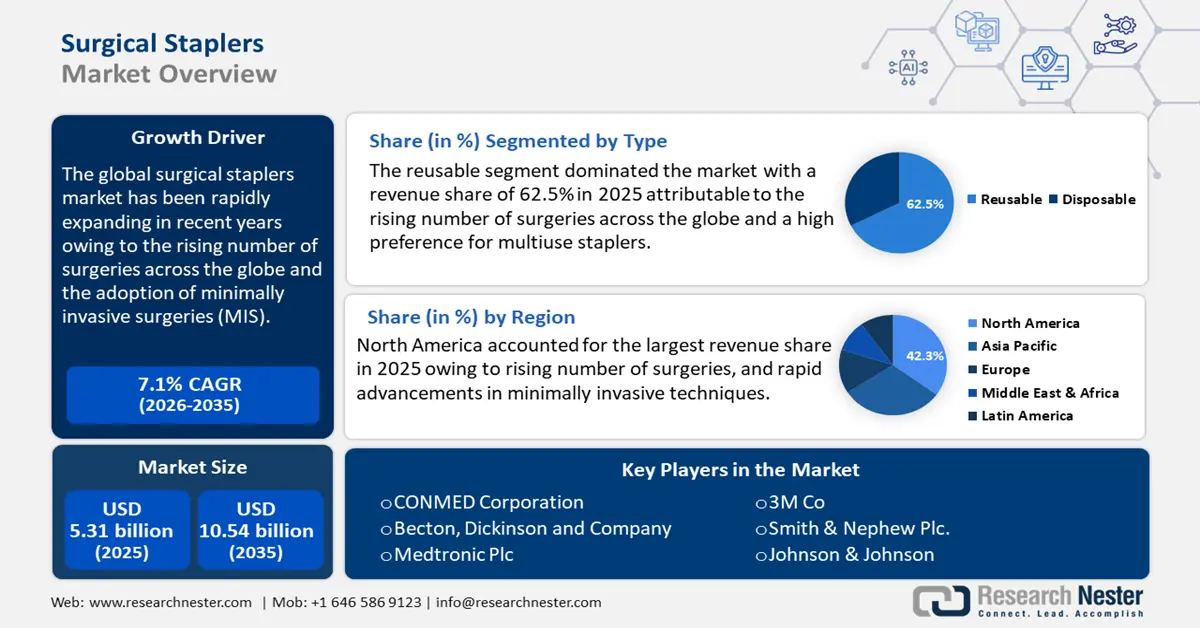

Surgical Staplers Market size was valued at USD 5.31 billion in 2025 and is set to exceed USD 10.54 billion by 2035, registering over 7.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of surgical staplers is estimated at USD 5.65 billion.

The surgical staplers market has been rapidly expanding in recent years owing to the rising number of surgeries across the globe. The adoption of minimally invasive surgeries (MIS) such as laparoscopic and thoracoscopic procedures in hospitals, ambulatory care units, and other healthcare centers has exponentially increased. According to The International Federation for the Surgery of Obesity and Metabolic Disorders (IFSO) 2021 report, around 99.2% of bariatric surgeries were performed laparoscopically between 2016 and 2020 worldwide. This has resulted in high demand for different types of efficient and advanced stapling devices and solutions.

A high preference for robotic-assisted surgeries due to smaller incisions and reduced recovery time is another factor expected to boost sales of various types of surgical staplers. These staplers act as an essential tool in such surgeries as they allow precise closure of small incisions, compared to traditional suturing techniques. In June 2021, Intuitive India announced the launch of a robotic-assisted surgical stapler, SureForm integrated with SmartFire technology and software. Surgeons can fire the stapler from the console while forming the robotic-assisted surgery. Moreover, as the global healthcare infrastructure is improving, especially in emerging economies, demand for advanced surgical procedures and stapling devices is increasing.

Key Surgical Staplers Market Insights Summary:

Regional Highlights:

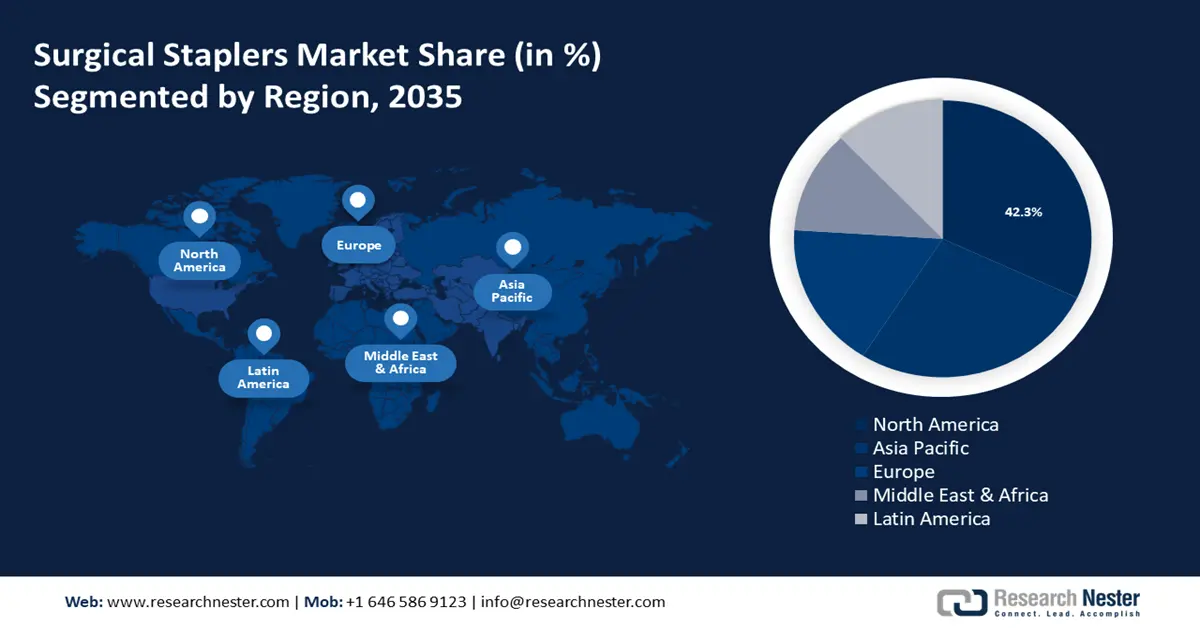

- North America surgical staplers market is anticipated to capture 41.30% share by 2035, driven by factors such as the high prevalence of chronic diseases, rising surgeries, and advancements in minimally invasive techniques.

- Asia Pacific market will exhibit the fastest growth during the forecast timeline, driven by a preference for stapling over sutures, improving healthcare infrastructure, and high adoption of advanced surgical stapling technology and devices.

Segment Insights:

- The reusable segment in the surgical staplers market is projected to maintain a 62.50% share by 2035, driven by rising surgeries worldwide and preference for cost-effective, durable multi-use staplers.

Key Growth Trends:

- Continuous technological advancements

- Increasing aging population and rising healthcare expenditure

Major Challenges:

- Limited versatility and rising concerns about device malfunctions

- Environmental concerns due to high usage of disposable staplers

Key Players: Becton, Dickinson and Company, Medtronic Plc, Johnson & Johnson, ConMed Corp, 3M Co, Smith & Nephew Plc., Braun Melsungen AG, Welfare Medical LTD, Reach Surgical, Grena LTD, and Meril Life Sciences PVT LTD.

Global Surgical Staplers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.31 billion

- 2026 Market Size: USD 5.65 billion

- Projected Market Size: USD 10.54 billion by 2035

- Growth Forecasts: 7.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 18 September, 2025

Surgical Staplers Market Growth Drivers and Challenges:

Growth Drivers:

- Continuous technological advancements: Surgical staplers have drastically transformed from simple manual devices to powered and highly sophisticated ones. The devices currently available enable surgeons to perform tasks with better precision and less manual effort. Several companies are focused on developing stapling devices with ergonomic devices to reduce overall fatigue and enhance precision during long surgical procedures.

For instance, in May 2024, Ethicon announced the U.S. launch of a first-of-its-kind surgical stapler, LINEAR Cutter that provides 47% fewer leaks at the staple line and helps to reduce risks associated with surgery. Another well-known company, Sinolinks Medical launched the first end cutter-powered stapler at a conference in China held in May 2022. Innovations like these are expected to fuel the global surgical staplers market growth during the forecast period. - Increasing aging population and rising healthcare expenditure: The increasing global population is another crucial factor, fueling market growth. Older people are more susceptible to chronic conditions such as cardiovascular, and gastrointestinal diseases, types of cancer, and orthopedic cancers, leading to surgical interventions and demand for efficient and safe advanced stapling devices. In addition, an increasing number of people undergoing complex surgeries is leading to demand for highly specialized stapling tools and devices.

Rapid expansion of healthcare infrastructure and increasing healthcare spending, especially in developing countries is another factor expected to boost surgical staplers market growth going ahead. Governments and private organizations in countries in the Asia Pacific and Latin America are investing in hospitals and healthcare centers. This is expected to increase the demand for several medical devices, including surgical staplers.

Challenges:

- Limited versatility and rising concerns about device malfunctions: Though surgical staplers are rapidly gaining traction; limited versatility can affect their adoption rate going ahead. Many types of staplers are not suitable for all tissues and wounds and are less effective for closing wounds of delicate tissues. In addition, many times, these stapling devices fail to function properly, leading to issues such as excessive bleeding, infection, or even post-surgical complications. This is a key factor that can hamper overall surgical staplers market growth during the forecast period.

- Environmental concerns due to high usage of disposable staplers: Disposable or single-use staplers often strain hospital budgets which can be a challenge for small-scale hospitals and clinics. These single-use staplers also generate significant medical waste, leading to increased environmental concerns and medical disposal issues.

Surgical Staplers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.1% |

|

Base Year Market Size (2025) |

USD 5.31 billion |

|

Forecast Year Market Size (2035) |

USD 10.54 billion |

|

Regional Scope |

|

Surgical Staplers Market Segmentation:

Type

The reusable segment will dominate the market with a revenue share of 62.5% by 2035 attributable to the rising number of surgeries across the globe and a high preference for multiuse staplers due to its cost-effectiveness, reduction in overall environmental impact and better durability as compared to disposable ones. These reusable staplers are made from highly durable materials, capable of withstanding repeated use and sterilization. In addition, most of these staplers have replaceable components and cartilages, making them compatible with different surgeries. In November 2020, Dolphin Sutures, launched Duramate, a high-quality and pocket-friendly multi-use skin stapler in India.

End use

The hospital segment in surgical staplers market is expected to witness staggering growth during the forecast period due to the increasing patient admissions and steady adoption of technologically advanced surgical devices, including stapling tools in medium to large hospitals worldwide. Different types of surgical staplers are widely used to close incisions made during various surgical procedures including abdominal, thoracic, and orthopedic operations. This leads to a growing demand for several surgical staplers including linear, circular, skin, and endoscopic. Moreover, improving healthcare infrastructure and rising investments by public and private sectors to build hospitals in remote areas is expected to boost surgical staplers market growth going ahead.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegment |

|

Technology |

|

|

Type |

|

|

Product |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Surgical Staplers Market Regional Analysis:

North America Market Insights

North America industry is poised to account for largest revenue share of 41.3% by 2035. This growth can be attributed to factors such as high prevalence of chronic diseases, rising number of surgeries, and rapid advancements in minimally invasive techniques. The key players in this region are constantly focused on developing novel and highly accurate, low-pain surgical devices and products, including staplers.

The U.S. and Canada are the largest contributing countries in North America. In the U.S., the surgical staplers market is expected to flourish as the U.S. has the highest obesity rate in the world, resulting in a large number of bariatric surgeries. According to a survey by the National Institute of Health (NIH), 1 in 3 adults in this country are overweight. This has encouraged manufacturing giants to launch novel products. For instance, in August 2022, Teleflex announced its plan to extend its surgical stapling portfolio for bariatric surgery to cater to the rising demand across hospitals and other healthcare centers.

In Canada, the surgical staplers market is expected to witness steady growth owing to the high adoption of advanced stapling devices in surgical procedures, emergence of players, and increasing investments in R&D activities, and product launches. Rising healthcare spending is another factor expected to boost market growth going ahead. According to the NIH Report 2021, over 2 million surgeries, costing around $60 million are performed every year in Canada. This has resulted in increasing demand for advanced surgical staplers.

Asia Pacific Market Insights

Asia Pacific is predicted to be the fastest-growing region for surgical staplers market between 2026 and 2035 attributed to a preference for stapling over sutures, improving overall healthcare infrastructure, and high adoption of advanced surgical stapling technology and devices. There has been a significant increase in the adoption of minimally invasive surgeries for colorectal, thoracic, gynecologic, and bariatric in APAC countries including India, China, Japan, and South Korea.

China is expected to hold the largest share of the surgical staplers market owing to fast-paced technological advancements, growing disposable income, and a rising number of surgeries. Key players in China are focused on launching novel products to cater to the demand. For instance, Ezisurg Medical Co. received an MDR certificate from TÜV Rheinland for its disposable powered endoscopic stapler and cartilage. This is one of the first MDR certificates issued by TÜV Rheinland for such staplers in Greater China.

In India, the surgical staplers market is expected to expand at a robust CAGR during the forecast period due to growing demand for minimally invasive surgeries, improving healthcare facilities, and rising adoption of advanced stapling devices. Global companies such as Medtronic, B. Braun, and Johnson & Johnson’s are expanding their product base to meet to growing demand. For instance, in December 2020, Medtronic announced the launch of EEA Circular Stapler with Tri-staple technology in India. This is the first ever 3-row circular stapler with different height staples that offer consistent performance for a broad range of tissue thicknesses. Such expansions and innovations are expected to fuel market growth in India in the coming years.

Surgical Staplers Market Players:

- CONMED Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Becton, Dickinson and Company

- Medtronic Plc

- Johnson & Johnson

- 3M Co

- Smith & Nephew Plc.

- Braun Melsungen AG

- Welfare Medical LTD

- Reach Surgical

- Grena LTD

- Meril Life Sciences PVT LTD

The surgical staplers market is quite competitive with key players operating at global and regional levels. The market is dominated by several companies focused on innovation, partnerships, and strategic acquisitions to maintain their market position and enhance their product base. These key players are focused on developing novel and more effective stapling devices to cater to the rising number of surgeries across the globe and the growing adoption of minimally invasive techniques. Some of the prominent players operating in the global surgical staplers market include:

Recent Developments

- In February 2022, Standard Bariatrics, Inc., a Cincinnati-based leading company in the bariatric medical device sector, announced the early completion of USD 35 million series B after the successful launch of its Tital SGS Surgical Stapler.

- In December 2021, Intuitive, a global leader in minimally invasive care received U.S Food and Drug Administration (FDA) clearance for its 8 mm Sure Form 30 curved tip surgical staplers. These staplers can be used in general, gynecologic, urologic, thoracic, and pediatric surgery.

- In August 2021, Panthera Healthcare announced the launch of the Smart Powered Stapler platform in Europe, Asia, the Middle East and Africa, and Latin America. This product offers automatic control over tissue transection, resection, and compression, specially designed for gastrointestinal, gynecologic, and other laparoscopic surgeries.

- Report ID: 6434

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Surgical Staplers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.