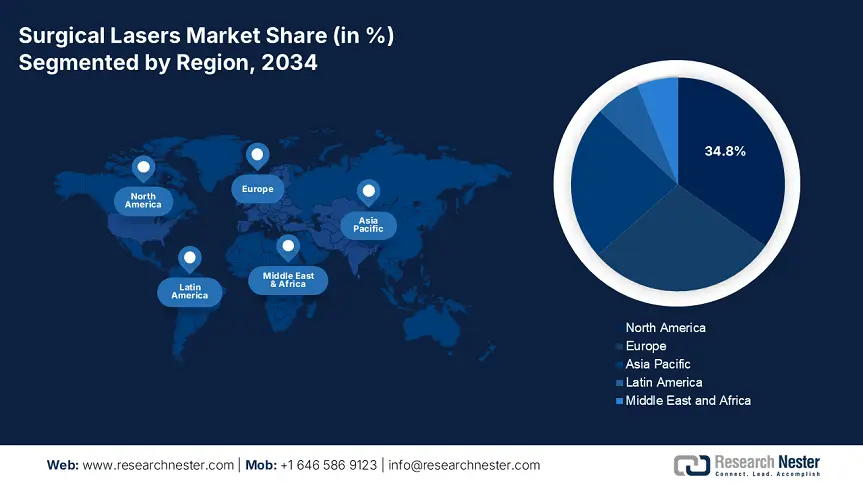

Surgical Lasers Market - Regional Analysis

North America Market Insights

North America is the dominating region in the surgical lasers market and is expected to hold the revenue share of 34.8% at a CAGR of 7.7% by 2034. The market is driven by the robust reimbursement systems, fast adoption of laser-based minimally invasive procedures, high surgical volumes. The U.S. and Canada are fueling the region with high-tech healthcare ecosystem that uses advanced surgical devices and technologies. The region is also driven by the factors such as chronic disease prevalence, precision-based surgical interventions and increasing geriatric population. As per the CDC report, 69.6% of complex ENT and oncology surgeries are performed via laser surgeries. Further, training programs by AHRQ and NIH aid the surgeons in enhancing the procedural access.

The U.S. surgical lasers market is growing due to precision-based treatment, increasing procedural need, and supportive reimbursement systems. In 2023, the CDC reported more than 2.8 million laser-assisted procedures, including oncologic, urologic, and ENT surgeries. The NIH and AHRQ have provided support to skill-development programs designed to enhance surgical accuracy using laser devices, particularly in community and rural hospitals. According to the Medicare report, the surgical laser expenditures increased 15.4% from 2020 to 2024 to $800.6 million, highlighting rising adoption in aging populations. In 2023, CMS broadened its outpatient coverage by including CPT codes for lithotripsy and laser prostatectomy, lowering patients' out-of-pocket costs. Policy, technological, and clinical trends make the U.S. the largest national market worldwide for surgical lasers by 2034.

The surgical lasers market in Canada is rapidly expanding and is driven by aging populations, provincial healthcare spending, and rising laser surgery programs in oncology and gynecology segments. Health Canada invested $3.6 billion, which is 8.5% of the healthcare budget in 2023, in surgical laser technologies and accounted to a 12.6% rise from 2020. The Canadian Institute for Health Information (CIHI) states that more than 60.6% of cancer surgeries in teaching hospitals used CO₂ and Nd:YAG lasers in 2024. Provinces such as Ontario, Alberta, and British Columbia have taken the lead in adoption, with Ontario's Ministry of Health boosting public expenditure on laser-based procedures by 18.4% between 2021 and 2024, benefiting over 200,010 patients every year. Additionally, Canada is fast evolving from a mid-sized market to an innovation center for precision surgery, solidifying its position as North America's second-largest surgical lasers market.

APAC Market Insights

The Asia Pacific surgical lasers market is the fastest growing region and is poised to hold the revenue share of 23.5% at a CAGR of 8.8% by 2034. The market is driven by government investments, advancements in minimally invasive technologies, and increasing procedural volumes. China leads the region and South Korea is expanding the market via local manufacturing subsidies and advanced hospital networks. Further, Malaysia is expanding under the National Medical Device Authority by rising the patient pool. The regional adoption is surged by tariff exemptions and government funded training programs on import devices.

China is the market's biggest contributor and is also expected to hold the revenue share of 28.9% in 2034, led by rising disease burden and improved availability in public hospitals. As per the National Medical Products Administration (NMPA), government expenditure on surgical lasers increased by 15.6% over the last five years, with targeted allocation in tertiary hospitals. More than 1.8 million patients received laser-based treatments in 2023, especially in urology and gynecology, where the least invasive treatment is always the first choice. Additionally, expansion of the insurance coverage under the Urban Employee Basic Medical Insurance (UEBMI) and new approvals for locally developed laser technologies enhance national adoption.

The surgical lasers market in India is expected to hold a revenue share of 18.8% by 2034. The marker is driven rapidly by public-private collaborations and infrastructure development. According to the Ministry of Health and Family Welfare (MoHFW), government expenditure on surgical lasers increased by 18.4% between 2015 and 2023, reaching $2.2 billion annually. This expansion aids the installation of surgical laser units in tier-2 and rural hospitals under the PMSSY and Ayushman Bharat schemes. Over 2.8 million patients underwent laser-based procedures, mainly in oncology, ENT, and ophthalmology procedures, in 2023. With a rising middle class and expanding insurance penetration, India is a strategic hotspot for manufacturers.

Country-wise Government Provinces

|

Country |

Initiative / Policy |

Funding / Investment Value |

Launch Year |

|

Australia |

National Surgical Equipment Modernization Initiative (via Department of Health) |

AUD 520.4 million allocated for laser tech upgrade |

2022 |

|

Japan |

Surgical Innovation Grant by AMED |

¥430.6 billion across advanced surgical tools |

2023 |

|

South Korea |

Smart Hospital Project by MOHW for robotic & laser surgeries |

₩390.8 billion (~$320.7 million) |

2024 |

|

Malaysia |

Health Transformation Plan (HTP): Laser Tech Expansion in Public Hospitals |

RM 900.3 million total investment |

2025 |

Sources: NHRA, AMED, MOHFW, MOHW, MOH

Europe Market Insights

The Europe surgical lasers market is projected to hold a revenue share of 28.7% at a CAGR of 7.0% by 2034. The market is driven by rising aging populations, minimally invasive surgery, and supportive EU funding. Improved reimbursement structures and high hospital acceptance rates of laser-based surgical devices have sped up industry maturity. The UK and Germany are leading the market in innovation, mainly in ophthalmology and urology procedures. The EU’s Horizon Europe health program allocated €2.8 billion towards innovation in surgical technology, reinforcing cross broader R&D. Further, increasing preference for outpatient laser procedure with integration of digital surgery is anticipated to boost the demand.

Germany has the largest share in the surgical lasers market and is expected to hold a revenue share of 28.6% by 2034. Germany has invested nearly €4.4 billion in 2024 in the surgical laser market. As per the Federal Ministry of Health (BMG), the demand has increased by 12.6% from 2021. This rise is due to the use of minimally invasive laser treatments for BPH (benign prostatic hyperplasia), ENT, and oncology. The next-gen holmium and thulium lasers have been used in more than 405 hospitals since 2022. BÄK data also depicts that Germany leads in robotic-assisted laser procedures. The country's centralized insurance reimbursement model ensures cost recovery for hospitals and attracts global manufacturers to expand within the nation.

The surgical lasers market in France is expected to hold a revenue share of 19.8% by 2034. France's Ministry of Solidarity and Health has allocated 7.4% of its healthcare budget in 2023 toward surgical lasers, which is an increase from 5.8% in 2021. The French National Authority for Health (HAS) emphasized an increasing need for gynecology and ENT procedures. In 2023, more than 125,010 laser gynecological surgeries were performed with a rise of 20.5% YoY. HAS has also implemented fast-track approval for laser technologies that fall under high medical benefit. The change in policy has assisted firms such as Lumenis and Quanta System in increasing their presence globally. Expansion of ambulatory care centers in France also benefits outpatient laser-based treatments.

Government Investments, Policies & Funding

|

Country |

Initiative / Policy / Program |

Launch Year |

Key Focus / Funding Details |

|

United Kingdom |

NHS Surgical Innovation Fund |

2022 |

£1.6 billion allocated (2022-2024) for upgrading laser systems in NHS Trusts for urology & dermatology |

|

Spain |

Strategic Health and Innovation Plan (PERTE-Salud) |

2022 |

€1.8 billion national health R&D budget includes surgical laser and robotics innovation |

|

France |

Plan France 2030 - Santé Innovation |

2021 |

€7.9 billion health tech fund; laser-based surgery prioritized under high medical benefit category |

|

Italy |

National Recovery and Resilience Plan (NRRP - PNRR) |

2021 |

€4.8 billion allocated for surgical innovation; focus on minimally invasive and laser procedures |

Sources: HAS, Salute.gov, SANIDAD, UK Government