Surgical Hemostats Market Outlook:

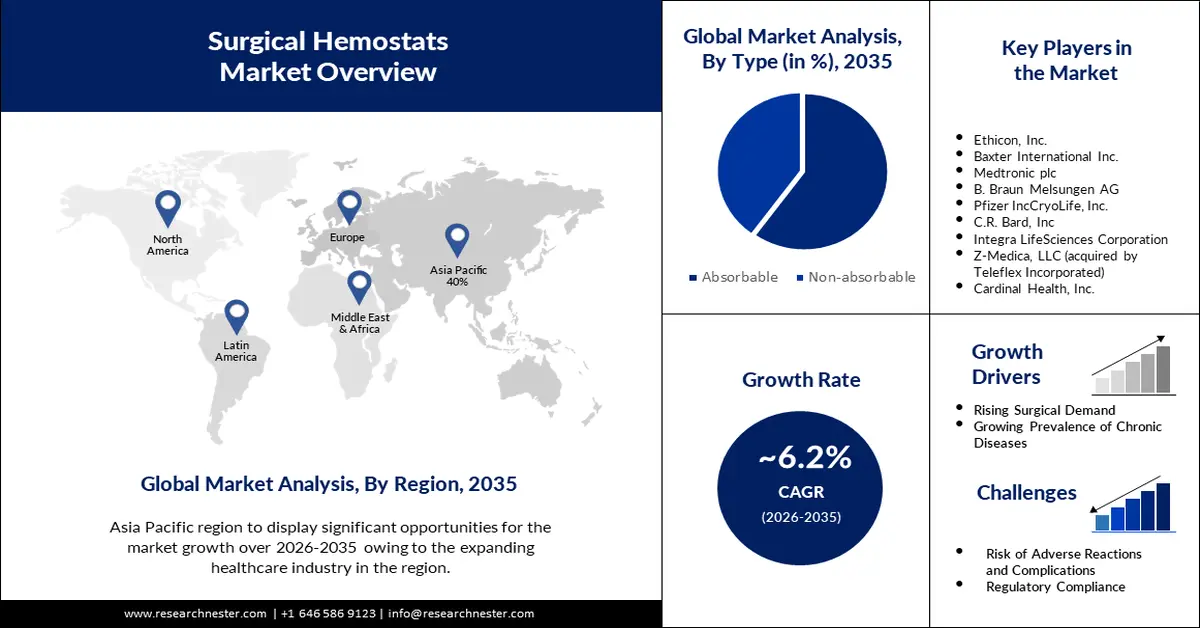

Surgical Hemostats Market size was over USD 4.51 billion in 2025 and is anticipated to cross USD 8.23 billion by 2035, witnessing more than 6.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of surgical hemostats is assessed at USD 4.76 billion.

The escalating number of surgical procedures worldwide stands out as the primary catalyst propelling the growth of the surgical hemostats industry. In recent years, there has been a notable surge in both elective and emergency surgeries, contributing to an augmented need for effective hemostatic solutions since they are crucial in preventing excessive blood loss and ensuring a safe and successful surgery. According to a report by the World Health Organization (WHO), the global volume of surgical procedures is poised to exceed 300 million annually.

In addition, factors that are believed to fuel the market expansion of surgical hemostats include technological advancements. Innovations such as the development of hemostatic agents with improved clotting mechanisms and quicker onset times contribute significantly to patient outcomes. Surgeons increasingly favor these advanced technologies, appreciating their role in minimizing complications and enhancing overall surgical success rates. A study highlighted that the adoption of advanced hemostatic technologies has resulted in a 25% reduction in postoperative bleeding complications across various surgical procedures.

Key Surgical Hemostats Market Insights Summary:

Regional Highlights:

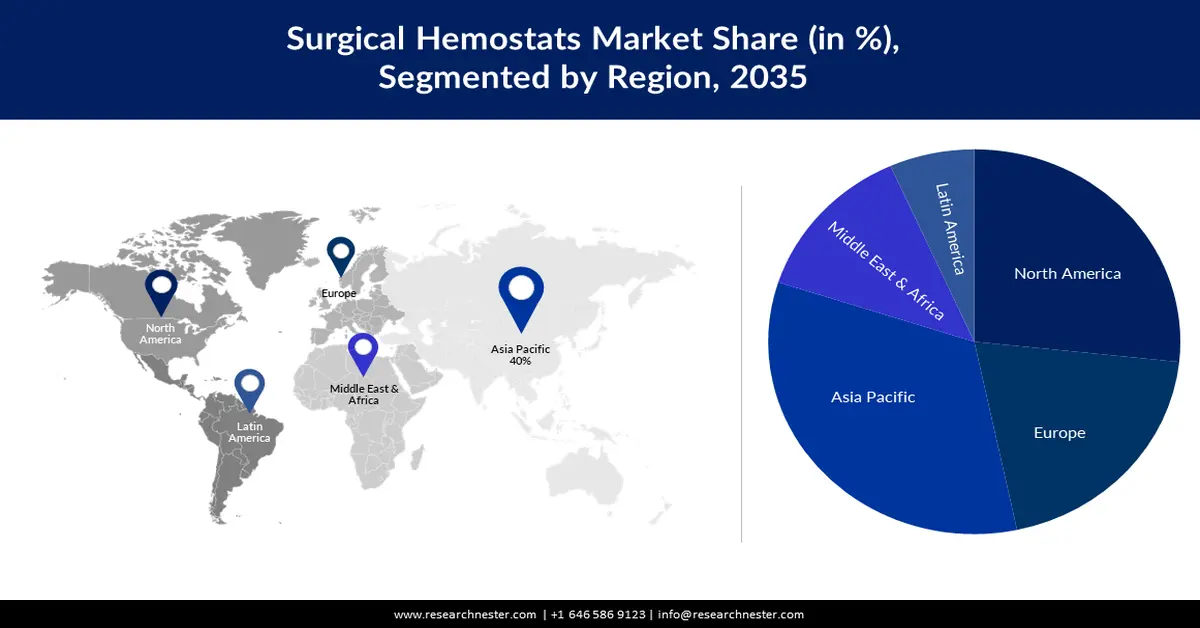

- North America surgical hemostats market is expected to capture 35% share by 2035, driven by rising healthcare spending and adoption of advanced surgical techniques including robotic-assisted surgeries.

- Asia Pacific market will register tremendous growth from 2026 to 2035, fueled by growing population and increased demand for surgical interventions.

Segment Insights:

- The hospitals segment segment in the surgical hemostats market is forecasted to hold a 50% share by 2035, influenced by integration of advanced healthcare technologies and patient safety concerns.

Key Growth Trends:

- Burgeoning aging population

- Increasing prevalence of chronic diseases

Major Challenges:

- Burgeoning aging population

- Increasing prevalence of chronic diseases

Key Players: Ethicon, Inc., Baxter International Inc., Medtronic plc, B. Braun Melsungen AG, Pfizer Inc., CryoLife, Inc., C.R. Bard, Inc., Integra LifeSciences Corporation, Z-Medica, LLC, Cardinal Health, Inc.

Global Surgical Hemostats Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.51 billion

- 2026 Market Size: USD 4.76 billion

- Projected Market Size: USD 8.23 billion by 2035

- Growth Forecasts: 6.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 16 September, 2025

Surgical Hemostats Market Growth Drivers and Challenges:

Growth Drivers

-

Burgeoning aging population- Elderly individuals often require surgical interventions for various health conditions, ranging from cardiovascular issues to orthopedic procedures. The prevalence of age-related ailments necessitating surgical treatment amplifies the demand for reliable hemostatic solutions. As healthcare systems adapt to address the needs of an aging demographic, the market for surgical hemostats is poised to witness sustained growth, aligning with the rising demand for surgical procedures among the elderly. According to the World Health Organization (WHO), the number of individuals 60 years of age and over will reach 2.1 billion worldwide by 2050.

-

Increasing prevalence of chronic diseases- Conditions such as cardiovascular disorders often require intricate surgical procedures where effective hemostasis is paramount. The incidence of chronic illnesses, coupled with advancements in medical diagnostics, leads to the identification of more cases necessitating surgical management.

- Growing number of road accidents- An increase in traffic accidents has resulted in a spike in surgical procedures, which necessitates the usage of surgical hemostats since it is essential for emergencies in hospital settings. As per statistics, globally there were more than 11% more traffic accidents in 2022 than there were in 2021.

Challenges

-

Exorbitant cost and need for skilled professionals - The high cost of hemostasis products is a result of the use of cutting-edge technology and the cost associated with acquiring qualified personnel may restrict the industry growth, particularly in areas with limited resources.

-

Risk of adverse complications can impact the market adoption of surgical hemostats- Despite being rare, there have been reports of potentially fatal side effects and complications with the use of resorbable hemostatic materials, such as gel foam, microfibrillar collagen, resorbable collagen since they run the risk of adhering to tissue and becoming infected, particularly if any portion of them is left unabsorbed.

- Regulatory compliance may cause approval delays and may impede industry expansion

Surgical Hemostats Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.2% |

|

Base Year Market Size (2025) |

USD 4.51 billion |

|

Forecast Year Market Size (2035) |

USD 8.23 billion |

|

Regional Scope |

|

Surgical Hemostats Market Segmentation:

End-Users Segment Analysis

The hospitals segment is expected to hold 50% share of the global surgical hemostats market by the end of 2035. The segment is flourishing as a result of the increasing integration of technology in healthcare practices. Modern hospitals are increasingly adopting advanced technologies such as robotic-assisted surgeries, image-guided interventions, and real-time monitoring systems. Hospitals, as early adopters of these technologies, drive the demand for innovative surgical hemostats that complement and enhance these technological advancements. The integration of healthcare technologies is steadily increasing, with an annual growth rate of 15%.

Additionally, patient safety remains a paramount concern for hospitals, influencing the adoption of surgical hemostats. Effective hemostasis is a critical component of surgical care, with the potential to significantly reduce postoperative complications. Hospitals prioritize the use of hemostatic agents that contribute to positive patient outcomes by minimizing complications related to bleeding.

Formulation Segment Analysis

The sheet & pad segment in the surgical hemostats market is set to garner a notable share shortly. Hemostat pads and sheets are multilayered materials with a self-adhering surface with a backing that resembles a sheet and are often used to regulate bleeding associated with surgery.

In addition, a hemostatic sponge promotes tissue regeneration and has antibacterial and absorbent qualities, which have been utilized in dermatologic surgery to manage postoperative hemostasis resulting from low-pressure arteriolar, venous, and capillary bleeding.

Our in-depth analysis of the surgical hemostats market includes the following segments:

|

Hemostats Type |

|

|

Formulation |

|

|

Application |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Surgical Hemostats Market Regional Analysis:

North America Market Insights

The surgical hemostats market in the region is estimated to hold a share of about 35% by the end of 2035. The market growth in the region is due to the rising spending on healthcare. As a result, companies are spending more on technological innovations in healthcare, with a particular emphasis on advanced surgical techniques. For instance, the amount spent on health care in the United States increased by around 4% in 2022 to over USD 3 trillion. The integration of robotic-assisted surgeries and other cutting-edge technologies necessitates specialized surgical hemostatic solutions. Surgeons increasingly rely on precise and efficient surgical hemostats to complement these innovations.

APAC Market Insights

The Asia Pacific region will also encounter tremendous growth for the surgical hemostats market during the forecast period and will hold the second position owing to the rapidly growing population. With a significant proportion of the global populace residing in this region, there is a consequent increase in the demand for surgical interventions. As healthcare infrastructures expand and access to medical services improves, the number of surgeries performed in the Asia Pacific region rises, creating a substantial market for surgical hemostats to manage bleeding effectively in diverse surgical procedures.

Surgical Hemostats Market Players:

- Ethicon, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Baxter International Inc.

- Medtronic plc

- B. Braun Melsungen AG

- Pfizer Inc.

- CryoLife, Inc.

- C.R. Bard, Inc.

- Integra LifeSciences Corporation

- Z-Medica, LLC

- Cardinal Health, Inc.

Recent Developments

- Baxter International Inc. a leading global MedTech company, announced the acquisition of Hillrom to expand its portfolio in the areas of acute treatments, surgical and critical care, and linked care, and to solidify the company's position as a top global MedTech provider.

- Ethicon, Inc. obtained approval for ETHIZIA an adjunctive hemostat solution with a unique design that surgeons can rely on to function as well on both sides and is made for maximum versatility and gives them the confidence they need in every surgical scenario.

- Report ID: 5638

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Surgical Hemostats Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.