Surgical Boom Market Outlook:

Surgical Boom Market size was valued at USD 458.66 million in 2025 and is likely to cross USD 768.73 million by 2035, expanding at more than 5.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of surgical boom is estimated at USD 480.54 million.

The market growth is led by rising number of surgeries being performed over the world as a result of rising cases of diseases, illnesses, and disorders across the globe. Statistics revealed by the National Library of Medicine stated that approximately 310 million major surgeries are performed each year worldwide. Out of these, around 40 to 50 million surgeries are performed in the United States and around 20 million in the European region. As surgical booms are extensively used in surgical procedures, the increasing number of surgeries is anticipated to fuel the global surgical boom market size.

The demand for surgical booms has intensified in recent years to improve the operating room settings, reduce the wiring requirement, and enhance overall safety during surgical procedures. Furthermore, increasing development of integrated and hybrid operating rooms in hospital settings with advanced medical equipment along with the need for digital devices for enhancing the patient's experience are projected to create favorable opportunities for the market expansion.

In addition, rising awareness about the surgical boom which includes the ability to adapt to different configurations depending on space requirements, function, and purpose along with the availability of support services for helping the operating staff will drive the market growth. Also, rising preference for minimally invasive procedures and the adoption of advanced medical devices such as surgical arms which requires the assistance of surgical booms will create a positive outlook for the market expansion.

Key Surgical Boom Market Insights Summary:

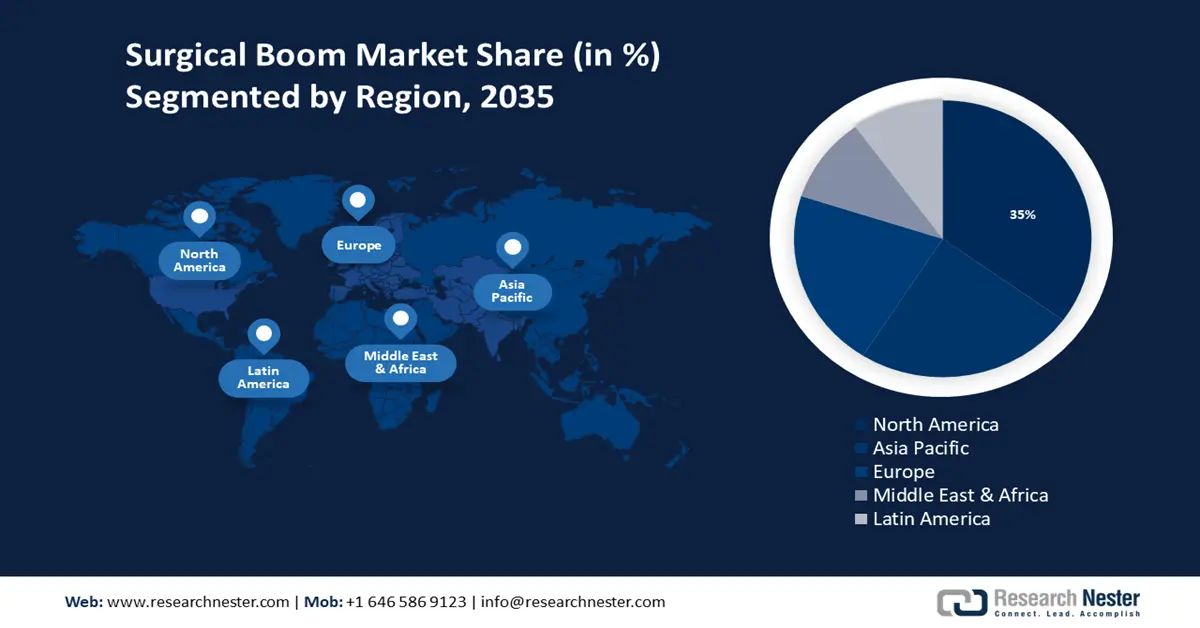

Regional Highlights:

- North America surgical boom market will hold around 35% share by 2035, driven by increasing frequency of disease diagnoses, high number of surgeries, and supportive healthcare policies.

- Asia Pacific market will capture a 24% share by 2035, driven by burgeoning geriatric population, rising investments in R&D, and expanding patient pool.

Segment Insights:

- The anesthesia boom segment in the surgical boom market is forecasted to secure a 38% share by 2035, influenced by growing awareness about medical device connectivity and operational efficiency.

- The medical hospital segment in the surgical boom market is anticipated to achieve a 26% share by 2035, driven by the high number of hospital-based surgeries and availability of trained professionals.

Key Growth Trends:

- Growing Cases of Chronic Diseases Around the World

- Rising Prevalence of Non-Communicable Illnesses among the Global Population

Major Challenges:

- High Costs Associated with Surgical Booms

- Rising Risks of Malfunctioning Surgical Booms

Key Players: Stryker Corporation, SKYTRON, LLC, CV Medical, Amico Group of Companies, STERIS, Hill-Rom Services, Inc., General Electric Company, Ondal Medical Systems.

Global Surgical Boom Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 458.66 million

- 2026 Market Size: USD 480.54 million

- Projected Market Size: USD 768.73 million by 2035

- Growth Forecasts: 5.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, France

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 8 September, 2025

Surgical Boom Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Cases of Chronic Diseases Around the World – Centers for Disease Control and Prevention (CDC) states that six in ten Americans today are diagnosed with at least one chronic disease such as cancer, stroke, and diabetes. The rising cases of chronic diseases require specific treatment and surgeries that are focused on curing the illness from its roots. Such critical surgeries require advanced medical devices such as surgical boom for proper conduction of procedure and help the medical professional for prospering critical operations. Thus, the rising cases of chronic diseases are anticipated to bring in lucrative growth opportunities for the global surgical boom market expansion in the forecast period.

-

Rising Prevalence of Non-Communicable Illnesses among the Global Population – The report published by the World Health Organization (WHO) in 2022 stated that non-communicable diseases are responsible for taking almost 41 million lives every year around the world which is equivalent to 74% of all deaths. The non-communicable diseases are fatal to human life and cause death if not treated effectively. Thus, a large number of surgeries are performed each year for diagnosing and treatment process of these non-communicable diseases which requires advanced surgical booms for proper conduction of the treatment process. Hence, with the increase in non-communicable diseases, it is anticipated to bring favorable opportunities for market expansion in the analysis period.

-

Escalation in the Cases of Cardiovascular Diseases -According to the World Health Organization, estimation, 17.9 million deaths worldwide in 2019 were attributable to CVDs, or 32% of all fatalities. Heart attack and stroke deaths accounted for 85% of these fatalities. The treatment of cardiovascular diseases requires advanced medical products such as surgical booms. Hence, the rapidly growing cases of cardiovascular diseases around the world are a positive indicator of market growth in the next few years.

-

High Amount of Investment in Developing the Healthcare Sector – Major key players in the market and governments are focusing on developing novel medical products that aid doctors and the medical staff present in the operation theatre during surgical procedures. This factor is henceforth projected to bring lucrative growth opportunities for market growth in the upcoming years. For instance, investment in medical and health research and development (R&D) in the United States (U.S.) increased by 11% to around USD 245 billion in 2020 from previous years.

-

Recent Surge of Investments in the Medical Devices Industry – As the number of diseases is creating a global burden, governments are focusing more on manufacturing technologically developed medical products such as surgical booms for the proper treatment of diseases and disorders. The data revealed by the India Brand Equity Foundation (IBEF) stated that in FY20, the foreign investments in the Indian medical devices sector increased to USD 301 million from USD 151 million in FY19, which indicates a 98% increment.

Challenges

-

High Costs Associated with Surgical Booms – Surgical booms are technologically developed medical equipment that is integrated with advanced features for performing complex functions. As a result, the cost of surgical booms is very high. This factor is anticipated to lower the adoption rate among the population with middle and low income. This factor is anticipated to subsequently hamper market growth during the forecast period.

-

Rising Risks of Malfunctioning Surgical Booms

-

Low Level of Awareness Among the Population

Surgical Boom Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 458.66 million |

|

Forecast Year Market Size (2035) |

USD 768.73 million |

|

Regional Scope |

|

Surgical Boom Market Segmentation:

Product Type

The anesthesia boom segment is set to garner 38% share in the market by 2035. The major factor that is aiding segment growth is growing awareness level of anesthesia boom among the population and medical staff about medical device connectivity which also includes surgical booms. Anesthesia booms save space, foster an organized work environment and enhance the efficiency level of the operating room and allow flexibility of patient positioning to suit the surgeons. Moreover, the anesthesia booms are efficient in creating space in an organized way by keeping cables, equipment, and medical gas lines above the floor. Also, the anesthesia boom has been developed with advanced features and tools to make it more efficient for performing in better conditions.

End-user

The medical hospital segment is projected to hold 26% market share by 2035. The segment growth can be attributed to fact that a relatively larger number of individuals choose hospital facilities for treatment as a result of the presence of a greater number of operating rooms and associated intensive care units. Furthermore, increasing number of hospitals in the world and the presence of trained professionals in hospital settings for using surgical booms correctly will drive the segment growth. For instance, there were over 8,000 hospitals in Japan as of 2020. Korea, by contrast, had about 4,000 hospitals. In addition, there were more than 6,000 hospitals in the United States.

Our in-depth analysis of the global market includes the following segments:

|

By Product Type |

|

|

By Installation |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Surgical Boom Market Regional Analysis:

North American Market Insights

The North American surgical boom market is predicted to hold revenue share of about 35% by the end of 2035. The market growth is propelled by increasing frequency of diseases being diagnosed with various diseases and disorders and the high number of surgeries being done every year. Recent statistics are being calculated that almost 15 million Americans undergo some type of surgery every year.

Further, the existence of an effective healthcare network in the region, along with the availability of supportive policies by government bodies, supports the promotion of using surgical booms for easy operation and surgery over a large target population. In addition, the region's expanding healthcare industry and rising commercialization of medical products will boost the market growth.

APAC Market Insights

The Asia Pacific surgical boom market is anticipated to account for 24% share during the forecast period, led by burgeoning geriatric who are prone is diseases, illnesses, and accidents that require surgeries. Furthermore, the presence of major key players in the region along with their rising investments in the research and development activities to manufacture technologically developed surgical booms is anticipated to create a positive outlook for the market expansion. Also, the expanding patient pool of the region which requires complex surgeries will fuel the market revenue.

Europe Market Insights

The European market will grow at significant CAGR through 2035, impelled by rising research and development activities along with the proven success in the development of surgical booms as an efficient treatment method. Furthermore, the rising adoption of surgical treatments and the region's growing geriatric population, as well as the increasing number of various types of surgeries performed each year in the region, are expected to be beneficial opportunities for the market expansion. As per the Eurostat statistics of the European Region, around 4.3 million cataract surgeries were performed in the European Union member states, making it the most common surgical procedure in 2018.

Surgical Boom Market Players:

- Stryker Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- SKYTRON, LLC

- CV Medical

- Amico Group of Companies

- STERIS

- Hill-Rom Services, Inc.

- General Electric Company

- Ondal Medical Systems

Recent Developments

-

Stryker Corporation started a national partnership with Minor League Basketball. This partnership allowed Stryker to become “The Official SmartRobotics Joint Replacement Partner” of Minor League Basketball.

-

SKYTRON, LLC launched a new surgical boom called “The Freedom Boom”, which is expected to upgrade the surgical boom technology of the company owing to its enhanced features such as movement sensors, five arms, and increased arm lengths.

- Report ID: 3296

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Surgical Boom Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.