Global Supply Chain Analytics Market

- Introduction

- Study Objective

- Scope of the report

- Market Taxonomy

- Study Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- Data Triangulation

- SPSS Methodology

- Executive Summary

- Global Industry Overview

- Market Overview

- Regional Synopsis

- Industry Supply Chain Analysis

- DROT

- Driver

- Restraint

- Opportunities

- Trends

- Government Regulation: How they would Aid the Business?

- Competitive Landscape

- Accenture Plc

- Capgemini SE

- Fujitsu Ltd.

- Genpact Ltd.

- IBM (International Business Machines) Corporation

- Kinaxis Inc.

- Micro Strategy Inc.

- Oracle Corporation

- SAP SE

- SAS Institute Inc.

- Tableau Software LLC

- Ongoing Technological Advancements

- PESTLE Analysis

- SWOT Analysis

- Merger and Acquisition Analysis

- Recent Developments Analysis

- Industry Risk Assessment

- Growth Outlook

- Startup Analysis

- Global Outlook and Projections

- Global Overview

- Market (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Global Segmentation (USD Million), 2024-2037,By

- Deployment, Value (USD Million)

- On-Premise

- Cloud

- End user, Value (USD Million)

- Logistics & Transportation

- Healthcare

- Retail

- Manufacturing

- Others

- Regional Synopsis, Value (USD Million)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

- Deployment, Value (USD Million)

- Global Overview

- North America Market

- Overview

- Market (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037,By

- Deployment, Value (USD Million)

- On-Premise

- Cloud

- End user, Value (USD Million)

- Logistics & Transportation

- Healthcare

- Retail

- Manufacturing

- Others

- Country Level Analysis Value (USD Million)

- U.S.

- Canada

- Deployment, Value (USD Million)

- Overview

- Europe Market

- Overview

- Market (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037,By

- Deployment, Value (USD Million)

- On-Premise

- Cloud

- End user, Value (USD Million)

- Logistics & Transportation

- Healthcare

- Retail

- Manufacturing

- Others

- Country Level Analysis Value (USD Million)

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Netherlands

- Switzerland

- Poland

- Belgium

- Rest of Europe

- Deployment, Value (USD Million)

- Overview

- Asia Pacific Market

- Overview

- Market (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037,By

- Deployment, Value (USD Million)

- On-Premise

- Cloud

- End user, Value (USD Million)

- Logistics & Transportation

- Healthcare

- Retail

- Manufacturing

- Others

- Country Level Analysis Value (USD Million)

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Taiwan

- Thailand

- Singapore

- Philippines

- Vietnam

- New Zealand

- Malaysia

- Rest of Asia Pacific

- Deployment, Value (USD Million)

- Overview

- Latin America Market

- Overview

- Market (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037,By

- Deployment, Value (USD Million)

- On-Premise

- Cloud

- End user, Value (USD Million)

- Logistics & Transportation

- Healthcare

- Retail

- Manufacturing

- Others

- Country Level Analysis Value (USD Million)

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Deployment, Value (USD Million)

- Overview

- Middle East & Africa Market

- Overview

- Market (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037,By

- Deployment, Value (USD Million)

- On-Premise

- Cloud

- End user, Value (USD Million)

- Logistics & Transportation

- Healthcare

- Retail

- Manufacturing

- Others

- Country Level Analysis Value (USD Million)

- Saudi Arabia

- UAE

- Israel

- Qatar

- Kuwait

- Oman

- South Africa

- Rest of Middle East & Africa

- Deployment, Value (USD Million)

- Overview

- Global Economic Scenario

- World Economic Outlook

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

Supply Chain Analytics Market Outlook:

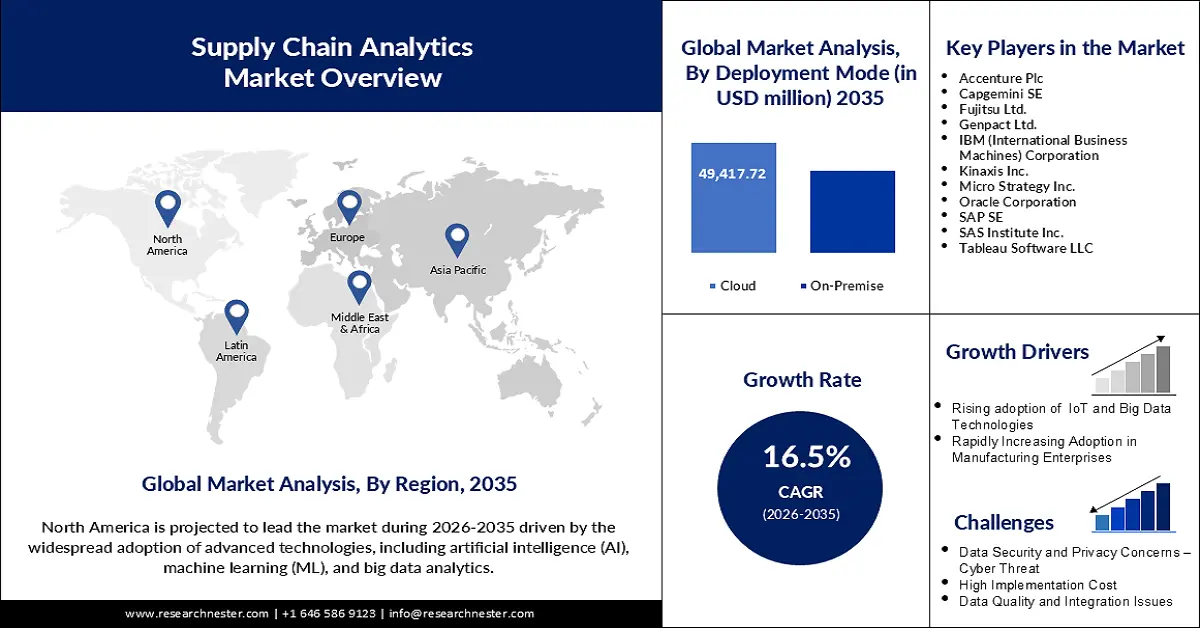

Supply Chain Analytics Market size was over USD 9.62 billion in 2025 and is anticipated to cross USD 44.3 billion by 2035, growing at more than 16.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of supply chain analytics is assessed at USD 11.05 billion.

The demand for supply chain analytics is expanding as companies are focusing on real-time visibility, predictive analytics, and decision-making with the help of artificial intelligence. Due to the increase in e-commerce, Industry 4.0, and globalization, organizations are implementing data analytics to improve their inventory control, sales forecasting, and risk management. In May 2024, IBM unveiled the IBM Sterling Intelligent Promising Premium, which is an AI-based solution for predictive analytics that can apply generative AI for order fulfillment in real-time. This advancement underlines the importance of AI and ML in the simplification of the supply chain process.

Government initiatives are also driving the pace of adoption of supply chain analytics to a higher level. Furthermore, as per the International Trade Administration (ITA), the B2B e-commerce market is expected to grow at 14.5% through 2026, which presents a growing need for logistics solutions based on data. In September 2024, Oracle released new AI features for Oracle Fusion Data Intelligence to help enterprises get the most out of their supply chain data. With increasing globalization, there is a need to improve supply chain agility and reduce risks through the adoption of AI and cloud-based analytics.

Key Supply Chain Analytics Market Insights Summary:

Regional Highlights:

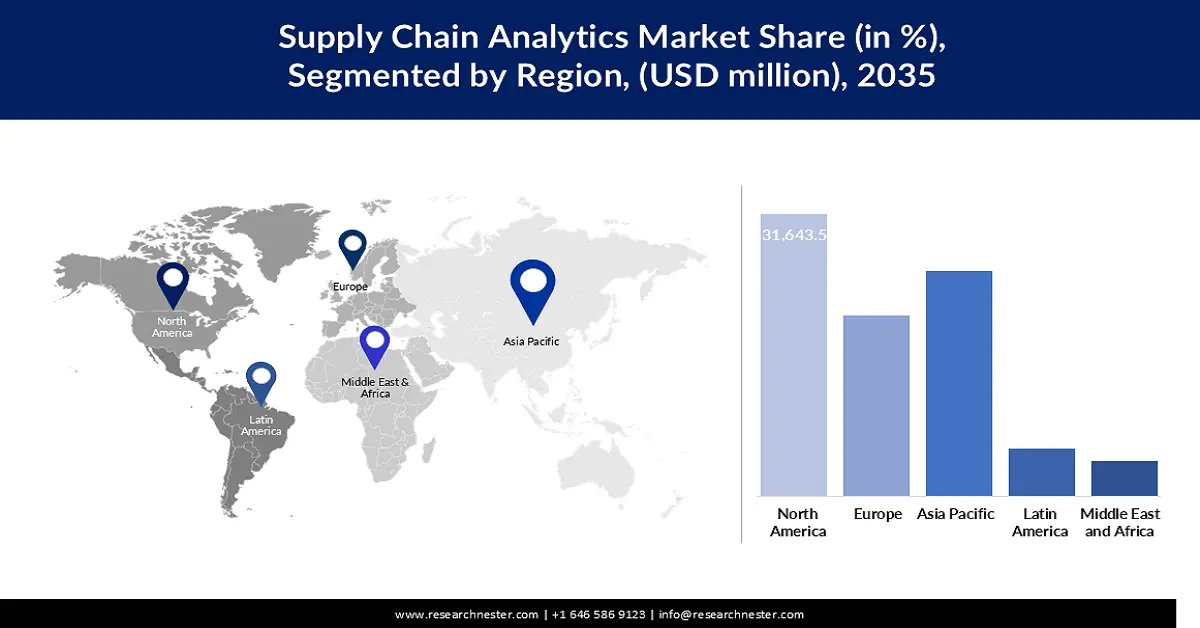

- By 2035, North America is projected to secure nearly 36.5% of the Supply Chain Analytics Market share, attributed to intensifying focus on AI-driven logistics, cloud analytics adoption, and advanced predictive modeling.

- Asia Pacific is anticipated to record notable expansion through 2035 as rising manufacturing output, surging e-commerce logistics, and smart city initiatives stimulate demand for AI-enabled supply chain optimization across industries.

Segment Insights:

- The cloud-based segment in the Supply Chain Analytics Market is expected to command over 57.3% share by 2035, supported by its scalable architecture, cost-efficiency, and real-time analytical capabilities.

- By 2035, the manufacturing segment is estimated to hold around 25.9% share as enterprises strengthen AI-enabled production scheduling, demand forecasting, and predictive maintenance requirements.

Key Growth Trends:

- AI and predictive analytics for demand forecasting

- Cloud-based analytics and real-time visibility

Major Challenges:

- Cybersecurity threats in data-driven supply chains

- Integration complexity and data silos

Key Players: Accenture Plc, Capgemini SE, Fujitsu Ltd., Genpact Ltd., IBM (International Business Machines) Corporation, Kinaxis Inc., MicroStrategy Inc., Oracle Corporation, SAP SE, SAS Institute Inc., Tableau Software LLC.

Global Supply Chain Analytics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.62 billion

- 2026 Market Size: USD 11.05 billion

- Projected Market Size: USD 44.3 billion by 2035

- Growth Forecasts: 16.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 10 September, 2025

Supply Chain Analytics Market Growth Drivers and Challenges:

Growth Drivers

- AI and predictive analytics for demand forecasting: AI is being widely used in demand forecasting, inventory holding cost, and supply chain flexibility in the current business environments. Real-time data analysis enables businesses to forecast the demand and hence control their procurement strategies. In June 2024, Kinaxis launched Kinaxis Maestro, an artificial intelligence supply chain orchestration platform to manage decisions from planning to delivery. Due to the fluctuations in the supply chain and consumer behavior, predictive models have become an indispensable tool for risk management. AI integration also makes it possible to automate decision-making so that companies can adapt to fluctuating demand without ending up with too much inventory or running out of stock. With the increasing levels of sophistication of supply chains, AI is proving to be an invaluable tool in improving the functioning and robustness of supply chains.

- Cloud-based analytics and real-time visibility: The growing adoption of cloud-based analytics solutions is revolutionizing supply chain transparency, providing real-time data, flexibility, and accessibility. As a result, cloud-native platforms have now been adopted to consolidate data from different supply chain interfaces for enhanced efficiency. In December 2024, Zebra Technologies implemented MicroStrategy ONE, an artificial intelligence analytics platform, for Workcloud Workforce Optimization Suite to optimize staffing and logistics. The use of cloud computing enables the processing of large volumes of data in real-time, which minimizes disruptions in the supply chain. The scalability of cloud solutions also implies that the solutions are available for companies of any size, from small businesses to large multinationals. Despite the shift toward Industry 4.0, cloud-based supply chain analytics will be the key driver of growth.

- Digital transformation in manufacturing and logistics: The use of IoT, blockchain, AI, and robotics is speeding up digitalization in the manufacturing and logistics industries. Supply chain analytics are now being used in the management of warehouses, the planning of delivery routes, and the tracking of inventories. As stated by Research Nester, the IoT industry was valued at USD 800 billion in 2023 and is expected to cross USD 1 trillion by 2026, which indicates the importance of connected devices in supply chain management. In March 2024, Accenture acquired Flo, a logistics analytics firm, to improve logistics data analytics skills to help European businesses boost their use of Oracle supply chain solutions. A number of manufacturers are now using data analytics for efficient production planning and scheduling, while logistics companies are using AI in route planning to reduce delivery time and fuel expenses. This shift is changing the dynamics of supply chain management, making processes more efficient and economical.

Challenges

- Cybersecurity threats in data-driven supply chains: With supply chains becoming more digital, big data, AI, and cloud computing, cyber threats are a growing concern. Supply chain cyberattacks have increased in recent years, disrupting global commerce and exposing crucial operational information. According to the World Economic Forum, more than 800,000 cyberattacks were recorded in 2023, and several of those attacks were on the logistics and procurement systems. Despite firms increasing their spending on cybersecurity and blockchain-based security solutions, the risks remain a concern and are being exploited through supply chain attacks. A single data breach can lead to significant business disruptions, financial losses, and negative brand impressions. AI-based threat detection and end-to-end encryption are emerging as the key solutions for improving supply chain cyber resilience.

- Integration complexity and data silos: Most organizations face challenges in adapting their old platforms to new analytical platforms, thus creating a gap in data management. The integrated structure of legacy infrastructure also does not support the exchange of real-time data between different departments or partners. The lack of integrated data makes it hard for businesses to have a holistic view of the supply chain, and this affects the decision-making process. Moreover, the use of AI and cloud-based analytics entails considerable expenses on acquisitions of new software, training of employees, and data transfers. Companies that do not address these integration challenges may be left behind by competitors who have adopted fully connected, real-time analytics environments.

Supply Chain Analytics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

16.5% |

|

Base Year Market Size (2025) |

USD 9.62 billion |

|

Forecast Year Market Size (2035) |

USD 44.3 billion |

|

Regional Scope |

|

Supply Chain Analytics Market Segmentation:

Deployment Mode Segment Analysis

Cloud-based segment is set to capture over 57.3% supply chain analytics market share by 2035, due to its flexibility, cost-effective and real time analysis feature. Cloud solutions have gained popularity as organizations look for real-time analytics applications that support decision-making in logistics, warehouse, and procurement. In September 2024, Oracle AI-based Oracle Fusion Data Intelligence was launched to provide enhanced cloud analytics for supply chain management. The increasing focus on supply chain reliability, remote access, and timely tracking is driving the demand for cloud-based analytics solutions.

End user Segment Analysis

By the end of 2035, manufacturing segment is estimated to capture around 25.9% supply chain analytics market share as industries adopt AI in production scheduling and demand forecasting. The use of data analytics is important to manufacturers for inventory, supply chain risk management, and prediction of when the manufacturing equipment needs to be serviced. United Nations Industrial Development Organization (UNIDO) reported that manufacturing production grew by 1.5% in the fourth quarter of 2023, pointing to a revival of the industrial sector. In April 2024, SAP released its AI-based solutions in supply chain management, increasing productivity and flexibility in the production of goods. The need for smart factories and accurate prediction of supply chains is the key factor that is propelling the demand for advanced analytics.

Our in-depth analysis of the global supply chain analytics market includes the following segments:

|

Deployment Mode |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Supply Chain Analytics Market Regional Analysis:

North America Market Insights

North America supply chain analytics market is likely to exhibit around 36.5% revenue share till 2035, owing to factors such as AI in logistics, cloud analytics, and predictive modeling. Organizations are targeting time-sensitive visibility, risk, and automation to improve operational performance. Currently, the region is experiencing a growth in investment from both the government and private players in supply chain management that is data driven. In January 2023, Project 44 and SAS entered into a partnership to improve supply chain visibility for retailers, manufacturers, and e-commerce companies. The idea is to improve inventory management, cut transportation expenses, and make the supply chain as customer friendly as possible.

The U.S. continues to be one of the most advanced countries in terms of digitization of the supply chain with the adoption of AI, IoT, and blockchain. The country’s focus on building and implementing a resilient and automated supply chain has brought about significant changes in inventory tracking, risk evaluation, and demand forecasting. In addition, adoption is promoted by government programs and business investments in analytics with the help of artificial intelligence. In February 2024, Amazon Web Services (AWS) released an AI-based supply chain optimization solution to enhance forecasting, warehouse management, and logistics planning. This initiative demonstrates the trend toward the development of smart supply chain solutions that improve performance, cut expenses, and meet demand.

Canada is also seeing high levels of adoption for supply chain analytics, with companies adopting cloud solutions and real-time inventory. The well-developed trading operations and international transportation systems within the country increase the need for AI-based analysis and modeling. Businesses are increasingly adopting automation and machine learning to enhance supply chain operations. In March 2024, Kinaxis took the decision to partner with Canadian Tire Corporation in deploying artificial intelligence in supply chain analytics. The collaboration improves inventory management, demand planning, and supplier integration, making the supply chain in the retail and e-commerce industries more dynamic and effective.

Asia Pacific Supply Chain Analytics Market Insights

Asia Pacific region is poised to witness substantial growth through 2035. The region’s manufacturing industries, the growth of e-commerce logistics, and innovative smart city projects are boosting the demand for AI logistics and cloud computing. Real-time data processing and predictive insights are becoming increasingly popular in industries to enhance productivity and minimize risks. The International Trade Association (ITA) has predicted that India is poised to become the hub of semiconductor manufacturing, with an estimated demand of USD 80 billion by 2026. These trends are driving supply chain optimization investments across industries.

The supply chain analytics market in India is rising at a fast pace due to investment in artificial intelligence, machine learning, and automation in logistics and manufacturing. This is due to the government’s focus on digital transformation and the local sourcing of goods and services. The increase in the adoption rate of e-commerce and warehousing automation also leads to the increased adoption of analytics. In November 2024, Google Cloud was integrated with Flipkart to implement artificial intelligence in the supply chain management system of Flipkart such as demand forecasting, logistics, and order delivery. These measures help enhance the country’s role as a technology-oriented supply chain hub.

China is also one of the supply chain analytics leaders with a focus on AI-based prediction, robotics, and cloud-based logistics platforms. The manufacturing industries and e-commerce firms in the country are increasingly automating supply chain management and transportation logistics. Businesses are investing in automation and real-time data analytics to enhance the security and performance of supply chain management. Furthermore, several vendors are entering into strategic partnerships to expand the application of supply chain orchestration in China to improve supply chain stability and manufacturing throughput using real-time predictive analytics.

Supply Chain Analytics Market Players:

- Accenture Plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Capgemini SE

- Fujitsu Ltd.

- Genpact Ltd.

- IBM (International Business Machines) Corporation

- Kinaxis Inc.

- Micro Strategy Inc.

- Oracle Corporation

- SAP SE

- SAS Institute Inc.

- Tableau Software LLC

The supply chain analytics market is fragmented, and major technology firms and consulting companies are increasingly venturing into the realm of AI-based supply chain analytics. Some of the key players are Accenture, Capgemini, Fujitsu, Genpact, IBM, Kinaxis, MicroStrategy, Oracle, SAP, SAS Institute, and Tableau Software. In addition, the strategic acquisition and technological affiliations are paving the way to the competition by extending the firms’ competencies in logistics, e-commerce, and industrial supply chains.

As part of efforts to minimize disruptions that impact the customer experience in January 2023, Project44, a platform for supply chain visibility, and SAS, a company in the provision of analytics software and services, unveiled a new retail ecosystem partner. The companies aim to demonstrate the advantages of supply chain updates and how they allow retailers, manufacturers, and e-commerce companies to stand out from the competition by improving collaboration, reducing transportation costs, and optimizing inventory for a customer-centric supply chain.

Here are some leading companies in the supply chain analytics market:

Recent Developments

- In December 2024, NTT DATA Japan entered into a strategic partnership with Kinaxis, a global leader in end-to-end supply chain orchestration. The collaboration aims to drive supply chain modernization by integrating Kinaxis’ advanced analytics solutions with NTT DATA’s expertise in system integration and value-added reselling.

- In August 2024, Genpact was recognized as a Leader in HFS Research’s Supply Chain Services Horizon assessment for its AI-driven enterprise planning, predictive analytics, and data management. Its partnerships with AWS and Salesforce enhance supply chain solutions, improving agility, efficiency, and revenue growth.

- In July 2024, Fujitsu partnered with Cohere to advance generative AI for enterprises, focusing on Large Language Models (LLMs) with enhanced Japanese language capabilities. The collaboration aims to optimize supply chain operations by leveraging AI-driven analytics to enhance employee decision-making and customer experience.

- Report ID: 4837

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Supply Chain Analytics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.