Super High Frequency Communication Market Outlook:

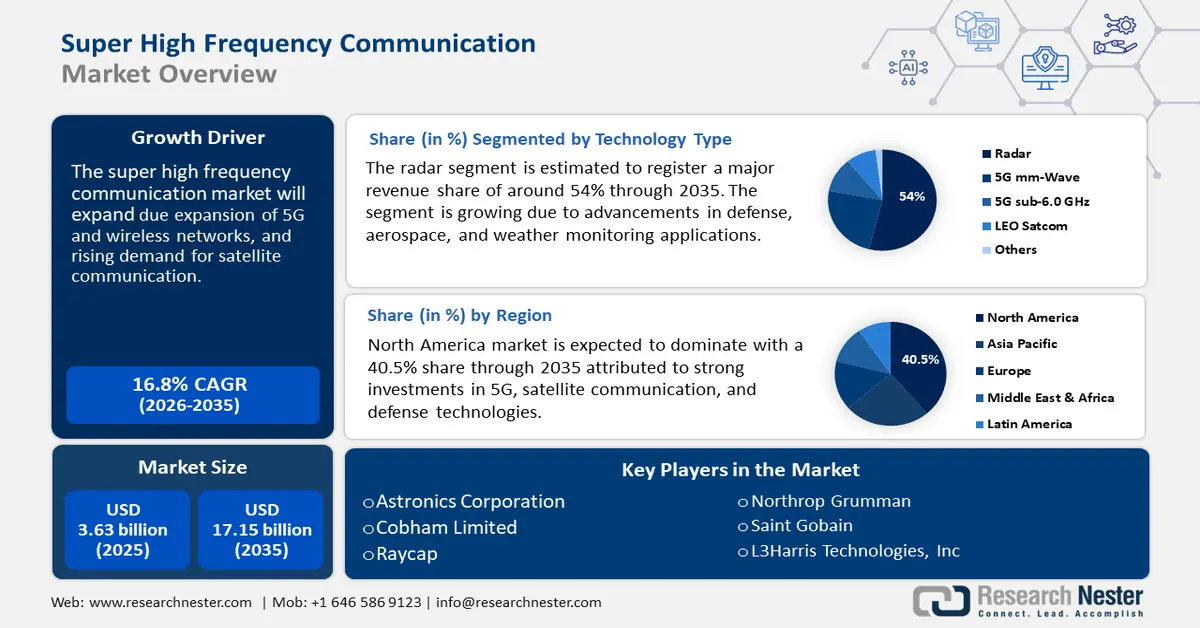

Super High Frequency Communication Market size was valued at USD 3.63 billion in 2025 and is expected to reach USD 17.15 billion by 2035, registering around 16.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of super high frequency communication is evaluated at USD 4.18 billion.

The primary growth driver of the super high frequency communication market is the expansion of 5G and wireless networks. 5G deployment relies heavily on SHF frequencies particularly in the millimeter wave (mmWave) spectrum, enabling high-speed low latency communication. Super high frequency communication refers to wireless communication that operates in the 3GHz to 30GHz frequency range. The increasing demand for IoT devices, smart cities is driving the need for ultra-fast and reliable networks provided by SHF. The 5G frequency ranges consist of 1 to 4 GHz, 6 to 24 GHz, 30 GHz, and 40 GHz. A recent example of the expansion of 5G and wireless networks through the deployment of millimeter wave (mm Wave) technology is EE’s activation of over 1000 small cell masts across UK in August 2024. These small cells attached to lamp posts and phone boxes enhance mobile signal in busy areas without the need for large new masts. Such advancements propel the demand for super high frequency communication.

Additionally, the increasing demand for high-speed data transmission is also responsible for the demand of super high frequency communication technologies. The advancements in antenna and signal processing technologies bring out innovations in beam forming, phased array antennas, and MIMO (Multiple Input Multiple Output) technologies enhancing SHF communication capabilities. The miniaturization of SHF transceivers makes them more accessible for commercial and consumer applications.

Key Super High Frequency Communication Market Insights Summary:

Regional Highlights:

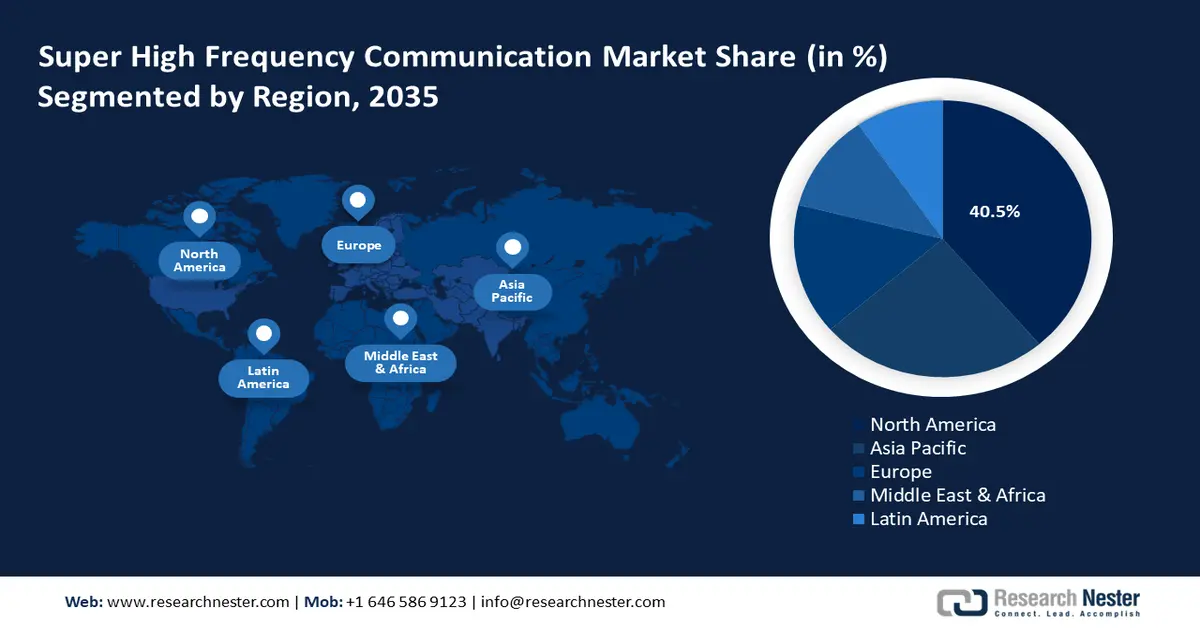

- North America leads the Super High Frequency Communication Market with a 40.5% share, propelled by strong investments in 5G, satellite communication, and defense technologies, driving growth through 2026–2035.

- The Asia Pacific region is anticipated to see rapid growth in the Super High Frequency Communication Market from 2026 to 2035, driven by rising defense budgets, smart city initiatives, and expanding satellite networks.

Segment Insights:

- The 20 - 30 GHz segment is expected to experience substantial growth during 2026-2035, fueled by its critical role in high-speed data transmission and next-generation wireless networks.

- The Radar segment is anticipated to hold a 54% share by 2035, driven by advancements in defense, aerospace, and weather monitoring applications.

Key Growth Trends:

- Rising demand for satellite communication

- Military and defense applications

Major Challenges:

- Signal blockage and line of sight requirements

- Regulatory constraints and spectrum congestion

- Key Players: Cobham Limited, Raycap, General Dynamics Corporation, Hensoldt, JENOPTIK AG, L3Harris Technologies, Inc., Northrop Grumman, Saint-Gobain.

Global Super High Frequency Communication Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.63 billion

- 2026 Market Size: USD 4.18 billion

- Projected Market Size: USD 17.15 billion by 2035

- Growth Forecasts: 16.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 13 August, 2025

Super High Frequency Communication Market Growth Drivers and Challenges:

Growth Drivers

-

Rising demand for satellite communication: The proliferation of low earth orbit (LEO) satellites and geostationary communication satellites is boosting demand for SHF frequencies. A recent example highlighting the growth of low earth orbit satellite networks is Vodafone’s achievement of the first-ever space-based mobile video call. This milestone was accomplished using AST SpaceMobile’s Bluebird satellites, designed to provide mobile broadband directly to standard smartphones at speeds up to 120 Mbps. This achievement highlights the expanding capabilities of LEO satellite technology in delivering high bandwidth super high-frequency (SHF) connections.

-

Military and defense applications: Growing geopolitical tensions and the need for secure, high-speed communication are prompting governments to invest in SHF-based radar, surveillance and encrypted communications. Further, electronic warfare and intelligence-gathering systems use SHF bands for advanced signal processing and real-time battlefield awareness. A recent example of military investment in super high-frequency technologies is India’s induction of the Akashteer system. The system is an automated air defense control and reporting system developed by Bharat Electronics Limited. This system enhances the Indian Army’s air defense capabilities by integrating various surveillance assets, radar systems and communication nodes into a unified network, thereby improving situational awareness and response efficiency.

Challenges

-

Signal blockage and line of sight requirements: SHF signals travel in straight lines and do not easily bend around obstacles, unlike lower frequency waves which can travel long distances and penetrate obstacles. This means physical obstructions such as buildings, trees, and mountains can cause signal degradation. Environmental factors such as rain, fog, and moisture in the air can absorb and scatter SHF signals weakening their strength.

-

Regulatory constraints and spectrum congestion: The increasing demand for 5G, satellite communications and military applications is leading to spectrum congestion as multiple industries are competing for the same super high frequency bands. Additionally, regulatory bodies such as the FCC in U.S., ITU (International Telecommunication Union), and Ofcom (UK), strictly control the allocation of frequency bands. Thus, it is difficult for emerging technologies or players to acquire spectrum licenses leading to delay in innovation.

Super High Frequency Communication Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

16.8% |

|

Base Year Market Size (2025) |

USD 3.63 billion |

|

Forecast Year Market Size (2035) |

USD 17.15 billion |

|

Regional Scope |

|

Super High Frequency Communication Market Segmentation:

Technology Type (Radar, 5G mm-Wave, 5G sub-6.0 GHz, LEO SATCOM)

In super high frequency communication market, radar segment is poised to capture revenue share of around 54% by the end of 2035. The segment is growing due to advancements in defense, aerospace, and weather monitoring applications. Military radars use SHF frequencies for long-range surveillance, target tracking, and missile defense systems. Aviation and maritime industries rely on super high-frequency radar for navigation, collision avoidance, and air traffic control. Moreover, emerging autonomous vehicle radar applications leverage SHF for real-time object detection and high-precision mapping.

Advancements in the radar segment of the super high frequency communication market are prominent in the Indian Navy’s adoption of next-generation radar technology. In August 2024, Astra Microwave executed the Active Antenna Array Unit (AAAU) of the ship-borne radar (SBR). This 6-meter S-band radar known as the long-range multi-function radar (LRMFR) is set to replace the existing MFSTAR radar systems on Indian naval vessels. The LRMFR handles a range of crucial tasks from target tracking to fire control for surface air missiles and ballistic missile defense.

Frequency Range (20 - 30 GHz, 10 - 20 GHz, 30 - 40 GHz, 3 - 10 GHz, Above 40 GHz)

20 - 30 GHz segment in the super high frequency communication market is set to showcase growth rate of over 25.4% through 2035. This segment plays a crucial role in high-speed data transmission, advanced radar systems and next generation wireless networks. This range includes the Ka-band 26.5-4.0 GHz which is widely used in satellite communications especially for high throughput satellites that provide broadband internet, military communications and commercial aviation connectivity. Additionally, 5G networks also leverage this spectrum for millimeter wave communication enabling ultra fast speeds and low latency in urban environments. In the defense sector, radar systems operating in this range offer high resolution imaging and target tracking for surveillance and missile defense applications.

Our in-depth analysis of the global super high frequency communication market includes the following segments:

|

Technology type |

|

|

Frequency range |

|

|

Radome type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Super High Frequency Communication Market Regional Analysis:

North America Market Analysis

By 2035, North America super high frequency communication market is set to capture over 40.5% revenue share. The market growth is attributed to strong investments in 5G, satellite communication, and defense technologies. The U.S. military heavily utilizes SHF frequencies for radar, secure satellite links and electronic warfare systems. Telecom giants like Verizon and AT &T are expanding mmWave 5G networks in the 24-30GHz range for ultra-fast wireless connectivity. The region also sees growing demand for Ka-band satellite services (26.5-40GHz) supporting high-speed internet access in remote areas.

The U.S. is a major player in the super high frequency communication market, driven by advancements in military radar, satellite broadband and 5G infrastructure. The Department of Defense (DoD) invests heavily in SHF based secure communications and electronic warfare systems, including the AEHF satellite network for global military connectivity. In the commercial sector, Amazon’s Project Kuiper is set to launch Ka-band satellites competing with Space X’s Starlink for satellite internet services. Additionally, the Federal Communications Commission (FCC) continues to auction the SHF spectrum for 5G expansion boosting high-speed wireless networks across the country.

Canada Super high frequency communication market is expanding due to investments in satellite connectivity for remote regions, defense modernization, and research in advanced wireless technology. The Canadian government supports SHF-based satellite internet services, with companies such as Telesat launching lightspeed satellites in the Ka-band to improve broadband access in rural areas. Additionally, the Innovation, Science and Economic Development Canada Report 2024 states that the government in Canada is investing USD 1.7 billion in new funding for broadband infrastructure. This includes a new Universal Broadband Fund to support broadband projects across the country. It includes a top-up for the successful Connect to Innovate program and supports the low-Earth orbit satellite capacity to measure broadband usage.

Asia Pacific Market Analysis

Asia Pacific market is anticipated to rapid growth in the super high frequency communication market during the forecast period. This growth is driven by rising defense budgets, smart city initiatives, and expanding satellite networks. Countries such as China, Japan and South Korea are investing in mmWave 5G and future 6G networks, enhancing ultra-fast connectivity.

China is advancing super high frequency communication market with strong investments in satellite networks, military radar, and next-gen 5G/6G technologies. China’s 6G research explores THz and SHF bands aiming for global leadership in future wireless communication. The country is expanding Ka-band satellite internet through projects such as China Satcom’s HTS satellites. The military forces in China are integrating SHF-based radar for stealth detection and missile defense. For instance, in December 2024, China developed a ghost radar that utilizes extremely low-frequency electromagnetic signals to locate enemy submarines at significant depths, enhancing anti-submarine warfare capabilities.

India is expanding super high frequency communication with a focus on satellite broadband, defense modernization and 6G research. The Defense Research and Development Organization (DRDO) is integrating SHF-based radar and electronic warfare systems for national security. Furthermore, the country’s push for indigenous 6G technology includes research into mmWave and terahertz communication for future networks. Due to these factor, India is anticipated to garner steady adoption of super high frequency communication during the forecast period.

Key Super High Frequency Communication Market Players:

- Astronics Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cobham Limited

- Raycap

- General Dynamics Corporation

- Hensoldt

- JENOPTIK AG

- L3Harris Technologies, Inc.

- Northrop Grumman

- Saint-Gobain

- The NORDAM Group LLC

The super high frequency communication market is fragmented with key players driving advancements in 5G, satellite broadband, and defense technologies. Space X’s Starlink and Telesat lead in Ka-band satellite internet, expanding global connectivity. Lockheed Martin and Raytheon develop SHF-based radar and military communication systems for defense applications. Companies such as Huawei, Ericsson and Qualcomm push mmWave 5G and early 6G research, shaping the future of high-frequency wireless networks.

Here are some leading players in the super high frequency communication market:

Recent Developments

- In January 2025, Chang Guang Satellite Technology in China achieved a significant milestone in satellite to ground laser communications, reaching a data transmission rate of 100 Gbps. This breakthrough supports the deployment of 6G internet and other advanced technologies.

- In May 2023, Thuraya and SAT Global achieved a milestone in satellite IoT by demonstrating a low-latency messaging system for direct-to-satellite IoT texting. Utilizing the Thuraya-2 Satellite (T2), they successfully transmitted low-power IoT messages, marking a significant advancement in satellite communication technology.

- Report ID: 7261

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Super High Frequency Communication Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.