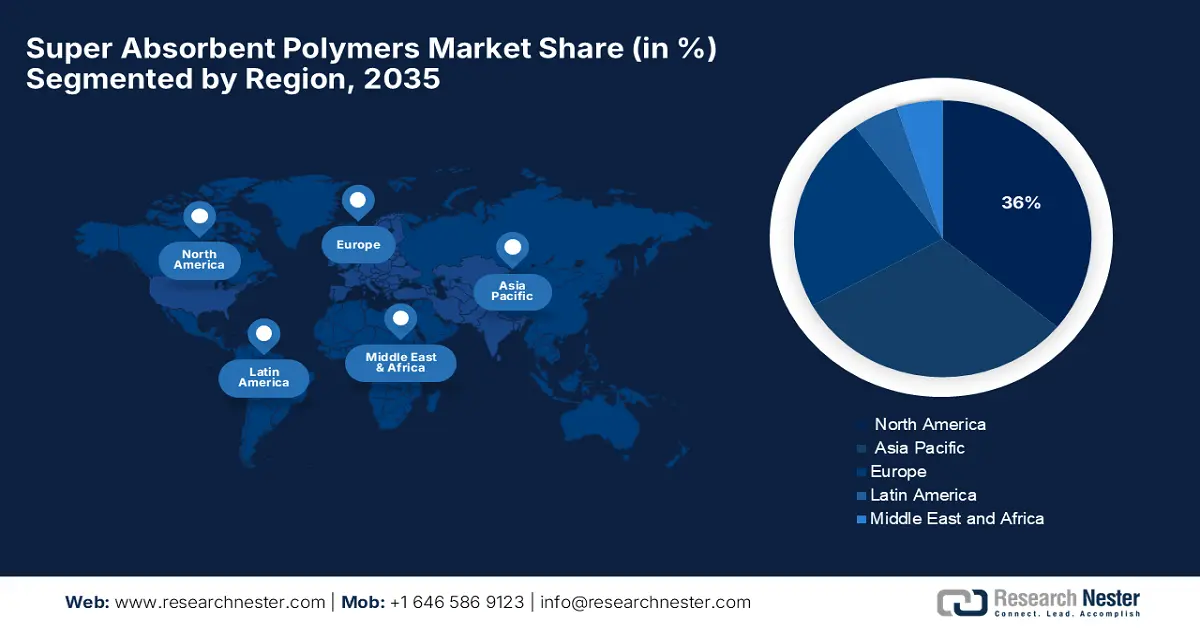

Super Absorbent Polymers Market - Regional Analysis

North America Market Insights

North America's super absorbent polymers (SAPs) market is expected to occupy the largest share in the market with 36% market share because of strong demand for personal care, notably baby diapers, where SAPs' improved fluid control offers convenience, hygiene, and leakage protection. Secure access to hygiene products facilitates secure growth in the SAPs market, notably in the personal care and healthcare industries. As per a study submitted by ISPOR in 2025, with over 50% of the U.S. population covered by employer-sponsored insurance, SAP-based personal products' frequent use is being encouraged through institutional and consumer markets.

The U.S. super absorbent polymers market is expanding on the heels of extensive use in adult incontinence wear for an aging population, robust demand in the healthcare industry, and government assistance toward healthcare development. According to the American Hospital Association 2025 report, the U.S. super absorbent polymers (SAPs) market is well backed by its huge healthcare infrastructure, which includes more than 6,000 hospitals and almost 913,000 staffed beds in the country. Out of these, 5,112 are community hospitals, and they receive more than 32 million admissions per year. This reflects the huge SAP-based medical product demand for wound dressings, surgical pads, and incontinence care material.

The super absorbent polymers market in Canada is expanding as a result of a high population and the availability of universal health care, increasing demand for incontinence and medical hygiene products, and government health care and aged care spending. According to a Hexavision 2025 report, the USD 300 federal payment in Canada shows that the government is taking more action to support low- and middle-income families as living costs rise. This trend also increases the demand for affordable hygiene products. With increased economic demands, there is a corresponding demand for more affordable, high-absorbency items like SAP-based incontinence care products and diapers by families and the elderly.

Europe Market Insights

The super absorbent polymers market in Europe is expected to hold the highest growing market share within the forecast period. In Europe, the dominance of public hospital provision of care impacts the super absorbent polymers (SAP) market, notably in healthcare and hygiene segments. According to the NLM January 2024 report, Hospital care costs share while measuring against total current health expenditures have varying percentages across Europe, from 28.8% in Germany to over 48.0% in Romania, with 25 countries in Europe reporting that hospital costs are above 35%, hence majorly contributing toward hospital care in total healthcare expenditure in the region. There exists a solid and consistent demand for SAP-based items, such as incontinence products for adults, surgical dressings, and hygiene products.

The super absorbent polymers market in the UK is expanding steadily as a result of rising demand in personal care products and healthcare uses. As per the report by The Commonwealth Fund, published in January 2023, the UK spent 4,725 USD on health care, which makes healthcare innovations favorably supported, and, therefore, there is high demand for superior absorbent material for medical and wound care products. Moreover, with a prevalence of voluntary health insurance, there is a growing market for high-end and specialty healthcare products, which tend to take up SAP technology.

Germany's market is developing due to demand. As per the report by The Commonwealth Fund, January 2023, the country has almost a health insurance coverage of 6,524 USD per year, which is a relatively high voluntary insurance percentage underpinning a robust health care system with a focus on innovation. The country's advanced health infrastructure generates huge demand for SAP in medical applications such as dressing wounds and sanitary products. Besides, Germany's emphasis on sustainability and environmental protection is broadening SAP applications.

Potential SAP Healthcare Market (2022):

|

Country |

Healthcare Expenditure (€ million) |

€ per Inhabitant |

% of GDP |

Relevance to the SAP Market |

|

Germany |

488,677 |

5,832 |

12.6% |

Very High - Largest spender; aging population boosts demand for SAP-based wound care. |

|

France |

313,574 |

4,607 |

11.9% |

High - Strong healthcare infrastructure, high chronic wound prevalence. |

|

Netherlands |

96,820 |

5,470 |

10.1% |

High - Advanced wound care market, emphasis on medical innovation. |

|

Sweden |

59,110 |

5,637 |

10.7% |

High - Universal healthcare, strong demand for high-tech medical dressings. |

|

Austria |

49,897 |

5,518 |

11.2% |

Moderate-High - High per capita spending with a focus on chronic care. |

|

Italy |

175,719 |

2,978 |

9.0% |

Moderate - Large aging population, growing chronic wound needs. |

|

Spain |

131,114 |

2,745 |

9.7% |

Moderate - Increasing investment in healthcare, rising elderly population. |

Source: Eurostat, November 2024

Asia Pacific Market Insights

The super absorbent polymers market in the Asia Pacific is expected to hold a steadily growing market, with hygiene products driving demand. investment in R&D for new hygiene uses, M&A, capacity expansion, and new product development. According to a report by ResearchGate in September 2021, the Asia Pacific market for post-surgical care has a high demand for highly absorbent and elastic dressings that are the primary characteristics of superabsorbent polymer (SAP) products, since 77.3% of healthcare professionals are willing to pay extra for best-in-class dressing characteristics. Since 39.8% of them indicate that they deal with post-operative complications like infections, SAP dressings can potentially greatly improve outcomes.

The super absorbent polymers market in China is growing due to rapid growth in the usage of diapers because of a high number of infants, an aging population, and the unwinding of the one-child policy, with rising incomes boosting steady SAP demand. Based on a WHO 2024 report, the number of people in China is 1,422,584,933 as of 2023. China's rising population, with an aged population and increasing life expectancy at 77.6 years, is driving increased demand for innovative wound care solutions such as superabsorbent polymers (SAP) for the treatment of chronic wounds and post-surgery wounds. With over 90% of deaths being caused by noncommunicable diseases, some of which are complications involving good care of wounds, the SAP market is on an expansion course.

The super absorbent polymers market in India is growing due to higher demand for adult incontinence, sanitary pads, and tampons because of urbanization and high health standards, and sustainability & eco-friendly trends. As per a report by NHM August 2025, government interventions supporting menstrual hygiene in rural adolescent girls are pushing the demand for cheap and good-quality sanitary products containing superabsorbent polymer (SAP). Subsidized schemes such as distribution of Freedays napkins at Rs. 6 per pack promote access in 107 districts by way of decentralized procurement under the National Health Mission.