Sulphonated Naphthalene Formaldehyde (SNF) Market Outlook:

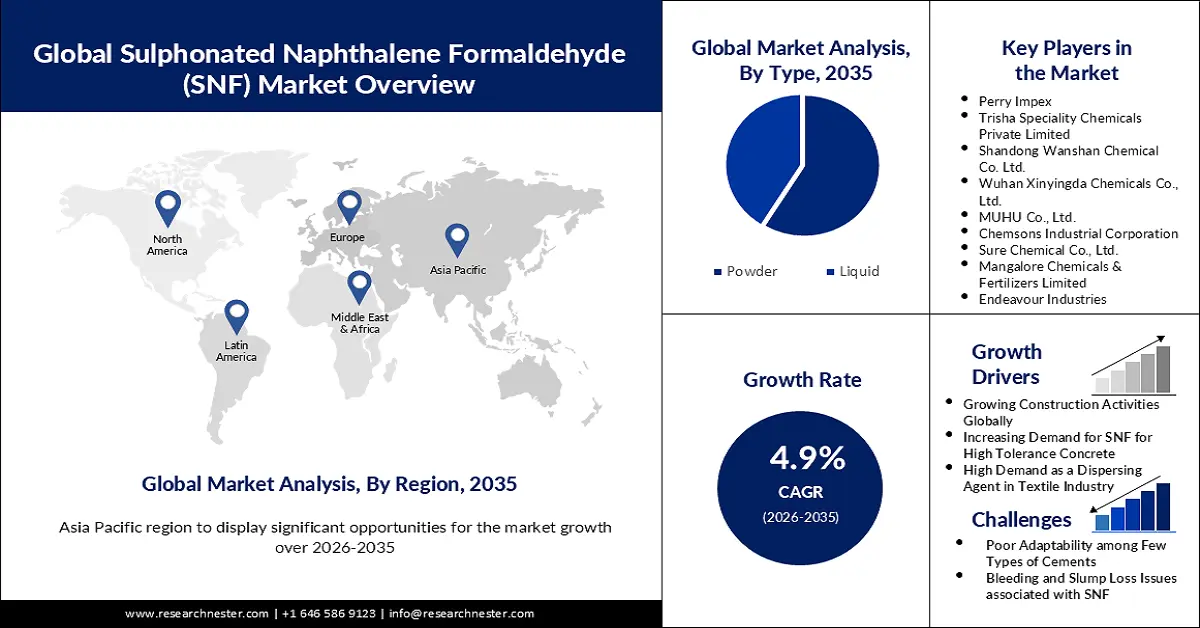

Sulphonated Naphthalene Formaldehyde (SNF) Market size was over USD 2.73 billion in 2025 and is anticipated to cross USD 4.4 billion by 2035, growing at more than 4.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of sulphonated naphthalene formaldehyde is estimated at USD 2.85 billion.

The growth of the market can be attributed to the Increasing application of sulphonated naphthalene formaldehyde as a concrete additive in the construction industry. It is widely used in the creation of free-flowing, pumpable concrete blends. It is widely used in the building business. In the building industry, sulfonate naphthalene formaldehyde can be employed as a raw ingredient for anti-freezing intermediaries, compound catalysts, and retarders.

Also, a rise in the chemical industry is expected to propel the sulphonated naphthalene formaldehyde market. According to the U.S. Bureau of Economic Analysis, in 2020, for the U.S., the value added by chemical products as a percentage of GDP was around 1.9%. Additionally, according to the World Bank, the Chemical industry in the U.S. accounted for 16.43% of manufacturing value-added in 2018. With the growing demand from end-users, the market for chemical products is expected to grow in the future. According to UNEP (United Nations Environment Programme), the sales of chemicals are projected to almost double from 2017 to 2030.

Key Sulphonated Naphthalene Formaldehyde (SNF) Market Insights Summary:

Regional Insights:

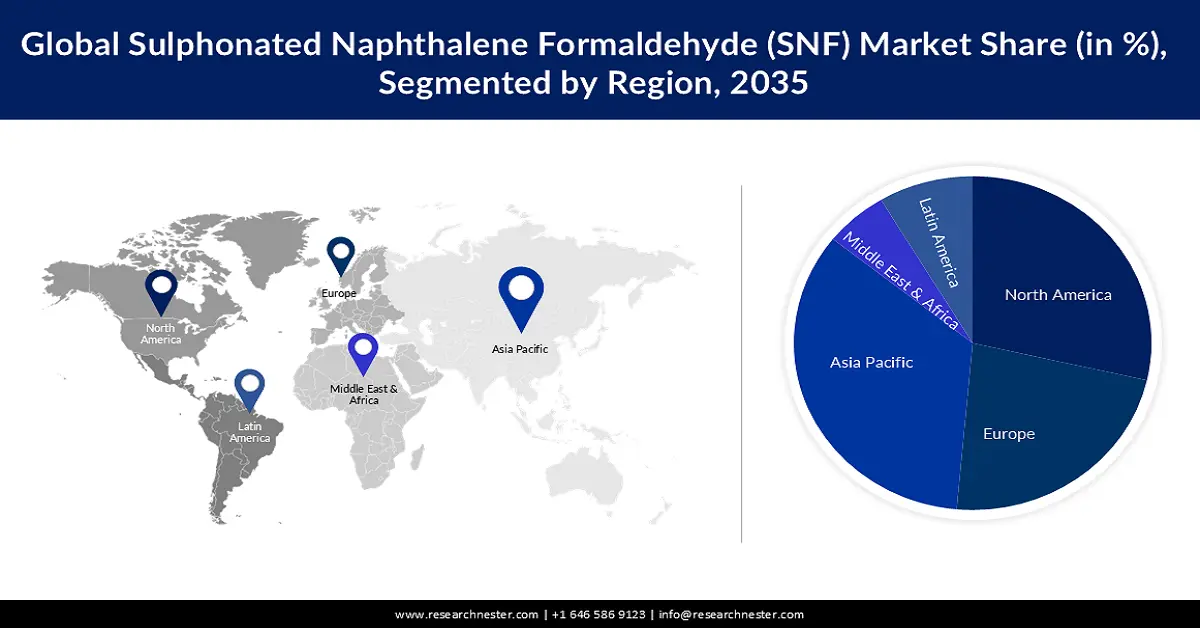

- By 2035, the Asia Pacific region is anticipated to secure the largest revenue share in the sulphonated naphthalene formaldehyde (SNF) market, supported by the accelerating construction activities across China and other developing economies.

- By 2035, North America is expected to command the largest revenue share in the region-specific analysis, fueled by the surging need for concrete in line with rapid urban population growth.

Segment Insights:

- By 2035, the water reducing agent segment in the sulphonated naphthalene formaldehyde (SNF) market is projected to account for about 35% share, supported by its capability to lower water usage while maintaining concrete performance.

- By 2035, the powder segment is anticipated to attain nearly 65% share, strengthened by its increasing utilization across construction, agricultural, and plastic-processing applications.

Key Growth Trends:

- Growing Construction Activities Globally

- Increasing Demand for SNF for High Tolerance Concrete

Major Challenges:

- Poor Adaptability among Few Types of Cement

- Bleeding and Slump Loss Issues associated with SNF

Key Players: Arihant Dyechem, Perry Impex, Trisha Speciality Chemicals Private Limited, Shandong Wanshan Chemical Co. Ltd., Wuhan Xinyingda Chemicals Co., Ltd., MUHU Co., Ltd., Chemsons Industrial Corporation, Sure Chemical Co., Ltd., Mangalore Chemicals & Fertilizers Limited, Endeavour Industries.

Global Sulphonated Naphthalene Formaldehyde (SNF) Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.73 billion

- 2026 Market Size: USD 2.85 billion

- Projected Market Size: USD 4.4 billion by 2035

- Growth Forecasts: 4.9%

Key Regional Dynamics:

- Largest Region: Asia Pacific (Largest Revenue Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: Brazil, Indonesia, Vietnam, Mexico, Turkey

Last updated on : 20 November, 2025

Sulphonated Naphthalene Formaldehyde (SNF) Market - Growth Drivers and Challenges

Growth Drivers

- Growing Construction Activities Globally- SNF is commonly used in the production of building compounds such as concrete. Therefore, the expansion of the construction industry is likely to contribute to market growth. The construction sector was worth 6.4 trillion US dollars in 2020, and it is predicted to grow to 14.4 trillion by 2030.

- Increasing Demand for SNF for High Tolerance Concrete- It can be used to make high-flowing concrete, prefabricated concrete, and solid concrete. It is an effective water-reducer and dispersant for concrete and mortar. The worldwide demand for cement, which solidifies into concrete while mixed with water and minerals, is predicted to rise 48 percent by 2050, from 4.2 billion to 6.2 billion tons.

- High Demand as a Dispersing Agent in Textile Industry- Increasing demand for Sulphonate Naphthalene Formaldehyde Market over the forecast period is driven by its utilization in the textile sector. The Indian textile sector's market value was 223 billion US dollars in 2021. This was a rise from the year prior when India's market value was 150 billion US dollars. The market is expected to grow to 220 billion dollars by 2026.

- Increasing Utilization in Plastics & Rubber Industry- The worldwide plastics industry was expected to be worth $593 billion in 2021. Thailand, on the other hand, generated 4.83 million metric tons of organic rubber in 2021, accounting for around 35% of the worldwide natural rubber output that year.

- Rising Requirement in Agriculture- Sulphonate naphthalene formaldehyde is well renowned for its pest prevention and stabilizing capabilities. It is frequently used as a pesticide as it interferes with pests' senses of taste and smell, preventing them from eating crops. The agricultural sector in India is expected to grow to US$ 24 billion by 2025.

Challenges

- Poor Adaptability among Few Types of Cement

- Bleeding and Slump Loss Issues associated with SNF

- The availability of alternatives- In the concrete business, sulphonated naphthalene formaldehyde is very frequently utilized as superplasticizer. Other super plasticizing compounds on marketplaces, nevertheless, include polycarboxylate ether, lignosulphonates, and sulphonated melamine product typealdehyde (SMF). A few examples are sodium and calcium lignosulphonate salts, hydroxycarboxylic acids, and carbohydrates.

Sulphonated Naphthalene Formaldehyde (SNF) Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.9% |

|

Base Year Market Size (2025) |

USD 2.73 billion |

|

Forecast Year Market Size (2035) |

USD 4.4 billion |

|

Regional Scope |

|

Sulphonated Naphthalene Formaldehyde (SNF) Market Segmentation:

Application Segment Analysis

The global sulphonated naphthalene formaldehyde (SNF) market is segmented and analyzed for demand and supply by application into water reducing agent, wetting agent, dispersing agent, super plasticizer, and others. Out of these, the water reducing agent segment is estimated to gain the largest market share of about 35% in the year 2035. It has extensive water reduction characteristics and is used to minimize water consumption by 12-25% while maintaining workability, resulting in powerful concrete and lesser permeability. appropriate for moderate or high-strength concrete where a wide range of water lessening is sought. As a result, the Water Reducing Agent segment is expected to have the largest market share over the projection period.

Type Segment Analysis

The global market is also segmented and analyzed for demand and supply by type into powder, and liquid. Amongst these segments, the powder segment is expected to garner a significant share of around 65% in the year 2035. As a result of its higher cost-to-performance, the powder segment commands a substantial market proportion. This is utilized in extremely high quantities. It performs better but is more costly than liquid form. Due to its expanding demand in agriculture, plastic, and other industries, as well as its use in the construction industry, SNF powder is in substantial demand and is an important contributor to the expansion of the market in focus. Construction output is anticipated to increase by 85% to $15.5 trillion globally by 2030, with three nations - China, the United States, and India - leading in the industry and accounting for 57% of total global growth. As a result, massive development in the construction industry is projected to contribute to segmentation growth in the next decades.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Application |

|

|

By End-Use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Sulphonated Naphthalene Formaldehyde (SNF) Market - Regional Analysis

APAC Market Insights

Asia Pacific industry is anticipated to hold largest revenue share by 2035, on the back of the growing construction industry in China, and other developing countries. For instance, the construction industry in China amounted to USD 1,050 billion in 2020. Moreover, the growing demand for houses and workplaces, backed by the rising population in the countries, including, India, China, and Japan, is projected to boost the market growth. As a result of a growing number of multinational contractors, the Indian government permitted and simplified its foreign direct investment (FDI) policy in the construction industry, which is improving the industry's profitability. After the service field, the construction industry in India receives the second-highest investment of FDI. Furthermore, the Pradhan Mantri Awas Yojana (PMAY), also known as the Housing for All by 2022 initiative, was established in 2015 with the goal of providing inexpensive housing to all residents by 2022, and according to official estimates, this might entail the construction of 20 million residences by 2022. Therefore these factors are also expected to propel the regional growth over the forecast period.

North American Market Insights

The market in the North American region is anticipated to gain the largest market share throughout the forecast period on the back of the rising demand for concrete for construction activities, backed by the rising urban population. Moreover, the construction industry holds a prominent share in the economy of the United States, which is anticipated to boost market growth in the region. The U.S. construction industry was valued at around USD 1.4 trillion in 2020. As a consequence, the significant rise in the construction industry and construction equipment is expected to contribute to US market growth in the next decades.

Europe Market Insights

The rise in numerous sectors such as agriculture, plastics and rubber, paper, construction, clothing, oil, and others is likely to drive the expansion of the sulphonated naphthalene formaldehyde market in Europe. Furthermore, expansion in the building industry is expected to boost the sulphonated naphthalene formaldehyde market. Also, the expansion of the population and urbanization is expected to buffer the development of the sulphonated naphthalene formaldehyde market in Europe. Moreover, the key businesses for sulphonated naphthalene formaldehyde study and development are expected to provide higher opportunities for the sulphonated naphthalene formaldehyde market growth in the approaching years in this region.

Sulphonated Naphthalene Formaldehyde (SNF) Market Players:

- Arihant Dyechem

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Perry Impex

- Trisha Speciality Chemicals Private Limited

- Shandong Wanshan Chemical Co. Ltd.

- Wuhan Xinyingda Chemicals Co., Ltd.

- MUHU Co., Ltd.

- Chemsons Industrial Corporation

- Sure Chemical Co., Ltd.

- Mangalore Chemicals & Fertilizers Limited

- Endeavour Industries

Recent Developments

- Wuhan Xinyingda Chemicals Co., Ltd. announced the addition of methyl naphthalene sulphonate and condensate of sodium naphthalene sulphonate to its portfolio.

- MUHU (China) Co. ltd. and FILCA, established a joint synthetic PC superplasticizer production plant in the Philippines.

- Report ID: 4018

- Published Date: Nov 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Sulphonated Naphthalene Formaldehyde (SNF) Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.