Subsea Production and Processing Market Outlook:

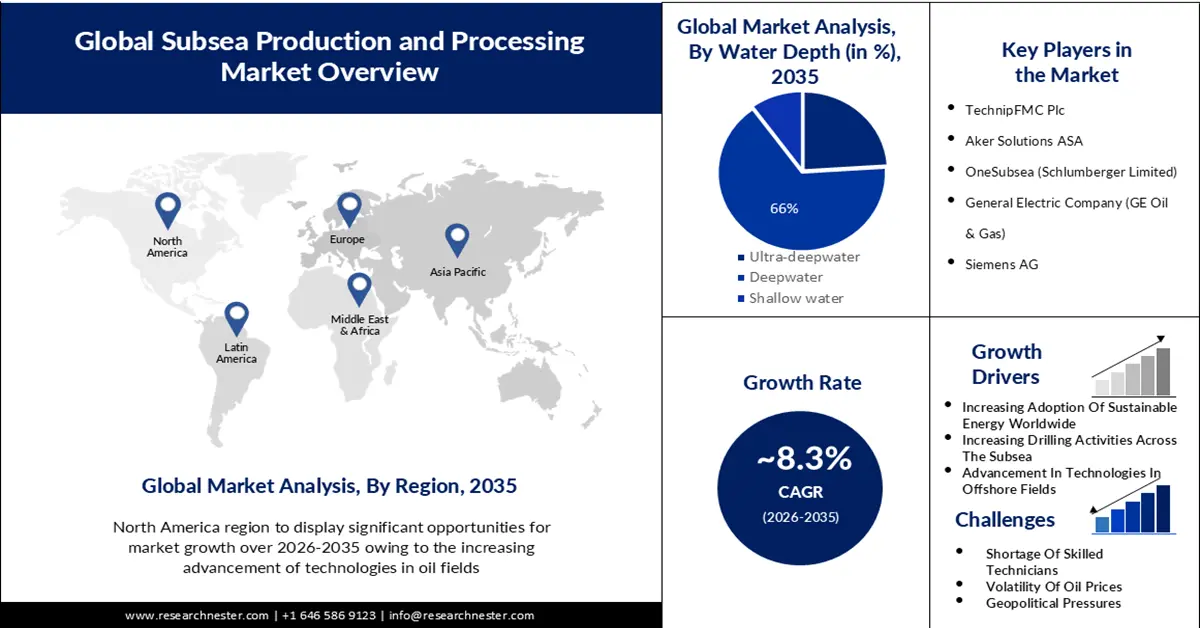

Subsea Production and Processing Market size was valued at USD 23.25 billion in 2025 and is set to exceed USD 51.61 billion by 2035, expanding at over 8.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of subsea production and processing is estimated at USD 24.99 billion.

The primary factor that will propel the growth of the market in the forecast period is the increasing activity in the subsea region worldwide. The EIA calculates the international liquid fuels use to rise by 1.1 MMbbl/d in 2023 and by 1.8 MMbbl/d in 2024, and the Brent spot price standard is USD 85/bbl in the first half of 2023. The growth of subsea production systems needs expertized subsea gadgets. The use of such gadgets needs expertized and costly vessels, which need to be equipped with diving equipment for relatively shallow equipment work, and robotic equipment for deeper water depths.

Another reason for the growth of the subsea production and processing market is the increasing drilling activities worldwide for exploring oil and gas in the subsea areas. Canada has strategies to become a major player in the international LNG sector upon the fulfillment of multiple new projects. With exposure and extra well activity across different oil areas, Mexico will keep its slow, estimated path toward regeneration of its oil production. World Oil projects this region’s drilling activity to rise 13.7%. Offshore drilling will be increased by 8.6%. Oil generation, excepting the U.S., increased by 1.9% at 6.273 MMbpd. The international energy system that gives advanced societies and economies secondary energy for growth requirements is closely linked to multiple fields of the Earth's environment. Every step in the production, improvement, and utilization of energy engages with the environment and, accordingly, adapts the Earth and its inhabitants.

Key Subsea Production and Processing Market Insights Summary:

Regional Highlights:

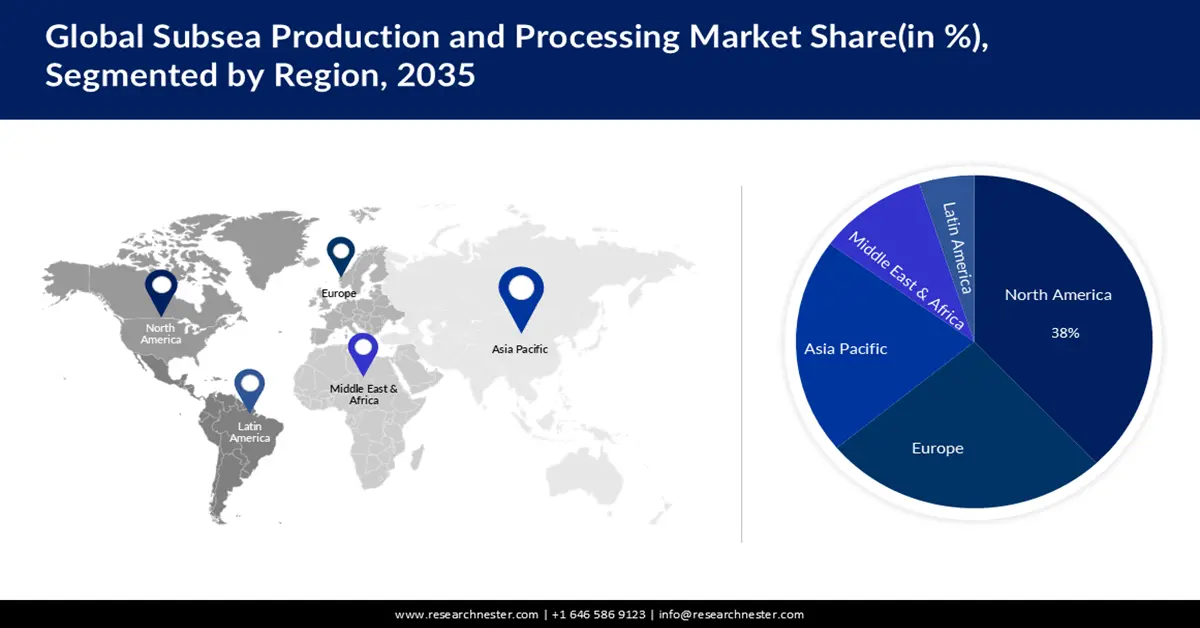

- North America subsea production and processing market will hold more than 38% share by 2035, attributed to increasing exploration of oil and gas in the region, boosting subsea oil activities.

- Europe market will secure 27% share by 2035, attributed to the region’s commitment to renewable energy and sustainable resource adoption.

Segment Insights:

- The deep water segment in the subsea production and processing market is anticipated to hold a 66% share by 2035, driven by increasing subsea drilling activities for oil and gas exploration.

- The oil production segment in the subsea production and processing market is anticipated to hold a 56% share by the forecast year 2035, driven by increasing crude oil generation in offshore oilfields across the world.

Key Growth Trends:

- Significant Production of Green Energy

- Exploration of the New Offshore Oilfields

Major Challenges:

- Fluctuation in Oil Prices Across the World

- Shortage of Skillful Technicians

Key Players: TechnipFMC plc, Aker Solutions ASA, OneSubsea (Schlumberger Limited), General Electric Company (GE Oil & Gas), Siemens AG, Baker Hughes Company, Subsea 7 S.A., National Oilwell Varco Inc., Saipem S.p.A., Oceaneering International Inc., Japan Petroleum Exploration Co. Ltd, INPEX CORPORATION, Sakhalin oil and gas Development, Japex Corporation.

Global Subsea Production and Processing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 23.25 billion

- 2026 Market Size: USD 24.99 billion

- Projected Market Size: USD 51.61 billion by 2035

- Growth Forecasts: 8.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Norway, United Kingdom, China, Brazil

- Emerging Countries: China, India, Japan, South Korea, Malaysia

Last updated on : 16 September, 2025

Subsea Production and Processing Market Growth Drivers and Challenges:

Growth Factors

-

Significant Production of Green Energy - By 2026, international sustainable electricity potential is anticipated to increase by over 60% from 2020 levels to more than 4,800 GW – similar to the recent total international power potential of fossil fuels and nuclear united. Renewables are set to contribute to almost 95% of the rise in international power potential through 2026, with solar PV alone giving over half. The amount of renewable potential added throughout 2021 to 2026 is projected to be 50% higher than from 2015 to 2020. More than 70% of this is expected to come from China, Southeast Asia, and India. However, cutting-edge economies are looking to generate more electricity, along with limited dependence on fossil fuels in sectors like heating and transportation. Utilizations in Europe and the United States are also on follow to accelerate substantially from the earlier five years. These four markets together contribute to 80% of sustainable potential growth across the world.

- Exploration of the New Offshore Oilfields - Recently, deepwater, deep-creation, and unconventional oil and gas are the top three essential areas for hydrocarbon exploration and growth in the world. This paper outlined advancements in the exploration of deepwater basins across the world from potential circulations of deepwater basins and key deepwater oil areas to, the history of deepwater oil and gas discovery, and major exposures in key basins. Additionally, exploration possibilities have been considered to give essential guidance for appropriate research and deepwater oil and gas exploration operations in China. In line with the Net Zero case put forward by the International Energy Agency (IEA), hydrocarbons are set to account for half of the globe's energy requirements in 2030 and will be limited to below 20% in 2050. Natural gas is sincerely a transition energy that enables the increased production of renewables and gives renewable fuels in the mobility sector.

- Appearing Technologies and IoT in Oil and Gas Fields -Technologies are developing quickly and recently can transform operations and provide enhanced value. These technologies range from devices that offer and increase association to those that connect the primary network (the international internet) to small subnetworks across its edge, acknowledged as the backhaul. Approach technologies link users to their service providers or, in the case of the oil and gas industry, to the backhaul.

Challenges

- Fluctuation in Oil Prices Across the World -The current fluctuation in oil prices shows an outstanding scope for traders to make revenue if they can anticipate the correct direction. Fluctuation is calculated as the projected change in the price of an instrument in either way. On November 30, multiple OPEC+ countries declared an extension and growth of their voluntary cuts, summing to 2.2 mb/d. This comprised the continuing 1 mb/d cut by Saudi Arabia and an enhanced cut by Russia to 0.5 mb/d. As of November 2023, the OPEC+ association held 5.1 million barrels per day (mb/d) of spare potential, about 5 percent of international requirements. In June 2023, OPEC + declared the continuation of the voluntary supply cuts, beginning because of expire in December 2023, through December 2024.

- Shortage of Skillful Technicians

- Problem with Tool's Trustworthiness

Subsea Production and Processing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.3% |

|

Base Year Market Size (2025) |

USD 23.25 billion |

|

Forecast Year Market Size (2035) |

USD 51.61 billion |

|

Regional Scope |

|

Subsea Production and Processing Market Segmentation:

Water Depth Segment Analysis

The deep water segment is expected to hold 66% share of the global subsea production and processing market by the end of 2035. This growth will be noticed primarily because of the increasing recent subsea drilling activities for oil and gas exploration and production worldwide. For instance, Nigeria’s recent oil and gas production stayed below the average level of 3 MMboe/d from 2010-2015, owing in part to a 74% decrease in capex from USD 27 billion in 2014 to USD 6 billion in 2022. Moreover, over the past decade, increasing oil prices have made deepwater drilling economically workable. While there is a shortage of consensus associating the depth at which offshore drilling turns “deepwater,” technological growths have been driving the restrictions of what was earlier thought to be impracticable, thereby redesigning the term. However, recent deepwater drilling is usually attributed to any depth greater than 1,000 feet. Drillships involve exploratory drilling before oil and gas generation starts. Although drillships are not a new technology (they have been there almost since the 1950s), new imaging and placement technology enables much higher levels of accuracy during the management and fulfillment of a well.

Application Segment Analysis

The subsea production and processing market from the oil production segment is slated to account for 56% of the revenue share in the forecast period. This growth will be noticed due to the increasing generation of crude oil in offshore oilfields across the world. For instance, around 6.0 million barrels of oil were secreted from offshore Newfoundland and Labrador in November 2023, showcasing a reduction of 17.3% related to November 2022. The proportionate worth of production is limited by 23.7%. Generation was down at Hibernia, Hebron, and White Rose. The Terra Nova FPSO (floating generation, storage, and offloading) vessel, which discontinued its operations in late 2019 to undergo an overhaul, came back to offshore Newfoundland and Labrador in August 2023. Suncor Energy declared that it securely started production in late November.

Our in-depth analysis of the global subsea production and processing market includes the following segments:

|

Production System Component |

|

|

Processing System Type |

|

|

Water Depth |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Subsea Production and Processing Market Regional Analysis:

North American Market Insights

The North America subsea production and processing market will increase massively in the forecast period and will hold almost 38% revenue share. The increasing exploration of oil and gas in the North American region will help subsea oil activities to grow. The expansion in North American gas generation is completely caused by the US. It was the region’s biggest originator by far, with a regional share of 77%. US output increased its Production Indicator to 99%. Different projects are in progress to set up the US as a major exporter of Liquefied Natural Gas (LNG). The government is in charge of planning and utilizing the regulatory ecology. If the regulatory environment is not constant and foreseen or contributing to exploration or production it can postpone activity or impede investment. Given the possible economic, social, and environmental influences of exploration and production, multiple government departments and organizations are required to undertake parts of the technique.

European Market Insights

The subsea production and processing market in the Europe region will also encounter massive growth and will hold the second position because of the increasing demand for renewable energy in this region. The European Union (EU) is at the front line of the international energy transformation. Its persistent dedication and permanent view combined with today’s affordable sustainable energy choices have offered the region approximately double the share of sustainable energy from 2005 to 2015. As an outcome, the EU is on track to match its 2020 sustainable resources aim, and its 2030 aim of a 27% share of sustainable energy is well inside reach.

Subsea Production and Processing Market Players:

- TechnipFMC plc

- Company Overview

- Business Planning

- Main Product Offerings

- Financial Execution

- Main Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Aker Solutions ASA

- OneSubsea (Schlumberger Limited)

- General Electric Company (GE Oil & Gas)

- Siemens AG

- Baker Hughes Company

- Subsea 7 S.A.

- National Oilwell Varco Inc.

- Saipem S.p.A.

- Oceaneering International Inc.

Recent Developments

- Aker Solutions ASA looks up the circular economy, and people will get it’s about keeping resources by introducing new ways to generate, share, reuse, repair, and recycle. Aker Solutions and signs a joint venture Aker BP, F3nice, and Additech have occupied an essential step toward a more circular economy.

- Aker Solutions ASA to kind, and recycle 18,000t topside. If deactivated in the right direction, offshore energy infrastructure such as the Gyda topsides presents a massive resource of worthy components — comprising steel prized by builders. Recycling and reutilizing metals present a lower-emissions substitute to metal taken straight from ore and shipped.

- Report ID: 5613

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.