Subsea Manifolds Market Outlook:

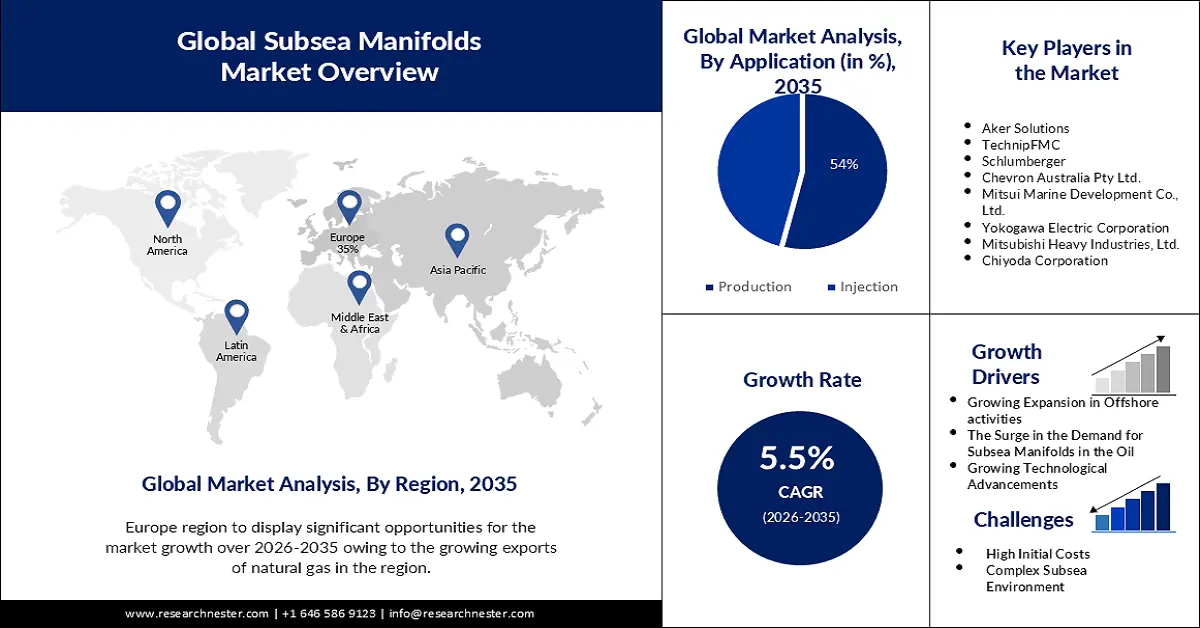

Subsea Manifolds Market size was valued at USD 4.7 billion in 2025 and is expected to reach USD 8.03 billion by 2035, registering around 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of subsea manifolds is evaluated at USD 4.93 billion.

In recent years, subsea production technologies have been profitable in comparison to topside production technologies.

To achieve optimal production levels, oil & gas exploration companies that operate in offshore producing fields with heavy oils and low reservoir pressures choose to deploy this technology. The main piece of equipment used to control the flow from subsea production wells to numerous production flowline headers in subsea manifold systems. In 2020, there were 483,326 wells in the US producing natural gas and gas condensate. Thus, the growing number of subsea wells is driving the growth of the subsea manifolds market.

Additionally, deepwater exploration cannot begin until subsea equipment used for resource extraction and transportation complies with regulations. Drilling equipment and pipes corrode and break down in the deep-sea environment due to high pressure and temperature fluctuations. This means that sophisticated machinery, including subsea manifolds with improved resistance to corrosion and weathering.

Key Subsea Manifolds Market Insights Summary:

Regional Highlights:

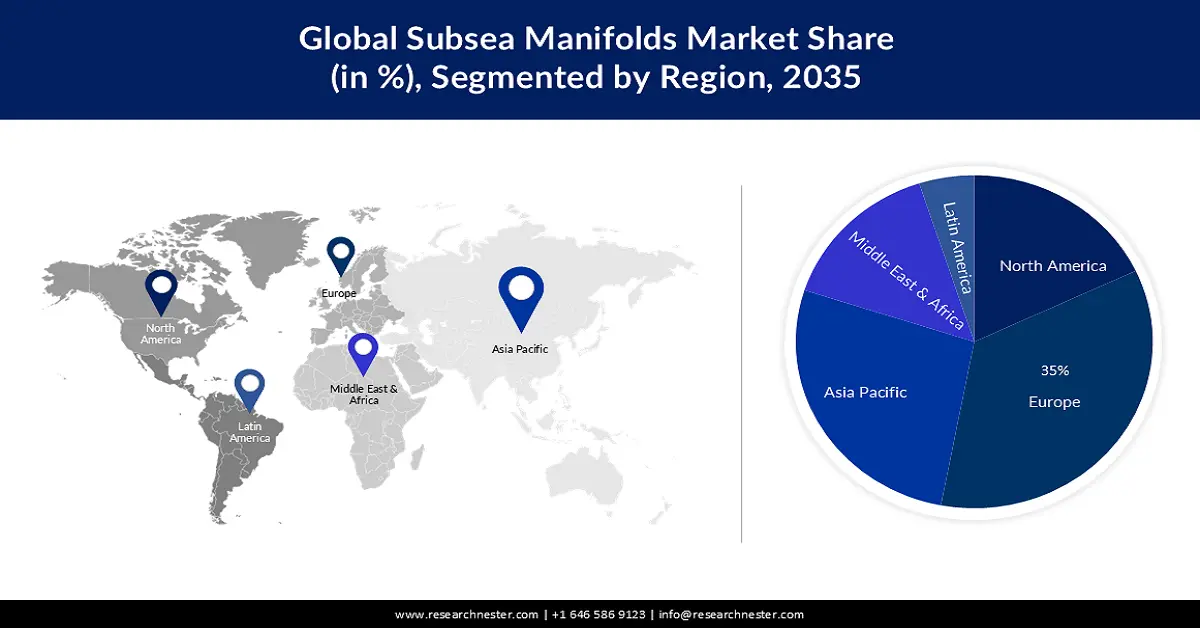

- Europe subsea manifolds market will hold more than 35% share by 2035, driven by the developed offshore sector, particularly around the North Sea, facilitating quick project completion and reliable support.

- Asia Pacific market will experience huge growth during 2026-2035, fueled by supportive government policies to increase shale gas production and promote coal bed methane extraction.

Segment Insights:

- The production segment in the subsea manifolds market is projected to capture a 54% share by 2035, driven by use in E&P businesses for isolation, sampling, allocation management, and well-testing.

- The pipeline end manifold (plem) segment in the subsea manifolds market is projected to hold a 43% share by 2035, influenced by the growth of offshore oil production and advancements in subsea technology.

Key Growth Trends:

- Growing expansion in offshore activities

- The surge in the demand for subsea manifolds in the oil & gas industry

Major Challenges:

- High Initial Costs

- Complex Subsea Environment may hinder the growth of the subsea manifolds market.

Key Players: Baker Hughes Company, Aker Solutions, TechnipFMC plc, Schlumberger Limited, Chevron Corporation., ABB Ltd, Nexans, OneSubsea, Dril-Quip, Inc, Siemens.

Global Subsea Manifolds Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.7 billion

- 2026 Market Size: USD 4.93 billion

- Projected Market Size: USD 8.03 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Norway, United Kingdom, Brazil, Australia

- Emerging Countries: China, India, Brazil, Mexico, Malaysia

Last updated on : 16 September, 2025

Subsea Manifolds Market Growth Drivers and Challenges:

Growth Drivers

- Growing expansion in offshore activities - The subsea manifolds market is developing because of the increasing growth of offshore activities, which are pushing exploration and production into deeper oceans and more difficult settings. Subsea manifolds are also more necessary as offshore activities grow to facilitate the development of new offshore fields and the optimization of existing ones.

Subsea manifolds also make it possible to apply different production tactics, like boosting and subsea processing, which improve the recovery factors and production rates in offshore fields. As per a report, in 2020, offshore oil production made up around 30% of the world's total oil production. In 2019, the share of deepwater and ultra-deepwater projects in total offshore oil production was approximately 9.5%. - The surge in the demand for subsea manifolds in the oil & gas industry - Future developments in the subsea manifold market are expected due to the increasing demand for oil & gas. Subsea manifolds have been used in the oil & gas industry to transfer oil & gas from wellheads into pipelines. Exploration and production activities are moving into farther-flung areas and deeper oceans as the demand for gas and oil rises.

In these demanding conditions, efficient and economical manufacturing is made possible by subsea manifolds. Furthermore, as subsea manifolds can adapt to shifting reservoir conditions and facilitate the use of various production tactics, they provide production flexibility. - Growing technological advancements in subsea technology - Intelligent subsea systems refer to the integration of sensors, communication systems, and automation technology in subsea equipment. These systems enable real-time monitoring of various parameters such as pressure, temperature, flow rates, and equipment conditions. By collecting and analyzing this data, operators can make informed decisions and optimize subsea operations.

Also, the integration of underwater robotics or remotely operated vehicles (ROVs), is accelerating the growth of the market. ROVs can be remotely controlled from surface vessels or operated autonomously. They can reach great depths, withstand high pressures, and provide visual feedback to operators. Therefore, these innovative advancements in subsea technology are propelling the growth of the subsea manifolds market.

Challenges

- High Initial Costs - The installation and operation of subsea manifolds involve significant upfront capital costs. The complexity of these systems, coupled with the challenging subsea environment, contributes to the overall project expenses.

- Complex Subsea Environment may hinder the growth of the subsea manifolds market.

- Fluctuating prices of the oil & gas industry may hamper market growth.

Subsea Manifolds Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 4.7 billion |

|

Forecast Year Market Size (2035) |

USD 8.03 billion |

|

Regional Scope |

|

Subsea Manifolds Market Segmentation:

Application Segment Analysis

The production segment in the subsea manifolds market is estimated to gain the largest revenue share of about 54% in the year 2035. E&P businesses employ subsea manifolds for production purposes for a variety of functions, such as isolation, sampling, allocation management, and well-testing. These systems are submerged structures made of valves and piping that are created and developed to mix and guide the produced resources from the wells into several flow lines. The subsea production manifolds' adaptable design permits the simultaneous distribution of gas lift from several wells and flow line connections by the operators.

Furthermore, it is possible to achieve horizontal or vertical flow line connections with these technologies. Compact structural design, direct mounting to the intended foundation, reconfigurability via retrievable or internal pigging loops for round-trip pigging, and installation of an easier-to-install jumper are some of the advantages and features of the vertical flow line connections.

Type Segment Analysis

The pipeline end manifold (PLEM) segment for the subsea manifolds market is expected to hold a share of 43% during the projected period. Effective and dependable ways to move the generated hydrocarbons from the bottom to the surface are required as offshore oil and gas production grows. It is projected that by 2025, 28% of the world's crude oil production will come from offshore sources. High pressures and corrosive substances are just two of the challenging circumstances that PLEMs must endure in the subsea environment. They give the subsea pipes a safe point of connection, allowing hydrocarbons to be transferred without compromising the system's integrity.

Furthermore, access to previously unexplored offshore assets is now feasible due to developments in subsea technology. The necessity for PLEMs has increased as a result of the growth of already established subsea fields and the creation of new ones. Therefore, these factors are contributing to the expansion of the pipeline end manifold (PLEM) segment.

Our in-depth analysis of the subsea manifolds market includes the following segments:

|

Type |

|

|

Application |

|

|

Water Depth |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Subsea Manifolds Market Regional Analysis:

European Market Insights

Subsea manifolds market in the European region, amongst the market in all the other regions, is set to hold the largest with a share of about 35% by the end of 2035. The market growth in the region is also expected on account of a developed offshore sector. Major producers of oil & gas, equipment, and services are situated close to the North Sea. Due to the ease with which technology, knowledge, and supply chain networks can be accessed, projects can be completed quickly and with dependable assistance. Russia is a significant producer and exporter of natural gas and oil, and the export of energy is vital to the country's economy.

Furthermore, the Russian government failed to establish any legislation or any meaningful measures to regulate hydraulic fracturing in the area. Additionally, Russia possesses the greatest undiscovered shale oil deposits in the world, offering participants excellent investment opportunities.

APAC Market Insights

The APAC region will also witness huge growth for the subsea manifolds market during the forecast period and will hold the second position owing to supportive government policies in the region. The government’s initiatives to increase the region’s current shale gas production capacity along with the increasing acreage in shale basins are anticipated to propel subsea manifolds market expansion in this region. Moreover, the natural gas production in the Asia Pacific region is substantial, the production accounted for around 681 billion cubic meters in 2022.

The region’s exploration and production activities are likely to rise, and favorable government backing will help to boost offshore drilling in the nation. Through subsidies, the governments in the region are promoting the extraction of coal bed methane (CBM), and all these factors cumulatively propagate the subsea manifolds market in the region.

Subsea Manifolds Market Players:

- Baker Hughes Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Aker Solutions

- TechnipFMC plc

- Schlumberger Limited

- Chevron Corporation.

- ABB Ltd

- Nexans

- OneSubsea

- Dril-Quip, Inc

- Siemens

Recent Developments

- Baker Hughes Company has been contracted by Chevron Australia Pty Ltd. To supply subsea compression manifold technology for the Jansz-Io Compression project. The business will offer a subsea compression manifold structure with module and foundation, as well as the most recent optimized version of its horizontal clamp connector system and subsea controls, all driven by Baker Hughes' Subsea Connect early engagement methodology.

- Aker Solutions has been awarded by ConocoPhillips with a sizable contract to supply a subsea production system for the Eldfisk North development off the coast of Norway. The field will be connected to the Eldfisk Complex and developed as a subsea satellite.

- Report ID: 5589

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Subsea Manifolds Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.