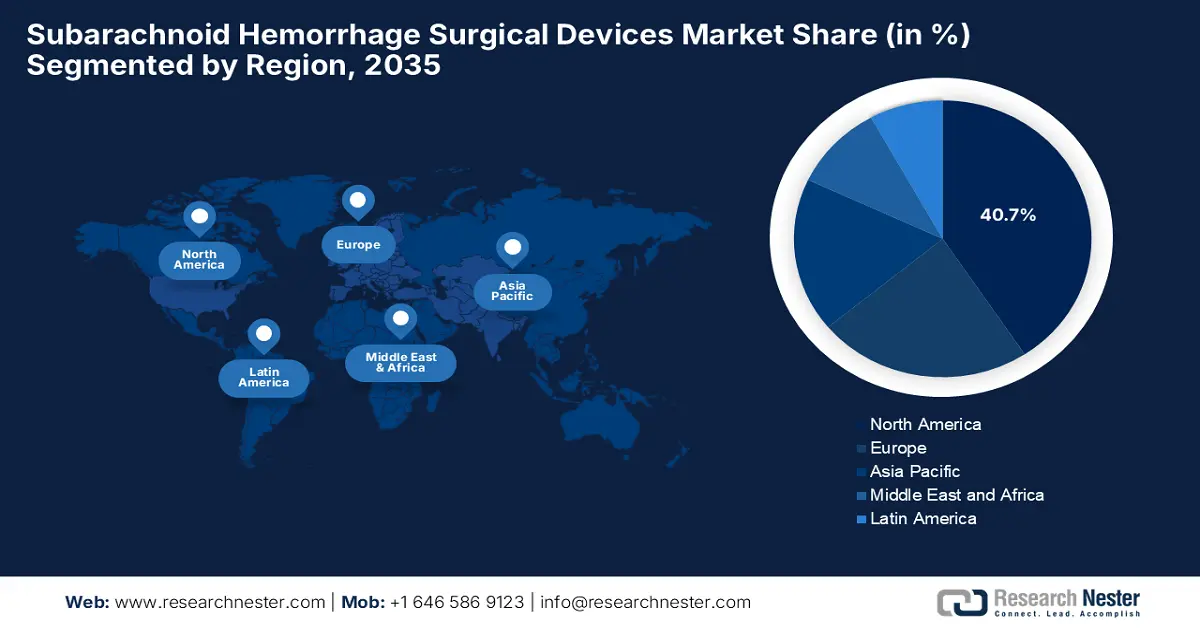

Subarachnoid Hemorrhage Surgical Devices Market - Regional Analysis

North America Market Insights

North America is expected to dominate the global subarachnoid hemorrhage surgical devices market with the largest share of 40.7% by the end of 2035. The dominance of the region is effectively attributable to the early adoption of innovative neurovascular technologies and the strong presence of leading medical device manufacturers. NIH in January 2024 stated that it provides funding for cerebrovascular disease research, which totaled an amount of USD 700 million across 1,232 projects as of January 2023, mostly towards ischemic stroke, followed by carotid disease and hemorrhagic stroke.

In the U.S., the prevalence of SAH is increasing, and with the introduction of reforms and initiatives to improve support for patients, it is fostering a favorable business environment for the subarachnoid hemorrhage surgical devices market. In February 2023, Vesalio announced the first successful U.S. use of its FDA-approved NeVa VS device, which is the only device specifically designed and approved for treating cerebral vasospasm following aneurysmal subarachnoid hemorrhage.

Canada is gaining enhanced recognition in the subarachnoid haemorrhage surgical field, attributed mainly to centralized funding for health care, an aging population, and provincial investment in neurosurgical services. In May 2024, the Government of Canada reported that it renewed a USD 80 million investment in Brain Canada within a span of four years, which is matched by the organization for a total of USD 160 million, thereby accelerating brain health research across the country.

APAC Market Insights

Asia Pacific is poised to register the highest pace of growth in the global subarachnoid hemorrhage surgical devices market by the end of 2035. The growth is propelled by the increasing demand for neurovascular interventions created by an expanding patient cohort. Besides the new governmental investments in neurological care, the growing publicly stated preference for minimally invasive procedures is also fostering a favorable business environment for the regional pioneers in this sector.

China is displaying strong dominance over the regional subarachnoid hemorrhage surgical devices market owing to the rapid advancements in neurovascular technologies, increasing government investments, and a rising focus on early diagnosis. In November 2024, MicroPort NeuroScientific reported that it completed the first post-market implantation of its next-generation Tubridge Plus Flow Diverter in the country at Changhai Hospital on a patient with an internal carotid artery aneurysm.

India also has a huge opportunity to capitalize on the Asia Pacific’s subarachnoid hemorrhage surgical devices market, backed by the increased awareness of neurovascular conditions and the expansion of specialized neurosurgical centers. In October 2022, Medtronic announced the launch of the Neurovascular Co-Lab Platform to accelerate innovation in stroke treatment, hence denoting a positive market outlook.

Financial Snapshot Supporting India's Surgical Devices Sector

|

Category |

Details |

|

Medical Device Exports (2022-23) |

USD 3.39 Billion (up from USD 2.9 Billion in 2021-2022) |

|

Projected Exports (2025) |

USD 10 Billion |

|

Indian MedTech Players’ Revenue (FY 2023) |

USD 2.5 Billion (up from ~USD 1.8 billion in FY 2020) |

|

FDI Received (April 2000-Present) |

USD 3.7 Billion (in the medical & surgical appliances sector) |

Source: Invest India.gov

Europe Market Insights

The Europe subarachnoid hemorrhage surgical devices market is estimated to garner a notable industry share from 2026 to 2035. The growth is fueled by an increase in SAH cases, advances in minimally invasive techniques, and expanding reimbursement support. In September 2025, Penumbra Inc. reported that it had received CE Mark for its SwiftPAC neuro embolisation coil, which is now commercially available across the region, enabling dense, controlled occlusion in delicate neurovascular procedures.

Germany is the key contributor to growth in the subarachnoid hemorrhage surgical devices market, effectively propelled by the increasing investments in neurosurgical innovation and a high density of specialized neurovascular centers. In June 2023, Lucicle Medical AG reported that it had acquired Spiegelberg GmbH, which aims to create a leader in advanced brain monitoring devices, thereby attracting more players to make investments in this field.

The U.K. is growing exponentially in the subarachnoid hemorrhage surgical devices market, backed by the National Health Service, which emphasizes evidence-based medicine and cost-effectiveness in treatment pathways. Besides, there has been a concerted effort to centralize complex SAH care within the highly specialized major trauma centers and neurological units, thereby significantly improving patient outcomes. Furthermore, the country’s strong focus on standardized care protocols creates an encouraging opportunity for pioneers in the country.

Cost Breakdown of Subarachnoid Hemorrhage Surgical Treatments in the UK (2020/2021 Prices)

|

Treatment |

Intervention Cost (£) |

Imaging & Investigations (£) |

Hospital Stay (£) |

Total Cost per Patient (£) |

|

Endovascular Coiling |

8,113 |

1,590 |

20,727 |

30,431 |

|

Neurosurgical Clipping |

5,647 |

1,583 |

27,483 |

34,714 |

Source: NIH