Styrene Butadiene Latex Market Outlook:

Styrene Butadiene Latex Market size was over USD 4.24 billion in 2025 and is anticipated to cross USD 6.46 billion by 2035, witnessing more than 4.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of styrene butadiene latex is assessed at USD 4.4 billion.

Styrene butadiene (SB) latex’s increasing applications in textile flooring as a binder to enhance the appearance, texture, and strength of the fabrics are significantly contributing to their sales growth. Continuous innovation in the textile industry and the rising adoption of specialized chemicals and materials, including styrene butadiene latex, are set to offer lucrative opportunities for key styrene butadiene latex market players. For instance, the International Trade Administration (ITA) revealed that the imports of silk blends, cotton, wool, non-cotton vegetable fiber textile and apparel products, and man-made fiber were calculated at 8,321.1 million square meter equivalents (MSME) in April 2024, a hike of 6.1% compared to the previous year. The textiles industry is expected to generate a revenue of USD 295.9 million in 2025. The growth of the textile and flooring trade is anticipated to positively influence the consumption of styrene butadiene latex.

|

Styrene Butadiene Rubber (SBR/XSBR) Latex |

|||

|

Country |

Export Value in USD Million |

Country |

Import Value in USD Million |

|

Germany |

375 |

China |

268 |

|

Japan |

190 |

Belgium |

77.2 |

|

Netherlands |

152 |

Germany |

73 |

|

U.S. |

144 |

Turkey |

69.4 |

|

Belgium |

90.6 |

Canada |

55.2 |

Source: OEC

The Observatory of Economic Complexity (OEC) report highlights that increasing at a CAGR of 2.15% between 2021 and 2022, the global styrene butadiene rubber (SBR/XSBR) latex trade totaled USD 1.43 billion in 2022. Germany and China are dominating marketplaces for styrene butadiene rubber (SBR/XSBR) latex trade. The market concentration amounted to 3.75 using Shannon Entropy, explaining the export dominance of 13 countries. Furthermore, the study states that the biggest trade value in exports than in imports of styrene butadiene rubber (SBR/XSBR) latex was concentrated around Germany (USD 302.0 million), Japan (USD 187.0 million), the U.S. (USD 114.0 million), the Netherlands (USD 105.0 million), and South Korea (USD 65.1 million).

Key Styrene Butadiene Latex Market Insights Summary:

Regional Highlights:

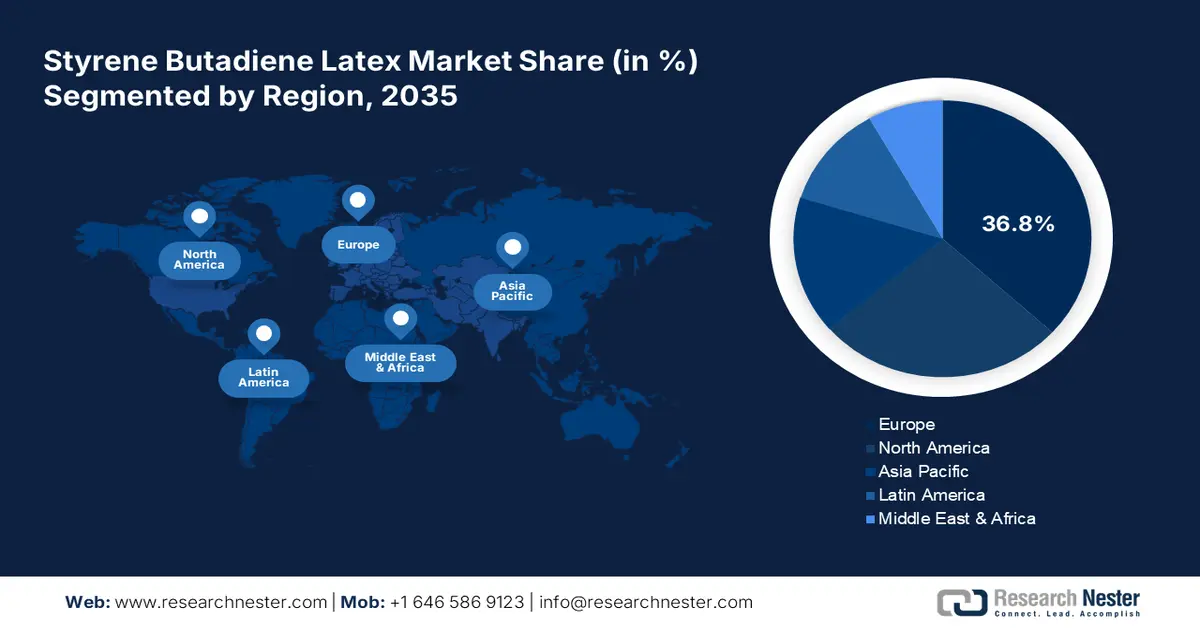

- Europe commands a 36.8% share in the Styrene Butadiene Latex Market, driven by increasing demand from automotive, electrical, and medical device sectors, ensuring robust growth by 2035.

- North America's Styrene Butadiene Latex Market is projected to expand rapidly by 2035, fueled by booming automobile trade, construction activities, and packaging innovations.

Segment Insights:

- Paper Processing segment is forecasted to hold around 30.5% share by 2035, driven by its superior performance in improving paper surface and brightness.

- Emulsion Styrene Butadiene Latex segment is projected to hold more than a 73.5% share by 2035, fueled by its performance, durability, and rising demand across paper, construction, and textile industries.

Key Growth Trends:

- Increasing use in automotive sealants and adhesives

- Emerging opportunities in the medical devices, electrical, and construction sectors

Major Challenges:

- Disruption in the raw material supply chain increases final product costs

- Alternatives challenging the revenue growth of key players

Key Players: BASF SE, Trinseo, Dow Chemical Company, and Synthomer Plc.

Global Styrene Butadiene Latex Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.24 billion

- 2026 Market Size: USD 4.4 billion

- Projected Market Size: USD 6.46 billion by 2035

- Growth Forecasts: 4.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (36.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Germany, United States, China, Japan, France

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 13 August, 2025

Styrene Butadiene Latex Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing use in automotive sealants and adhesives: The high demand for specialized and superior-performance adhesives and sealants in the automotive sector is fueling the consumption of styrene butadiene latex. The growing demand for lightweight and fuel-efficient vehicles coupled with sustainability trends is promoting the sales of styrene butadiene latex-based adhesives and sealants. For instance, the International Energy Agency (IEA) underscores that more than 14.0 million electric cars were registered in 2023. In the coming years, electric vehicle (EV) sales are anticipated to exhibit substantial growth. EV adoption is more prominent in China, European countries, and the U.S.

-

Emerging opportunities in the medical devices, electrical, and construction sectors: Medical devices, electrical & electronics, and construction are emerging as the most opportunistic markets for styrene butadiene latex manufacturers. In electronics, SB latex's increasing use in protective coatings for circuit boards and devices is set to propel its sales growth in the years ahead. The World Integrated Trade Solution (WITS) revealed that China USD 927 million), European Union (USD 911.9 million), United States (USD 769.1), Germany (USD 624.6 million), and Netherlands (USD 246.07 million) were the leading exporters of medical and surgical furniture in 2023.

Challenges

-

Disruption in the raw material supply chain increases final product costs: Styrene and butadiene the primary raw materials used to manufacture styrene butadiene latex are derived from petroleum-based sources. The styrene butadiene latex market vulnerability and fluctuations in oil prices directly affect the production and supply of these raw materials. Disruption in the supply chain of raw materials uplifts the final product costs, further lowering their adoption rates. Many market players in such scenarios employ competitive pricing strategies to earn stable shares.

- Alternatives challenging the revenue growth of key players: The easy availability of alternative materials is acting as a barrier to styrene butadiene latex market growth. Acrylic latex, natural rubber latex, and polyurethane are some of the alternatives to styrene butadiene latex. The similar properties and performance of alternatives are driving the attention of end users to invest in them and are challenging revenue growth for styrene butadiene latex manufacturers. The growing popularity of plant-based or bio-based latex materials is also estimated to hinder the consumption of styrene butadiene latex in the coming years.

Styrene Butadiene Latex Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.3% |

|

Base Year Market Size (2025) |

USD 4.24 billion |

|

Forecast Year Market Size (2035) |

USD 6.46 billion |

|

Regional Scope |

|

Styrene Butadiene Latex Market Segmentation:

Type (Emulsion Styrene Butadiene Latex, Solution Styrene Butadiene Latex)

Emulsion styrene butadiene latex segment is expected to hold more than 73.5% styrene butadiene latex market share by 2035. The high performance, durability, flexibility, and versatility are fueling the use of emulsion styrene butadiene latex in several end use industries such as paper, construction, automotive, packaging, and textile and carpet. The booming demand for carpets from both residential and commercial settings is fueling the use of emulsion styrene butadiene latex for backing and layering purposes. The increasing advancements in the emulsion polymerization techniques are set to enhance the performance of styrene butadiene latex. The widespread awareness and adoption of styrene butadiene latex are expected to fuel the revenue growth of key players in the coming years.

Application (Paper Processing, Fiber and Carpet Processing, Glass Fiber Processing, Paints and Coatings, Adhesives, Mortar Additives, Foams and Mattresses, Others)

By the end of 2035, paper processing segment is projected to dominate around 30.5% styrene butadiene latex market share. The superior performance of styrene butadiene latex in smoothing, brightening, and surface quality of paper products is promoting its sales growth. Magazines, catalogs, and packaging companies are holding a significant share in the consumption of styrene butadiene latex. The boom in the packaging and magazine sectors is set to directly uplift the consumption of styrene butadiene latex during the foreseeable period.

Our in-depth analysis of the global styrene butadiene latex market includes the following segments:

|

Type |

|

|

Application |

|

|

Butadiene Content

|

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Styrene Butadiene Latex Market Regional Analysis:

Europe Market Forecast

Europe styrene butadiene latex market is predicted to dominate revenue share of over 36.8% by 2035. The increasing demand for specialized chemicals and materials from end use industries such as automotive, electrical and electronics, paper, and packaging is augmenting the consumption of styrene butadiene latex. The rapidly expanding textile and medical device sectors are generating lucrative opportunities for styrene butadiene latex producers. France, Germany, the U.K., and Italy are some of the opportunistic marketplaces for styrene butadiene latex companies.

The strong existence of automobile manufacturing companies in Germany is propelling the demand for styrene butadiene latex-based adhesives and sealants. The consistent production and supply of innovative automobiles including EVs, luxury cars, and customized vehicles are opening profitable doors for styrene butadiene latex manufacturers. For instance, the Germany Trade & Invest (GTAI) study discloses that nearly 1.7 million electric passenger cars were manufactured in the country in 2023. It also highlights the dominance of Germany in Europe’s automotive market due to the presence of 54 automotive assembly and production capacities.

In the U.K., the high investments in infrastructure development projects are set to propel the sales of styrene butadiene latex. Paints and coatings are finding high applications in infra projects, which is further fueling the consumption of styrene butadiene latex. The commitments towards modernization and R&D spending on innovations are creating high-growth opportunities for styrene butadiene latex manufacturers. For instance, the Office of National Statistics states that in 2023, the investment in the U.K. infrastructure market totaled USD 17.16 billion, 3.9% up from the previous year.

North America Market Statistics

The North America styrene butadiene latex market is anticipated to rise at the fastest pace during the projected period. The booming automobile trade, high investments in the production of specialized chemicals and materials, and innovations in the packaging industry are fueling the sales of styrene butadiene latex. The swiftly increasing construction activities are augmenting the consumption of styrene butadiene latex products in both the U.S. and Canada. The rising online trade is further fueling the use of styrene butadiene latex in packaging solutions.

In the U.S., robust construction actions are directly fueling the sales of styrene butadiene latex solutions. These chemicals are widely used in paint and coatings, as construction activities grow, so do the styrene butadiene latex-based paints and coating sales. For instance, in February 2025, the U.S. Census Bureau revealed that the construction spending in December 2024 was around USD 2192.2 billion. Both the private and public construction projects exhibited high investments in Q4’24.

Canada’s swiftly expanding automotive and component sectors are most profitable for styrene butadiene latex companies. Styrene butadiene latex, owing to its lightweight, durable, and flexible properties, is finding high applications in automobile manufacturing. For instance, the Statistique Canada study estimated that the total number of road motor vehicles reached nearly 26.3 million in FY22. While in Q3’24, around 483,287 new motor vehicles were registered in the country. The continuous growth in vehicle production and supply is thus anticipated to drive the consumption of styrene butadiene latex in the coming years.

Key Styrene Butadiene Latex Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Trinseo

- Dow Chemical Company

- Synthomer Plc

- LANXESS AG

- Omnova Solutions Inc.

- LG Chem Ltd.

- Wacker Chemie AG

- Sibur International GmbH

- Kumho Petrochemical Co., Ltd.

- Eastman Chemical Company

- Arkema S.A.

- Daelim Industrial Co., Ltd.

The styrene butadiene latex market is estimated to be dominated by the presence of industry giants and the increasing emergence of new companies. Start-ups are investing heavily in research and development activities to introduce innovative solutions and stand out in the styrene butadiene latex market. Leading companies are employing several organic and inorganic strategies to earn high profits and maximize their reach. Some of the tactics are new product launches, technological advancements, regional expansion, mergers & acquisitions, and strategic collaborations & partnerships. The high demand for specialized chemicals and materials from end use industries is set to uplift the revenues of styrene butadiene latex producers in the coming years.

Some of the key players include:

Recent Developments

- In September 18, 2024, the Ministry of Chemicals and Fertilizers, India through a gazette announced an important amendment to the Styrene Butadiene Rubber Latex (Quality Control) Order of 2021. This new order is not applicable to the use of carboxylated Styrene Butadiene Rubber (SBR) latex in the manufacturing of automotive lithium-ion batteries.

- In March 2023, Trinseo showcased its extensive portfolio of all acrylic, styrene acrylic, and styrene butadiene latex binder innovations at the European Coatings Show in Nürnberg, Germany. By participating in the events and exhibitions the company is expanding its market reach and attracting a new customer base.

- Report ID: 7138

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Styrene Butadiene Latex Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.