Styrene Acrylonitrile Market Outlook:

Styrene Acrylonitrile Market size was valued at USD 2.69 billion in 2025 and is set to exceed USD 4.14 billion by 2035, expanding at over 4.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of styrene acrylonitrile is estimated at USD 2.8 billion.

Styrene acrylonitrile’s increasing use in packaging, medical devices, automobiles, and electronics is significantly augmenting their sales growth. The growth in sustainable manufacturing practices in every sector is directly influencing the sales of bio-based or eco-friendly chemicals including styrene acrylonitrile. Furthermore, the rising need to manufacture lightweight and durable vehicles is fueling the use of specialized materials and chemicals such as styrene acrylonitrile (SAN). Styrene acrylonitrile’s ability to maintain structural integrity and impact resistance is propelling their use in the production of automobile interior components such as trims, consoles, and dashboards.

The rise in the sales of automobiles is anticipated to directly augment the consumption of styrene acrylonitrile. The rising popularity of electric vehicles, vehicle customization & personalization trends, and a hike in the spending power of individuals are prime factors boosting automobile sales, and ultimately SAN consumption. For instance, the International Energy Agency (IEA) states that over 14.0 million electric cars were sold in 2023 and this number is set to double in the coming years. These sales are dominated by China, European countries, and the U.S., holding 95.0% of sales. Further, the Specialty Equipment Market Association (SEMA) reveals that specialty automobile sales reached USD 52.0 billion in 2023. The estimated high growth in the automotive aftermarket is set to offer lucrative opportunities for styrene acrylonitrile manufacturers in the coming years.

|

Styrene Acrylonitrile (SAN) Copolymers |

|||

|

Country |

Export Value in USD Million |

Country |

Import Value in USD Million |

|

South Korea |

314 |

China |

317 |

|

Chinese Taipei |

185 |

Thailand |

57.1 |

|

Germany |

78.1 |

Hungary |

54.7 |

|

Thailand |

72.7 |

Vietnam |

49.2 |

|

U.S. |

64.1 |

Indonesia |

39.7 |

Source: OEC

The Observatory of Economic Complexity (OEC) explains that in 2022, the global trade of styrene acrylonitrile (SAN) copolymers was calculated at USD 1.02 billion, capturing the 2177th position as the world's most traded product. The styrene acrylonitrile trade is highly concentrated in Asia Pacific, particularly dominated by South Korea and China. Measured using Shannon Entropy, the market concentration was accounted at 3.42, in 2022.

Key Styrene Acrylonitrile Market Insights Summary:

Regional Highlights:

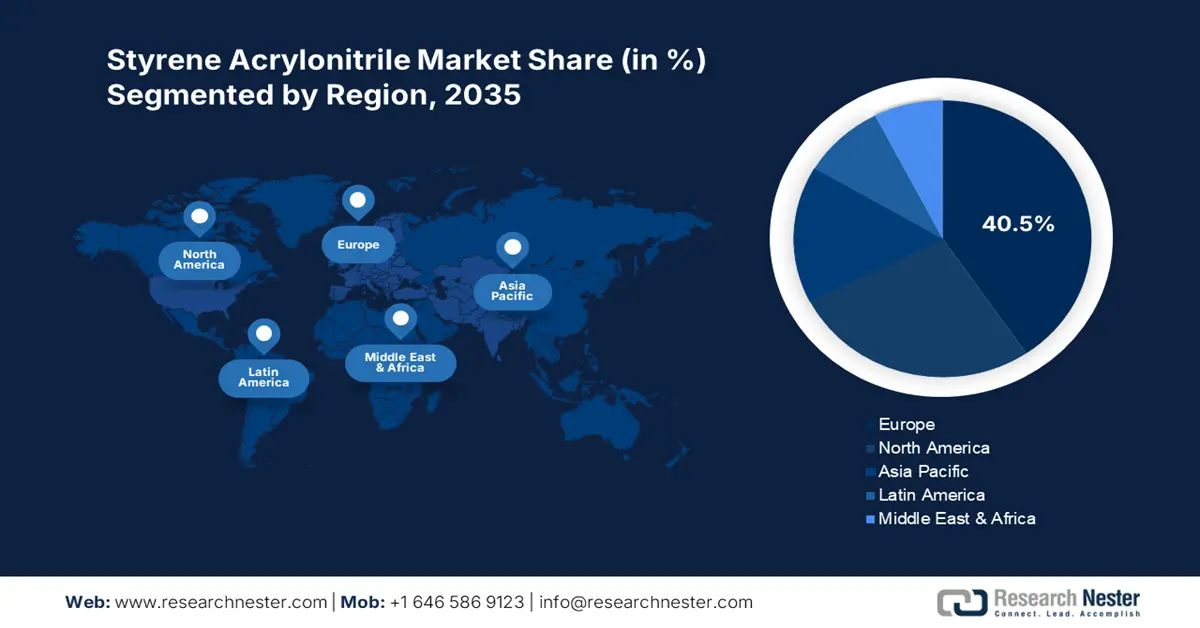

- Europe holds a commanding 40.5% share in the Styrene Acrylonitrile Market, driven by strong end-use industries such as packaging, medical, and automotive sectors, fueling growth through 2035.

- North America’s styrene acrylonitrile market is anticipated to grow rapidly by 2035, driven by adoption of specialized materials and innovations in automotive sector.

Segment Insights:

- The Electrical & Electronics segment is expected to achieve a 34.2% share by 2035, fueled by its heat resistance and superior electrical insulating properties.

- Kitchenware segment is expected to capture a 32.80% share by 2035, driven by the chemical resistance, thermal stability, and cost-effectiveness of SAN products.

Key Growth Trends:

- Growing utilization in transparent plastic production

- Packaging is a lucrative market for SAN producers

Major Challenges:

- Compounds with similar properties limit styrene acrylonitrile sales

- Disposability and profitability issues

Key Players: SABIC, INEOS Group Limited, BASF SE, Trinseo, and Chi Mei Corporation.

Global Styrene Acrylonitrile Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.69 billion

- 2026 Market Size: USD 2.8 billion

- Projected Market Size: USD 4.14 billion by 2035

- Growth Forecasts: 4.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (40.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Germany, United States, China, Japan, South Korea

- Emerging Countries: China, Japan, South Korea, India, Brazil

Last updated on : 13 August, 2025

Styrene Acrylonitrile Market Growth Drivers and Challenges:

Growth Drivers

-

Growing utilization in transparent plastic production: The rise in the adoption of transparent plastic products owing to their clear visibility and aesthetic appeal is driving the sales of styrene acrylonitrile. Cosmetic, medical, and home care sectors are primarily driving the transparent plastic demand and ultimately styrene acrylonitrile consumption. styrene acrylonitrile a transparent polymer is emerging as a cost-effective and durable alternative to glass and other expensive transparent chemicals and materials. The Research Nester’s study estimates that the global transparent market is expected to increase at a CAGR of 5.2% and reach USD 157.4 billion in 2025. Furthermore, the UN Trade & Development (UNCTD) reports reveal that global plastics exports have more than doubled since 2005 and crossed USD 1.0 trillion. Such a huge growth represents profitable opportunities for styrene acrylonitrile manufacturers.

-

Packaging is a lucrative market for SAN producers: The packaging industry is exhibiting substantial growth owing to its increasing importance in the food, pharma, cosmetics, and e-commerce trade. Continuous innovations in packaging are promoting the use of specialized chemicals such as styrene acrylonitrile. Its safety, durability, and clarity are boosting its applications in innovative packaging purposes.

Challenges

-

Compounds with similar properties limit styrene acrylonitrile sales: Styrene acrylonitrile manufacturers face strong competition from other materials such as polycarbonates, polyethylene terephthalate (PET), and polystyrene. The similar features of these chemical compounds drive the attention of end users to invest in them. The growing popularity of alternatives is estimated to potentially hinder the sales of styrene acrylonitrile, and ultimately revenue shares of key players. To overcome these barriers, digital marketing is an effective strategy to reach a wider customer base.

-

Disposability and profitability issues: Styrene acrylonitrile is a recyclable chemical but the process of disposal is highly complex, which creates a challenge towards sustainability growth. Apart from this, the styrene acrylonitrile (SAN) market saturation in the developed regions significantly creates barriers to profit growth. The drop in styrene acrylonitrile prices results in low-profit margins, which hinders the overall budget of the company. Most companies employ regional expansion strategies but the presence of domestic competitors and end users’ resistance to change again limits their profitability ratio.

Styrene Acrylonitrile Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.4% |

|

Base Year Market Size (2025) |

USD 2.69 billion |

|

Forecast Year Market Size (2035) |

USD 4.14 billion |

|

Regional Scope |

|

Styrene Acrylonitrile Market Segmentation:

Application (Food Container, Kitchenware, Electronics Covers, Plastic Optical Fiber, Others)

Kitchenware segment is set to capture styrene acrylonitrile market share of around 32.8% by the end of 2035. The chemical resistance, aesthetic qualities, thermal stability, and durability are prime properties of styrene acrylonitrile contributing to their consumption in kitchenware product manufacturing. Styrene acrylonitrile-based kitchenware products are more cost-effective than glass and metal products. The non-toxic nature of styrene acrylonitrile is also contributing to its adoption in food storing products. The rising kitchenware product demand is set to positively influence the styrene acrylonitrile sales during the study period.

End user (Packaging, Electrical & Electronics, Medical, Automotive, Transportation, Others)

In styrene acrylonitrile (SAN) market, electrical & electronics segment is expected to capture revenue share of around 34.2% by the end of 2035. Heat resistance, lightweight, durable, and superior electrical insulating properties are promoting the use of styrene acrylonitrile in electrical and electronic products. SAN is finding high applications in circuit boards, switches, connectors, and wire protection solutions. The increasing global demand for consumer electronics such as computers, laptops, smartphones, and tablets is directly pushing the sales of styrene acrylonitrile. The increasing adoption of special chemicals in electrical and electronic production is foreseen to double the profits of styrene acrylonitrile manufacturers in the coming years.

Our in-depth analysis of the styrene acrylonitrile market includes the following segmen

|

Type |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Styrene Acrylonitrile Market Regional Analysis:

Europe Market Forecast

Europe styrene acrylonitrile market is projected to account for revenue share of more than 40.5% by the end of 2035. The strong existence of end use industries such as packaging, plastic, medical, automotive, and electrical & electronics is opening lucrative doors for styrene acrylonitrile producers. Continuous technological innovations and a strong focus on climatic commitments are set to boost the sales of eco-friendly styrene acrylonitrile in the coming years. The booming kitchenware sector of Europe is also expected to uplift the revenues of styrene acrylonitrile manufacturers in the years ahead.

Germany’s robust automotive and electronics sector is majorly fueling the consumption of styrene acrylonitrile. The swiftly expanding automobile aftermarket is also contributing to the sales of styrene acrylonitrile. The high registrations of luxury & supercars and increasing demand for electric vehicles are further aiding the styrene acrylonitrile manufacturers in earning high profits. For instance, the Germany Trade & Invest (GTAI) report states that around 1.7 million electric passenger cars were produced in 2023. The same report also reveals that Germany is the biggest automotive market in Europe owing to the presence of over 54 automotive assembly and production sites.

The France styrene acrylonitrile market is expected to register a healthy CAGR throughout the study period. The high popularity of France-made kitchenware products is directly augmenting the styrene acrylonitrile trade activities. Continuous innovations and the growing green chemistry trend owing to strict environmental regulations and climatic commitments are further propelling the consumption of styrene acrylonitrile in the country. Studies estimate that France is set to generate a valuation of USD 700.0 million from the kitchenware market in 2025 and the per-person revenue to amount to USD 10.75 in the same year.

North America Market Statistics

The North America styrene acrylonitrile market is poised to increase at the fastest CAGR between 2025 to 2035. The robust adoption of specialized materials and chemicals in the automotive sector, innovations in medical device and equipment production, and high demand for aesthetic kitchenware products are boasting the sales of styrene acrylonitrile. The swiftly expanding food service industry and booming online food delivery applications are augmenting the use of styrene acrylonitrile in packaging solutions. The dominance of every end user in the region is opening lucrative doors for styrene acrylonitrile manufacturers.

The U.S. robust food service sector is pushing the sales of styrene acrylonitrile-based packaging solutions. For instance, the study by Auguste Escoffier School of Culinary Arts highlights that the restaurant and food service sector generates nearly 2.5% of the U.S. GDP. The continuous growth in this sector is anticipated to propel the demand for styrene acrylonitrile in packaging solution manufacturing. The rising e-commerce activities are also expected to double the use of styrene acrylonitrile-based packaging solutions in the coming years.

Canada’s automotive and component manufacturing field is a major driving factor for the styrene acrylonitrile (SAN) market growth. The high registration of EVs as well as ICE propulsion system vehicles in the country are positively influencing the styrene acrylonitrile sales growth. For instance, the Statistique Canada study discloses that the number of registered road motor vehicles totaled 26.3 million in 2022. The same source also reveals that in the third quarter of FY 2024, the new motor vehicle registrations reached 483,287. Thus, the consistent production and export of vehicles are set to uplift the revenue growth of styrene acrylonitrile companies.

Key Styrene Acrylonitrile Market Players:

- SABIC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- INEOS Group Limited

- BASF SE

- Trinseo

- Chi Mei Corporation

- Styron LLC

- LG Chem

- Ravago Group

- China National Petroleum Corporation

- Versalis S.p.A.

- Chevron Phillips Chemical Company LLC

The styrene acrylonitrile market is dominated by the presence of gigantic players and the increasing emergence of start-ups. New companies are investing heavily in research and development activities to introduce innovative solutions and stand apart from the crowd. Industry giants are employing various organic and inorganic marketing strategies such as new product launches, technological innovations, strategic collaborations and partnerships, mergers and collaborations, and regional expansions to earn high profits and reach a wider customer base.

Some of the key players include:

Recent Developments

- In June 2024, Trinseo revealed the launch of new recycled-containing acrylonitrile-butadiene-styrene (ABS) and styrene-acrylonitrile (SAN) resins. These solutions are available under the MAGNUM ECO+, MAGNUM CR, and TYRIL CR trade names.

- In May 2023, INEOS Group Limited introduced a new Luran 2555 for masterbatches and compounding. This new product complements the company’s existing portfolio of industrial styrene acrylonitrile (SAN) materials.

- Report ID: 7129

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Styrene Acrylonitrile Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.