Structured Data Management Software Market Outlook:

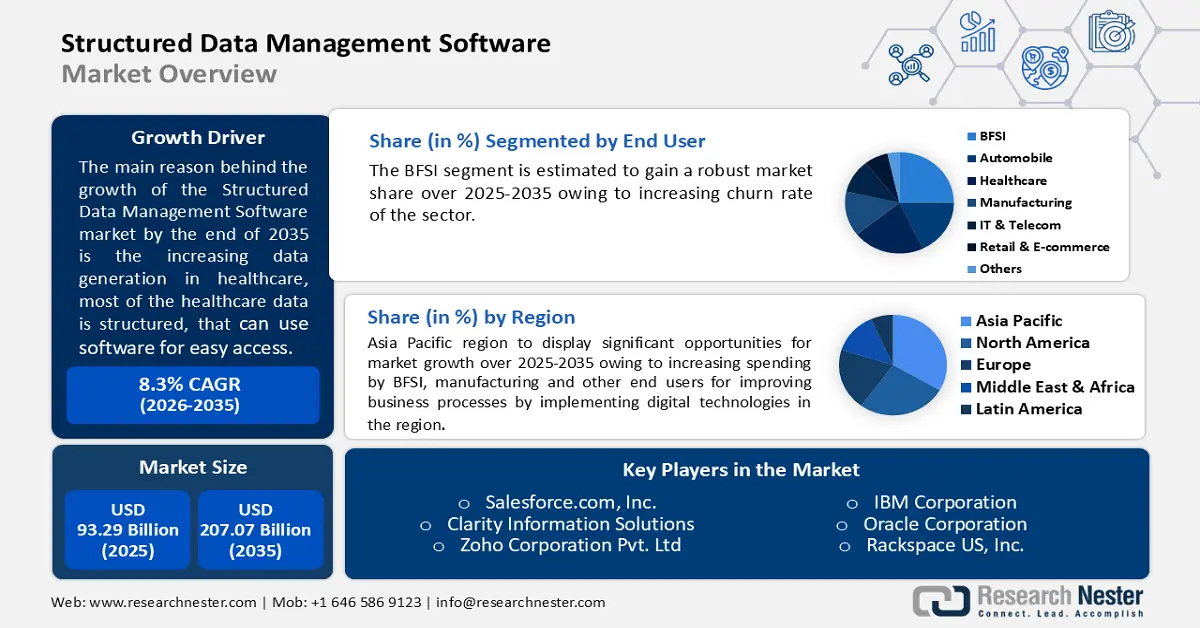

Structured Data Management Software Market size was valued at USD 93.29 billion in 2025 and is expected to reach USD 207.07 billion by 2035, registering around 8.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of structured data management software is assessed at USD 100.26 billion.

The growth of the market can be attributed to the increasing data generation in healthcare, most of the healthcare data is structured, that can use software for easy access. The amount of healthcare data greatly expanded by the end of 2020, rising from 500 petabytes in 2012 to 25,000 petabytes. Furthermore, rising trends of digital payments is also expected

In addition to these, factors that are believed to fuel the market growth of structured data management software include the rapidly increasing data volumes, the consequent rise in the adoption of digital technologies for the transformation of businesses, along with the development of new technologies for database applications are expected to fuel the progress of this market. Along with this, structured data management software helps to reduce data footprints and storage, maintenance, hardware, and administration costs, which is another factor estimated to benefit the market growth in the coming years. Moreover, the growth of the market can also be attributed to the adoption of structured data management software by BFSI, IT & telecom, manufacturing, healthcare, and retail companies to manage scattered. Additionally, the growing focus of enterprises towards digital transformation and increasing developments in e-commerce sector is projected to offer ample opportunities for market growth in the near future. For instance, as per the United Nations Conference on Trade and Development (UNCTAD), global e-commerce sales increased to USD 26.7 trillion in 2019, up 4% from 2018.

Key Structured Data Management Software Market Insights Summary:

Regional Insights:

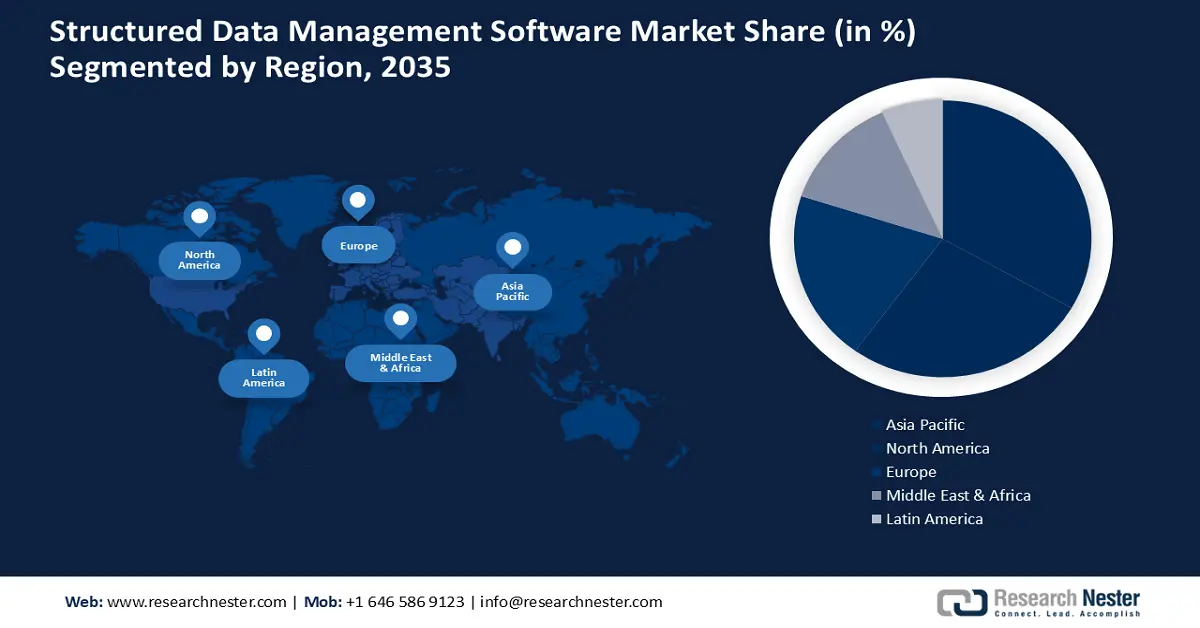

- By 2035, the Asia Pacific region is anticipated to command the largest revenue share in the Structured Data Management Software Market, bolstered by rising spending from BFSI, manufacturing, and other end users to enhance business processes through digital technologies.

- By 2035, North America is expected to capture a substantial share of the market, underpinned by the growing adoption of cloud storage and centralized data storage.

Segment Insights:

- By 2035, the BFSI segment in the Structured Data Management Software Market is projected to hold the leading share, propelled by the increasing churn rate.

- By 2035, the small & medium enterprises segment is anticipated to secure a notable market share, supported by the rising number of SMEs.

Key Growth Trends:

- Rising Use of Internet of Things (IoT) Devices

- Growing Need for Centralized Data Storage

Major Challenges:

- Rising Concerns Associated with Data Security and Privacy

- Rising Instances of Cyber Attacks on Enterprises

Key Players: SAS Institute Inc., IBM Corporation, Oracle Corporation, Rackspace US, Inc., Teradata Corporation, Huawei Technologies Co., Ltd, Micro Focus International plc, Salesforce.com, Inc., Clarity Information Solutions, Zoho Corporation Pvt. Ltd.

Global Structured Data Management Software Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 93.29 billion

- 2026 Market Size: USD 100.26 billion

- Projected Market Size: USD 207.07 billion by 2035

- Growth Forecasts: 8.3%

Key Regional Dynamics:

- Largest Region: Asia Pacific (Largest Revenue Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, India, Japan, United Kingdom

- Emerging Countries: Indonesia, Vietnam, Brazil, Mexico, South Korea

Last updated on : 19 November, 2025

Structured Data Management Software Market - Growth Drivers and Challenges

Growth Drivers

-

Rising Use of Internet of Things (IoT) Devices –With the emergence of IoT connected devices, there is a lot of real-time sensitive data, that can be managed by this software. By 2023, there will be 14.4 billion IoT devices, an 18% growth, and by 2025, there may be 27 billion connected IoT devices. IoT devices are predicted to number 25.4 billion by 2030.

-

Growing Need for Centralized Data Storage – In a survey of almost 500 professionals, over 63% of respondents stated their business intended to increase its use of customer data in the next year. Moreover, around 57% indicated they'll employ centralized data storage, such as a customer data platform (CDP).

-

Rising Need to Reduce the Churn Rate – Structured data management software helps to increase the employee retention. The churn rate of energy and utility suppliers is around 11%. Moreover, the churn rate of IT sector is nearly 12%.

-

Growing Volumes of Data– the software increases the life span of the data irrespective of its time of generation. Over 64 zettabytes of data were produced, collected, transferred, and used globally in 2020. For the ensuing five years, up until 2025, it is predicted that the amount of data generated worldwide would rise to more than 180 zettabytes.

-

Rising Use of Cloud Storage – the software helps companies to store the on public cloud platforms. Almost 60% of corporate data was stored in the cloud by 2022. This represents a considerable increase from 2015, when only 30% of data was stored in the cloud.

Challenges

- Rising Concerns Associated with Data Security and Privacy – the data present in the structured data management contains sensitive information, therefore, in case of any cyber-attacks, the privacy of these data is at high risk. Threat to data privacy is the major roadblock in the market growth.

- Rising Instances of Cyber Attacks on Enterprises

- There are Limited Options to Save the Structure Data

Structured Data Management Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.3% |

|

Base Year Market Size (2025) |

USD 93.29 billion |

|

Forecast Year Market Size (2035) |

USD 207.07 billion |

|

Regional Scope |

|

Structured Data Management Software Market Segmentation:

End-user Segment Analysis

The global structured data management software market is segmented and analyzed for demand and supply by end-user industry into BFSI, automobile, healthcare, manufacturing, IT & telecom, retail and commerce, and others. Out of the six types of end-user, the BFSI segment is estimated to gain the largest market share over the projected time frame. The growth of the segment can be attributed to the increasing churn rate of the sector. Financial services companies have an average client retention rate of around 81%, translating to a median churn rate of 19% approximately. Besides this, rise in the number of digital payments, that give rise to massive data. From 68% in 2017 and 51% in 2011, 76% of adults worldwide now have an account with a bank, another financial institution, or a mobile money provider as per the statistics of the World Bank. Furthermore, almost 40% of adults in low- and middle-income countries (apart from China) who paid a merchant in-person or online with a card, phone, or the internet

Organization Segment Analysis

The global structured data management software market is also segmented and analyzed for demand and supply by enterprise size into small & medium, and large enterprises. The growth of the segment is attributed to rise in the number of small and medium. In the United Kingdom, there are around 5 million small enterprises that have less than 50 employees in each company. Moreover, there were nearly 31,000 medium enterprises in the region. Small and medium enterprises can leverage the structured data management software, to reduce the overall storage costs and data layouts by curbing the price of hardware upkeep and management.

Our in-depth analysis of the global market includes the following segments:

|

By Deployment |

|

|

By Enterprise Size |

|

|

By End User Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Structured Data Management Software Market - Regional Analysis

APAC Market Insights

Asia Pacific industry is estimated to hold largest revenue share by 2035. The market growth in the region expected on the account of increasing spending by BFSI, manufacturing and other end users for improving business processes by implementing digital technologies in the region. For instance, in India, the BFSI industry spent 57 percent of their expenditure on digital services in 2020.

North American Market Insights

The North American structured data management software market, amongst the market in all the other regions, is projected to hold the significant market share by the end of 2035. The growth of the market can be attributed majorly to the increasing use of cloud storage and centralized data storage. Around 50% of business indicated that centralized data storage is beneficial for this business. Moreover, the most crucial data is kept in the cloud by 48% of businesses in the United States. Furthermore, higher use of the Internet of Things (IoT) in healthcare, banking, government, and other sectors is also expected to boost the market growth in the region.

Structured Data Management Software Market Players:

- SAS Institute Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- IBM Corporation

- Oracle Corporation

- Rackspace US, Inc.

- Teradata Corporation

- Huawei Technologies Co., Ltd

- Micro Focus International plc

- Salesforce.com, Inc.

- Clarity Information Solutions

- Zoho Corporation Pvt. Ltd

Recent Developments

-

Rocket Software announced that it has signed an agreement to acquire ASG Technologies. The acquisition aims at helping the company to boost its expertise in the management of content, structured and unstructured data, and systems.

-

OneTrust is all set to enhance its OneTrust DataDiscovery platform after signing an acquisition deal with Integris Software. The platform helps enterprises to understand their data across all assets and systems.

- Report ID: 3247

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Structured Data Management Software Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.