Structural Insulated Panels Market Outlook:

Structural Insulated Panels Market size was over USD 10.52 billion in 2025 and is anticipated to cross USD 19.75 billion by 2035, witnessing more than 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of structural insulated panels is assessed at USD 11.14 billion.

Structural insulated panels are predicted to gain popularity globally because of their lightweight nature, enhanced external look, and potential to enhance a building's thermal performance. Manufacturers of new, energy-efficient homes constructed in compliance with the 2005 federal Energy Policy Act's Federal Manufactured Housing Building Standards and Security Standards are eligible for a tax credit of up to USD 2,000 in the United States.

In addition, the construction industry is expanding and getting better quickly in the upcoming years. Over the next several years, it is expected that the market will expand significantly due to the rising demand for residential and commercial real estate. An increase in the use of energy-efficient and green building practices, along with a rise in demand for structural insulation panels for cold storage applications, is predicted to propel the market. 37% of businesses in the current construction and retrofitting industry plan to create environmentally friendly buildings of the respondents, 57% were listed globally.

Key Structural Insulated Panels Market Insights Summary:

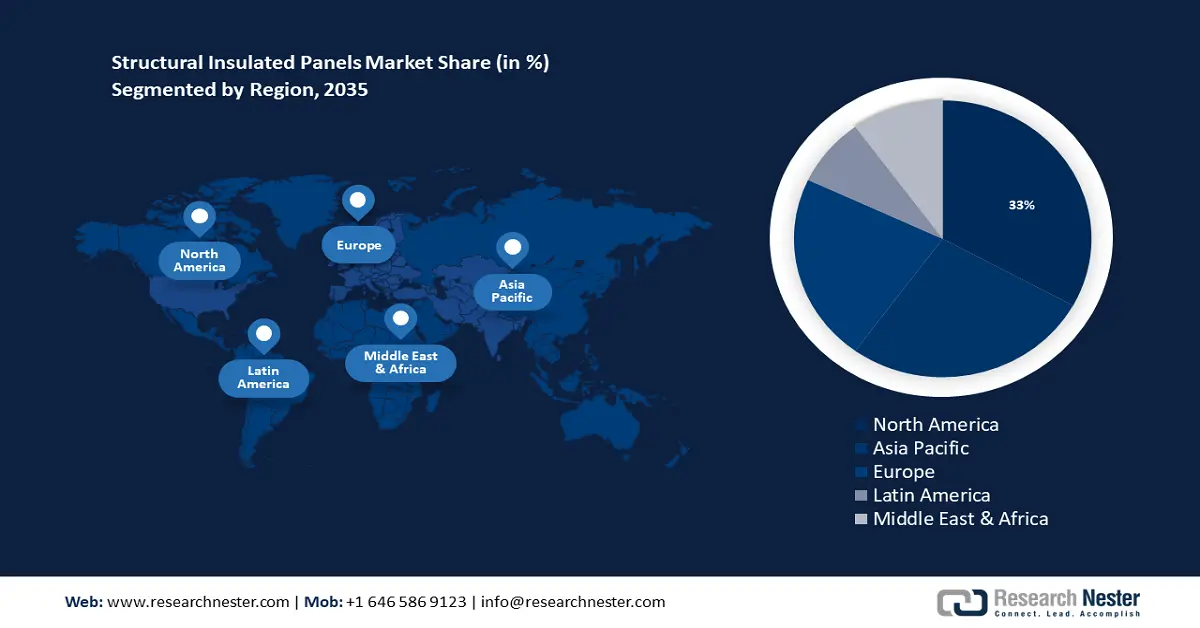

Regional Highlights:

- The North America structural insulated panels market will dominate around 38% share by 2035, attributed to an expanding tendency in multi-family construction, a well-developed cold chain industry, and government measures to improve infrastructure funding.

- The Asia Pacific market will achieve a 25% share by 2035, facilitated by the quick development of residential and commercial building industries as well as the adoption of green building standards.

Segment Insights:

- The osb segment in the structural insulated panels market is anticipated to experience robust growth through 2035, propelled by its exceptional load-bearing qualities and efficient raw material use.

- The osb segment in the structural insulated panels market is projected to hold a 66% share by 2035, driven by its exceptional load-bearing qualities and efficient raw material use.

Key Growth Trends:

- Growing Need for Structural Insulated Panels in Cold Storage Applications

- Quicker Construction and Lower Labor Cost

Major Challenges:

- Growing Need for Structural Insulated Panels in Cold Storage Applications

- Quicker Construction and Lower Labor Cost

Key Players: Kingspan Group, PFB Corporation, Isopan, KPS Global, American Insulated Panel, Owens Corning, All Weather Insulated Panels, Ingreen Systems Corp., Structural Panels Inc.

Global Structural Insulated Panels Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.52 billion

- 2026 Market Size: USD 11.14 billion

- Projected Market Size: USD 19.75 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, Germany, China, Japan

- Emerging Countries: China, India, Japan, South Korea, Malaysia

Last updated on : 16 September, 2025

Structural Insulated Panels Market Growth Drivers and Challenges:

Growth Drivers

- Growing Need for Structural Insulated Panels in Cold Storage Applications- Since structural insulated panels are reasonably priced, eco-friendly, and long-lasting, they are frequently employed in the construction of cold storage facilities. Cold storage is a crucial component for numerous industries, such as food processing, food preparation, warehousing, and storage systems, as well as pharmaceutical and retail solutions. The increasing need for cold storage systems is expected to drive growth in the Structural Insulated Panels industry.

- Quicker Construction and Lower Labor Cost- Prefabricated panels, or SIPs, can be rapidly erected during prefabricated construction by starting from scratch on the job site. This has a far shorter construction period than traditional building techniques. A project can be completed more effectively and with lower labor and overall project management costs the sooner the construction is completed. Due to the building industry's requirement for shortened project durations and more efficiency, SIPs have grown in popularity. By 2020, the construction industry in the EU employed 10 million people.

- Energy Efficiency and Sustainable Construction Practices- As the construction industry places a greater emphasis on energy efficiency and sustainable building practices, SIPs specifically, their better thermal performance are gaining traction. SIPs offer greater insulation and reduced heating and cooling energy usage when compared to traditional building techniques. As a result of the increasing regulatory requirements and customer demand for environmentally friendly buildings, SIPs are being increasingly embraced in both residential and commercial construction projects.

- Mitigation of Disasters and Resilience - An increase in extreme weather occurrences and an increasing emphasis on developing disaster-resistant structures are driving up demand for construction materials that can help buildings better handle these difficulties. SIPs provide a sturdy framework that can endure long-term wear and tear as well as the force of hurricanes because of their demonstrated strength and resilience. As a result, the demand for SIP is still expanding because to its appeal in areas vulnerable to natural disasters including hurricanes, earthquakes, and bad weather. In September 2022, the national construction unemployment rate (NSA) was 4.7%, not seasonally adjusted.

Challenges

- Insufficient knowledge Regarding Structural Insulated panels- Architects, contractors, and builders are just a few examples of skilled construction workers who may find little use for the information and expertise gained by working with them. For SIPs to be extensively used, these interested parties must get education regarding the advantages of SIPs and the proper installation procedures. Fewer people in some developing and underdeveloped APAC, African, and South American countries are aware of the benefits that these insulating panels offer. The sustainability, flexibility, recyclability, and durability of structural insulated panels in developing economies such as those in Africa and South America are poorly understood.

- It is predicted that fierce industry competition will impede market expansion.

- A scarcity of high-quality materials could impede structural insulated panels market expansion.

Structural Insulated Panels Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 10.52 billion |

|

Forecast Year Market Size (2035) |

USD 19.75 billion |

|

Regional Scope |

|

Structural Insulated Panels Market Segmentation:

Application Segment Analysis

Based on application the wall segment is predicted to account for 46% share of the global structural insulated panels market during the forecast period. The growing understanding of the financial benefits of utilizing effective building insulation is what is fuelling the growth in this industry. Wall insulation is one of the most crucial components to improve a building's energy efficiency. Together with wall insulation, floor insulation forms a protective envelope that stops heat from the outside environment from entering the building through conduction and convection radiation. This lowers the energy needed for the building's heating and cooling systems. US construction spending reached a total of USD 1.79 trillion in 2022.

Product Segment Analysis

Based on product, the polystyrene segment is predicted to account for 45% share of the global structural insulated panels market during the forecast period. The great demand for these products can be due to their cost-effectiveness and resilience to dust and moisture. Additionally, because of its sturdy and solid surface, polystyrene provides a higher degree of resistance to punctures and earthquake-proof qualities. Nonetheless, the polyurethane segment is anticipated to increase at the fastest rate. 10.59 million tons of expandable polystyrene (EPS) will be produced worldwide in 2021.

Facing Material (OSB, MgO Board)

Based on facing material the OSB segment is estimated to grow significantly and is expected to have about 66% market share during the forecast period. Large-scale OSB is commonly accessible and has undergone extensive testing as a material capable of supporting loads. It is widely used in the construction industry because of its exceptional load-bearing qualities. Furthermore, wood species that are underutilized, rapidly developing, and generally less expensive can be used to create OSB, this is an efficient use of raw materials.

Our in-depth analysis of the global market includes the following segments:

|

Facing Material |

|

|

Application |

|

|

End-User |

|

|

Insulation Material |

|

|

Product |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Structural Insulated Panels Market Regional Analysis:

North American Market Insights

Structural insulated panels market in the North America region is anticipated to hold the largest revenue share about 38% during the forecast period. The region's expansion is attributed to several factors, including an expanding tendency in multi-family construction, a well-developed cold chain industry, and government measures to improve the flow of funding into infrastructure development. As more people become aware of the advantages of building insulation, the market is anticipated to expand in the upcoming years. The Infrastructure for Rebuilding America (INFRA) program will grant 24 projects across 18 states with a total of USD 905.25 million in discretionary financing, according to a July 2021 announcement made by the USDOT Secretary.

APAC Market Insights

Structural insulated panels market in the Asia Pacific region is attributed to hold the second largest share of about 25% during the forecast period. This expansion has been facilitated by the quick development of the residential and commercial building industries as well as the adoption of various green building standards. With Osaka serving as the host city for the 2025 World Expo, the Japanese construction sector is anticipated to do well. The new 61-story, 390-meter-tall office tower will be finished in 2027, and Yaesu's renovations will conclude in 2023.

Structural Insulated Panels Market Players:

- Melt - Span

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Kingspan Group

- Isopan

- KPS Global

- Owens Corning

- PFB Corporation

- American Insulated Panel

- Structural Panels Inc.

- All Weather Insulated Panels

- Ingreen Systems Corp

Recent Developments

- July 2020: Kingspan helps Passivhaus development to meet the standard. A development of 13 homes in the Bedfordshire village of Sharnbrook has been certified to the rigorous requirements of the Passivhaus Standard, with a specification combining Kingspan’s premium performance insulation boards and the Kingspan TEK Building System of Structural Insulated Panels

- January 2022: Foamglas Perinsul SIP, a thermal bridging solution for high-performance buildings, was introduced by Owens Corning. Cellular glass, which makes up the new structural insulated panel, will reduce performance loss in the event of moisture exposure, improve energy efficiency, and aid in the elimination of thermal bridging.

- Report ID: 5937

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Structural Insulated Panels Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.