Stroke Assistive Devices Market Outlook:

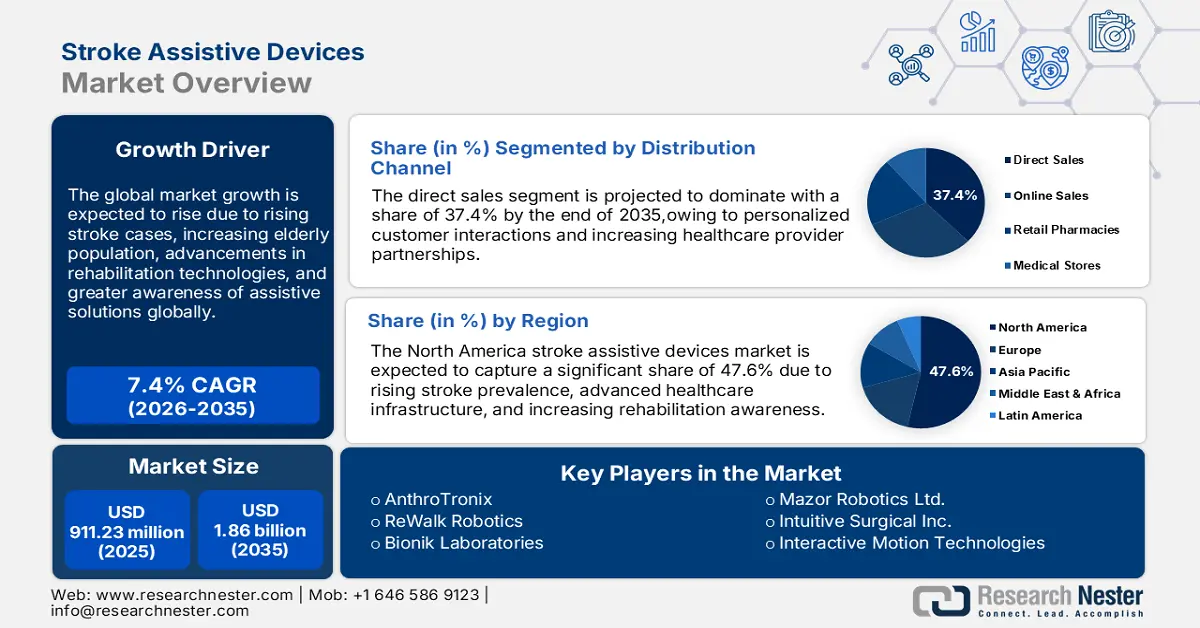

Stroke Assistive Devices Market size was over USD 911.23 million in 2025 and is poised to exceed USD 1.86 billion by 2035, witnessing over 7.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of stroke assistive devices is estimated at USD 971.92 million.

The rising global prevalence of strokes, driven by the aging population, sedentary lifestyles, and risk factors such as hypertension and diabetes, is fueling demand for rehabilitation and assistive devices to manage post-stroke disabilities and improve recovery. According to an American Heart Association, Inc. research from April 2023, the age-standardized incidence rate of ischemic stroke was expected to rise to 89.32 per 100,000 people worldwide by 2030. Simultaneously, technological advancements such as exoskeletons and AI revolutionize rehabilitation outcomes. These innovations are increasing the adoption of modern stroke assistive devices in hospitals and home care settings, significantly contributing to the growth of the market.

Additionally, growing awareness about the importance of post-stroke care among patients, caregivers, and healthcare providers is significantly driving the adoption of assistive devices designed to enhance recovery and overall quality of life. This increased awareness is bolstered by educational initiatives, support programs, and the growing availability of information on the benefits of early and effective rehabilitation. Consequently, more individuals and healthcare facilities are embracing advanced assistive technologies for post-stroke care, thereby further fueling the demand for market.

Key Stroke Assistive Devices Market Insights Summary:

Regional Highlights:

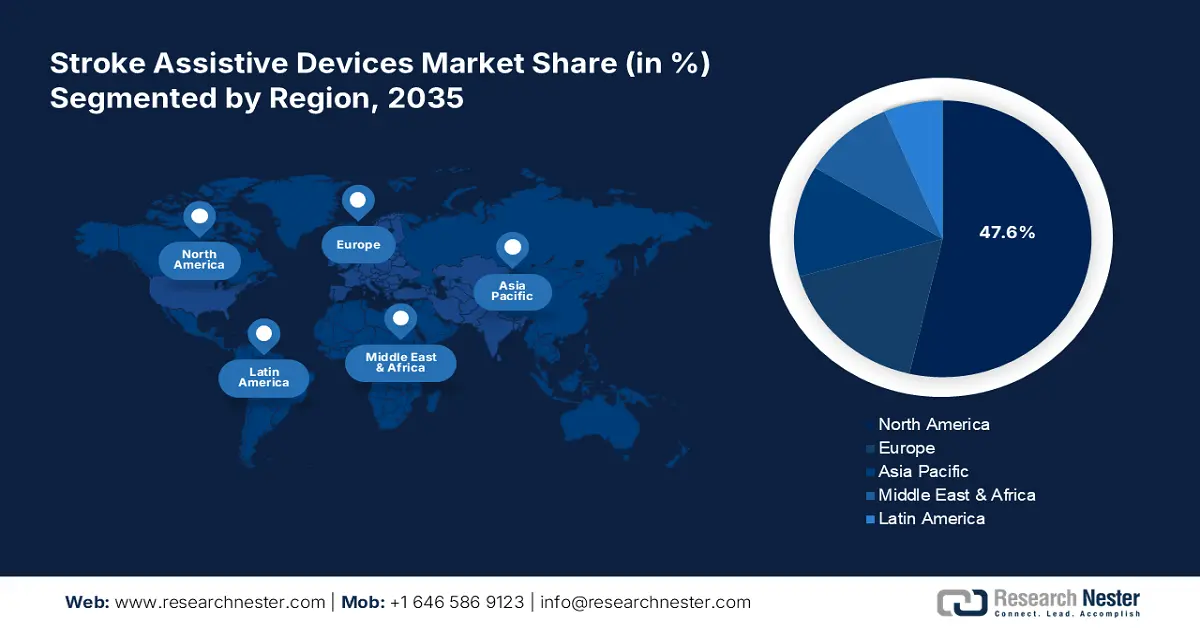

- By 2035, North America is projected to command over 47.6% share of the stroke assistive devices market, attributed to rising stroke cases and advanced healthcare infrastructure.

- The APAC region is anticipated to record the fastest CAGR through 2026-2035, bolstered by rapid technological advancements in rehabilitation technologies.

Segment Insights:

- The direct sales segment is estimated to secure over 37.4% share by 2035 in the stroke assistive devices market, propelled by its ability to establish direct connections between manufacturers and end-users.

- The home care settings segment is set to capture the majority share over 2026-2035, underpinned by rising demand for personalized, cost-effective rehabilitation solutions.

Key Growth Trends:

- Healthcare facility expansion

- Supportive government policies

Major Challenges:

- Exponential cost of devices

- Stringent regulatory hurdles

Key Players: AnthroTronix, ReWalk Robotics, Bionik Laboratories, Saebo, Ekso Bionics, Bioxtreme Robotics Rehabilitation, Mazor Robotics Ltd., Intuitive Surgical Inc, Interactive Motion Technologies, Accuray, Inc, Athersys, Inc.

Global Stroke Assistive Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 911.23 million

- 2026 Market Size: USD 971.92 million

- Projected Market Size: USD 1.86 billion by 2035

- Growth Forecasts: 7.4%

Key Regional Dynamics:

- Largest Region: North America (47.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Indonesia, Mexico

Last updated on : 2 December, 2025

Stroke Assistive Devices Market - Growth Drivers and Challenges

Growth Drivers

- Healthcare facility expansion: The expansion of hospitals, specialized stroke rehabilitation centers, and home care services, particularly in emerging economies, is significantly enhancing the accessibility and utilization of stroke assistive devices. For instance, as of March 2023, India had extensive healthcare infrastructure, including 1,69,615 sub-centers, 31,882 PHCs, 6,359 CHCs, and 714 district hospitals, supported by over 2.4 lakh health workers, 1.3 lakh paramedics, and 1.4 lakh nursing staff. Advanced healthcare facilities and home care services enhance stroke rehabilitation access, boosting global demand for stroke assistive devices market.

- Supportive government policies: Favorable government regulations, healthcare reforms, and supportive reimbursement policies are playing a crucial role in making stroke assistive devices more affordable and accessible to a broader population. These initiatives reduce the financial burden on patients and encourage healthcare providers to adopt advanced technologies in stroke rehabilitation. By addressing cost barriers and improving accessibility, such measures are fostering widespread adoption of assistive devices, thereby significantly contributing to the growth and expansion of the stroke assistive devices market globally.

Challenges

- Exponential cost of devices: Advanced stroke assistive devices, including robotic rehabilitation systems and brain-computer interfaces, are highly effective but often come with a significant price tag. This high cost makes these devices inaccessible to a large portion of the population, particularly in low- and middle-income regions where healthcare budgets are limited. For underserved populations, the expense creates a barrier to adoption, as many patients cannot afford these advanced solutions without sufficient insurance coverage or government subsidies, limiting market growth.

- Stringent regulatory hurdles: The regulatory approval process for new stroke assistive devices is often lengthy and complex, involving rigorous testing, clinical trials, and compliance with stringent safety and efficacy standards set by governing authorities. These challenges can lead to a significant delay in bringing innovative products to market, impacting manufacturers’ ability to deliver timely solutions to patients. The extended timelines and high costs associated with this process also deter some companies from pursuing new development, further hindering stroke assistive devices market growth and innovation.

Stroke Assistive Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.4% |

|

Base Year Market Size (2025) |

USD 911.23 million |

|

Forecast Year Market Size (2035) |

USD 1.86 billion |

|

Regional Scope |

|

Stroke Assistive Devices Market Segmentation:

Distribution Channel Segment Analysis

The direct sales segment is estimated to capture stroke assistive devices market share of over 37.4% by 2035. The segment is growing due to its ability to establish direct connections between manufacturers and end-users, such as hospitals, rehabilitation centers, and home care providers. This approach enables personalized consultations, a better understanding of customer needs, and quicker feedback for product improvements. Direct sales also ensure competitive pricing by eliminating intermediaries, making advanced devices more accessible. Furthermore, the rising demand for tailored solutions encourages manufacturers to leverage direct sales channels.

Application Segment Analysis

Based on application, the home care settings segment is poised to garner the majority of stroke assistive devices market share over the forecast period. This is due to the increasing demand for personalized, cost-effective rehabilitation solutions. Many stroke patients prefer recovering in the comfort of their homes to reduce hospital visits and associated expenses. Technological advancements, such as portable and user-friendly devices, enhance accessibility and convenience. Additionally, the growing elderly population and supportive healthcare policies promoting home-based care further drive the adoption of stroke assistive devices in home settings. For instance, in April 2024, the FDA launched Home as a Health Care Hub to integrate homes into healthcare and promote health equity nationwide.

Our in-depth analysis of the global stroke assistive devices market includes the following segments:

|

Distribution Channel |

|

|

Application |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Stroke Assistive Devices Market - Regional Analysis

North America Market Insights

North America in stroke assistive devices market is poised to capture over 47.6% revenue share by 2035. Rising stroke cases, fueled by aging populations and lifestyle factors such as hypertension and obesity, are driving the demand for effective rehabilitation solutions. Stroke prevalence rose 7.8% in the U.S. between 2011–2013 and 2020–2022 as published by CDC in May 2024. North America has advanced healthcare infrastructure playing a crucial role in addressing this demand by ensuring widespread access to cutting-edge stroke assistive technologies. Adopted in hospitals and rehab centers, these devices improve recovery, enhance outcomes, and drive growth in the stroke assistive devices market.

The U.S. leads globally in healthcare spending, enabling the integration and widespread use of advanced stroke assistive devices in hospitals and rehabilitation centers. According to the U.S. Centers for Medicare & Medicaid Services, healthcare spending in the U.S. increased by 7.5 percent in 2023 to reach USD 4.9 trillion, or USD 14,570 per person, as of December 2024. Additionally, favorable government reimbursement policies for medical devices, including stroke assistive technologies, enhance both affordability and accessibility. These policies support the broader adoption of innovative rehabilitation solutions, making them more available to patients, and fostering the growth of the stroke assistive devices market across healthcare providers in the U.S.

The well-established healthcare system in Canada ensures broad access to rehabilitation services, including advanced stroke assistive devices in hospitals, rehabilitation centers, and home care settings. As published by the Canadian Medical Association, total health spending in Canada was expected to reach USD 344 billion in 2023 As the elderly population grows, there is an increasing demand for these devices to address mobility and independence challenges faced by individuals recovering from strokes. This combination of healthcare access and the need to support aging individuals with post-stroke disabilities is driving the growth of the stroke assistive devices market in Canada.

Asia Pacific Market Insights

The APAC stroke assistive devices market is established to garner the fastest CAGR throughout the forecast period. The region is experiencing rapid technological advancements, including robotic rehabilitation devices, brain-computer interfaces, and AI-powered systems, which are significantly improving patient outcomes and driving market growth. Additionally, rising stroke cases from aging, urbanization, and lifestyle diseases drive demand for effective rehabilitation devices. According to NLM data from December 2023, the annual incidence of stroke in Asia ranges from 116/100,000 to 483/100,000. This combination of cutting-edge technologies and increasing healthcare needs is contributing to the expansion of the stroke assistive devices market in the region.

The following countries' stroke costs were compared in a 2019 study:

|

Country |

Cost of stroke per day |

|

Indonesia |

USD 135.5 |

|

Malaysia |

USD 227.5 |

|

Singapore |

USD 366.7 |

Source: NLM

China is experiencing a growing prevalence of strokes driven by lifestyle-related factors such as hypertension, smoking, and poor dietary habits, creating a heightened need for advanced stroke assistive devices to support effective rehabilitation and recovery. In 2020, 17.8 million [95% CI 17.6–18.0 million] adults in China suffered a stroke, according to a China Stroke Surveillance Report 2021, which was released in July 2023 by the China Stroke High-risk Population Screening and Intervention Program. Additionally, continuous improvements in healthcare infrastructure, particularly in urban and semi-urban areas, are enhancing access to the advanced stroke assistive devices market by addressing rising healthcare demands and improving patient outcomes.

The rising prevalence of stroke in India, fueled by lifestyle changes, urbanization, and risk factors such as hypertension and diabetes, is driving demand for assistive devices to support rehabilitation and enhance the quality of life for stroke survivors. According to a study that was published in NLM in October 2024, the prevalence of hypertension in India was 22.6% overall, with men being more likely to have it (24.1%) than women (21.2%). As people aged, the prevalence rose, reaching 48.4% in those 60 and older. Additionally, rising disposable income and health insurance coverage enhance affordability, driving growth in the stroke assistive devices market.

Stroke Assistive Devices Market Players:

- AnthroTronix

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ReWalk Robotics

- Bionik Laboratories

- Saebo

- Ekso Bionics

- Bioxtreme Robotics Rehibilitation

- Mazor Robotics Ltd.

- Intuitive Surgical Inc

- Interactive Motion Technologies

- Accuray, Inc

- Athersys, Inc.

Key companies in the stroke assistive devices market are driving innovation through advanced technologies such as robotic exoskeletons, brain-computer interfaces, and AI-driven rehabilitation systems. They focus on developing personalized solutions to enhance motor function recovery and improve patient outcomes. Collaborations with research institutions and healthcare providers are enabling the integration of cutting-edge therapies. For instance, in October 2024, Philips and Medtronic partnered to advocate timely stroke care, raising awareness of health benefits and expanding collaboration with the World Stroke Organization. Additionally, efforts to make these devices more accessible and user-friendly are accelerating market growth. These players are:

Recent Developments

- In March 2024, Neurolutions, Inc launch of the ipsiHand with a new CMS HCPCS code accelerates innovation in stroke assistive devices, enhancing accessibility to thought-activated rehabilitation technology.

- In December 2021, Bionik Laboratories addressed post-COVID-19 stroke recovery demands with advanced robotic rehabilitation solutions, driving growth in the stroke assistive devices market.

- Report ID: 7067

- Published Date: Dec 02, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Stroke Assistive Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.