Stretchable Electronics Market Outlook:

Stretchable Electronics Market size was valued at USD 606.81 million in 2025 and is set to exceed USD 5.74 billion by 2035, expanding at over 25.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of stretchable electronics is estimated at USD 744.43 million.

Rising concerns about the impact of electronics pollution on the environment are pushing further development and investment in the stretchable electronics market. According to a WHO report, published in October 2024, around 62 million tons of e-waste were generated globally in 2022, becoming one of the fastest-growing solid waste sources worldwide. Among these, merely 22.3% were documented to be formally collected or recycled. It makes this sector appealing to industries and consumers, prioritizing eco-friendly solutions in crucial applications. These advanced flexible electronics can be an effective and sustainable alternative to traditional rigid electronics, creating a surge in this sector.

Extensive R&D projects are being released to discover new methods, applications, and materials to help manufacturers maintain their compliance while retaining their performance, propelling growth in the stretchable electronics market. For instance, in November 2023, Würth Elektronik launched a research project, HyPerStripes on improving the manufacturing process of flexible electronics for various uses. The researchers aimed to develop a technology platform, creating new manufacturing techniques for R2R processing, and methods of integrating electronic components into endless, flexible, and stretchable printed circuit boards. This was further estimated to be utilized to manufacture high-performance products while reducing the cost and environmental impact.

Key Stretchable Electronics Market Insights Summary:

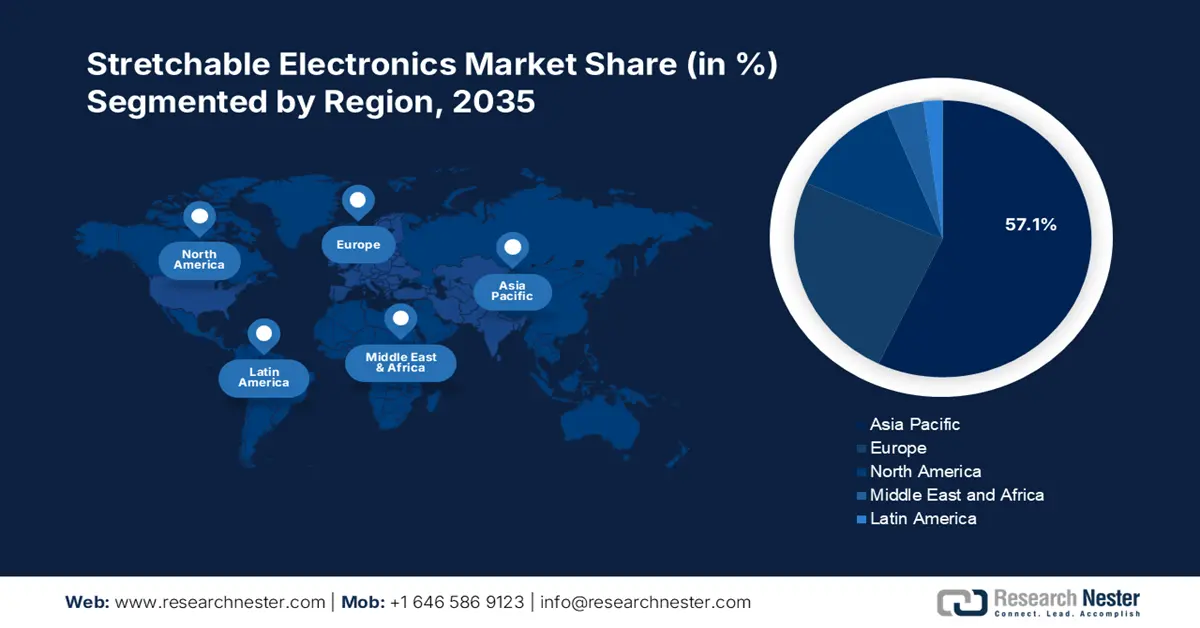

Regional Highlights:

- Asia Pacific commands a 57.1% share in the Stretchable Electronics Market, driven by economic development due to rapid industrialization, ensuring robust growth by 2035.

Segment Insights:

- The Stretchable Circuit segment is forecasted to achieve a significant share by 2035, propelled by global demand for printed circuit boards and sustainable electronics manufacturing.

- The Healthcare segment is forecasted to achieve an 85.7% share by 2035, driven by demand for smart medical devices like flexible biosensors.

Key Growth Trends:

- Government support for advancement

- Diverse applications across industries

Major Challenges:

- High pricing and lack of consumer acceptance

- Dependency on legacy systems

- Key Players: Forciot Ltd., RISE Acreo, Sri International, Avery Dennison Corporation, CAMBRIOS, Canatu Oy, GCell, Georgia Institute of Technology, Holst Centre, IMEC, MC10, Northwestern University, PowerFilm Solar Inc., Shimmer, DuPont., Touchcode, Verhaert New Products & Services NV, Apple Inc., NextFlex., Palo Alto Research Center Incorporated, FINELINE Circuits Limited., StretchSense., tacterion, Bainisha cvba, Leap Technology ApS.

Global Stretchable Electronics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 606.81 million

- 2026 Market Size: USD 744.43 million

- Projected Market Size: USD 5.74 billion by 2035

- Growth Forecasts: 25.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (57.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, South Korea, United States, Germany

- Emerging Countries: China, Japan, South Korea, India, Singapore

Last updated on : 13 August, 2025

Stretchable Electronics Market Growth Drivers and Challenges:

Growth Drivers

- Government support for advancement: Besides implementing environmental regulations, the governing bodies are proactively taking part in promoting adoption in the stretchable electronics market. Their initiatives and funding to accelerate the manufacturing and commercialization of these solutions have influenced leading electronic companies to participate in this sector. For instance, in January 2022, the government of India released a roadmap to achieve USD 300 billion in manufacturing capacity and global exports of sustainable electronics. The strategic plan includes broadening and deepening production through the PLI approach, aiming to transform India into a hub of electronics manufacturing.

- Diverse applications across industries: Offerings of the stretchable electronics market are capable of delivering multi-functional applications. This attracts investments from various industries including healthcare, consumer electronics, textile, automotive, robotics, and aerospace. Moreover, the trend of embedding smart features into products has increased the demand for such hybrid electronics. For instance, in June 2020, SEMI FlexTech collaborated with the U.S. Army Research Laboratory (ARL) to launch three projects aimed at maturing the flexible hybrid electronics (FHE) technology ecosystem. The company further funded USD 2.6 million for the projects, accelerating innovations and applications of sensors in healthcare, automotive, industrial, and defense.

Challenges

- High pricing and lack of consumer acceptance: Cost sensitivity among consumers can be a major setback behind less adoption in the stretchable electronics market. Volatility in material and component pricing and availability may heighten the prices of these electronics. Often complex and expensive production makes these solutions unreachable for the consumer from the cost-sensitive consumer electronics and mass-market applications, limiting sales and growth.

- Dependency on legacy systems: The complete penetration of products from the stretchable electronics market into the existing technological grid is still under process. Thus, legacy devices or systems may oppose the integration of these electronics due to their lack of compatibility with rigid components. A new approach to circuit design needs to be introduced to resolve these issues, which may not be profitable or faster for the production houses, preventing companies from participating.

Stretchable Electronics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

25.2% |

|

Base Year Market Size (2025) |

USD 606.81 million |

|

Forecast Year Market Size (2035) |

USD 5.74 billion |

|

Regional Scope |

|

Stretchable Electronics Market Segmentation:

Application (Healthcare, Consumer Electronics, Automotive Electronics, Aerospace & Defense)

By 2035, healthcare segment is expected to capture over 85.7% stretchable electronics market share. The comfort and flexibility of these electronics have made their place in a wide range of applications in the medical industry. They are now being heavily used to produce flexible biosensors and wearable health monitors due to the increasing demand for smart medical devices.

Thus, continuous investments from consumers in the digital health sector have subsequently fueled this segment. For instance, in July 2024, JMIR published a study report conducted on 23,974 participants in the U.S. about wearable ownership. The results revealed that 44.5% of them owned these devices, showcasing the growing awareness of their importance in clinical and public health.

Component (Electroactive Polymer, Stretchable Batteries, Stretchable Conductor, Photovoltaic, Stretchable Circuit)

In terms of components, the stretchable circuit segment is anticipated to capture a significant share of the stretchable electronics market by the end of 2035. Demand in this segment is driven by the growth of worldwide trade for printed circuit boards. According to the 2022 OEC data, the global market value of printed circuit boards reached USD 56.8 billion with top exporters being China, Chinese Taipei, South Korea, and Hong Kong.

With the shifting focus of these countries towards adopting sustainable options in manufacturing electronics, the demand for stretchable alternatives is increasing. For instance, in October 2021, Panasonic launched a new thermoset stretchable film, BEYOLEX for printed electronics, featuring softness, conformability, high-temperature resistance, and ultra-low permanent deformation after stretching.

Our in-depth analysis of the global stretchable electronics market includes the following segments:

|

Application |

|

|

Component |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Stretchable Electronics Market Regional Analysis:

APAC Market Statistics

By 2035, Asia Pacific stretchable electronics market is likely to dominate over 57.1% share. Economic development due to rapid industrialization, particularly in the automotive and consumer electronics sector is fueling demand in this field. According to the International Monetary Fund, with economic powerhouses such as China, Japan, India, and Australia, the Asia-Pacific region achieved approximately 4.6 % real GDP growth in 2023.

This further encourages the domestic electronic components supplier to elevate their technology. For instance, in November 2024, LG Display introduced world’s first stretchable display with 50% expansion ability, delivering a resolution of 100ppi and full red, green, and blue color. The 12-inch screen can be stretched up to 18 inches and is a milestone in the stretchable display national project of South Korea.

India, with its goal to become a global sustainable and efficient electronic supplier, is paving the path of development in the stretchable electronics market by involving in ongoing R&D projects. Research institutes are proactively taking part in strategic collaborations with the governing authorities to support the country’s goals. For instance, in May 2024, IIT Kanpur teamed with DRDO-Industry-Academia Centre of Excellence to bring development in defense technologies by innovating new printing methods and applications for flexible substrates.

South Korea is at the forefront of the stretchable electronics market due to its large manufacturing facilities and notable economic growth. The country makes a profitable landscape for global leaders due to its strong emphasis on consumer electronics. This is pushing domestic manufacturers to create new ways to cope with the rising demand by introducing innovative components. For instance, in June 2024, the joint-research team of DGIST-POSTECH developed next-generation impact-resistant stretchable electronic component, offering high mechanical stability.

North America Market Analysis

Advancement in technology is the major growth factor of the North America stretchable electronics market. The ongoing innovations are the key drivers in this region, making it one of the major suppliers of new technologies and materials. The collaborative efforts from private and research institutions to leverage the healthcare infrastructure are further fueling this sector. For instance, in March 2024, researchers at Stanford developed small stretchable integrated circuits for wearables and implantables. The compact and powerful circuit can drive a micro-LED screen and read thousands of sensors in a single square centimeter. This marks a significant achievement in monitoring health, diagnosing diseases, and providing opportunities for improved and autonomous treatments.

The U.S. is house to major discoveries and industry tycoons, making it a potential leader in the stretchable electronics market. Besides, the country is highly aware of the impact of electronic pollution and the importance of sustainable alternatives. This drives the researchers of the country to accelerate their progress in attaining new innovations with better performance and less environmental harm. For instance, in August 2024, a consortium of MIT, the University of Utah, and Meta developed a new flexible substrate material for flexible electronics to fight against e-waste. The material is capable of supporting scalable production of complex multilayered circuits while enabling the recyclability of materials and components.

Canada is also contributing to the development trail in the stretchable electronics market by introducing more effective and efficient electronic components. The continuous funding and research projects are now propelling the progress of the country in becoming a co-pilot of the U.S. in innovations. For instance, in November 2023, the Université de Sherbrooke launched a new R&D program in association with the new Umicore Research Chair in Semiconductor Nanomembranes and Flexible Optoelectronics. With a funding of USD 1.5 million over five years, the project aims to revolutionize optoelectronics and quantum applications by creating flexible and cost-effective electronics.

Key Stretchable Electronics Market Players:

- Forciot Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- RISE Acreo

- Sri International

- Avery Dennison Corporation

- CAMBRIOS

- Canatu Oy

- GCell

- Georgia Institute of Technology

- Holst Centre

- IMEC

- MC10, Northwestern University

- PowerFilm Solar Inc.

- Shimmer

- DuPont.

- Touchcode

- Verhaert New Products & Services NV

- Apple Inc.,

- NextFlex.

- Palo Alto Research Center Incorporated;

- FINELINE Circuits Limited.

- StretchSense.

- tacterion

- Bainisha cvba

- Leap Technology ApS

The global leaders in this market are now focusing on and putting in efforts to produce environment-friendly technologies to meet their sustainability goals. Along with the funding and supportive regulatory framework across regions, they are now introducing sustainable and advanced manufacturing methods and technologies to increase production and commercialization. For instance, in October 2022, Voltera launched a manufacturing platform, NOVA for printing flexible hybrid electronics. Its direct printing technology can print circuits on eco-friendly materials, such as biodegradable substrates and can align them to sub10-micron precision, causing less waste and material contamination. Such key players include:

Recent Developments

- In October 2024, DuPont signed a strategic cooperation agreement with Zhen Ding Technology Group to leverage its progress in PCB technology. The partners aim to work on enhancing applications, advancing cutting-edge R&D, improving material performance, and promoting sustainable development of the flexible electronics sector.

- In June 2024, NextFlex released a USD 5.3 million funding opportunity, Project Call 9.0 to fund projects for the development and adoption of hybrid electronics. The total project value is expected to reach USD 11.0 million strengthening U.S. electronics manufacturing and promoting commercialization by introducing advanced flexible electronics.

- Report ID: 6879

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Stretchable Electronics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.