Flexible Electronics Market Outlook:

Flexible Electronics Market size was over USD 34.76 billion in 2025 and is poised to exceed USD 96.93 billion by 2035, growing at over 10.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of flexible electronics is estimated at USD 38.14 billion.

The growth of the market can be attributed to the rising demand and production of OLED (Organic Light Emitting Diode) displays coupled with increasing use in the development of electronic circuits. According to recent statistics, the global RGB OLED panel production for mobile devices in 2022 reached about 30 square million meters. Furthermore, the increasing demand for flexible electronics has already witnessed various innovations such as mechanical design, material synthesis, and fabrication strategies. The use of stretchable electronic circuits is widely useful in the healthcare sector. Medical devices use these circuits in fitness trackers, device monitors, and skin patches to observe the slightest changes. The growing healthcare industry and digitalization adoption among people are also estimated to drive the growth of the market.

The global flexible electronics market is also projected to grow on the back of the increasing adoption of flexible electronics in the automotive industry as well as in defense. The use of thinner electronics on the substrate material helps reduce the vehicle’s weight and is considered a primary concern in the production of vehicles. Therefore, the growth of the automobile industry is anticipated to result in increased demand for flexible electronics in the market. According to recent statistics, worldwide automobile manufacturing is projected to reach 97 million units in the coming years, supported by rising global population levels and emerging market prosperity. The rising preference for lightweight vehicles among people to reduce fuel costs and increase the efficiency of the engine is anticipated to boost the market growth as per the market analysis.

Key Flexible Electronics Market Insights Summary:

Regional Highlights:

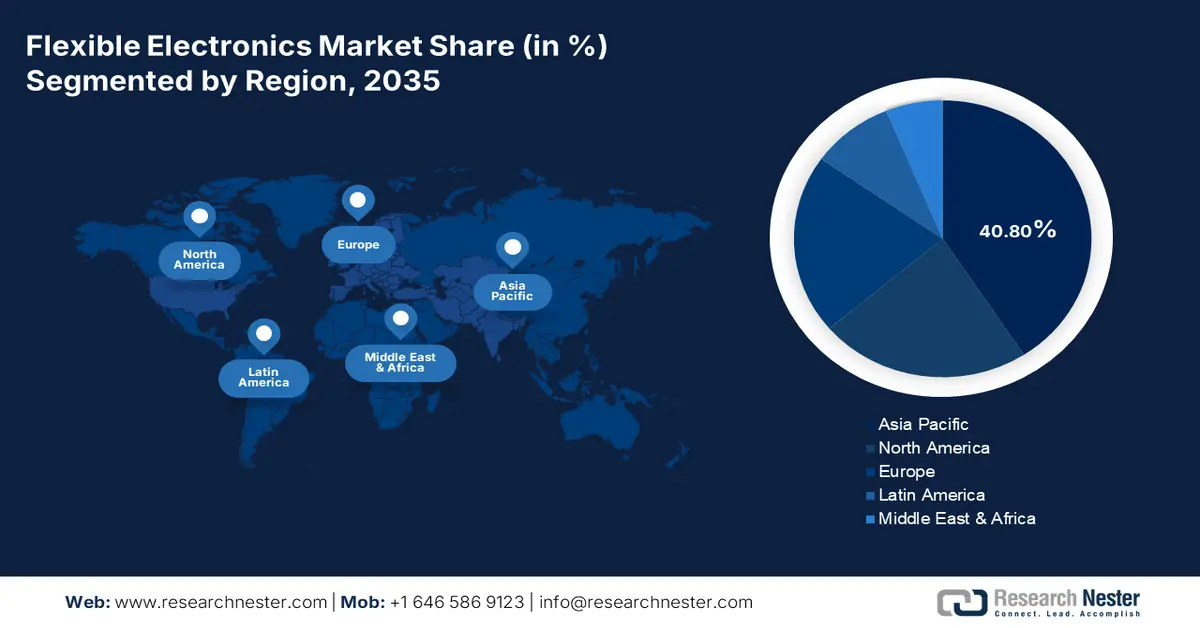

- Asia Pacific flexible electronics market is predicted to capture 40.8% share by 2035, driven by the rising consumer durable industry and increasing government support.

- Europe market will register significant growth during the forecast timeline, driven by increasing adoption of smartwatches and wearables in the region.

Segment Insights:

- The smartwatches & wearables segment in the flexible electronics market is anticipated to hold a significant share by 2035, driven by the growing demand for health-monitoring devices using flexible electronics.

- The stretchable displays segment in the flexible electronics market is expected to hold the largest share by 2035, driven by rising adoption of flexible displays in consumer electronics.

Key Growth Trends:

- Rising Trend of IoT Devices with Increasing Adoption of Electronics

- Increasing Adoption of Smartwatch and Wearables with Increasing Disposable Income

Major Challenges:

- High cost of Research

- Trained Workforce is Required for the Development of Operation

Key Players: LG Display Co., Ltd., Samsung Electronics, Innolux Corporation, AUO Corporation, Japan Display Inc., Sharp Corporation, BOE Technology Group Co., Ltd., Visionox Technology Inc., E Ink Holdings Inc., Corning Incorporated.

Global Flexible Electronics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 34.76 billion

- 2026 Market Size: USD 38.14 billion

- Projected Market Size: USD 96.93 billion by 2035

- Growth Forecasts: 10.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, South Korea, Germany

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 9 September, 2025

Flexible Electronics Market Growth Drivers and Challenges:

Growth Drivers

-

Rising Trend of IoT Devices with Increasing Adoption of Electronics – Flexible Electronics have many applications in health care including medical wearables and remote patient monitoring. The growth of the healthcare industry is anticipated to increase the demand for flexible electronics in the market. As per data by the India Brand Equity Foundation, the valuation of the Indian Healthcare sector is estimated to reach 372 billion by the end of 2022, up from USD 110 billion in 2016.

-

Government Support through Policy and Investments with Growing Internet Penetration - According to data from India Brand Equity Foundation, the Government of India had set a target of attracting investments of around USD 2.4 billion in the electronics manufacturing sector by 2021-22.

-

Increasing Adoption of Smartwatch and Wearables with Increasing Disposable Income – As per data, the number of wearable device users in the United States reached 86 million in 2019, up from 80 million in 2018.

-

Growth of the Consumer Electronics Industry Owing to Digitalization Around the World – According to data from the Indian Brand Equity Foundation, the appliance and consumer electronics industry in India was valued at around USD 9 billion in 2021 and is expected to reach a valuation of USD 21 billion by the end of 2025.

-

Rising Growth of the Healthcare Industry with Increasing Concern on Health – flexible electronics have many applications in health care including medical wearables and remote patient monitoring. The growth of the healthcare industry is anticipated to increase the demand for flexible electronics in the market. As per data by the India Brand Equity Foundation, the valuation of the Indian Healthcare sector was estimated to reach 372 billion by the end of 2022, up from USD 110 billion in 2016.

Challenges

-

High cost of Research - The cost of research in developing flexible electronics is expensive as it involves the study of various accepts. This includes data collection, practical possibilities, equipment, skilled professionals, and raw materials. All these require a huge investment in the research phase which hampers the growth of the Flexible Electronics Market.

-

Trained Workforce is Required for the Development of Operation

-

Less Awareness of the Benefits of flexible electronics in the Market

Flexible Electronics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.8% |

|

Base Year Market Size (2025) |

USD 34.76 billion |

|

Forecast Year Market Size (2035) |

USD 96.93 billion |

|

Regional Scope |

|

Flexible Electronics Market Segmentation:

Technology Segment Analysis

The global flexible electronics market is segmented and analyzed for demand and supply by technology into stretchable circuits, stretchable batteries, stretchable displays, and others. Out of these segments, the stretchable displays segment is anticipated to garner the largest market share over the forecast period, owing to the rising adoption of stretchable displays amongst electronic device manufacturers. Stretchable displays allow manufacturers to create a wide range of electronic products ranging from smartphone screens to television displays. As per recent data, global OLED panel production for television displays reached around 17 million square meters in 2022, up from 10 million square meters in 2021. Such a factor is therefore estimated to fuel the segment growth in the coming years. Stretchable displays can be folded, elongated, and twisted, unlike solid displays. This display can be attached to the skin. The display is made of silicon and polyurethane materials which is the same material used in the making of contact lenses.

Application Segment Analysis

The global flexible electronics market is also segmented and analyzed for demand and supply by application into smartphone & tablet, smartwatches & wearables, television & digital signage systems, pc monitors & laptops, electronic shelf labels, vehicles & public transports, and others. Amongst these segments, the smartwatches & wearables segment is expected to garner a significant share. Smartwatches and wearables are highly used regarding physical fitness and health tracking. Many people use smartwatches to track their physical activity, glucose levels, and blood pressure. Stretchable electronics such as smartwatch and wearable can monitor many symptoms of the body. These devices can read the temperature, pH level, humidity, glucose, and stress levels of a person wearing them. Many pharmaceutical companies have discovered insulin-tracking flexible electronics that can be worn by patients to continuously monitor glucose levels. Instead of pricking fingers for blood glucose detection, the needle inside these devices helps to track insulin levels without blood collection. It is estimated that more than 20% of Americans used smartwatches to track fitness.

Our in-depth analysis of the global market includes the following segments:

|

By Technology |

|

|

By Substrate Material |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Flexible Electronics Market Regional Analysis:

APAC Market Insights

Asia Pacific region is likely to hold over 40.8% market share by 2035. The growth of the market can be attributed majorly to the rising growth of the electronic consumer durable industry along with increasing government support. As per data by the India Brand Equity Foundation, in India production value of mobile devices in 2020 was around USD 30 billion. In addition, by the end of 2025, the Indian consumer electronics and appliances industry is estimated to become the fifth largest in the world. Apart from this, to set up various display fabs in this region, the government is planning to offer several incentive schemes to the manufacturers. Moreover, increased research and development expenditure and rising demand for high-quality displays are also estimated to result in the growth of the market in the region. As per data from the World Bank, China’s research and development expenditure in terms of gross domestic product was around 2.4% in 2020, up from 2.14% in 2018.

Europe Market Insights

Further, the market in Europe is estimated to gain significant growth during the forecast period, owing to the increasing adoption of smartwatches and wearables. For instance, in the United Kingdom, user penetration for smartwatches is around 5% in 2022, expected to reach 6% by 2027. Moreover, the rising demand for flexible display solution technology in countries such as UK, Spain, and Italy are estimated to boost the flexible electronics market growth in the region.

Flexible Electronics Market Players:

- LG Display Co., Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Samsung Electronics

- Innolux Corporation

- AUO Corporation

- Japan Display Inc.

- Sharp Corporation

- BOE Technology Group Co., Ltd.

- Visionox Technology Inc.

- E Ink Holdings Inc.

- Corning Incorporated

Recent Developments

-

LG Display Co., Ltd., the market leader and innovator in display technology, announced that LG Display will introduce its flexible OLED technology at CES 2022. Showcasing aims to characterize OLED screens and highlight the potential of OLED to create a new market.

-

Sharp Corporation, a Japanese multinational corporation that designs and manufactures electronic products, has developed a 30-inch 4K flexible OLED display in collaboration with the Japan Broadcasting Corporation. The color-filter-less OLED display features a 30-inch flexible film substrate and is the world's largest display of its kind

- Report ID: 4194

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Flexible Electronics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.