Stretch Sleeve & Shrink Sleeve Labels Market Outlook:

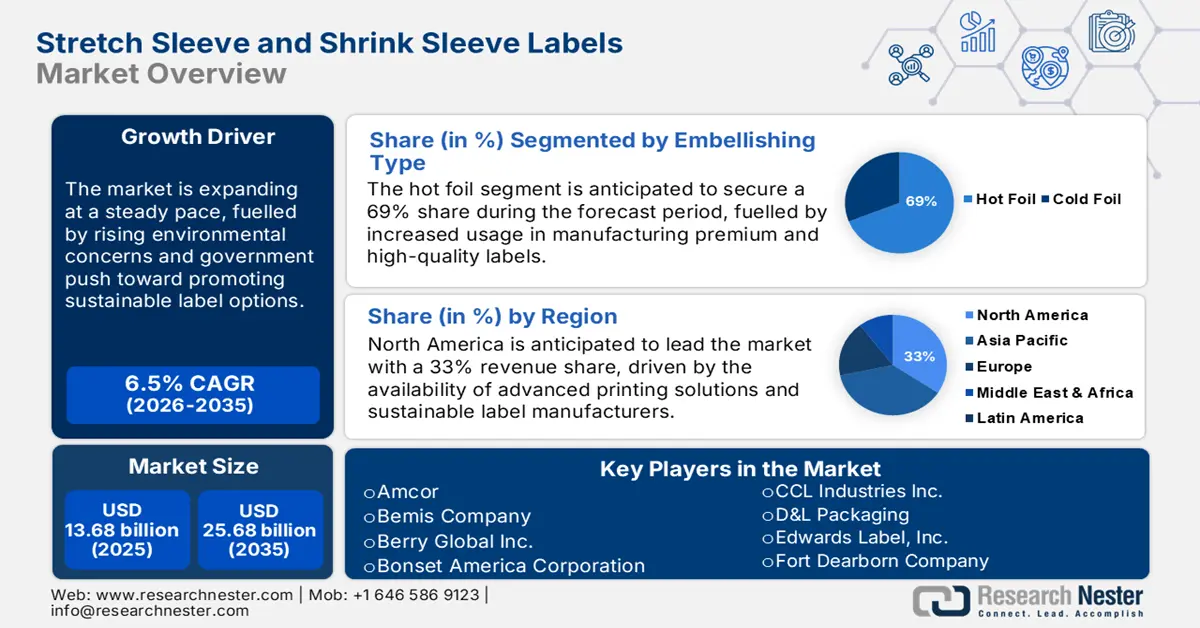

Stretch Sleeve & Shrink Sleeve Labels Market size was valued at USD 13.68 billion in 2025 and is set to exceed USD 25.68 billion by 2035, expanding at over 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of stretch sleeve & shrink sleeve labels is estimated at USD 14.48 billion.

The adoption of stretch sleeve & shrink sleeve labels is anticipated to rise significantly with increased demand for visually appealing and cost-effective labeling solutions. The opportunity for market growth lies in sustainable packaging solutions since many manufacturers are adopting environment-friendly raw materials and green processes for production. In January 2024, CCL Industries invested €50 million to open its new sustainable sleeve label hub in Dornbirn, Austria. The plant is one of the pioneer facilities designed to produce high-end, sustainable shrink sleeves based on state-of-the-art EcoFloat decoration technology. This underlines the commitment of the sector to sustainability and the rising regulatory pressures for environmentally friendly packaging solutions.

Investments from companies in advanced printing technologies are improving the appearance and functionality-related feature sets of labels. Moreover, government regulations related to packaging and labeling are also driving the market expansion. For instance, in 2022, the European Union passed new legislation that requires all types of packaging, including labeling, to be composed of recyclable material. As such, stretch sleeve & shrink sleeve label manufacturers have incorporated more sustainable label materials.

Key Stretch Sleeve and Shrink Sleeve Labels Market Insights Summary:

Regional Highlights:

- The North America stretch sleeve & shrink sleeve labels market will account for 33% share by 2035, driven by adoption of advanced printing technologies and sustainability concerns.

Segment Insights:

- The hot foil segment in the stretch sleeve & shrink sleeve labels market is projected to achieve lucrative growth till 2035, supported by its ability to add a luxurious, high-quality finish to labels, especially in premium products.

- The soft drinks segment in the stretch sleeve & shrink sleeve labels market is expected to achieve significant growth till 2035, driven by increasing demand for attractively designed and robust labels suitable for transportation.

Key Growth Trends:

- Growing demand for green packaging solutions

- Advances in labeling technologies

Major Challenges:

- Competition from other alternative solutions for labeling

Key Players: Amcor, Bemis Company, Berry Global Inc., Bonset America Corporation, CCL Industries Inc., D&L Packaging, Edwards Label, Inc., and Fort Dearborn Company.

Global Stretch Sleeve and Shrink Sleeve Labels Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 13.68 billion

- 2026 Market Size: USD 14.48 billion

- Projected Market Size: USD 25.68 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 18 September, 2025

Stretch Sleeve & Shrink Sleeve Labels Market Growth Drivers and Challenges:

Growth Drivers:

-

Growing demand for green packaging solutions: Key issues, such as environmental concerns and demand for sustainable packaging, are preferring growth in the market for stretch sleeve & shrink sleeve labels. In April 2024, Nestlé USA pledged to launch 100% recyclable, shrink-sleeve labels made with light-blocking print technology across its Nesquick ready-to-drink portfolio with the main goal of making bottle recycling easier within the U.S. stream. This swing toward sustainability is then anticipated to spur the growth of the market as more and more companies come into line with consumer preferences in relation to packaging strategies.

- Advances in labeling technologies: The capabilities of stretch sleeve & shrink sleeve labels are being enhanced exponentially by innovative technologies. State-of-the-art printing technologies allow for high-definition graphics and complex designs that easily draw the attention of consumers, giving brands an added advantage in distinction. Developments such as these encourage progressively more companies to use stretch and shrink sleeve labels, growing the market consequently.

- Growth in the beverage sector: The beverage industry is growing radically, especially in developing countries. This development, in turn, accelerates the growth in demand for stretch sleeve & shrink sleeve labels. Labels of this nature are most preferred for packaging containers with beverages because they have a high level of resistance to durability and moisture. Moreover, driven by the rising interest of consumers retrospectively in premium beverages and products, the market is touted to witness stable growth momentum throughout the forecast period.

Challenges:

- Compliance, regulatory, and environmental issues: There are huge challenges to meeting all the regulatory requirements that the stretch sleeve & shrink sleeve labels market needs to adhere to, especially where environmental sustainability is concerned. More and more countries are compelling companies to meet stricter regulations related to using plastics and non-recyclable materials. In March 2023, the European Union declared that from 2025, all labels must contain at least 30% of recycled matter. This drives the industry towards sustainability; however, this creates compliance and cost problems for manufacturers.

- Competition from other alternative solutions for labeling: The stretch sleeve & shrink sleeve labels market strongly competes with other solutions for labeling, including pressure-sensitive and in-mold labels. Available options offer similar benefits to the stretch and shrink sleeve label types. Hence, they are mostly preferred over the latter in some applications due to their ease of application and relatively lower cost. The stretch and shrink sleeve label manufacturing companies are still challenged with continuous innovation to help differentiate their products to sustain each firm's respective market share.

Stretch Sleeve & Shrink Sleeve Labels Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 13.68 billion |

|

Forecast Year Market Size (2035) |

USD 25.68 billion |

|

Regional Scope |

|

Stretch Sleeve & Shrink Sleeve Labels Market Segmentation:

Polymer Film Segment Analysis

The polyvinyl chloride (PVC) segment in the stretch sleeve & shrink sleeve labels market is anticipated to hold the largest revenue share during the forecast period. This is attributed to its cost-effective, hard-wearing properties, and outstanding printability that make this material most preferred for several labeling applications. In addition, flexibility combined with resistance against moisture and strong resistance to chemicals makes PVC a very useful material in food and beverage industries where long-lasting labels are a necessity. Furthermore, in March 2024, Klockner Pentaplast, launched a new line of PVC shrink sleeve films that deliver augmented environmental performance, thus showing the continuous improvements being made in this area.

Embellishing Type Segment Analysis

The hot foil segment is projected to maintain its leading position in the embellishing type category, with a market share of 69% by 2035. The segment's growth is driven by its ability to add a luxurious, high-quality finish to labels, which is increasingly sought after in premium product markets like cosmetics and spirits. Several players in the industry are shifting to new eco-friendly rupturing series for hot foils made with sustainable materials as demand increases for environmentally responsible packaging.

Application Segment Analysis

In the application segment, the soft drinks category will dominate the market with a 27% share by 2035. The segment's strength is fueled by increasing demand for attractively designed and robust labels to withstand all odds during transportation and storage. Shrink sleeve labels provide 360-degree branding that makes them suitable for the competitive soft drink market. This growing need for functional and flavored beverages also fuels the demand for new labeling solutions. In March 2024, Coca-Cola introduced a new range of beverages that included shrink sleeve labels on its bottle design, with dynamic and interactive designs that give prominence to the growth potential in the segment. In March 2024, Coca-Cola launched a new line of beverages featuring on its bottle design shrink-sleeve labels with dynamic and interactive designs that emphasized the growth potential in the segment.

Our in-depth analysis of the stretch sleeve & shrink sleeve labels Market includes the following segments:

|

Polymer Film

|

|

|

Embellishing Type |

|

|

Application |

|

|

Printing Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Stretch Sleeve & Shrink Sleeve Labels Market Regional Analysis:

North America Market Insights

North America industry is predicted to dominate majority revenue share of 33% by 2035. Digital printing and rotogravure are some major advanced printing technologies that seem to be adopted rapidly for producing high-quality, customized sleeve labels. Again, growing concerns regarding sustainability in packaging are impelling North America’s manufacturers to replace their raw materials used for sleeve labels with biodegradable and recyclable material resources.

Another key driver of the market is the surge in growth of the food and beverage industry across the United States. As per the U.S. Department of Commerce, food and beverage manufacturing plants witnessed an increase in sales by 16.8% in 2021. Key players invest in advanced printing technologies and extend production capacities in response to growing demand in the U.S. market.

Canada’s market is also expected to rise steadily till 2035, powered by increasing demand for ecological innovation concerning packaging. Some manufacturers are thus involved in the development of eco-friendly stretch sleeve labels made with recycled material. Government initiatives in Canada for promoting enhancement in the use of circular economy strategies and reducing plastic waste further support the growth of stretch sleeve & shrink sleeve labels in the country.

Asia Pacific Market Insights

Asia Pacific is also projected to provide potential growth opportunities in the stretch sleeve & shrink sleeve labels market. Rapid industrialization and urbanization in countries like India, China, and Japan back a demand push for such labeling solutions from end-use industries. Prominent end user industries driving the market include food and beverages, personal care, and consumer electronics. Companies based in the region are investing in the latest printing technologies and materials to offer customized, high-quality sleeve labels.

In March 2022, Uflex introduced improved durability and printability shrink sleeve labels targeting the growing packaged food and cosmetics sectors in India. Governments are also playing their part in this growth of the stretch sleeve & shrink sleeve labels market. For instance, the campaign of the Indian government, "Make in India," was a domestic manufacturing initiative that gained heaps of support and incentives to packaging companies for investing in new technologies and increasing production capacities.

Stretch Sleeve & Shrink Sleeve Labels Market Players:

- Amcor

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bemis Company

- Berry Global Inc.

- Bonset America Corporation

- CCL Industries Inc.

- D&L Packaging

- Edwards Label, Inc.

- Fort Dearborn Company

- Huhtamaki Oyj

- Klockner Pentaplast

- Macfarlane Group plc

- Polysack Flexible Packaging Ltd.

- The Dow Chemical Company

- Westrock Company

The global stretch sleeve & shrink sleeve labels market is fragmented with several players established in the market. Some key players in this industry are Multi-Color Corporation, Fort Dearborn Company, Inland Packaging, Fuji Seal International, Constantia Flexibles, CCL Industries, and Macfarlane Group. These companies thus come up with innovative products and develop a market niche; they continuously fund research and development. Regional players intensify the competitive environment by easily justifying specific demand locally through customized solutions.

In August 2022, Constantia Flexibles acquired FFP Packaging Solutions. This strategic acquisition did much to build on the positioning of Constantia within the UK market through the expansion of its products for more sustainable or circular packaging solutions. FFP Packaging Solutions has a thorough knowledge of recyclable and compostable films; the growing demand for environmentally friendly means of packaging can be well placed with this. This transaction will likely further boost Constantia's capability in the production of stretch and shrink sleeve labels in an eco-friendly way. This could potentially change the competitive landscape over the next few years.

Here are some leading players in the stretch sleeve & shrink sleeve labels market:

Recent Developments

- In April 2024, Berry Global Inc. announced that the company would cut virgin plastic use by 30% come 2026 and by 40% in 2028; the company will begin producing its shrink sleeve labels from post-consumer recycled (PCR) plastic this April.

- In October 2023, NATIVIA PLA labels were launched by Taghleef Industries, including bio-based adhesives and inks for compostable fruit bands, in a drive to keep organic waste free of contaminants.

- In February 2023, CCL Industries launched the brand-new, ultra-thin stretch sleeve labeling material, measuring 30 microns instead of its existing 35-micron stock, for in-house design returnable 1-liter polyethylene terephthalate bottles.

- Report ID: 6345

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Stretch Sleeve and Shrink Sleeve Labels Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.