Streaming Devices Market Outlook:

Streaming Devices Market size was over USD 17.59 billion in 2025 and is projected to reach USD 61.31 billion by 2035, growing at around 13.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of streaming devices is assessed at USD 19.7 billion.

Streaming devices are modern-day sources of entertainment and communications. The growing easy and seamless accessibility to internet services worldwide is significantly augmenting streaming device sales. The global expansion of broadband internet infrastructure coupled with the rollout of the 5G network and advanced cloud platforms makes content streaming faster and of high quality. The World Broadband Association estimates that the integration of artificial intelligence is substantially transforming broadband and cloud solutions performance.

According to the Broadband and Cloud Development Index (BCDI) report by the World Broadband Association, in Q1FY24, over 1 billion fiber broadband subscriptions were totaled for the 62 countries included in the report. Fiber subscriptions increased from 49% in 2022 to 53% by 2023, making it a dominant broadband technology for streaming movies and playing online games. The U.K. is one of the major European countries with above-average broadband scores and Egypt, followed by South Africa and Nigeria with above-average cloud scores. In Egypt, the fixed broadband penetration is around 40%. Furthermore, Oman, Romania, Brazil, China, and Slovakia are some other countries with high broadband coverage and adoption. Thus, the analysis suggests that streaming device manufacturers have a profitable scope in Africa and Europe.

Key Streaming Devices Market Insights Summary:

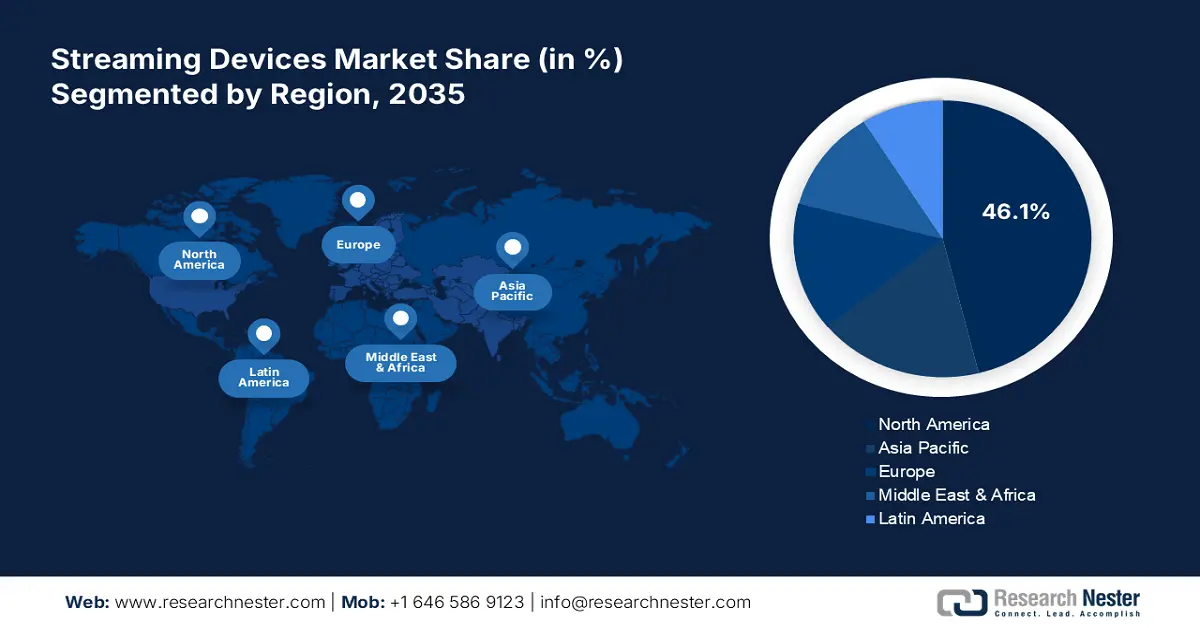

Regional Highlights:

- North America leads the streaming devices market with a 46.1% share, fueled by the high adoption of smart home solutions through 2026–2035.

- The Asia Pacific Streaming Devices Market is rapidly expanding through 2035, driven by increasing investments in broadband infrastructure, growing popularity of smart TVs, and high admiration of OTT platforms.

Segment Insights:

- The TV Streaming Devices segment is expected to hold a dominant market share by 2035, fueled by the rising adoption of smart TVs and easy availability of the Internet.

- The Low-range Streaming Devices segment of the Streaming Devices Market is expected to capture a 51.90% share by 2035, fueled by the budget-conscious mindset of customers in price-sensitive markets.

Key Growth Trends:

- Integration of advanced technologies

- Rise in gaming and OTT platforms

Major Challenges:

- Intense Competition

- Privacy and data security concerns

Key Players: Roku Inc., Apple, Inc., Philips Electronics, and Amazon.com, Inc.

Global Streaming Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 17.59 billion

- 2026 Market Size: USD 19.7 billion

- Projected Market Size: USD 61.31 billion by 2035

- Growth Forecasts: 13.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (46.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, South Korea, Germany

- Emerging Countries: China, Japan, South Korea, India, Singapore

Last updated on : 14 August, 2025

Streaming Devices Market Growth Drivers and Challenges:

Growth Drivers

-

Integration of advanced technologies: The continuous advancements in streaming devices such as the integration of artificial intelligence, machine learning, and feature-rich technologies such as Dolby Vision and Dolby Atmos are augmenting the sales of advanced streaming devices. AI & ML algorithms effectively translate languages and make live streaming more accessible and visible to a larger audience base. To maintain these features and drive innovations, key players are investing heavily in research and development activities. For instance, in August 2024, Google LLC announced the launch of a new Google TV streamer. This next-gen AI-powered streaming device offers a personalized and smart home experience to users. Google uses its self-innovated generative AI tool Gemini to boost the productivity of its new streamer device.

-

Rise in gaming and OTT platforms: The rising popularity of over-the-top (OTT) platforms such as Netflix, Hulu, Disney+ Hotstar, and Amazon Prime Video is expanding the use of modern streaming devices. These devices seamlessly connect with smart TVs making the content-watching experience more realistic. For instance, the number of OTT video users is anticipated to reach over 4.9 billion by 2029. The OTT user penetration is set to increase from 50.6% in 2024 to 61.1% by 2029. Furthermore, the admiration of live gaming and augmented/virtual reality streaming is booming the adoption of next-gen streaming solutions. There are more than 2.5 billion gamers and gaming title holders around the globe. Many content creators with millions of subscribers stream live gaming on platforms such as YouTube and Facebook with the help of modern streaming tools and devices. This interactive content trend is thriving in the profit revenues of streaming devices market.

Challenges

- Intense Competition: Increasing competitiveness is one of the major challenges for streaming device manufacturers. The strong presence of industry giants and the continuous emergence of start-ups is creating a price war. Key market players are necessitated to offer high-quality services at lower prices, hampering their revenue growth. Thus, reduced profitability and high competition are hindering the streaming devices market growth to some extent.

- Privacy and data security concerns: Streaming devices with advanced technologies are able to collect data based on viewing habits and preferences. These devices when installed in a smart home ecosystem, where all systems are interconnected, create an open-door data theft opportunity for cyber attackers. Thus, the high privacy issues and data breach concerns can hamper the overall streaming devices market growth.

Streaming Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

13.3% |

|

Base Year Market Size (2025) |

USD 17.59 billion |

|

Forecast Year Market Size (2035) |

USD 61.31 billion |

|

Regional Scope |

|

Streaming Devices Market Segmentation:

Price Range (Low-Range, Medium-Range, High-Range)

Low-range segment is expected to account for streaming devices market share of around 51.9% by 2035. The high-potential economies such as Latin America and Asia Pacific are more opportunistic marketplaces for low-range streaming device manufacturers. Key players employ competitive pricing strategies to expand their product offerings in these markets. The budget-conscious mindset of customers in these price-sensitive markets is a vital aspect driving the sales of low-range streaming devices. Streaming services such as OTT platforms are becoming more integral to entertainment consumers increasingly look for affordable ways to access these platforms and low-range streaming devices are effective entry points without high investments.

Application (TV, Gaming Consoles, Others)

The TV segment is anticipated to hold a dominant streaming devices market share throughout the forecast period. The rising adoption of smart TVs is directly fueling the sales of streaming devices, globally. The easy and cost-effective availability of the Internet in the majority of countries is also augmenting the adoption of streaming devices and tools. The Federal Trade Commission reveals that over 40% of U.S. homes have smart TVs installed and more than 90 million people have subscribed to OTT platforms. The penetration rate of smart TV sets increased to 75% in the U.K. and in Germany, all TVs sold were of the Smart category in 2023, respectively. Thus, the continuous rise in the adoption rate of connected TVs is set to uplift the revenue growth of streaming device producers in the coming years.

Our in-depth analysis of the global streaming devices market includes the following segments:

|

Component |

|

|

Sales Channel |

|

|

Price Range |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Streaming Devices Market Regional Analysis:

North America Market Forecast

By 2035, North America streaming devices market is set to hold more than 46.1% revenue share. The high adoption of smart home solutions and the presence of key market players is majorly driving the sales of streaming devices. The increasing dominance of media streaming platforms such as Amazon Prime, Hulu, and Netflix is also fueling the adoption of streaming solutions.

In the U.S., more than 50% of homes are installed with streaming devices, reveals the Energy Information Administration. On an average basis, around 79.0% of U.S. individuals own smart TVs. Such an increasing penetration of smart home systems makes the U.S. a potential market for streaming device manufacturers.

Individuals in Canada spend over 10 hours a week watching streaming content and over 90% of people stream content online. Netflix and YouTube are the most popular streaming services in Canada and adults between 25 to 34 age group highly invest in streaming services. Thus, the rising popularity of various media platforms is fueling the sales of streaming devices in the country.

Asia Pacific Market Statistics

In Asia Pacific, the sales of streaming devices market are set to expand at the fastest pace during the anticipated period. The increasing investments in broadband infrastructure development, the growing popularity of smart TVs, and the high admiration of OTT platforms are fueling the streaming devices market growth in the region. India and China are the most profitable marketplaces for streaming device manufacturers followed by Japan and South Korea.

In India, the entertainment and media industry is projected to expand at 9.7% annually in revenue terms and reach USD 73.6 billion by 2027. The Indian video OTT market dominated by service providers such as Amazon Prime, Disney+ Hotstar, and Netflix is expected to double and reach USD 3.5 billion by 2027, according to the India Brand Equity Foundation. These statistics highlight that the increasing demand for media and entertainment services is poised to boost the adoption of modern streaming devices in the coming years.

The rapidly advancing digital infrastructure, the cost-effective availability of streaming ecosystems, and the rising popularity of Chinese drama are generating profitable opportunities for streaming device producers in China. The China video streaming market was valued at USD 22.0 billion in 2024. This underscores that the rising popularity of streaming media content is set to directly fuel the sales of streaming devices and tools in the coming years.

Key Streaming Devices Market Players:

- Roku Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Apple, Inc.

- Philips Electronics

- Amazon.com, Inc.

- Huawei Technologies CO., Ltd

- HiMedia Technology

- Arris Group Inc.

- D-Link Corporation

- Google, Inc.

- Cox Communications

Key players in the streaming devices market are employing several organic and inorganic tactics to earn high profits. They are investing in research and development activities to enhance the features of streaming devices. Leading companies are collaborating with other players to reach a wider consumer base by developing next-gen streaming devices. Mergers and acquisition strategies are also helping them expand their product offerings. Furthermore, regional expansion moves are expected to open new streams to maximize their revenue shares.

Some of the key players include:

Recent Developments

- In October 2024, Cox Communications announced the launch of Xumo Stream Box a next-gen voice-activated streaming device for internet users. The voice remote with the streaming box makes the content search easy and smooth.

- In September 2024, Roku, Inc. revealed the launch of a new Roku Ultra streaming box with fast performance and cinematic Dolby Vision & Atmos. This streaming box is powered by advanced machine learning technology.

- Report ID: 6780

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Streaming Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.