Pressure Sensitive Tapes Market Outlook:

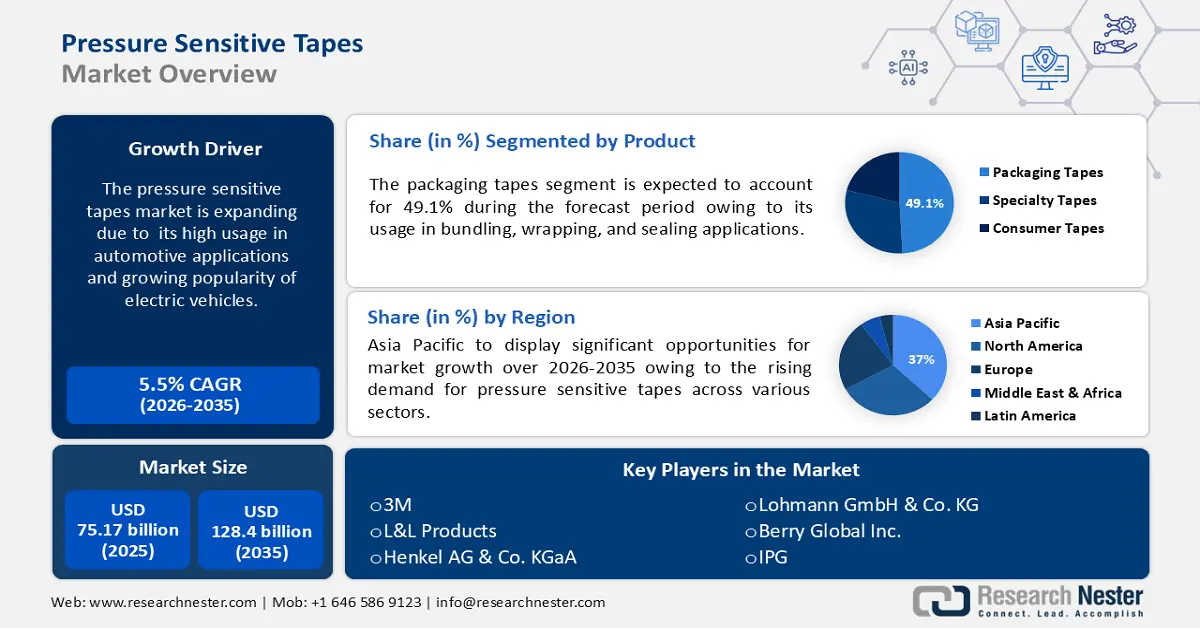

Pressure Sensitive Tapes Market size was valued at USD 75.17 billion in 2025 and is set to exceed USD 128.4 billion by 2035, registering over 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of pressure sensitive tapes is estimated at USD 78.89 billion.

The pressure sensitive tapes market is expanding due to its high usage in automotive applications and growing popularity of electric vehicles worldwide. Pressure sensitive tapes are used in car batteries to prevent thermal runaway and link cells to one another. These tapes help to increase fuel efficiency due to their low weight and transparent surfaces and enhance the visual appeal of the vehicles.

Key Pressure Sensitive Tapes Market Insights Summary:

Regional Highlights:

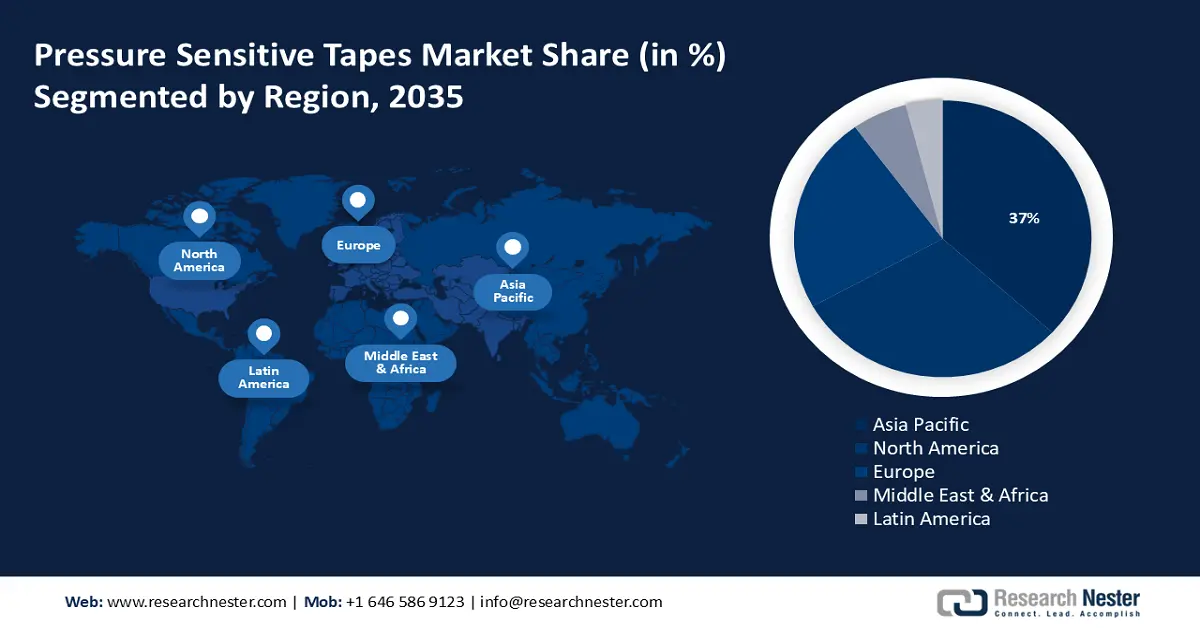

- The Asia Pacific pressure sensitive tapes market achieves a 37% share by 2035, driven by the rising demand from the packaging sector.

Segment Insights:

- The packaging tapes segment in the pressure sensitive tapes market is expected to experience robust growth till 2035, driven by the growing use in bundling, wrapping, and sealing applications.

- The hot melt segment in the pressure sensitive tapes market is projected to achieve significant growth till 2035, attributed to its rising demand in aerospace and automotive bonding.

Key Growth Trends:

- Growth of the label industry

- Growing need for bio-based pressure-sensitive adhesives

Major Challenges:

- Expensive prices

- Raw materials derived from petroleum

Key Players: Tesa Tapes Private Limited, L&L Products, Henkel AG & Co. KGaA, Lohmann GmbH & Co. KG, Berry Global Inc., IPG, AVERY DENNISON CORPORATION, Ahlstrom, HB Fuller Company.

Global Pressure Sensitive Tapes Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 75.17 billion

- 2026 Market Size: USD 78.89 billion

- Projected Market Size: USD 128.4 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 17 September, 2025

Pressure Sensitive Tapes Market Growth Drivers and Challenges:

Growth Drivers

- Growth of the label industry: The increasing use of these tapes in sectors such as construction and automotive is driving the pressure sensitive tapes market growth. This expansion is fueled by rising international trade and robust packaging with the increasing e-commerce and the retail industry. Pressure-sensitive tapes are in high demand due to the growing labeling sector. Continuous research in developing eco-friendly and renewable tape materials is also anticipated to support market expansion.

- Growing need for bio-based pressure-sensitive adhesives: The pressure-sensitive tapes market is expected to witness significant growth due to the rising need for sustainable and bio-based equipment in the global construction sectors. Plant-based resources are used as raw materials in developing bio-based pressure-sensitive tapes. Bio-based pressure sensitive adhesives are considered to decrease CO2 emissions compared to traditional petroleum-based formulations.

- Rising demand for pressure sensitive tapes in the packaging sector: The packaging industry makes considerable use of pressure-sensitive adhesive tape. This tape, for instance, is used to package boxes that hold fragile goods. These tapes are durable and safer during transit. Additionally, this type of tape can be combined with other solvent-based pressure-sensitive adhesive tapes to create an airtight seal in containers.

Challenges

- Expensive prices: The pricing dynamics play a crucial role in determining the cost structures of products. The price volatility is due to increasing global demand, geopolitical upheaval in oil-producing regions, and market speculation. Such unpredictability and price fluctuations have far-reaching effects that affect the pressure sensitive adhesives market's growth trajectory.

- Raw materials derived from petroleum: Rubber, acrylic, silicone, and additives are just a handful of the raw ingredients used in pressure-sensitive adhesives. Majority of these raw materials are derivatives derived from petroleum, making them vulnerable to changes. This is a key factor that can hamper overall pressure sensitive tapes market growth going ahead.

Pressure Sensitive Tapes Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 75.17 billion |

|

Forecast Year Market Size (2035) |

USD 128.4 billion |

|

Regional Scope |

|

Pressure Sensitive Tapes Market Segmentation:

Product Segment Analysis

The packaging tapes segment is poised to capture about 49.1% pressure sensitive tapes market share by the end of 2035. The growing use of packaging tapes in bundling, wrapping, sealing, and enclosing applications is expected to fuel demand for these tapes. These tapes are utilized in the packaging of consumer and industrial items, construction transit packaging, pharmaceutical delivery systems, electronics and electrical gadgets, and hygiene and medical products. Segment expansion is anticipated to be aided by the growing usage of packaging tapes, including polypropylene tapes, in various applications, such as transportation, cartons, warehousing, and logistics.

Technology Segment Analysis

Hot melt segment is expected to dominate pressure sensitive tapes market share of around 40.7% by the end of 2035 owing to its rising demand in the bonding and mounting of components in the aerospace and automotive industries. Furthermore, the segment growth is driven by the rising focus on sustainability in the packaging sector. For example, in April 2023, Dow and Avery Dennison collaborated to develop a novel and environmentally friendly hotmelt label adhesive solution that allows polypropylene or polyethylene (PP/PE) packaging and polyolefin film labels to be mechanically recycled in the same stream.

Our in-depth analysis of the pressure sensitive tapes market includes the following segments:

|

Product |

|

|

Technology |

|

|

Backing Material |

|

|

Adhesive Chemistry |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Pressure Sensitive Tapes Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is set to dominate majority revenue share of 37% by 2035. The demand for tapes is positively impacted due to rising demand for pressure sensitive tapes across various sectors and increasing investments by manufacturers to develop and launch enhanced, eco-friendly, and durable products. Asia Pacific is world's largest manufacturing hub with strong demand for sticky tapes in packaging and labeling business. Rising demand from the packaging sector is a key factor fueling market growth in this region.

The market is rapidly growing in China due to the significant expansion of end user industries such as healthcare, e-commerce, and automobiles. It is anticipated that growing disposable incomes will increase demand for automobiles and online shopping which will support the market for pressure-sensitive tapes in China.

The automobile industry in Japan is one of the biggest sectors worldwide. Pressure sensitive tape applications in the automotive industry are likely to fuel the market's growth here. These applications include bonding, noise reduction, and surface protection. Japan’s automobile sector is expanding steadily, with a rise in two-wheelers, passenger cars, and commercial vehicles.

North America Market Insights

North America will encounter huge growth in the pressure sensitive tapes market during the forecast period owing to increasing building and construction activities in many parts of this region. These tapes work better than mechanical fasteners and are perfect for connecting architectural panels as they can withstand wind loads in Canada's shifting climate. Franklin Adhesives & Polymers, an American firm, introduced Covinax 625 in April 2024. It is an emulsion pressure-sensitive adhesive that is designed to be versatile and work well in a range of durable label and tape applications.

The expansion of packaging materials in the e-commerce industry is increasing demand for pressure-sensitive tapes in the U.S. The pressure sensitive tapes play a key role in keeping the shipments and goods secure during transit. In addition, the government’s focus on infrastructural developments and increasing investing in building projects is expected to enhance the sales of pressure sensitive tapes.

Pressure Sensitive Tapes Market Players:

- 3M

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Tesa Tapes Private Limited

- L&L Products

- Henkel AG & Co. KGaA

- Lohmann GmbH & Co. KG

- Berry Global Inc.

- IPG

- AVERY DENNISON CORPORATION

- Ahlstrom

- HB Fuller Company

The pressure sensitive tapes market is quite fragmented, consisting of key players operating at global and regional levels. The key players are focused on developing novel products, including eco-friendly tapes and expanding their production capacities to cater to the rising demand. These players are adopting several strategic alliances such as mergers and acquisitions, partnerships, license agreements and product launches to expand their product offerings and retain their market position. Here is a list of key players operating in the global pressure sensitive tapes market.

Recent Developments

- In September 2023, Henkel launched a new mineral oil-free hot melt tape called Technomelt PS 3500. This tape helps the label industry reduce the waste and weight of liner-less label solutions, improve container recycling and waste disposal.

- In June 2023, Ahlstrom introduced Acti-V Industrial RF Brown and Acti-V Industrial RF Natural to expand their selection of Acti-V Industrial release liners. The new Acti-V Industrial RF Natural uses a different blend of raw materials and does not require any dye, which might reduce the carbon footprint of the product overall by 17%–20% compared to normal Acti-W Industrial liners.

- Report ID: 6323

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Pressure Sensitive Tapes Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.