Steviol Glycoside Market Outlook:

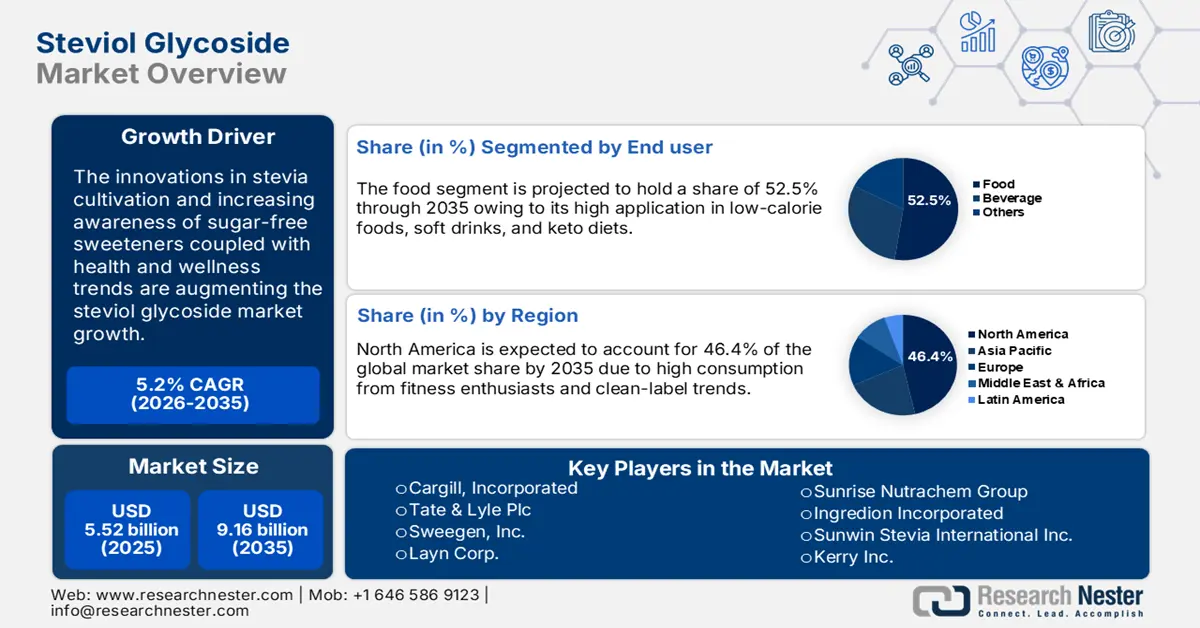

Steviol Glycoside Market size was over USD 5.52 billion in 2025 and is projected to reach USD 9.16 billion by 2035, growing at around 5.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of steviol glycoside is evaluated at USD 5.78 billion.

The health-conscious trend is a significant driver for the sales of steviol glycosides particularly, in high-potential economies such as Asia Pacific, Latin America, and the MEA. The rise in the modern retail channels is boasting the trade of glycosides at large. For instance, as per the analysis by the Observatory of Economic Complexity (OEC), glycosides were the 794th most traded global product with around USD 1.89 billion in trade. The glycosides trade expanded by 4.01% between 2021 and 2022. China and the U.S. ranked as the top exporters and importers of glycosides in 2022, respectively.

|

Country |

Glycoside Value in Exports (USD Million) |

Country |

Glycoside Value in Imports (USD Million) |

|

China |

1020 |

United States |

383 |

|

France |

171 |

Hong Kong |

185 |

|

Malaysia |

83.4 |

France |

110 |

|

Spain |

76.9 |

India |

100 |

|

Chile |

48.5 |

Russia |

74.7 |

Source: OEC World

The product complexity index (PCI) of glycosides was ranked 533rd in 2o22 and the market concentration using Shannon Entropy totaled 2.99, determining the export dominance of 7 countries. The study also elaborates that India is the most opportunistic market for glycosides with an export gap of USD 26 million and an import gap of USD 1.97 million. The relative relatedness of glycosides in India is around 3.22. The gross glycoside product export growth amounted to USD 444.0 million in 2022. Collectively it can be understood that emerging economies are win-win marketplaces for glycoside producers.

Key Steviol Glycoside Market Insights Summary:

Regional Highlights:

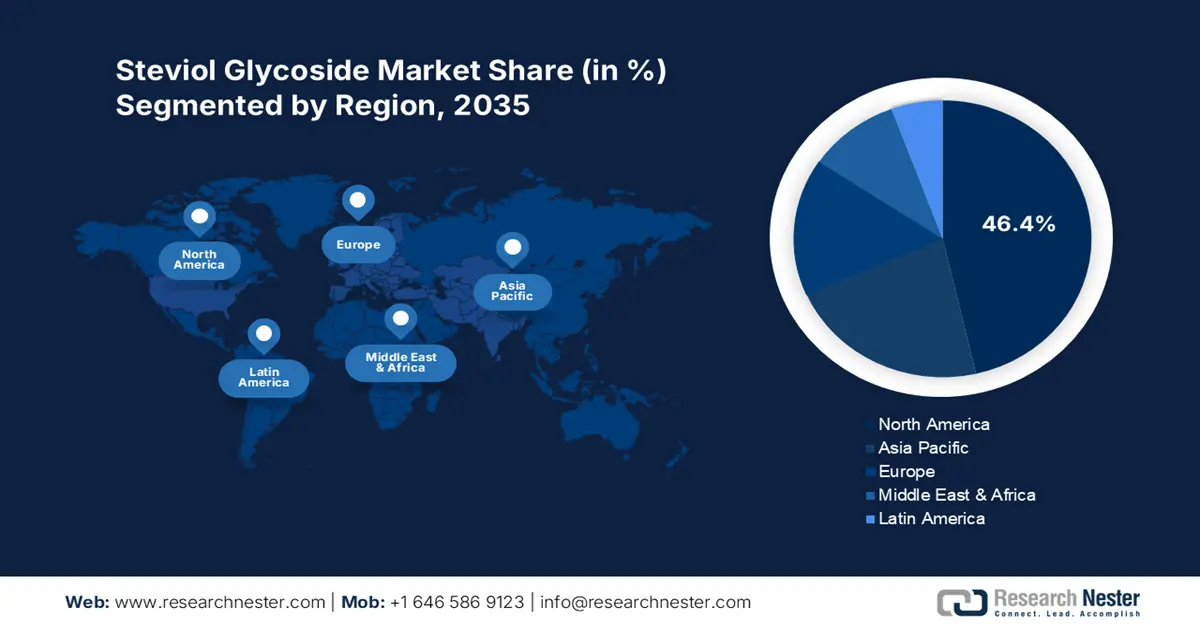

- North America's 46.4% share in the Steviol Glycoside Market is bolstered by health-conscious consumers and early adoption of clean-label sweeteners, supporting strong growth through 2026–2035.

- The Asia Pacific Steviol Glycoside Market is forecasted to grow robustly by 2035, driven by rising diabetes cases and demand for natural sweeteners.

Segment Insights:

- The Food segment is forecasted to achieve over 52.5% market share by 2035, attributed to the rising demand for sugar-free diets and innovation by food manufacturers using steviol glycoside.

- The Stevioside segment of the Steviol Glycoside Market is expected to maintain a dominating share by 2035, driven by growing demand for healthier, plant-based, and allergen-free food and beverages.

Key Growth Trends:

- Innovations and trends in stevia cultivation

- Rise in sugar-free and ketogenic diets

Major Challenges:

- Competition from alternatives

- High production and extraction costs

- Key Players: Cargill, Incorporated, Tate & Lyle Plc, Sweegen, Inc., Layn Corp., and Sunrise Nutrachem Group.

Global Steviol Glycoside Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.52 billion

- 2026 Market Size: USD 5.78 billion

- Projected Market Size: USD 9.16 billion by 2035

- Growth Forecasts: 5.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (46.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, Brazil

- Emerging Countries: China, Japan, India, South Korea, Australia

Last updated on : 13 August, 2025

Steviol Glycoside Market Growth Drivers and Challenges:

Growth Drivers

-

Innovations and trends in stevia cultivation: The rise in stevia cultivation across the world is expected to augment the production of steviol glycosides in the coming years. The integration of advanced technologies in the harvesting and extraction of stevia plants is contributing to their high yields and purity. Manufacturers are forming direct partnerships with farmers or cultivators to boost their production and revenue shares. Key players also employ investment strategies and provide the latest technologies to cultivators to enhance the overall profile of stevia. For instance, in April 2024, Ingredion Incorporated announced that its stevia subsidiary PureCircle received plant breeders’ rights (PBR) from the Chinese regulators. The rights were granted to its new stevia plant variety PCS-13 with authorization number: CNA 20191005282.

-

Rise in sugar-free and ketogenic diets: The increasing popularity of low-calorie and ketogenic diets is driving food and beverage producers’ attention to introducing sugar-free or natural sugar-integrated products. This move is generating high-earning opportunities for steviol glycoside manufacturers. The rising cases of diabetes across the world are also a booming factor for the consumption of steviol glycosides. For instance, in November 2024, the World Health Organization (WHO) revealed that diabetes cases have increased four-fold in the past 10 years and currently, there are over 800 million adults living with diabetes. Diabetes patients widely consume traditional sugar-free or sugar-sweetener diets, which directly augments the sales of steviol glycosides.

Challenges

- Competition from alternatives: The strong steviol glycoside market presence of sugar alternatives or sweeteners is majorly challenging the sales of steviol glycosides. Some of the top competitive sweeteners are aspartame, sucralose, erythritol, and monk fruit extract. The continuous development of new and cost-effective or more flavorful alternatives is set to hamper the revenue growth of the steviol glycoside manufacturers.

- High production and extraction costs: The extraction and production process of steviol glycosides is expensive, which drives up the overall cost of the final product. Most end users invest in cost-effective conventional sugar instead of enhanced sweeteners to mitigate their production costs. Thus, the high costs of steviol glycosides in smaller volumes directly lower their adoption rates worldwide.

Steviol Glycoside Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.2% |

|

Base Year Market Size (2025) |

USD 5.52 billion |

|

Forecast Year Market Size (2035) |

USD 9.16 billion |

|

Regional Scope |

|

Steviol Glycoside Market Segmentation:

Type (Stevioside, Dulcoside A, Others)

The stevioside segment is anticipated to capture a dominating steviol glycoside market share between 2025 and 2035. The shift toward healthier and organic food and beverages is boosting the sales of stevioside. The increasing popularity of veganism and gluten-free diets is growing the consumption of plant-based and allergen-free ingredients such as stevioside. Continuous research and development activities are augmenting the use of stevioside in nutraceuticals. The widespread application areas of stevioside are making it an opportunistic segment for key players to earn high profits. Overall, the health and awareness trends are set to propel the consumption of stevioside in the coming years.

End user (Food, Beverage, Others)

The food segment is poised to capture over 52.5% steviol glycoside market share by 2035. The rapidly expanding food sector and boom in demand for conventional sugar-free diets are opening lucrative doors for steviol glycoside manufacturers. The use of steviol glycoside is also finding high applications in candies to sustain its sweet flavor. Furthermore, LifeSavers held a dominating position as a sugar-free candy brand in the same year. Food product manufacturers’ focus on innovation is set to double the sales of steviol glycosides in the coming years.

Our in-depth analysis of the global steviol glycoside market includes the following segments:

|

Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Steviol Glycoside Market Regional Analysis:

North America Market Forecast

In steviol glycoside market, North America region is predicted to dominate over 46.4% revenue share by 2035. The presence of early adopters, innovative food and beverage manufacturers, organic and clean-label trends, and the existence of industry giants are augmenting market growth. The evolving consumer preferences and high demand from fitness enthusiasts are further pushing the consumption of steviol glycosides in the U.S. and Canada.

In the U.S., the increasing awareness among consumers regarding the adverse effects of excess consumption of sugar is directly boosting the use of natural sweeteners such as steviol glycosides. The increasing awareness programs are also contributing to the steviol glycoside market growth. For instance, in October 2024, the U.S. Food and Drug Administration released a response on aspartame and other sweeteners in food. Such moves increase confidence and safe intake of sweeteners including steviol glycoside by consumers.

In Canada, steviol glycoside in purified stevia form is regulated as a food additive, which is creating a profitable pool for key manufacturers. Innovations in food & beverages and nutraceuticals are further fueling the use of steviol glycosides as sweeteners. The clean label trend is also propelling the sales of steviol glycoside-based products in the country. As per the OEC report, in 2022, Canada exported around USD 2.6 million worth of glycosides.

Asia Pacific Market Statistics

The Asia Pacific steviol glycoside market is estimated to expand at a robust pace during the forecast period. The big food & beverage industry coupled with the high demand for modern food items is expected to drive the sales of steviol glycosides. The rising diabetes cases in the region are fueling the demand for natural sweeteners including steviol glycosides. The increasing expansion of chemical manufacturing companies in the region is also contributing to the steviol glycoside market growth. China, India, South Korea, and Japan are some of the opportunistic marketplaces for steviol glycoside manufacturers.

China is one of the major producers of glycosides and majorly focuses on export trade, which directly drives the sales of steviol glycosides. The strong existence of global companies’ subsidiaries propels the production cycle of steviol glycosides, contributing to export trade. The OEC study estimates that in 2022, China held the top position as a glycoside exporter and totaled trade worth USD 1.02 billion with an export value growth of 16.4%.

In India, steviol glycoside manufacturers are estimated to earn high profits owing to the increasing prevalence of diabetes and high awareness of sugar-free sweeteners. The health and wellness trends are acting as major drivers for the high sales of steviol glycosides. The rapidly expanding food processing market is also set to boost the consumption of steviol glycosides. The India Brand Equity Foundation (IBEF) report reveals that the food processing market of the country is projected to reach USD 1274.0 billion by 2027. In June 2024, nearly 92,549 micro-food processing companies were approved for assistance under Pradhan Mantri Formalisation of Micro Food Processing Enterprises (PMFME).

Key Steviol Glycoside Market Players:

- Cargill, Incorporated

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Tate & Lyle Plc

- Sweegen, Inc.

- Layn Corp.

- Sunrise Nutrachem Group

- Ingredion Incorporated

- Sunwin Stevia International Inc.

- Kerry Inc.

- Evolva AG

- Koninklijke DSM N.V.

- Archer Daniels Midland Company

- GLG Life Tech Corp.

- Zhucheng HaoTian Pharm Co.Ltd.

The steviol glycoside market is characterized by the presence of leading companies and the emergence of start-ups. The new companies are adopting research and development strategies to stand out in the crowd by introducing innovative products. Industry giants are employing several organic and inorganic tactics such as new product launches, technological innovations, strategic collaborations & partnerships, mergers & acquisitions, and global expansions to earn high profits. The players are forming direct partnerships with stevia cultivators to expand their production cycle and meet increasing demand. Collaborating with other players is aiding them to reach a wider customer base.

Some of the key players in steviol glycoside market:

Recent Developments

- In August 2023, Sweegen, Inc. announced that its Bestevia Rebaudioside M (Reb M), D, and E received approval from the Food and Drug Administration Taiwan to use in food and beverages. Through this move, the company expanded its operations in markets where end users seek new-generation stevia ingredients to increase their sugar reduction solutions.

- In May 2023, Ingredion Incorporated introduced a five-part video series on the potential of stevia sweeteners and functional build-back (FBB) ingredients in sugar reduction formulations. This series is aiding food and beverage manufacturers to explore and understand steviol glycosides.

- Report ID: 6979

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Steviol Glycoside Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.