Sterile Medical Packaging Market Outlook:

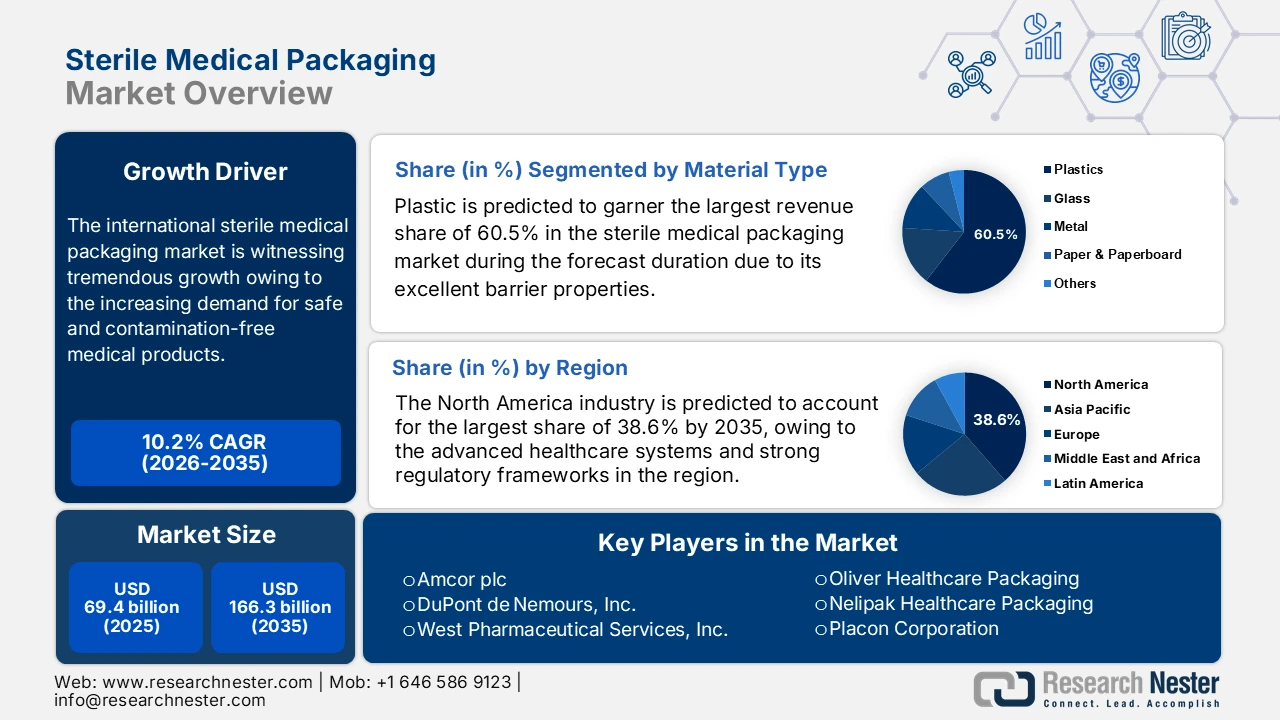

Sterile Medical Packaging Market size was valued at USD 69.4 billion in 2025 and is projected to reach USD 166.3 billion by the end of 2035, rising at a CAGR of 10.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of sterile medical packaging is estimated at USD 76.4 billion.

The international sterile medical packaging market is witnessing tremendous growth owing to the increasing demand for safe and contamination-free medical products. Simultaneously, trends such as sustainability, smart packaging, and the integration of tamper-evident and traceability features are shaping the evolution of the market. DuPont, in February 2024, reported that it has launched the Tyvek sustainable healthcare packaging awards program to recognize healthcare and sterile packaging initiatives that demonstrate significant sustainability achievements using Tyvek materials. The company also mentioned that this program is open to medical device and pharmaceutical manufacturers, sterile packaging producers, healthcare facilities, and other stakeholders, with submissions required to show measurable sustainability impact within the prior 18 months. Hence, this supports the company’s broader goals of advancing a circular economy and reducing Scope 3 emissions, positively impacting market growth.

Furthermore, the rising awareness of infection control, coupled with the expansion of healthcare infrastructure and the growing adoption of minimally invasive procedures, is fueling the need for advanced sterile packaging solutions. In July 2025, Demetra announced that it had acquired OrthoFundamentals, LLC, which is a U.S.-based company providing sterile-packed, single-use instrument kits for sacroiliac joint fusion procedures, and launched Demetra Spine, a new global business unit focused on spinal surgery. Besides, this move builds on Demetra’s prior acquisitions of GetSet Surgical and Bespoke Technologies by adding sterile-packed single-use spine procedure kits and 3D-printed titanium implants for ACDF procedures. Hence, the acquisition emphasizes infection control and minimally invasive procedures, thereby supporting outpatient surgical settings with ready-to-use, sterile solutions that reduce infection risk, driving growth in the market.