Sterilant Market Outlook:

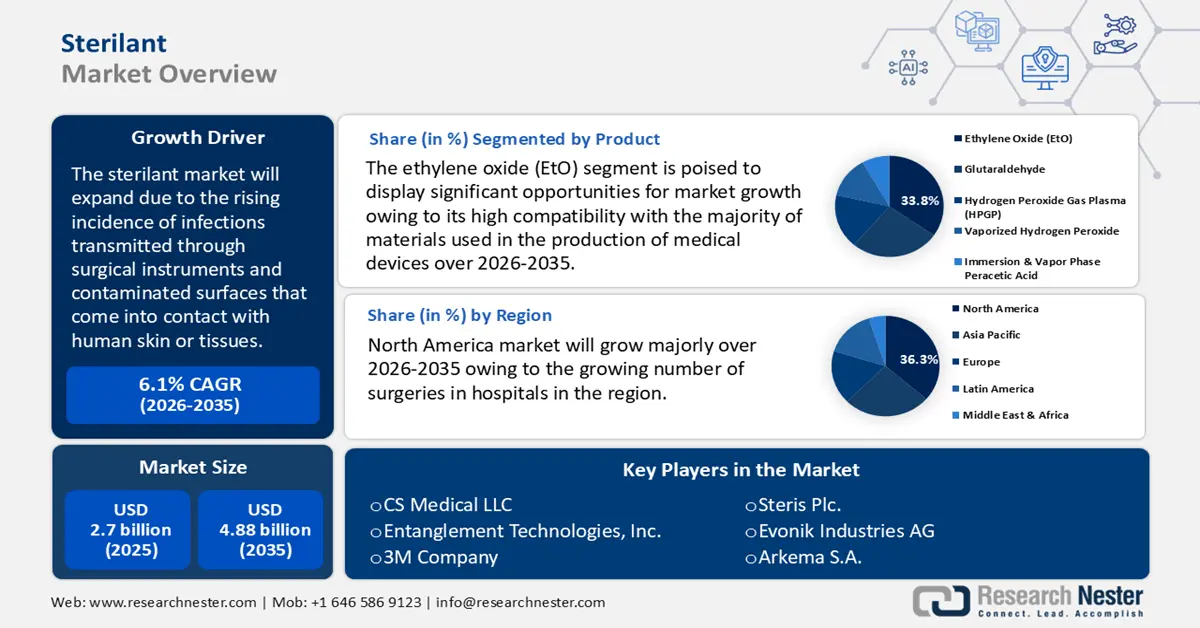

Sterilant Market size was valued at USD 2.7 billion in 2025 and is set to exceed USD 4.88 billion by 2035, registering over 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of sterilant is estimated at USD 2.85 billion.

The sterilant market is experiencing growth due to the rising incidence of infections transmitted through surgical instruments and contaminated surfaces that come into contact with human skin or tissues. This surge in infections has created a demand for effective sporicidal agents and suitable sterilization solutions. The World Health Organization (WHO) reported that 52.3% of patients treated in an intensive care unit and more than 24% of patients with healthcare-associated sepsis die each year. Antimicrobial-resistant illnesses increase mortality by two to three times.

There is a greater need for cold sterilants that are safe, efficient, and have low toxicity levels to prevent damage and chemical reactions. Since sterilants are stronger and more effective than disinfectants, their demand is rising significantly. Additionally, because medical equipment must be disinfected using sterilants such as peracetic acid, the expanding healthcare sector supports the expansion of the sterilant market.

|

Country |

Export Value of Medical Devices (in USD) |

Country |

Import Value of Medical Devices (in USD) |

|

U.S. |

33.3 Billion |

U.S. |

34.7 Billion |

|

Germany |

17.6 Billion |

Netherlands |

12.9 Billion |

|

Mexico |

14.1 Billion |

Germany |

11.4 Billion |

|

China |

12.0 Billion |

China |

10.1 Billion |

|

Netherlands |

11.5 Billion |

Japan |

6.58 Billion |

Source: OEC

According to the Observatory of Economic Complexity (OEC), with a total trade of USD 157 billion in 2022, medical instruments ranked as the 17th most traded product globally. Medical instrument exports increased by 4.22% between 2021 and 2022, from USD 151 billion to USD 157 billion. Commerce in Medical Instruments constitutes 0.66% of total world commerce. According to the Product Complexity Index (PCI), Medical Instruments is ranked 211th.

Key Sterilant Market Insights Summary:

Regional Highlights:

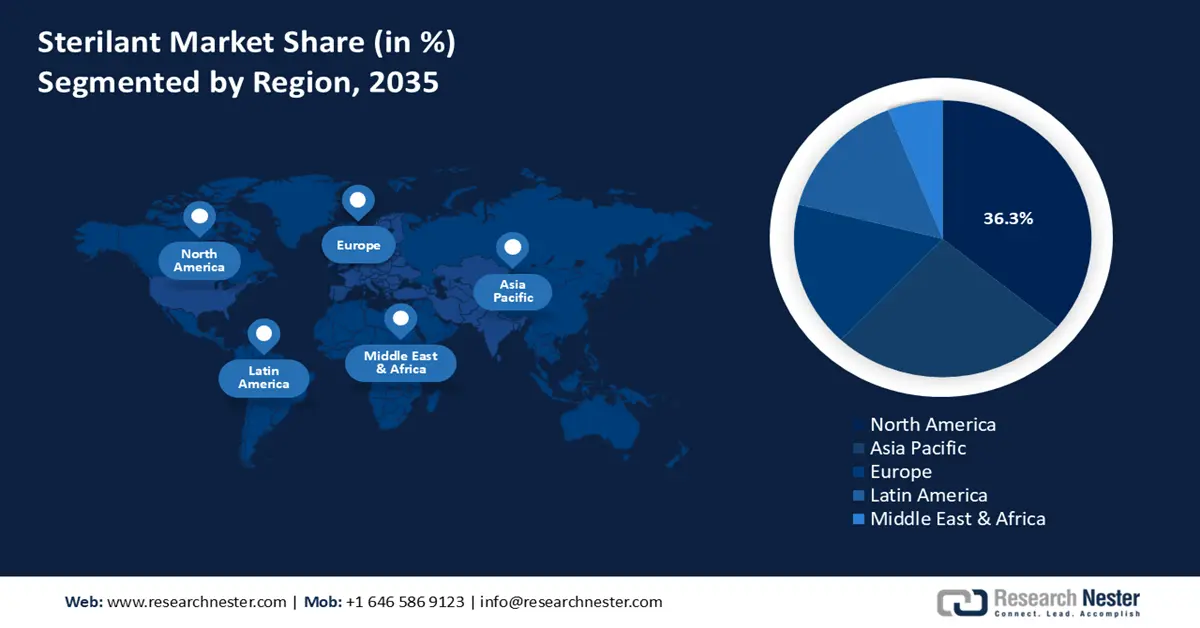

- North America is anticipated to command nearly 36.3% share of the sterilant market by 2035, expanding as rising surgical procedures in hospitals necessitate stringent sterilization to curb infection risks.

- Asia Pacific is expected to record robust growth through 2035, supported by escalating healthcare spending and the widening adoption of sterilants across healthcare and non-healthcare environments.

Segment Insights:

- The Ethylene Oxide (EtO) segment in the sterilant market is projected to secure about 33.8% share by 2035, propelled by its extensive compatibility with diverse medical device materials.

- The hospitals segment is set to attain a substantial share by 2035, supported by the increasing emphasis on disinfecting medical equipment and environments to reduce infection transmission.

Key Growth Trends:

- Rising applications in food and agricultural settings

- Recent developments in sterilization techniques

Major Challenges:

- Availability of alternatives

- Safety concerns and stringent regulations

Key Players: CS Medical LLC, Entanglement Technologies, Inc., 3M Company, Steris Plc., Evonik Industries AG, Arkema S.A., Metrex Research, LLC, Ecolab Inc., Solvay S.A., LANXESS AG.

Global Sterilant Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.7 billion

- 2026 Market Size: USD 2.85 billion

- Projected Market Size: USD 4.88 billion by 2035

- Growth Forecasts: 6.1%

Key Regional Dynamics:

- Largest Region: North America (36.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Mexico, Indonesia

Last updated on : 2 December, 2025

Sterilant Market - Growth Drivers and Challenges

Growth Drivers

- Rising applications in food and agricultural settings: Soil sterilants are chemical agents applied to soil that eradicate all living organisms. These substances may consist of either long-lasting compounds or volatile liquids or gases that do not retain their presence in the soil. In nurseries and various agricultural environments, temporary soil sterilants are predominantly utilized before planting. Such sterilants are occasionally employed to treat soil suspected of harboring organisms contributing to infectious root diseases. Furthermore, soil sterilants are used to prevent the dissemination of pathogens through root grafting. Furthermore, sterilant is utilized as food preservatives to extend shelf life and safeguard against microbial contamination, particularly in light of the increasing consumption of processed foods.

The UN Trade & Development Organization (UNCTAD) revealed that between 2000 and 2021, the value of the world's food commerce increased by 350% to USD 1.7 trillion. Approximately 48% of the food imported by developed economies is processed whereas only roughly 35% is imported by emerging economies. Sterilization, whether applied to food, equipment, or medical supplies, constitutes a physical or chemical process that eliminates or neutralizes microorganisms and pathogens, including fungi, bacteria, viruses, and prions. The primary objectives of food sterilization technology are to minimize food spoilage and eradicate harmful germs. It is essential to emphasize that nutritional quality remains a critical factor within the food industry. - Recent developments in sterilization techniques: Major new techniques are oxidative processes based on peroxy chemicals, whereas the most popular traditional chemical procedures were based on alkylating agents like EtO and the different aldehydes. These consist of sterilants that are based on substances like ozone, hydrogen peroxide, peracetic acid, peroxy sulfates, and chlorine dioxide. Nowadays, peracetic acid is employed in several sterilization procedures. For instance, it can be used as a liquid sterilizer in appropriate disinfectors to sterilize thermolabile endoscopes or in liquid systems like the Steris machine for endoscopes. Products like isolators can be sterilized, disinfected, or decontaminated using vapor-phase generators that use peracetic acid. Also, a 3% aqueous solution of hydrogen peroxide has long been used as an antimicrobial. For instance, production-line sterilization of commodity items, such as food product cartons, has been done using hydrogen peroxide that has been enhanced by ultraviolet radiation.

Challenges

- Availability of alternatives: Although alcohol-based disinfectants are popular and effective, plant-based solutions and quaternary ammonium compounds (QACs) are becoming more popular substitutes. Owing to their broad-spectrum antibacterial action and surface compatibility, QACs—which the NIH estimates make up over 25% of the global disinfection market—are widely used in residential, food processing, and healthcare environments. Additionally, the development of plant-based disinfectants derived from natural substances like essential oils and plant extracts has been prompted by the growing popularity of eco-friendly and sustainable solutions. These substitutes, which are frequently promoted as safer and eco-friendly, seriously hinder the sterilant market's expansion.

- Safety concerns and stringent regulations: The permitted concentration range should be adhered to when using high-level disinfectants or sterilants. For instance, the U.S. Environmental Protection Agency has restricted the use of glutaraldehyde because of its high toxicity, even though it is typically used in concentrations between 2 and 3%. Furthermore, skin corrodes when high quantities of sterilants are directly contacted. Acute or long-term exposure to different sterilants can result in mutagenic changes, cancer, negative reproductive effects, headaches, nausea, shortness of breath, neurotoxicity, sensitization, and many other negative effects, according to the National Institute for Occupational Safety and Health.

Sterilant Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 2.7 billion |

|

Forecast Year Market Size (2035) |

USD 4.88 billion |

|

Regional Scope |

|

Sterilant Market Segmentation:

Product Segment Analysis

Ethylene oxide (EtO) segment is projected to capture sterilant market share of around 33.8% by the end of 2035. The most often used industrial sterilants for sterilizing medical devices are ethylene oxide sterilants. It has high compatibility with the majority of materials used in the production of medical devices, including glass, metals, polymers, and plastics, and is employed in a cold sterilization approach. Its chemical reaction (alkylation) with the DNA of bacteria, viruses, molds, yeasts, and even insects is what causes its mortality. Advanced Medical Technology Association stated that EtO is used to sterilize 50% of all medical devices and for many of them.

End use Segment Analysis

The hospitals segment in sterilant market will garner a significant share during the assessed period. The segment is growing due to the hospitals' crucial role in the healthcare system, where disinfecting medical equipment, facilities, and staff is necessary to stop the spread of illnesses. The increased number of human clinical studies to find vaccines and other medications during the COVID-19 pandemic has given the hospital segment a strong market presence. As a result, hospitals are now in more need of disinfectants to stop the infection from spreading. Demand in this sterilant market is also being driven by regulatory agencies like the U.S. Food and Drug Administration (FDA), which are regulating high-level disinfectants and placing more emphasis on public health.

Our in-depth analysis of the global sterilant market includes the following segments:

|

Product |

|

|

Form |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Sterilant Market - Regional Analysis

North America Market Insights

North America in sterilant market is likely to dominate around 36.3% revenue share by the end of 2035. The market is expanding in the region due to the growing number of surgeries in hospitals necessitating the use of sterilants to prevent infection and maintain high standards of patient care and hygiene. Inadequate high-level disinfection, incorrect sterilization of medical equipment, and the growing use of disinfectants to clean various surfaces, including reusable medical devices like endoscopes, can have detrimental and dangerous impacts on patients. A longer hospital stay is also necessary due to the rise in chronic illnesses such as cardiovascular disease and others. As a result, the frequency of hospital-acquired illness cases rises during these stays. According to the National Association of Chronic Disease Directors, almost 60% of American adults suffer from at least one chronic illness. The main causes of death in the region are chronic illnesses like diabetes, cancer, and heart disease.

The healthcare system in the U.S. is renowned for its sophisticated infrastructure and hefty costs. To lessen their healthcare burden, the government and regulatory agencies are implementing several economic initiatives into action. The White House reported that by enacting legislation such as the American Rescue Plan Act and the Inflation Reduction Act to reduce the cost of prescription drugs and health insurance premiums, the government is continuing to expand, fortify, and safeguard Medicare, Medicaid, and the Affordable Care Act. Furthermore, the nation has seen a sharp increase in the use of sterilants in recent months, driven by the need to maintain sterility and cleanliness owing to the pandemic and to prevent infection exposure.

With the greatest proportional death rate in the world and a high number of cases diagnosed, the nation was affected by the epidemic the hardest. People consequently spent a lot of money on sterile procedures, which led to an increase in their use. Additionally, the sterilant market in the region was driven by the presence of major players such as Thor Group, Cantel Medical Corporation, Steris Plc, 3M Company, and many others.

APAC Market Insights

Asia Pacific sterilant market will witness tremendous growth during the projected period. Healthcare spending is on the rise in the Asia-Pacific region, driven by factors such as population growth, the expansion of healthcare infrastructure, and increasing awareness of health issues. By 2030, Asia-Pacific will account for almost 20% of global healthcare spending, making it the region with the greatest rate of growth. Manufacturers of sterilants are well-positioned to meet the growing demands from clinics, hospitals, and other healthcare facilities. The need for sterilants is also rising across various sectors, including healthcare, food and beverage, hospitality, and even residential spaces, as people become more conscious of the importance of maintaining clean and hygienic environments.

In China, the rise in disposable income is set to significantly influence economic growth in developing countries, particularly impacting the accessibility of quality healthcare. It is anticipated that rising disposable income combined with high health insurance will help make healthcare services to prevent infectious diseases more affordable. The WHO reported that more than 95% of people in China are covered by the basic health insurance program. The National Healthcare Security Administration, which oversees all of China's basic health insurance programs, was founded in 2018. Its creation marks a turning point in China's health sector reform and offers chances to enhance the system's effectiveness in cost reduction, service quality, and value for money.

The sterilant market in India will witness expansion due to the robust rise of pharmaceutical and biopharmaceutical firms with increasing research initiatives. However, when compared to other South Asian nations, India consumes the most sterilants. Since major items in the pipeline are anticipated to reach the final stage and be commercialized by the end of the decade, there will be a rise in the demand for sterilization. Patient recruitment for clinical trials is simpler in developing nations. It is feasible to innovate and create successful products at competitive prices in India since research and development expenses are far lower there than in wealthy nations.

Sterilant Market Players:

- CS Medical LLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Entanglement Technologies, Inc.

- 3M Company

- Steris Plc.

- Evonik Industries AG

- Arkema S.A.

- Metrex Research, LLC

- Ecolab Inc.

- Solvay S.A.

- LANXESS AG

The sterilant market is highly competitive as a result of numerous major competitors concentrating on different market consolidation operations such as mergers, acquisitions, supply distribution partnerships, and the introduction of advanced products. Major manufacturers are eager to offer end users solutions and increase the sterilant market share of their main items. For instance, many leaing manufacturers now offer tailored solutions to different end-user needs.

Recent Developments

- In June 2023, CS Medical announced the U.S. FDA cleared a new Class II medical device, the Ethos Automated Ultrasound Probe Cleaner Disinfector. Ethos is the first medical gadget certified in North America to clean and disinfect endocavity and surface ultrasound probes.

- In June 2021, Entanglement Technologies announced the availability of their newest product, AROMA-ETO. AROMA-ETO provides in-field ethylene oxide (EtO) detection limits in the low part-per-trillion range. This capacity allows for rapid surveys and assessments, which are required by policymakers and industrial operators to make time-sensitive decisions to mitigate EtO-related health concerns, such as preventing leaks and releases before they cause harm or non-compliance.

- Report ID: 7022

- Published Date: Dec 02, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Sterilant Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.