Steel Pipes Market Outlook:

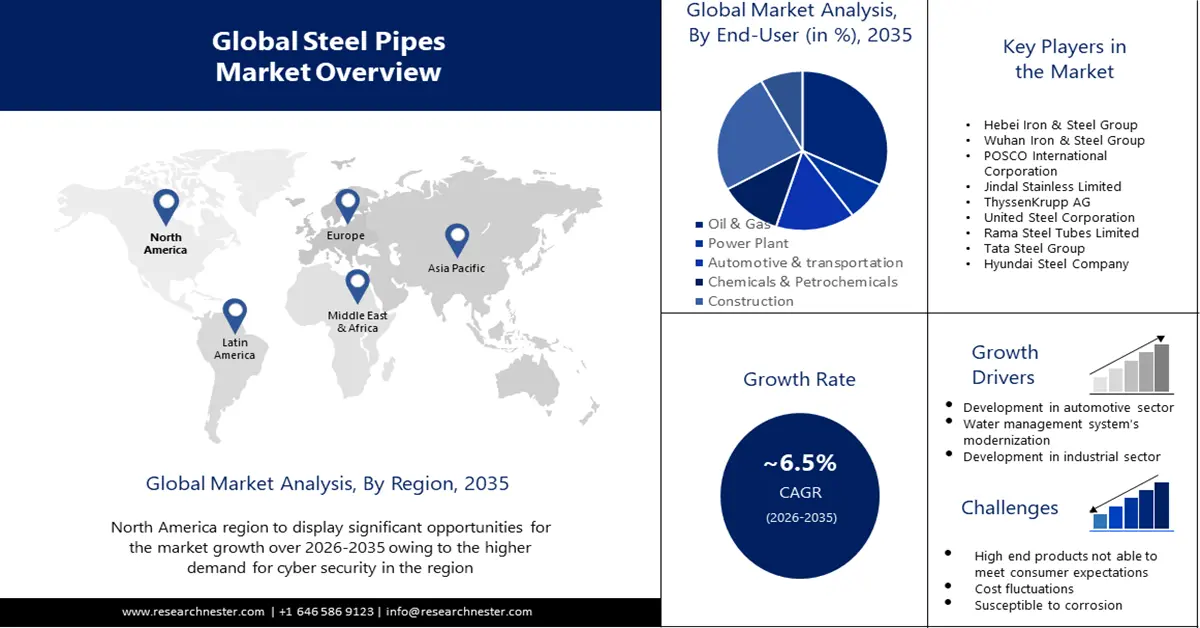

Steel Pipes Market size was valued at USD 168.32 billion in 2025 and is likely to cross USD 315.96 billion by 2035, expanding at more than 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of steel pipes is assessed at USD 178.17 billion.

An increase in the number of new petrochemical facilities being built globally is anticipated to drive up demand for steel pipes and tubes. In the chemical and petrochemical industries, steel pipes and tubes are used in heat exchangers, pressure tubes, and pipeline systems. Therefore, it is anticipated that rising investment in the building of petrochemical plants will support market expansion. One of the world's top producers of petrol and oil is the United States. The U.S. Energy Information Administration reports that as of December 2021, proven crude oil reserves have climbed by 14.8% year over year to 41.2 billion barrels. The reserves of wet natural gas increased by 32.1% to 625.4 trillion cubic feet. In 2021, the nation's proportion of the world's oil production was approximately 14.5%.

In addition, steel pipes are widely used for structural purposes in the building industry. They are employed in the construction of pilings, scaffolding, and frameworks. The growth of the building industry, especially in emerging nations will fuel the steel pipes market revenue. Urbanization and population growth are expected to have a positive effect on the market expansion. Moreover, government investments in infrastructure projects such as airports, bridges, and roadways are driving the demand for steel pipes.

Key Steel Pipes Market Insights Summary:

Regional Highlights:

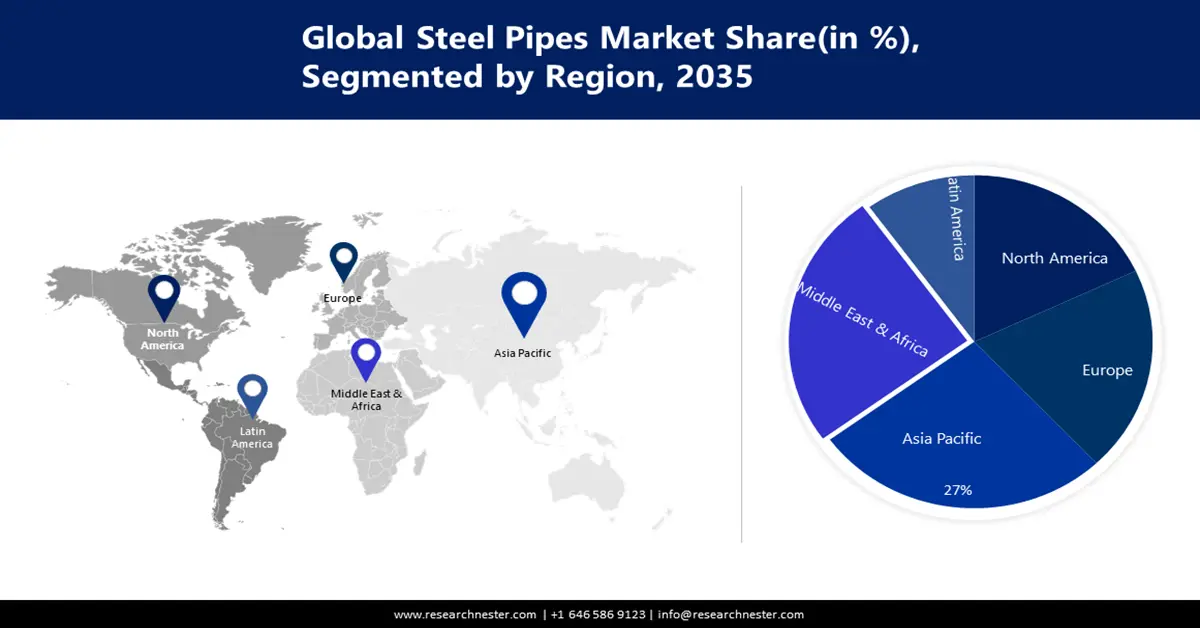

- The Asia Pacific steel pipes market is projected to secure a 27% share by 2035, driven by the sizable manufacturing and petrochemical industries in countries like China, South Korea, India, and Japan.

- The Middle East & Africa market is anticipated to hold a 25% share by 2035, driven by increasing private sector investment in new petrochemical facilities.

Segment Insights:

- The electric resistance welded (erw) segment in the steel pipes market is projected to hold a 52% share by 2035, propelled by the adoption of affordable ERW pipes enabled by modern welding technologies.

- The oil & gas segment in the steel pipes market is projected to capture a 32% share by the forecast year 2035, fueled by rising investment in cross-country pipeline networks and oil and gas applications.

Key Growth Trends:

- The Water Management System's Modernization

- Developments in the Automotive Sector

Major Challenges:

- High-end products not able to meet consumers expectations

Key Players: Hebei Iron & Steel Group, Wuhan Iron & Steel Group, POSCO International Corporation, Jindal Stainless Limited, ThyssenKrupp AG, United Steel Corporation, Rama Steel Tubes Limited, Tata Steel Group.

Global Steel Pipes Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 168.32 billion

- 2026 Market Size: USD 178.17 billion

- Projected Market Size: USD 315.96 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (27% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, India, United States, Japan, Germany

- Emerging Countries: China, India, Vietnam, Indonesia, Mexico

Last updated on : 8 September, 2025

Steel Pipes Market Growth Drivers and Challenges:

Growth Drivers

- Growth and Development of the Industrial Sectors- The global steel pipes market is significantly impacted by industrial growth in many different areas. Steel pipes are crucial parts of production processes because they serve as conduits for liquids, gases, and materials in a variety of industries, including the automotive, petrochemical, and chemical industries. The internal diameter, ductility, yield strength, and pressure rating are all crucial factors to consider when choosing pipes for specific purposes. In the US’s oil & gas sector, steel pipes and tubes are frequently utilised. The steel pipes market is anticipated to expand as a result of the adjustments made to the oil and gas industry. The oil and gas sector in the United States generated USD 332.9 billion in revenue in 2022. Compared to the prior year, when U.S. oil and gas generated a total revenue of USD 211.2 billion, that represented a significant gain.

- The Water Management System's Modernization- Steel pipes are widely used in industrial wastewater management, potable water delivery, and sewage disposal because of their resilience to corrosion. The need for steel pipes in the water management industry is growing, which confirms their position as a major factor propelling the global market. Water supply and waste water treatment systems also make extensive use of steel pipes. Steel pipe demand is anticipated to be driven by the need to upgrade and expand water infrastructure worldwide. Growing concerns about water scarcity also support the expansion of the steel pipes market. Furthermore, the emphasis on effective water management is probably going to encourage the use of steel pipes even more.

- Developments in the Automotive Sector- In the automotive industry, steel pipes are utilized for structural components, exhaust systems, and other parts. market is anticipated to witness growth opportunities in the upcoming years and provide cutting-edge solutions as the automobile sector progresses with the advent of electric vehicles and light weighting initiatives.

Challenges

- High-end products not able to meet consumers expectations- Expensive goods are unable to satisfy consumer demands. Customers occasionally have specific requirements regarding the features and calibre of steel pipes. However, because domestic products cannot satisfy their needs owing to variable production, low supply, and other factors, they are forced to choose expensive foreign products.

- Cost fluctuations in raw materials like coal and iron ore can have an impact on the stability of the steel pipes market and the overall cost structure of steel pipes.

- Steel pipes are susceptible to corrosion, which is particularly problematic in severe environment applications. It can be challenging to create a corrosion-resistant coating that works well and to deal with maintenance problems.

Steel Pipes Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 168.32 billion |

|

Forecast Year Market Size (2035) |

USD 315.96 billion |

|

Regional Scope |

|

Steel Pipes Market Segmentation:

End-User

The oil & gas segment is projected to account for 32% of the global steel pipes market share during the forecast period. The product is mostly used in distribution, process pipes, oil & gas industry applications, and oil country tubular goods (OCTG). Rising investment in the network of cross-country pipelines for the transmission of gas and oil is anticipated to drive demand for steel pipes and tubes. Global oil production exceeds four billion metric tonnes annually, with the Middle East holding about half of the proven oil reserves. Given how many uses there is for oil, it should come as no surprise that oil and gas firms rank among the biggest in the world.

Technology

Steel pipes market from the electric resistance welded (ERW) segment is predicted to hold the largest share of about 52% by the end of 2035. The growth of the segment is because of its affordable price and moderate performance. Plans by fertiliser, oil and gas, and electricity firms to build transportation pipelines will further propel the segment revenue. Additionally, due to their affordable costs and mediocre performance, ERW pipes and tubes are becoming increasingly popular. The segment's growth is also significantly aided by contemporary welding technologies like high-frequency welding, which are being incorporated into the process of creating ERW pipes and tubes.

Our in-depth analysis of the global steel pipes market includes the following segments:

|

Technology |

|

|

Material |

|

|

Type |

|

|

End-User |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Steel Pipes Market Regional Analysis:

APAC Market Insights

Steel pipes market in the Asia Pacific region is expected to hold 27% revenue share by 2035. The market growth of the region is due to existence of sizable manufacturing and petrochemical industries. Nations like China, South Korea, India, and Japan are credited with a big portion of the market share. These nations are major consumers of steel pipes and tubes. China's production of crude steel reached a remarkable 536 million tonnes in the first half of 2023, up 1.3% year over year, according to figures issued by the National Bureau of Statistics. On the other hand, there was a 1.9% decline in the apparent consumption of crude steel during the same period.

Middle East & Africa Market Insights

Middle East & Africa steel pipes market share is predicted to cross 25% during the forecast period, owing to increasing private sector investment in the establishment of new petrochemical facilities. For example, the Saudi Arabian Ministry of Energy approved Alujain Corporation's application to develop a new petrochemicals project in Yanbu Industrial City in November 2022.

Steel Pipes Market Players:

- ArcelorMittal

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Hebei Iron & Steel Group

- Wuhan Iron & Steel Group

- POSCO International Corporation

- Jindal Stainless Limited

- ThyssenKrupp AG

- United Steel Corporation

- Rama Steel Tubes Limited

- Tata Steel Group

- Hyundai Steel Company

Recent Developments

- ArcelorMittal launched the industry’s first low-carbon emission steel tubes, with a CO2 emissions reduction of up to 75%. It aimed to help companies in the construction, agriculture, and energy sectors in their decarbonisation journey to achieve the climate goals outlined in the Paris Agreement and the European Green Deal.

- Jindal Stainless Limited (JSL) planned to expand the capacity of the steel plant to 25.2 MTPA at Angul, Odhisha, by 2030. This capacity expansion is expected to increase JSPL's investment in Odisha to more than INR 1,25,000 crore (USD 15,875 million) from INR 45,000 crore (USD 5,715 million).

- Report ID: 493

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Steel Pipes Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.