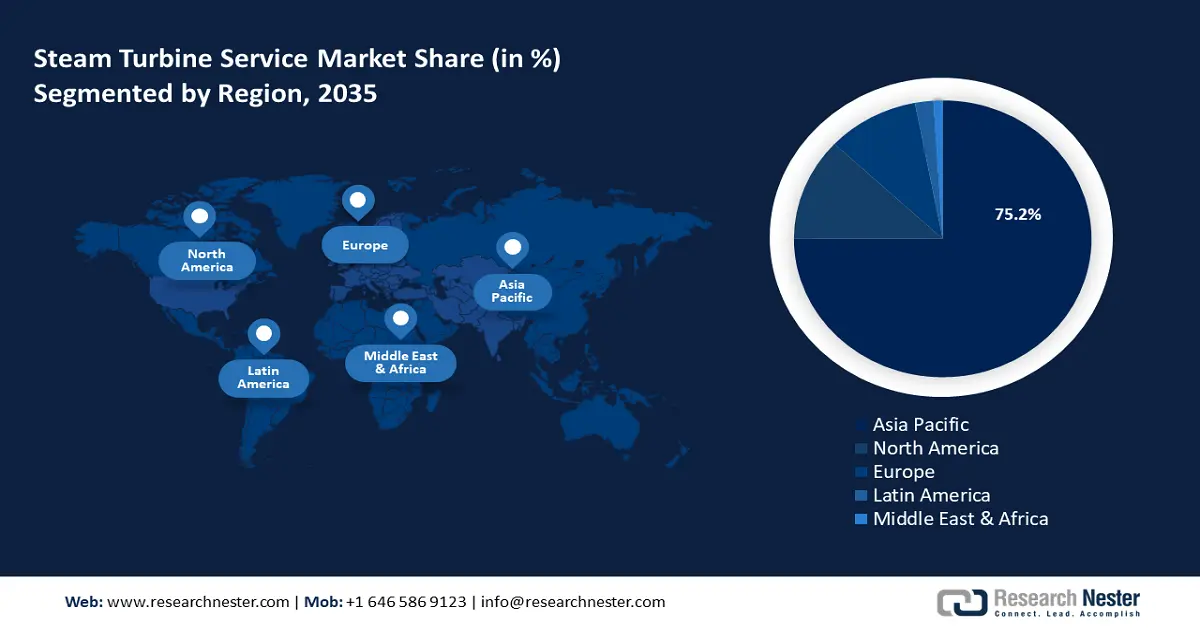

Steam Turbine Service Market Regional Analysis:

APAC Market Forecast

Asia Pacific steam turbine service market is predicted to hold revenue share of more than 75.2% by 2035. The region’s growth is driven by rapid industrialization increasing energy demand and growing reliance on thermal power generation in the region. China, India, Japan, and South Korea lead the revenue share in the APAC market. For instance, in July 2024, Korea Southern Power Co. started operations at the Shinsejong combined-cycle power plant in Sejong Multifunctional Administrative City, South Korea.

China leads the revenue share in the APAC steam turbine service sector. The steam turbine service demand in the country is driven by a vast network of coal-fired power plants in the country and rising demands for electricity. For instance, IEA’s energy report of 2024 indicated China has burned one of four tons of coal used globally to produce electricity. Additionally, favorable regulatory support such as the dual carbon goals of China that aims for peak carbon emissions by 2030 and achieve carbon neutrality by 2060 is poised to create a profitable domestic market for power operators to invest in turbine efficiency upgrades and retrofit emission controls. For instance, in July 2024, the Guangdong Huizhou combined plant entered commercial operation with GE Vernova hydrogen-ready combined-cycle units and Harbin Electric’s steam turbines.

India is poised to increase its revenue share in the global steam turbine service market during the forecast period. The market’s growth is attributed to heavy reliance on thermal power and rapid industrial growth. The country is poised to experience rising energy demands to cater to a growing urban population and improve power connectivity in rural regions. Additionally, sectors such as cement, steel, and chemicals are adopting steam turbines in combined heat and power (CHP) applications, creating a steady demand for specialized repair and maintenance services. For instance, in December 2022, NTPC Limited and GE Power signed a memorandum of understanding (MoU) to reduce carbon intensity from NTPC’s coal fired units.

North America Market Analysis

The North America steam turbine service market is poised to increase its revenue share during the forecast period. The region’s growth is attributed to rising investments in upgrading aging power infrastructure. The revenue share in the region is led by the U.S. and Canada. As the region transitions towards cleaner energy sources with net zero emission goals, operators are investing in retrofitting upgrades on fossil-fuel-based turbines to comply with environmental regulations. Additionally, rising demands to manufacture and upgrade equipment for nuclear power plants are poised to assist the market’s growth. For instance, in May 2024, GE Vernova announced the sale of a percentage of its steam power business to EDF which will include related maintenance and upgrade activities for existing power plants.

The U.S. registered the largest revenue share in the steam turbine service sector of North America. The market’s profitable growth curve is owed to rising demands to upgrade thermal power plants and maintenance demands in nuclear power plants. Additionally, the industrial sector of the country heavily relies on steam turbines in petrochemicals, steel, paper, etc. With advancements in predictive maintenance tools and technological advancements in steam turbine maintenance in the country, the market is positioned to continue its growth curve by the end of the forecast period. For instance, in June 2024, research highlighted the use of engineered compression to mitigate corrosion in steam turbine engines.

Canada is positioned to increase its revenue share in the steam turbine service market. The market’s growth is attributed to rising demands for repair and maintenance services in natural gas plants and heavy industries. With a rising focus on curbing carbon emissions, the operators are investing in turbine retrofitting benefiting the market’s growth. In August 2020, Siemens Energy and Kineticor announced a new 900-megawatt (MW) combined cycle power plant to supply 8% of Alberta’s energy supply.