Steam Turbine Service Market Outlook:

Steam Turbine Service Market size was valued at USD 23.04 billion in 2025 and is likely to cross USD 40.87 billion by 2035, registering more than 5.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of steam turbine service is estimated at USD 24.26 billion.

The market’s growth is attributed to surging demands for electricity globally and continued reliance on steam turbines in power generation and industrial applications. Aging power generation infrastructure drives demand for maintenance and upgrades benefitting the adoption of steam turbine services. Emerging economies that are reliant on coal and nuclear power as primary energy sources are positioned to provide greater opportunities in the market.

The International Energy Agency (IEA) estimates global energy demands to grow annually at an average of 3.4% from 2024 to 2026. The electricity demands are poised to be driven by electrification projects in residential and transport sectors, and rapid expansion of data centers. For instance, around 42% of all electricity generation in the U.S. in 2022 was from steam turbines. The heightened use drives demand for steam turbine MRO services. Additionally, the rapid expansion of the industrial sector for various applications such as chemical production and refinery operations increases the use of steam turbines. The increased application creates a burgeoning demand to retrofit steam turbines for efficiency improvements creating multiple opportunities in the global steam turbine service sector.

The global shift towards clean energy production is poised to boost the revenue growth of the steam turbine service sector. Globally, the push to reduce carbon emissions has intensified with net-zero goals. To align with global decarbonization goals, industries are driving demand for steam turbine services to meet regulatory standards. Industries are investing to retrofit existing infrastructure boosting the sector’s growth. For instance, in June 2024, GE Power announced an order for renovation & modernization of steam turbines in Gujarat, India. Additionally, advancements in digitalization can boost the predictive maintenance of steam turbines, increasing demands for services. The steam turbine services sector is poised to leverage the favorable trends and maintain its robust growth curve by the end of the forecast period.

Key Steam Turbine Service Market Insights Summary:

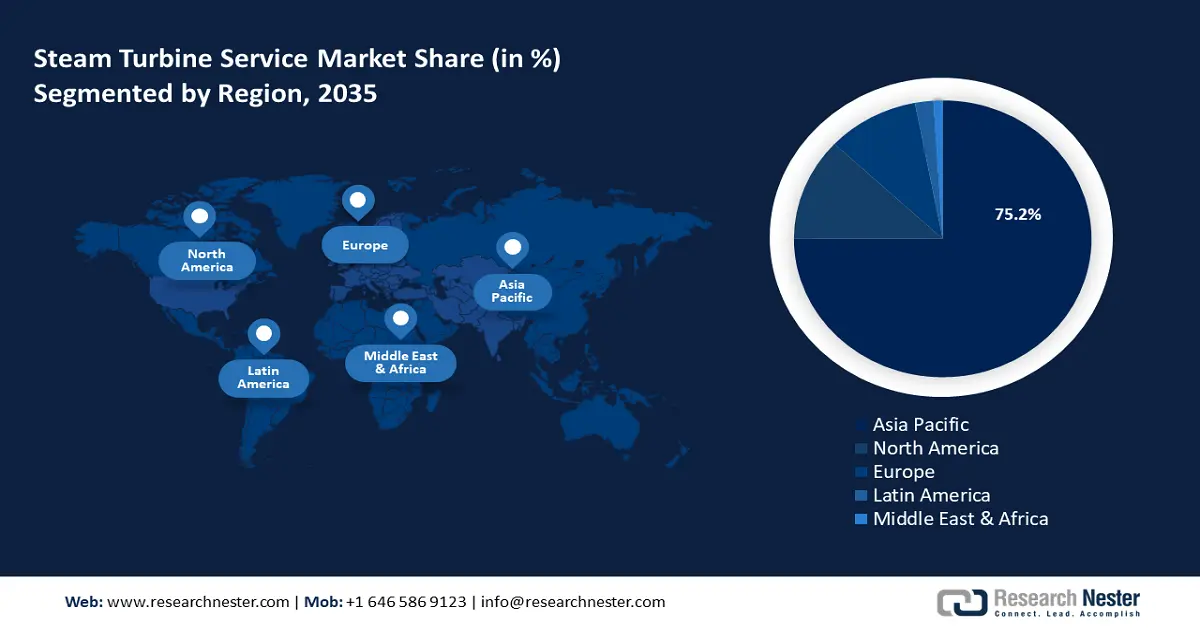

Regional Highlights:

- Asia Pacific commands a 75.2% share in the Steam Turbine Service Market, fueled by rapid industrialization and growing reliance on thermal power generation through 2026–2035.

- North America is expected to increase its revenue share in the Steam Turbine Service Market from 2026 to 2035, driven by rising investments in upgrading aging power infrastructure.

Segment Insights:

- The Maintenance segment is forecasted to achieve a 37.50% share by 2035, propelled by rising demands for services to ensure steam turbine longevity in power plants.

Key Growth Trends:

- Industrial expansion in emerging markets

- Rising demands for emission reductions and aging power generation infrastructure

Major Challenges:

- Supply chain disruptions and spare parts availability

- Regulatory and environmental compliance

- Key Players: GE Vernova, Siemens AG, Doosan Škoda, Ethos Energy, Toshiba Energy, Mitsubishi Heavy Industries, Shanghai Electric Group Co., Ltd., Triveni Turbines, Kessels, Söderqvist Engineering, Mitsubishi Heavy Industries.

Global Steam Turbine Service Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 23.04 billion

- 2026 Market Size: USD 24.26 billion

- Projected Market Size: USD 40.87 billion by 2035

- Growth Forecasts: 5.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (75.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, India, Japan, United States, Germany

- Emerging Countries: China, India, South Korea, Brazil, Mexico

Last updated on : 14 August, 2025

Steam Turbine Service Market Growth Drivers and Challenges:

Growth Drivers

- Industrial expansion in emerging markets: Rapid industrialization in emerging markets such as India, Brazil, and Indonesia drives energy consumption. Numerous industries rely on stream turbines for refining and chemical production. To avoid downtimes that can prove to be costly, industries invest in steam turbine services. For instance, in December 2024, WEG completed the repair of a 35 MW steam turbine. As governments in emerging markets continue to push for industrial growth to support economic progress, the demand for steam engine turbine services is poised to increase, positioning the global steam turbine service market to continue its robust growth.

- Rising demands for emission reductions and aging power generation infrastructure: The global steam turbine services sector is set to benefit from rising demands for emission reductions. Governments across the world are tightening regulatory guidelines to cut carbon emissions. For instance, in September 2022, the U.S. Department of Energy (DOE) announced USD 24 million to advance solar-thermal and industrial decarbonization technologies. The trends boost demands for steam turbine services to retrofit existing infrastructure. Additionally, the proliferation of solar energy is poised to lead to a surge in demand for steam turbine services. Steam turbines are of vital importance in solar thermal power plants to maintain operations.

- Adoption of digital maintenance solutions: The advent of digitalization is positioned to benefit the global steam turbine service market. Operators are investing in digital tools that can streamline maintenance through predictive analysis, reducing operation costs. Steam turbine service providers that can deliver digital maintenance solutions are poised to experience high demand. For instance, in March 2024, Ansaldo Energia announced attendance at the Steam Turbine and Generator User Group that will highlight new digital solutions for servicing and maintenance of steam turbines in cycling power plants. Additionally, the sector will benefit from a global push for Industry 4.0 that prioritizes data-driven decision-making.

Challenges

- Supply chain disruptions and spare parts availability: The steam turbine services sector relies on a steady supply of high-quality spare parts and materials. These materials often have specialized suppliers and global events disrupting the supply chain can be detrimental to the sector’s growth. For instance, COVID-19 impacted the availability and cost of essential components leading to delays of service projects. Additionally, customized parts for aging turbines may not be readily available causing prolonged downtime in services.

- Regulatory and environmental compliance: The steam turbine services sector can be affected by increasing pressure of environmental compliance. Steam turbine operators have to invest in continuous upgrades to ensure compliance with environmental regulations and it can drive the cost of operations. Additionally, the market can face challenges due to variations in regulations across various regions that prove to be a challenge for service providers in providing standardized offerings.

Steam Turbine Service Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.9% |

|

Base Year Market Size (2025) |

USD 23.04 billion |

|

Forecast Year Market Size (2035) |

USD 40.87 billion |

|

Regional Scope |

|

Steam Turbine Service Market Segmentation:

Service (Maintenance, Repair, and Overhaul)

Maintenance segment is predicted to hold steam turbine service market share of more than 37.5% by 2035. The segment’s growth is attributed to rising demands for services to ensure the longevity of steam turbines in power plants. For instance, in February 2024, Doosan Škoda Power signed a contract to supply a steam turbine for a waste-to-energy power plant in the U.S. Regular maintenance of steam turbines minimizes the risk of unexpected failures and helps operators reduce costly downtimes. With advancements in predictive maintenance, service providers can use remote monitoring to detect potential issues before they escalate, boosting the efficacy of maintenance work.

The repair segment of the global steam turbine services sector is poised to register profitable market growth during the forecast period. The segment’s growth is owed to rising demands for steam turbine repair services as operators focus on cost-efficiency by choosing repair over replacement. Additionally, the segment is poised to find opportunities in aging power infrastructure globally, requiring repair services. Businesses are leveraging opportunities in the segment by expanding their services portfolio for steam turbines. For instance, in October 2024, Power Services Group (PSG) announced the expansion of the Gainesville, Georgia Campus to include a steam turbine repair center of excellence.

Design (Reaction, Impulse)

By design, the reaction segment of the steam turbine service market is poised to increase its revenue share by the end of the forecast period. The segment’s growth is attributed to smooth energy transfers and high efficiency at variable loads benefiting the adoption of reaction turbines. Additionally, reaction turbines are in demand from large-scale power plants, where stable energy output is essential. Regions with fluctuating energy demands drive demand for reaction turbines owing to their lower operating costs. For instance, in October 2020, GE announced the supply of reaction steam turbines for a new waste-to-energy plant in Australia.

Our in-depth analysis of the global market includes the following segments:

|

Service |

|

|

Design |

|

|

Capacity |

|

|

End use |

|

|

Service Provider |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Steam Turbine Service Market Regional Analysis:

APAC Market Forecast

Asia Pacific steam turbine service market is predicted to hold revenue share of more than 75.2% by 2035. The region’s growth is driven by rapid industrialization increasing energy demand and growing reliance on thermal power generation in the region. China, India, Japan, and South Korea lead the revenue share in the APAC market. For instance, in July 2024, Korea Southern Power Co. started operations at the Shinsejong combined-cycle power plant in Sejong Multifunctional Administrative City, South Korea.

China leads the revenue share in the APAC steam turbine service sector. The steam turbine service demand in the country is driven by a vast network of coal-fired power plants in the country and rising demands for electricity. For instance, IEA’s energy report of 2024 indicated China has burned one of four tons of coal used globally to produce electricity. Additionally, favorable regulatory support such as the dual carbon goals of China that aims for peak carbon emissions by 2030 and achieve carbon neutrality by 2060 is poised to create a profitable domestic market for power operators to invest in turbine efficiency upgrades and retrofit emission controls. For instance, in July 2024, the Guangdong Huizhou combined plant entered commercial operation with GE Vernova hydrogen-ready combined-cycle units and Harbin Electric’s steam turbines.

India is poised to increase its revenue share in the global steam turbine service market during the forecast period. The market’s growth is attributed to heavy reliance on thermal power and rapid industrial growth. The country is poised to experience rising energy demands to cater to a growing urban population and improve power connectivity in rural regions. Additionally, sectors such as cement, steel, and chemicals are adopting steam turbines in combined heat and power (CHP) applications, creating a steady demand for specialized repair and maintenance services. For instance, in December 2022, NTPC Limited and GE Power signed a memorandum of understanding (MoU) to reduce carbon intensity from NTPC’s coal fired units.

North America Market Analysis

The North America steam turbine service market is poised to increase its revenue share during the forecast period. The region’s growth is attributed to rising investments in upgrading aging power infrastructure. The revenue share in the region is led by the U.S. and Canada. As the region transitions towards cleaner energy sources with net zero emission goals, operators are investing in retrofitting upgrades on fossil-fuel-based turbines to comply with environmental regulations. Additionally, rising demands to manufacture and upgrade equipment for nuclear power plants are poised to assist the market’s growth. For instance, in May 2024, GE Vernova announced the sale of a percentage of its steam power business to EDF which will include related maintenance and upgrade activities for existing power plants.

The U.S. registered the largest revenue share in the steam turbine service sector of North America. The market’s profitable growth curve is owed to rising demands to upgrade thermal power plants and maintenance demands in nuclear power plants. Additionally, the industrial sector of the country heavily relies on steam turbines in petrochemicals, steel, paper, etc. With advancements in predictive maintenance tools and technological advancements in steam turbine maintenance in the country, the market is positioned to continue its growth curve by the end of the forecast period. For instance, in June 2024, research highlighted the use of engineered compression to mitigate corrosion in steam turbine engines.

Canada is positioned to increase its revenue share in the steam turbine service market. The market’s growth is attributed to rising demands for repair and maintenance services in natural gas plants and heavy industries. With a rising focus on curbing carbon emissions, the operators are investing in turbine retrofitting benefiting the market’s growth. In August 2020, Siemens Energy and Kineticor announced a new 900-megawatt (MW) combined cycle power plant to supply 8% of Alberta’s energy supply.

Key Steam Turbine Service Market Players:

- GE Vernova

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Siemens AG

- Doosan Škoda

- Ethos Energy

- Toshiba Energy

- Mitsubishi Heavy Industries

- Shanghai Electric Group Co., Ltd.

- Triveni Turbines

- Kessels

- Söderqvist Engineering

The global steam turbine service market is projected to register a favorable growth curve during the forecast period. Steam turbine service providers are investing in predictive maintenance solutions to reduce downtime and improve the scope of their services.

Here are some key players in the market:

Recent Developments

- In February 2023, Mitsubishi Power announced orders from the Talimarjan-2 TPP project in Uzbekistan for two M701f gas turbines and steam turbines. Mitsubishi Power will provide technical advisors at the site to support the installation and commissioning of the project that is set for commercial operations in 2025.

- In October 2022, Doosan Škoda Power announced a contract with the company Elektrárny Opatovice (EOP) to replace a TG3 steam turbine. The upgrade is expected to improve the quality and reliability of heat and power supply and contribute to better environmental conditions.

- Report ID: 6695

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Steam Turbine Service Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.