Steam Trap Market Outlook:

Steam Trap Market size was over USD 4.65 billion in 2025 and is anticipated to cross USD 7.02 billion by 2035, witnessing more than 4.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of steam trap is assessed at USD 4.83 billion.

The growth might be attributed to the increasing investments and advances in the power and energy industries. Together with the ongoing global increase in industrialization and urbanization, energy consumption has increased dramatically. According to US Energy Information Administration projections, global power generation is expected to rise globally between 30% and 76% in 2050 compared to 2022 in all scenarios. Consequently, there has been an increase in the construction of intrastate transmission and sub-transmission networks in order to satisfy the growing power requirements. Because of the rising earnings of households and the growth of the manufacturing and heavy sectors, there will be an increasing need for energy and power.

Key Steam Trap Market Insights Summary:

Regional Highlights:

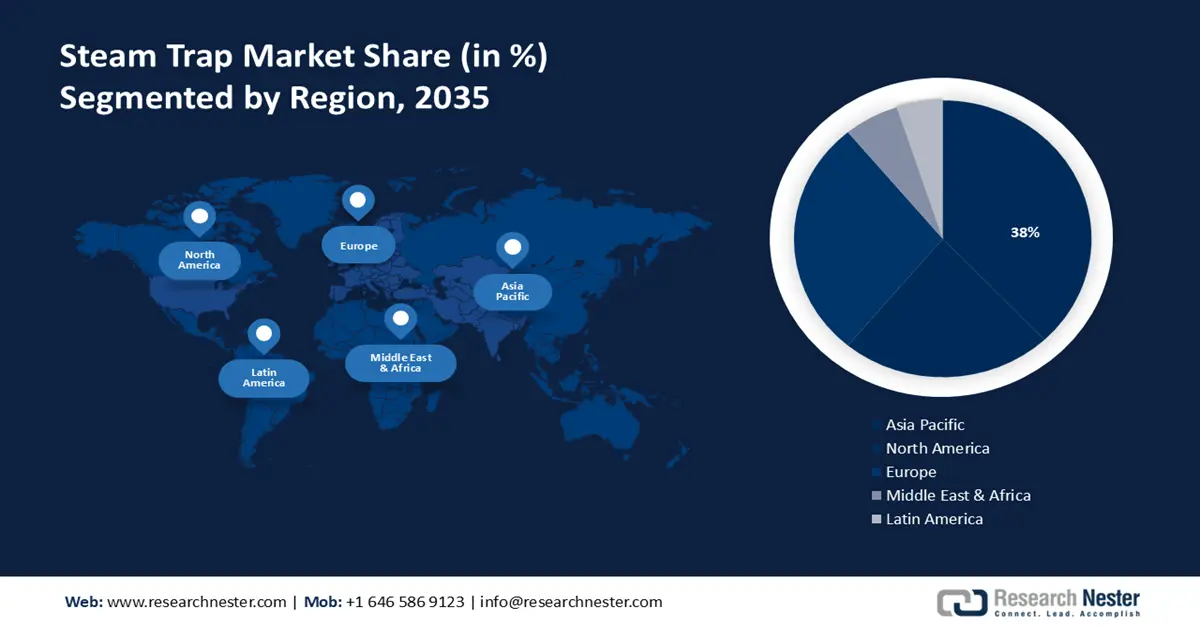

- Asia Pacific steam trap market will hold more than 38% share by 2035, driven by ongoing urbanization and industrialization driving demand for infrastructure and steam trap technology.

Segment Insights:

- The instrument steam tracing segment in the steam trap market is expected to achieve a 65% share by 2035, influenced by the need to maintain consistent temperatures in instrumentation lines.

- The mechanical steam traps segment in the steam trap market is projected to hold a 56% share by 2035, driven by their efficiency in handling large condensate loads in steam systems.

Key Growth Trends:

- Industrial expansion and process optimization

- Energy efficiency imperative - One of the main reasons driving the steam trap market's expansion is the growing awareness of environmental issues along with rising energy prices. To guarantee that steam systems run as efficiently as possible, steam traps are essential. Steam traps save fuel, cut down on greenhouse gas emissions, and avoid energy waste by efficiently extracting condensate and non-condensable gases from steam lines The typical lifespan of a steam trap is six years. Three kinds of steam traps are eligible for reimbursements under the Nicor Gas Energy Efficiency Program

Major Challenges:

- Shift towards renewable energy

- Technological advancements in alternative heating systems

Key Players: The Weir Group, PLC Circor International Inc., Emerson Electric Co., Flowserve Corporation, Pentair Inc., Schlumberger Limited, Spirax-Sarco Engineering, Thermax Ltd., Velan Inc., Watts Water Technologies Inc., Miyawaki Incorporation, Yoshitake, Phucminh Corporation, Motoyama, TLV Corporation.

Global Steam Trap Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.65 billion

- 2026 Market Size: USD 4.83 billion

- Projected Market Size: USD 7.02 billion by 2035

- Growth Forecasts: 4.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 17 September, 2025

Steam Trap Market Growth Drivers and Challenges:

Growth Drivers

- Industrial expansion and process optimization - The expansion of industrial sectors and the demand for process optimization are propelling the growth of the steam trap market. Steam systems that are dependable and effective are becoming more and more in demand as industries change. In many industrial operations, such as manufacturing, electricity generation, and chemical manufacture, steam is an essential ingredient.

The creation of steam accounts for a sizeable share of the fossil fuel consumption of all the major industrial energy consumers, including food processing (57%), pulp & paper (81%), chemicals (42%), petroleum refining (23%), and primary metals (10%). Furthermore, the importance of steam traps increases as enterprises work to optimize their manufacturing processes in order to lower costs and improve product quality.

- Energy efficiency imperative - One of the main reasons driving the steam trap market's expansion is the growing awareness of environmental issues along with rising energy prices. To guarantee that steam systems run as efficiently as possible, steam traps are essential. Steam traps save fuel, cut down on greenhouse gas emissions, and avoid energy waste by efficiently extracting condensate and non-condensable gases from steam lines

The typical lifespan of a steam trap is six years. Three kinds of steam traps are eligible for reimbursements under the Nicor Gas Energy Efficiency Program: Commercial Steam Traps: $15 per trap at 15 psig. As more and more sectors of the economy - from manufacturing to healthcare—invest in energy-efficient technologies, steam traps are becoming an indispensable part of their sustainability plans. - Stringent regulatory standards - The steam trap market is expanding as a result of the strict regulations that have been put in place regarding energy efficiency, safety, and emissions. Reducing energy usage and emissions in industrial processes is a global priority for governments and business organizations.

Steam traps are essential for accomplishing these goals because they manage steam systems effectively. Furthermore, in order to prevent accidents, safety rules require that steam equipment be operated properly, which makes steam traps an essential part of compliance.

Challenges

- Shift towards renewable energy - Steam traps are critical to conventional steam-based systems, but as companies and organizations shift to renewable energy sources like solar, wind, and geothermal energy, the need for them decreases. The global focus on lowering carbon emissions and raising energy efficiency is what is causing this change.

- Technological advancements in alternative heating systems - The steam trap market for conventional steam traps is facing serious competition from the creation and uptake of more sophisticated and energy-efficient heating technologies. The market demand for these components declines since modern technologies frequently do not require the intricate steam systems that make use of steam traps.

Steam Trap Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.2% |

|

Base Year Market Size (2025) |

USD 4.65 billion |

|

Forecast Year Market Size (2035) |

USD 7.02 billion |

|

Regional Scope |

|

Steam Trap Market Segmentation:

Product Type Segment Analysis

Mechanical steam traps segment is anticipated to capture over 56% steam trap market share by 2035. The segment growth can be attributed to mechanical steam traps operate efficiently by using the variation in density between steam and condensate. These steam traps are appropriate for many different process applications and are made to handle large amounts of condensate. These traps are necessary for effective condensate removal in steam systems, which guarantees that the dry and energy-efficient steam utilized in processes is produced. Their adaptability makes them the perfect option for a wide range of industrial applications where dependability and accurate control are essential.

At least once a year, routine inspections and maintenance can greatly increase their dependability. Plants that follow these maintenance plans can lower their failure rates from an average of 15–25% to about 5%. This proactive strategy enhances the plant's overall operational stability and cost-effectiveness in addition to increasing the efficiency of the steam traps.

Application Segment Analysis

By 2035, instrument steam tracing segment is set to hold more than 65% steam trap market share. The growth of the segment will be propelled by the use of steam traps to maintain consistent temperatures in instrumentation lines, ensuring accurate measurements and preventing freezing or condensation. Significant environmental deterioration may result in emerging countries due to the quick industrial growth of China and other Asian countries as well as a preference for economic growth over environmental protection.

Precise measurements are essential for process control and safety in industries such as oil refining and petrochemicals, where this application is critical. Designed to manage modest condensate loads and preserve temperature control, steam traps are utilized in instrument steam tracing.

Material Type Segment Analysis

In steam trap market, steel segment is projected to hold over 35% revenue share by the end of 2035 owing to their durability, corrosion resistance, and ability to withstand high-pressure and high-temperature environments. They are frequently utilized in sectors including power generation, petrochemicals, and heavy industry where steam systems must withstand harsh circumstances. Their extended service life is guaranteed by their sturdy construction, which lowers maintenance and replacement expenses.

Particularly when linked to appliances like the SuperKlean DuraMix 8000 mixers, steam strainers are essential for keeping steam lines clean and operational. The 3/4" stainless steel disc-style steam trap is a crucial component of this arrangement.

Our in-depth analysis of the global steam trap market includes the following segments:

|

Product |

|

|

Application |

|

|

Material |

|

|

Distribution Channel |

|

|

End-Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Steam Trap Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is predicted to hold largest revenue share of 38% by 2035. The Asia-Pacific region's ongoing urbanization and industrialization propels the expansion of infrastructure, which in turn raises demand for state-of-the-art steam trap technology. Ensuring compliance with stringent environmental regulations, reducing operational expenses, and enhancing energy efficiency all depend on these technologies.

India's steam trap market is expected to grow at an annual pace of 7% over the next five years, driven by the country's growing manufacturing sector and government initiatives promoting energy conservation. India's pledge to reduce carbon emissions has put enormous pressure on the industrial sector to adopt efficient steam management technologies. The installation of new infrastructure and the renovation of existing facilities are driving up demand for high-performance steam traps.

China experiences tremendous demand due to its strong industrial base and emphasis on energy conservation, accounting for more than 30% of the steam trap market in Asia Pacific fulfilling 25% global electricity demand. Sophisticated steam systems that minimize energy waste are required due to the country's environmental rules and ongoing industrial developments. Because of this, China is seeing a rise in demand for cutting-edge steam trap solutions that support its goals for environmental protection and operational efficiency.

Reliability in steam traps is still in high demand in Japan, a nation known for its sophisticated technical environment and meticulous engineering. Strong and efficient steam traps are necessary for Japanese companies, which account for 15% of the regional market, to comply with environmental requirements and maximize energy efficiency. The country's focus on boosting industrial productivity and preserving energy

North America Market Insights

By 2035, steam trap market size for North America region is likely to grow significantly with a focus on enhancing energy efficiency and optimizing processes across diverse industries. Steam traps are vital to a wide range of sectors in this region, particularly in the US and Canada, from manufacturing to food processing, sustaining the diverse range of economic activities that are typical in these countries.

In the US, steam traps are essential to sectors including chemical manufacturing, petroleum refining, and food processing where steam economy and system efficiency are vital. The market is driven by strict energy rules and the need for innovative steam management technologies. Sales of steam traps in the US are predicted to rise at a 4.5% annual rate as a result of facility improvements and new industrial projects that require efficient steam control system.

Canada's heavy industries and heating systems obviously rely on steam traps, given the country's colder climate. Particularly in district heating systems used in the paper and pulp industries, steam traps are essential for maintaining operational dependability and energy efficiency. The demand for efficient steam traps is always rising due to the nation's emphasis on sustainable practices, as steam generation constitutes 20% of industrial energy usage. The Canadian steam trap industry is expected to grow significantly as a result of government measures to improve industrial energy efficiency.

Steam Trap Market Players:

- The Weir Group PLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Circor International Inc.

- Emerson Electric Co.

- Flowserve Corporation

- Pentair Inc.

- Schlumberger Limited

- Spirax-Sarco Engineering

- Thermax Ltd.

- Velan Inc.

- Watts Water Technologies Inc.

Industry participants are extending the functionalities of automation control systems to facilitate their application in the industrial automation sector including aerospace and military, mining and metals, and transportation. Leading companies in the market for industrial automation and control systems include:

Recent Developments

- Spirax-Sarco Engineering has successfully acquired Cotopaxi Ltd., an energy consultancy company, as of January 2022. This strategic move is planned to fortify Spirax-Sarco's Steam Specialties division and broaden its offerings to industrial steam customers by leveraging Cotopaxi's experience with digital steam system solutions.

- Watts Water Technologies, Inc. announced on December 11, 2023, that it has finalized an agreement to buy Josam Company. By incorporating Josam's cutting-edge and precisely crafted goods, Watts Water Technologies will be able to offer a wider choice of products and solutions to its customers.

- Report ID: 6122

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Steam Trap Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.