Steam Methane Reforming Market Outlook:

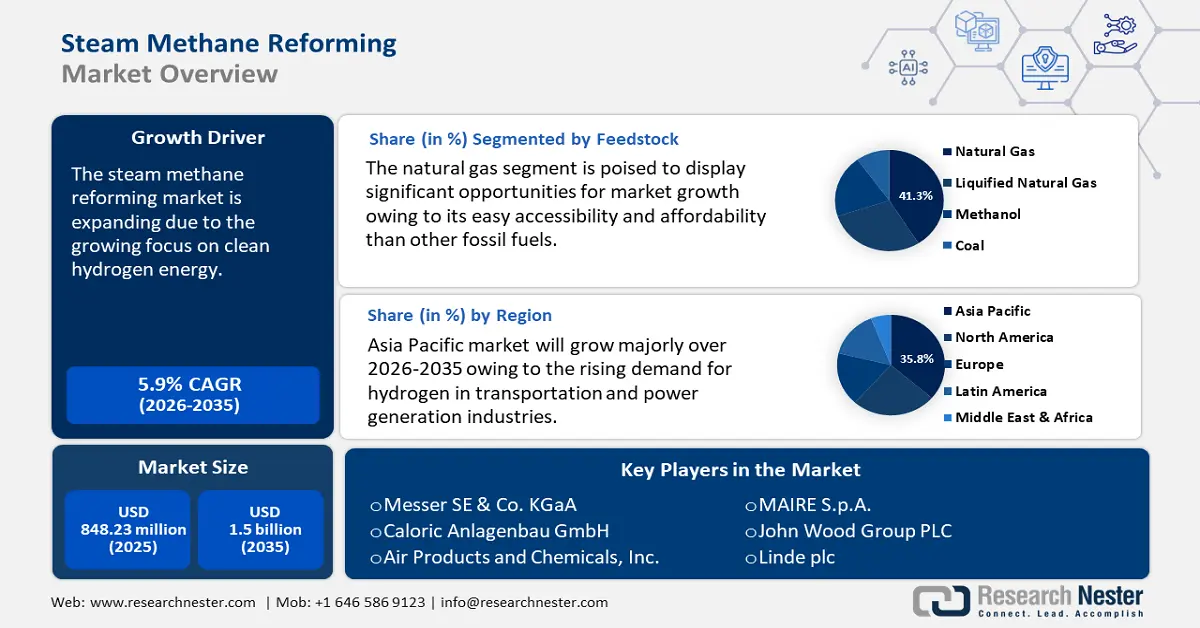

Steam Methane Reforming Market size was valued at USD 848.23 million in 2025 and is set to exceed USD 1.5 billion by 2035, expanding at over 5.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of steam methane reforming is estimated at USD 893.27 million.

The global steam methane reforming market is positioned for tremendous growth due to the escalating emphasis on clean hydrogen energy characterized by low carbon content and the increasing application of hydrogen fuel as an active propulsion system within the automotive sector. According to the International Renewable Energy Agency, as of June 2021, four countries—Japan, the People's Republic of China, Korea, and the United States—accounted for about 90% of the more than 40,000 fuel-cell electric vehicles in operation globally. This has resulted in the increased demand for hydrogen from various end use sectors.

Presently, the majority of hydrogen production, including blue hydrogen, is facilitated by the well-established steam-methane reforming process. This process employs high-temperature steam, ranging from 700°C to 1,000°C, to generate hydrogen from methane sources such as natural gas. In steam-methane reforming, methane and steam interact with a catalyst under pressures of 3 to 25 bar (1 bar equates to 14.5 psi), resulting in the production of hydrogen, carbon monoxide, and a minimal amount of carbon dioxide.

Moreover, as industries and governments push for cleaner energy solutions, SMR with carbon capture and storage (CCS) has emerged as an economical way to produce blue hydrogen at an industrial scale. Investments in CCS technology are making SMR a more viable option for meeting decarbonization targets while leveraging existing natural gas infrastructure. Therefore, the surging demand for low-carbon hydrogen is driving the increased production capacity for blue hydrogen, which in turn is boosting the steam methane reforming market.

|

Region |

Blue Hydrogen Production in 2023 (kilotons) |

|

North America |

2,091.6 |

|

South and Central America |

- |

|

Europe |

44.1 |

|

Middle East |

621.9 |

|

Africa |

- |

|

Asia Pacific |

1,929.7 |

|

World Total |

4,687.3 |

Key Steam Methane Reforming Market Insights Summary:

Regional Highlights:

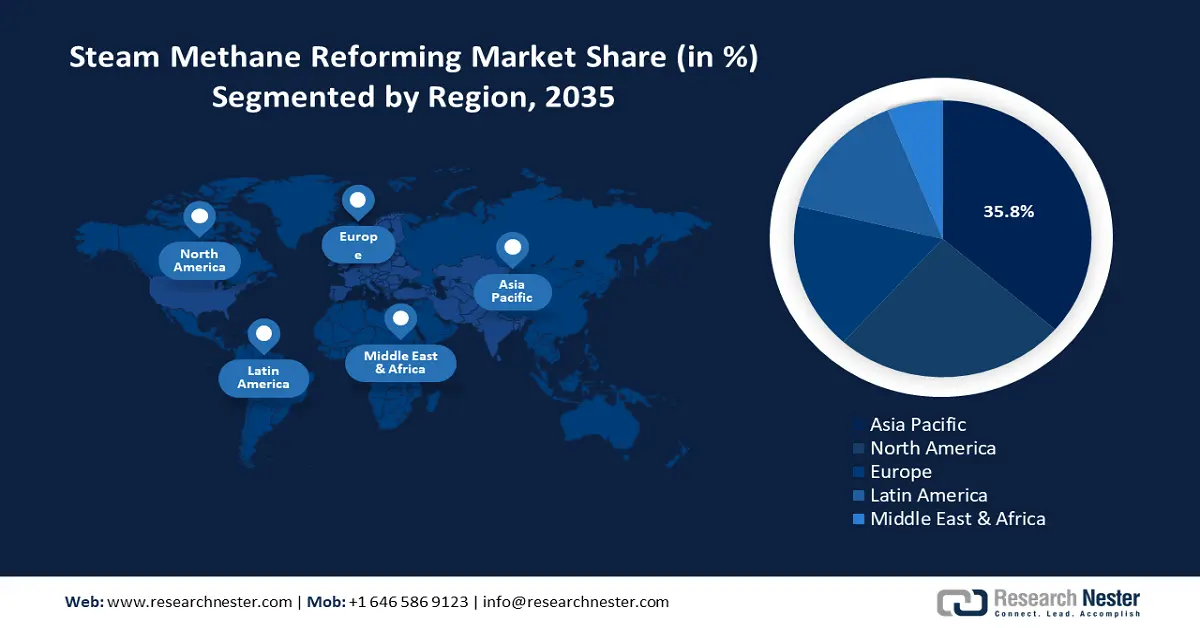

- Asia Pacific commands the Steam Methane Reforming Market with a 35.8% share, propelled by natural gas abundance, hydrogen demand, and government initiatives, driving growth through 2026–2035.

- North America’s steam methane reforming market is projected to achieve notable growth by 2035, driven by natural gas abundance and hydrogen production policies.

Segment Insights:

- The Natural Gas segment of the Steam Methane Reforming Market is projected to achieve a 41.30% share from 2026 to 2035, driven by its affordability, availability, and efficiency in hydrogen production.

Key Growth Trends:

- Expanding hydrogen fuel adoption beyond traditional industries

- Recent advances in steam methane reforming technology

Major Challenges:

- Increasing environmental and human health concerns

- Maintenance and operational issues

- Key Players: Messer SE & Co. KGaA, Caloric Anlagenbau GmbH, Air Products and Chemicals, Inc., MAIRE S.p.A., John Wood Group PLC, Linde plc, Plug Power Inc., Air Liquide S.A., Worthington Enterprises, Inc., Praxair, Inc..

Global Steam Methane Reforming Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 848.23 million

- 2026 Market Size: USD 893.27 million

- Projected Market Size: USD 1.5 billion by 2035

- Growth Forecasts: 5.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 13 August, 2025

Steam Methane Reforming Market Growth Drivers and Challenges:

Growth Drivers

-

Expanding hydrogen fuel adoption beyond traditional industries: While hydrogen has long been used in refining, ammonia production, and chemical processing, its role is broadening into transportation, power generation, heating, and others. The direct use of hydrogen in boiler units is poised to rise as a result of improved safety protocols and infrastructure improvements, which is raising its commercial demand. Furthermore, with fewer options for low-carbon fuels, industries such as shipping and aviation stand to gain significant benefits from hydrogen in terms of achieving environmental objectives.

Despite the higher energy consumption and costs associated with hydrogen-based fuels, recent regulatory changes intended to meet low-carbon targets are anticipated to significantly increase steam methane reforming market revenues. The market will develop due to the transition from fossil fuels to renewable energy sources and low-carbon hydrogen and the extensive use of these technologies in sectors including semiconductors. The International Energy Agency (IEA) reported that in 2023, the demand for low-emission hydrogen increased by over 10%, or fewer than 1 million tons. Recently, government action has increased through market development tools, incentive programs, and mandates. -

Recent advances in steam methane reforming technology: Recent advances in the catalysis of steam methane reforming include the development of nickel-based catalysts with enhanced stability, noble metal-doped catalysts for higher activity, and perovskite-based materials that offer improved resistance to sintering and deactivation. Furthermore, researchers have engineered ultrathin wash coats of Ni/CeO2/ZrO2 catalysts on honeycomb cordierite monoliths, achieving exceptional performance in methane drying reforming.

Despite minimal active phase loading, these monolithic catalysts reach thermodynamic conversion limits at 750°C under high-weight hourly space velocities, maintaining stability over extended operation periods. These innovations are propelling the steam methane reforming market by improving hydrogen production efficiency, decreasing costs, and supporting the shift toward low-carbon energy solutions. -

Rising policy support for hydrogen production: The government's support and funding for increasing production capabilities is growing in tandem with the demand for hydrogen. The IEA published a Global Hydrogen Review 2024 Report revealing that project developers worldwide invested USD 3.5 billion in ongoing hydrogen supply projects in 2023. Projects constructing electrolysis facilities accounted for around 80% of this, with the remaining projects combining hydrogen generation with carbon capture, utilization, and storage (CCUS).

Although the public market values of hydrogen companies have recently declined hydrogen start-ups have managed to raise a total of USD 3.7 billion in equity capital in 2023. This sum was dominated by project developers for industrial hydrogen usage and technology developers for hydrogen production; however, transactions made thus far in 2024 demonstrate a greater mix of technologies. Anion exchange membrane (AEM) electrolysis and the catalytic breakdown of methane to produce hydrogen have advanced to Technology Readiness Level (TRL) 7, marking several innovative milestones during the previous year. Therefore, supportive government policies are fueling the steam methane reforming market expansion.

Challenges

-

Increasing environmental and human health concerns: The production of large amounts of carbon dioxide (CO2) as a byproduct is the main disadvantage of steam methane reforming (SMR). Using steam as a reactant, SMR breaks down the hydrocarbon methane into hydrogen and carbon monoxide. The water-shifting reaction is then used to further break down the steam and carbon monoxide into hydrogen and carbon dioxide. Together, SMR and other conventional methods of producing hydrogen released 900 million tons of carbon dioxide into the atmosphere in 2020 alone. This amount is equivalent to the emissions of several developed countries. SMR's CO2 emissions can harm the environment and human health in addition to contributing to climate change. As a result, many scientists and decision-makers are searching for strategies to cut or completely eradicate CO2 emissions from SMR and other processes that produce hydrogen.

-

Maintenance and operational issues: High-temperature activities can subject equipment to significant thermal stress, leading to material deterioration and increased maintenance needs. This includes the routine replacement of components such as heat exchangers and refractory tubes. Additionally, potential breakdowns could disrupt the hydrogen supply chain, emphasizing the need for robust predictive maintenance strategies and the use of durable, heat-resistant materials. Successfully addressing these challenges requires an ongoing effort to optimize processes aimed at maximizing hydrogen yield while minimizing waste. This approach involves not only improving the performance of catalysts to work effectively at lower temperatures and pressures but also maintaining precise control over temperature, pressure, and gas flow rates.

Steam Methane Reforming Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.9% |

|

Base Year Market Size (2025) |

USD 848.23 million |

|

Forecast Year Market Size (2035) |

USD 1.5 billion |

|

Regional Scope |

|

Steam Methane Reforming Market Segmentation:

Feedstock (Natural Gas, Liquified Natural Gas, Methanol, Coal)

Natural gas segment is anticipated to dominate around 41.3% steam methane reforming market share by the end of 2035. Since it is easily accessible, easy to handle, and has a high hydrogen-to-carbon ratio that reduces the production of carbon dioxide byproducts (CO2), natural gas is a more affordable hydrogen feed than other fossil fuels. Natural gas reforming is a sophisticated and well-established production method that expands on the pipeline distribution system. Methane (CH4) found in natural gas can be utilized in thermal processes such as partial oxidation and steam-methane reformation to create hydrogen. At present, hydrogen for fuel cell electric cars (FCEVs) and other uses may be produced by reforming inexpensive natural gas. It is anticipated that the generation of hydrogen from natural gas will eventually be supplemented by production from nuclear, renewable energy, coal (with carbon capture and storage), and other domestic, low-carbon energy sources.

Technology (Steam Reforming, Autothermal Reforming, Partial Oxidation, Catalytic Partial Oxidation)

The steam reforming segment in steam methane reforming market is projected to garner a significant share during the assessed period. Natural gas, primarily methane (CH4), is the starting point for steam methane reforming (SMR), which is an established, scalable, and efficient technology. Before reforming, natural gas undergoes desulfurization to eliminate harmful sulfur compounds. SMR can produce low-carbon or blue hydrogen when combined with carbon capture and storage (CCS) to manage CO2 emissions. Many industries, particularly in refining and petrochemicals, utilize existing SMR units, reducing the need for significant new capital investments.

Our in-depth analysis of the global steam methane reforming market includes the following segments:

|

Feedstock |

|

|

Technology |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Steam Methane Reforming Market Regional Analysis:

APAC Market Statistics

Asia Pacific steam methane reforming market is poised to capture revenue share of around 35.8% by the end of 2035. There are abundant natural gas resources in the region, with countries such as China owning sizable quantities. India also plays a key role in the expansion of the Asia Pacific steam methane reforming market. The abundance of natural gas provides a strong foundation for the development of SMR technology. In terms of the global shift to a hydrogen-based economy, the region has been leading the way. Steam methane reforming produces hydrogen, which is essential to this transformation since it may be used in industry, transportation, and power generation. To reduce their dependency on imports, obtain a competitive advantage in the global hydrogen market, and address the geopolitical importance of energy security, many Asian countries are keen to create their own hydrogen sources.

Furthermore, as China pushes for carbon neutrality by 2060, hydrogen is gaining momentum as a key energy source for reducing emissions. China's carbon neutrality guidelines have identified low-emission hydrogen and carbon capture, utilization, and storage (CCUS) technologies as top priorities. The IEA announced that China produced about 33 Mt of hydrogen in 2020, which accounted for 30% of global production. China’s leading position results from its large share of the international chemical market and its considerable oil refining capacity, which are the primary sources of hydrogen demand today. Therefore, SMR remains the dominant method for hydrogen production due to its cost-effectiveness and well-established infrastructure.

Moreover, India’s focus on cleaner energy solutions has increased the demand for hydrogen for industrial decarbonization and as a potential source in emerging green energy projects. The government’s initiatives, such as the National Green Hydrogen Mission, are driving investments in hydrogen production technologies, including steam methane reforming with carbon capture. Additionally, the expansion of India’s petrochemical and ammonia industries is fueling the demand for cost-effective hydrogen production, where SMR remains the leading technology.

According to the Ammonia Energy Association with almost 8% of the world's current production, India is one of the biggest manufacturers of ammonia. To produce fertilizers like urea, diammonium phosphate (DAP), and other complex fertilizers (OCFs), India needs between 17 and 19 million metric tons of ammonia annually (MTPA). Grey ammonia created by reforming natural gas, is the only type now manufactured and utilized in India. Also, the availability of natural gas infrastructure and increasing investments in LNG imports further support the growth of the market.

North America Market Analysis

The steam methane reforming market in North America is predicted to hold a notable share during the projected period. North America has an abundance of natural gas, which is the main fuel used in steam methane reforming. The abundance of natural gas in the region makes SMR production more competitive. Major investments are made in the construction of SMR and other hydrogen-producing facilities. Both the public and corporate sectors are interested in funding projects related to hydrogen production and sustainable energy. Combining SMR with renewable energy sources such as solar and wind can increase the sustainability of hydrogen generation.

In the U.S., the government policies and tax credits supporting hydrogen economy development, along with investments in carbon capture and storage (CCS) to reduce emissions from SMR, are further boosting steam methane reforming market expansion. For instance, a new 10-year incentive for clean hydrogen production tax credit of up to USD 3.00 per kilogram is created under the Clean Hydrogen Production Tax Credit. Additionally, under Section 48, projects may receive an investment tax credit of up to 30%. Carbon intensity determines the amount of credit that can be given, with a maximum of four kilos of CO2 equivalent per kilogram of H2. The credit offers a four-tiered incentive that varies based on the hydrogen generation pathway's carbon intensity. Additionally, advancements in infrastructure for hydrogen distribution and storage, as well as collaborations between public and private sectors, are fueling the demand for SMR technology in the country.

Similarly, Canada’s commitment to reducing carbon emissions and transitioning to a hydrogen economy, particularly through blue hydrogen production with carbon capture and storage (CCS), is driving investments in SMR technology. Also, the Government of Canada reported that to develop this clean energy possibility, more than USD 100 billion in prospective investment has been expressed in the approximately 80 low-carbon hydrogen production projects that have been disclosed.

Key Steam Methane Reforming Market Players:

- Messer SE & Co. KGaA

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Caloric Anlagenbau GmbH

- Air Products and Chemicals, Inc.

- MAIRE S.p.A.

- John Wood Group PLC

- Linde plc

- Plug Power Inc.

- Air Liquide S.A.

- Worthington Enterprises, Inc.

- Praxair, Inc.

To improve the efficiency and economics of steam methane reforming, major participants in the steam methane reforming market have invested in innovations and conducted research and development. In addition to expanding their product and service offerings to reach a wider range of consumers, the leading competitors in the steam methane market are attempting to gain steam methane reforming market share through collaborations, mergers, and acquisitions.

Recent Developments

- In October 2024, MAIRE announced that Binh Son Refining and Petrochemical Joint Stock Company (BSR) awarded NEXTCHEM (Sustainable Technology Solutions), through its subsidiary KT Tech, hydrogen technologies licensor, the licensing and Process Design Package (PDP) for a new hydrogen production unit as part of the larger upgrading and expansion project of Vietnam's Dung Quat Refinery.

- In April 2022, Wood introduced its innovative steam methane reforming (SMR) technology, which reduces CO2 emissions by 95% compared to a standard hydrogen manufacturing facility. The technique addresses inefficiencies in energy, heat production, and industrial processes, which collectively account for more than half of worldwide greenhouse gas emissions.

- Report ID: 7208

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Steam Methane Reforming Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.