Steam Generator Market Outlook:

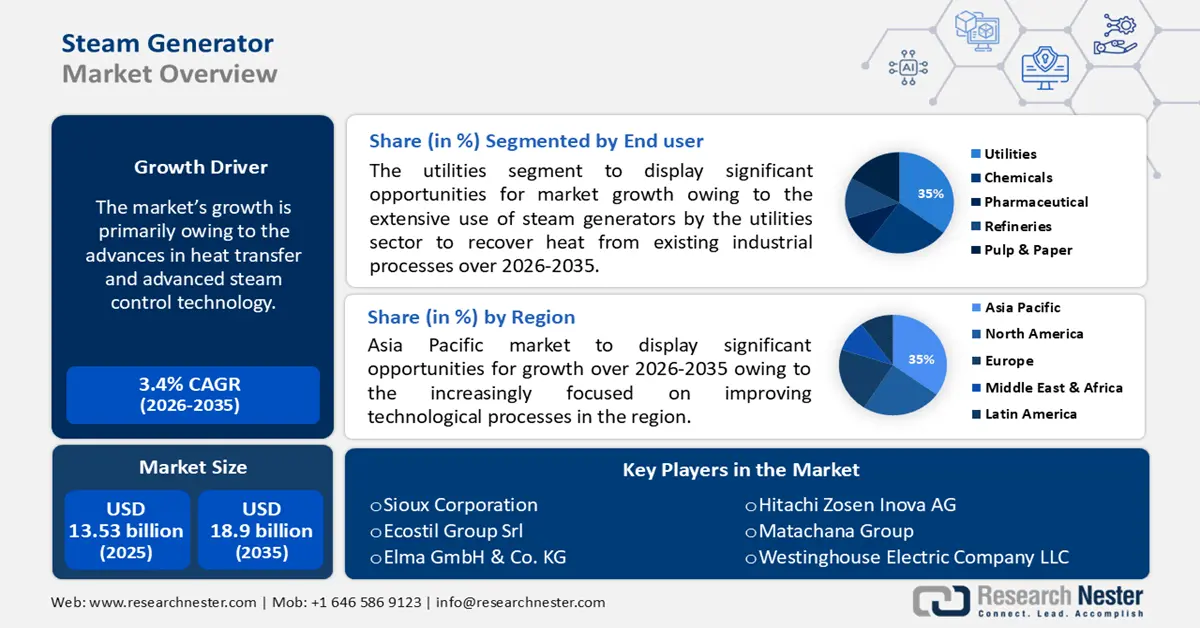

Steam Generator Market size was valued at USD 13.53 billion in 2025 and is likely to cross USD 18.9 billion by 2035, registering more than 3.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of steam generator is estimated at USD 13.94 billion.

Market growth is primarily owing to the advances in heat transfer and advanced steam control technology. Moreover, increasing demand for electricity worldwide has created a need among energy industry players to increase daily energy production, which is appraised to boost market growth. In the year 2018, approximately 23 trillion kWh of electricity was consumed worldwide, compared with 22 and 21 trillion kWh of electricity in 2017 and in the year 2016, respectively.

In addition, rising demand for energy efficient systems coupled with increased use of machinery for generating dry and saturated steam for pharmaceutical plants is expected to fuel market growth in the near future. It was noted that global energy demand increased by 2.3% in 2019, with buildings and industry accounting for 80% of the increase. Energy efficiency improvements accounted for 40% of the reduction in global energy demand in the year 2019. It is widely used to reduce the generation load and prevent low vapor rates. This has been assessed as a key factor that is estimated to create lucrative opportunities for the market over the forecast period. A steam generator is a low water boiler of a type similar to a flash steam boiler. The usual construction is a helical coil of water tubes arranged as a single or single tube coil. Circulation is done as a forced circulation boiler in the flow and pumped under pressure.

Key Steam Generator Market Insights Summary:

Regional Highlights:

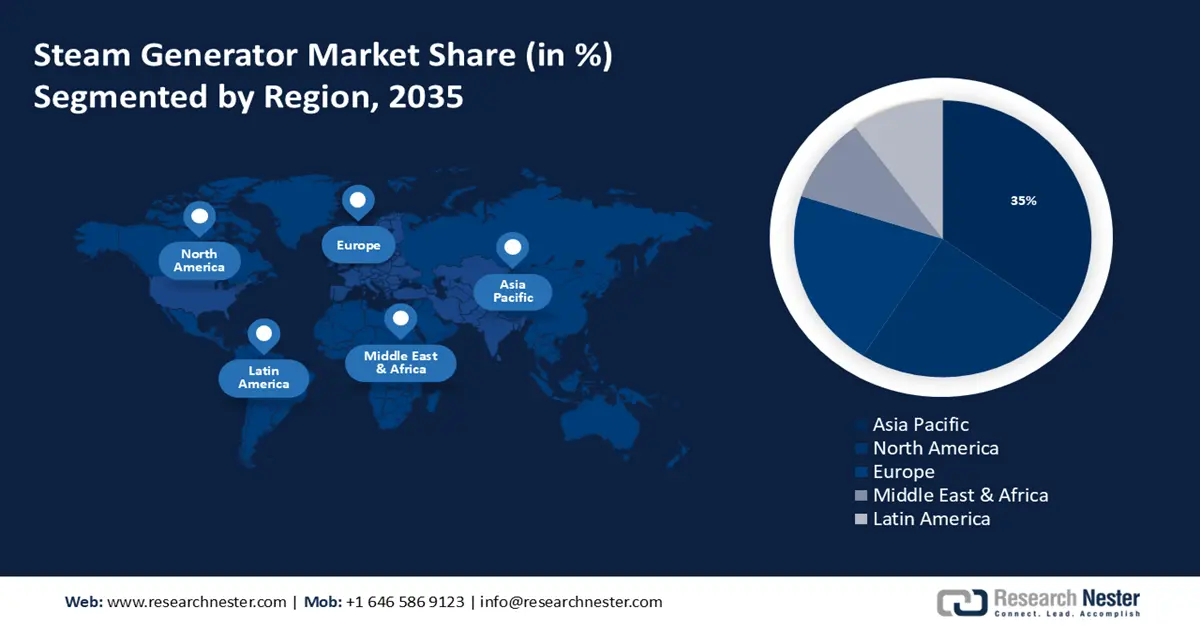

- By 2035, the Asia Pacific region is expected to secure a 35% share of the steam generator market, owing to improving technological processes and high manufacturing output.

- North America is anticipated to account for around 24% share during the forecast period, attributed to high urbanization and increasing housing projects.

Segment Insights:

- By 2035, the utilities segment in the steam generator market is projected to hold a 35% share, supported by the extensive use of steam generators by utilities to recover heat from existing industrial processes.

- Over 2026–2035, the austenitic segment is poised to dominate the market share, spurred by its high resistance to hydrogen embrittlement.

Key Growth Trends:

- Elevating Growth in Urbanization

- Increasing demand for electricity

Major Challenges:

- High Cost of Installing Steam Generators

- Dearth of Skilled Professionals

Key Players:Robert Bosch GmbH, Sioux Corporation, Ecostil Group Srl, Elma GmbH & Co. KG, Hitachi Zosen Inova AG, Matachana Group, Westinghouse Electric Company LLC, BBM Akustik Technologie GmbH, Larsen & Toubro Ltd, Aqua-Nova AB.

Global Steam Generator Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 13.53 billion

- 2026 Market Size: USD 13.94 billion

- Projected Market Size: USD 18.9 billion by 2035

- Growth Forecasts: 3.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: Vietnam, Indonesia, Brazil, Mexico, Turkey

Last updated on : 19 November, 2025

Steam Generator Market - Growth Drivers and Challenges

Growth Drivers

-

Elevating Growth in Urbanization – The population movement from rural to urban regions, the concomitant decline in the number of individuals living in rural areas, and the manner in which societies adjust to this transition are also included. Urbanization is significantly increasing all over the world and is estimated to increase more over the forecast period. Globally, 55% of people lived in cities in the year 2018, and 68% are expected to do so by the year 2050. The urbanization rate is rising as more individuals are showing the tendency of moving to urban areas. As a result, the demand for electricity services has been growing, which has increased the usage of steam generator for different activities.

-

Increasing demand for electricity: The demand for electricity is increasing owing to the growing population, urbanization, and industrialization. Steam generators are used in thermal power plants to generate electricity, and the increasing demand for electricity is expected to drive the market for steam generators. Global electricity demand increased by 3% in 2019, with buildings and industry accounting for 80% of the increase.

-

Rising focus on renewable energy: The world is moving towards renewable energy sources, and steam generators are used in solar thermal power plants to generate electricity. The increasing focus on renewable energy is expected to boost the steam generator market. The world has seen a significant increase in renewable energy generation capacity in recent years. As of the end of 2020, renewable energy had a total installed capacity of 2,799 GW, which represents an increase of 45% compared to 2015.

-

Rise in Research Spending – Growth in the global market during the forecast period can be further attributed to increased investment in research and development activities to continuously find more viable solutions for steam generations. Research reports show that global R&D spending has more than tripled in real terms since 2000, rising from about USD 680 billion to more than USD 2.5 trillion in the year 2019.

-

Spiking Electricity Consumption – The world consumed nearly 23,500 TWh (terawatt-hours) of electricity in the year 2020, according to the International Energy Agency (IEA) and it is anticipated to grow more over the forecast period.

-

Rapidly Growing Chemical Industry – For instance, chemical demand is expected to increase by 8% each year by 2025. By 2025, India's chemical industry will contribute USD 290 billion to its gross domestic product.

Challenges

-

High Cost of Installing Steam Generators – The cost of installing Steam Generators can be high owing to several factors, including equipment costs, civil works, and others, which is estimated to hamper the market growth.

-

Dearth of Skilled Professionals

-

Presence of Product Alternative

Steam Generator Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

3.4% |

|

Base Year Market Size (2025) |

USD 13.53 billion |

|

Forecast Year Market Size (2035) |

USD 18.9 billion |

|

Regional Scope |

|

Steam Generator Market Segmentation:

End-user Segment Analysis

The global steam generator market is segmented and analyzed for demand and supply by end user into cell utilities, chemicals, pharmaceutical, refineries, pulp & paper, and others. Out of these types of end users, the utilities segment is estimated to gain the largest market share of about 35% in the year 2035. The growth of the segment can be accredited to the extensive use of steam generators by the utilities sector to recover heat from existing industrial processes. Moreover, based on materials, the austenitic segment is projected to hold the largest share over the forecast period owing to the high resistance to hydrogen embrittlement of this class of steels. Apart from that, the excellent heat resistance, corrosion resistance, and ductility of this steel are projected to drive the growth of this market segment in the coming years. A utility is an organization that maintains the infrastructure of a public service. Utilities are subject to public control and regulation, from local community-based groups to statewide government monopolies. Utility services include telecommunications, power, natural gas, certain transportation services, and water and wastewater treatment services provided by private companies. The telecommunications industry is made up of a mix of large and small players around the world. The AT&T company makes more money than any other carrier with the revenue of nearly USD 172 billion, but China's total telecom asset base is much larger than that. This overarching term has four basic principles, including utility of form, utility of time, utility of place, and utility of possession.

Material Segment Analysis

The global steam generator market is also segmented and analyzed for demand and supply by material into martensitic, Ferritic, Austenitic, and Others. Amongst these five segments, the martensitic segment is expected to garner a significant share of around 30% in the year 2035. Martensitic is a very hard form of the crystal structure of steel. It is named after the German metallurgist Adolf Martens. Similarly, the term can also refer to any crystal structure resulting from non-diffusive transformation. Martensitic is a descriptive term used to refer to martensitic stainless steels. Martensitic stainless steel is a type of steel with added carbon and has a body-centered tetragonal crystal structure. The main difference between austenitic stainless steel and martensitic stainless steel is that the crystal structure of austenitic stainless steel is face-centered cubic, while the crystal structure of martensitic stainless steel is body-centered cubic. Martensitic steel is very useful in automotive applications such as door beams, bumpers, very light and strong lower side rails (sill plates), cross car beams, and beams designed to prevent intrusion into the vehicle interior. Hence, growing sales of vehicles is estimated to boost the segmental growth. For instance, it was noted that global passenger car sales in the year 2020 reached about 63 million units.

Our in-depth analysis of the global market includes the following segments:

|

By End User |

|

|

By Material |

|

|

By Rated Power |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Steam Generator Market - Regional Analysis

APAC Market Insights

The steam generator in the Asia Pacific region, amongst the market in all the other regions, is projected to hold the largest market share of about 35% by the end of 2035. The regional growth can majorly be attributed to the increasingly focused on improving technological processes and high manufacturing output. In the year 2020, China's manufacturing output was about USD 3.85 trillion, an increase of 0.8% from the year 2019. Moreover, increasing production of sterile products in the pharmaceutical industry is expected to boost the market growth in the region in the future. Moreover, the regional market is also expected to gain a prominent share during the forecast period owing to the high adoption rate of modern steam generator technology and the strong presence of key market players in the region. A steam generator is a device that uses a heat source to boil liquid water, transforming it into a gaseous phase known as steam. Heat can be generated by burning fuels such as coal, oil, natural gas, municipal waste or biomass, nuclear fission reactors, and other sources. Steam generators range from small medical and domestic humidifiers to the large steam generators used in traditional coal-fired power plants, producing approximately 3,500 kilograms of steam per megawatt-hour of power generation.

North American Market Insights

The steam generator in the North America region, amongst the market in all the other regions, is projected to hold the second largest share of about 24% during the forecast period. The growth of the market in this region can primarily be attributed to the high urbanization and increasing housing projects in the area. Public housing spending was tallied at about USD 9 billion in the year 2020 from about USD 6.5 billion in the year 2019. Population growth is estimated to boost domestic and electricity demand. In addition, about 20 million apartments are expected to be built in the area over the next ten years. The US commercial construction sector is expected to grow in the coming years. The University of Illinois at Chicago (UIC) recently announced plans to build a USD 95 million arts center on its campus. The 88,000-square-meter building is primarily used by its UIC School of Drama and Music. All these factors are estimated to increase the demand for steam generator in this region during the forecast period and hence, fuel the regional market growth.

Europe Market Insights

Further, the steam generator in the Europe region, amongst the market in all the other regions, is projected to hold a majority of the share by the end of 2035. The growth of the market can be attributed majorly to the increasing demand of electricity in the region. The demand for electricity in Europe is increasing due to the growing population, urbanization, and industrialization. Steam generators are used in thermal power plants to generate electricity, and the increasing demand for electricity is expected to drive the market for steam generators. Many European countries have set targets to reduce greenhouse gas emissions and promote the use of renewable energy sources. Steam generators are used in solar thermal power plants to generate electricity, and the increasing focus on renewable energy is expected to boost the steam generator market. Many of the power plants in Europe are old and inefficient, and there is a need to replace them with new, more efficient ones. Steam generators are used in modern power plants to generate electricity, and this is expected to drive the market for steam generators.

Steam Generator Market Players:

- Robert Bosch GmbH

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Sioux Corporation

- Ecostil Group Srl

- Elma GmbH & Co. KG

- Hitachi Zosen Inova AG

- Matachana Group

- Westinghouse Electric Company LLC

- BBM Akustik Technologie GmbH

- Larsen & Toubro Ltd

- Aqua-Nova AB

Recent Developments

- Larsen & Toubro has delivered a 700MW steam generator to Gorakhpur Haryana Anu Vidyut Pariyojana, 36 months ahead of schedule.

- Mitsubishi Power Europe has been awarded a contract to supply heat recovery boilers for a new combined cycle power plant in Flensburg, Germany.

- Report ID: 3770

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Steam Generator Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.