Boiler Market Outlook:

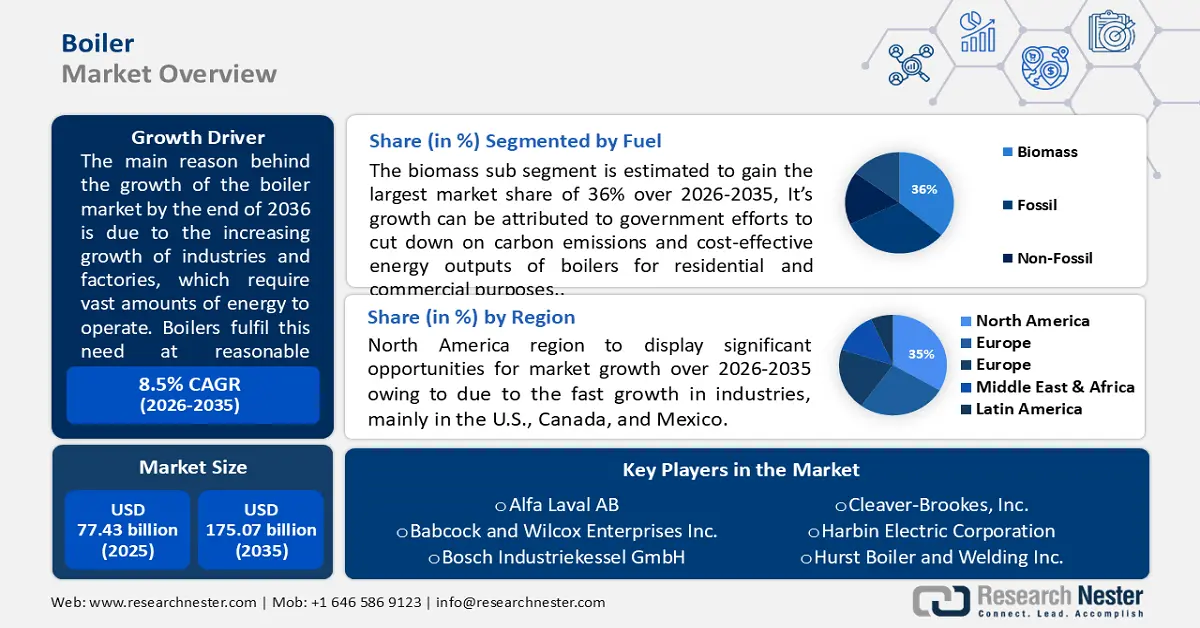

Boiler Market size was over USD 77.43 billion in 2025 and is poised to exceed USD 175.07 billion by 2035, witnessing over 8.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of boiler is estimated at USD 83.35 billion.

The global boiler market is growing exponentially every year due to the rapid growth of industries and factories like chemical, automotive, recycling, etc., which require vast amounts of energy that boilers can provide. Since boilers use less energy than other sources like furnaces to generate heat, they are also a popular option for not just factories but residential heating as well.

Key Boiler Market Insights Summary:

Regional Highlights:

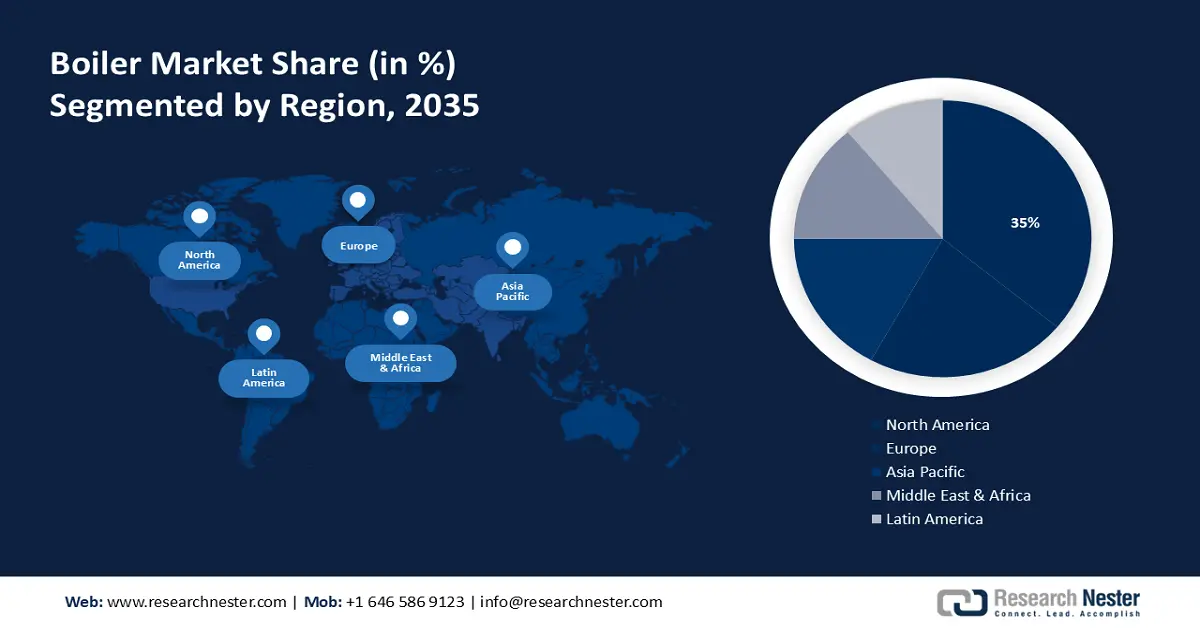

- North America boiler market will secure over 35% share by 2035, driven by industrial growth and green energy focus.

- Europe market will experience significant CAGR during 2026-2035, driven by demand for energy-efficient boilers amid the energy crisis.

Segment Insights:

- The steam boilers segment in the boiler market is expected to achieve significant growth till 2035, driven by their superior efficiency and widespread use in coal power projects.

- The biomass segment in the boiler market is anticipated to achieve lucrative growth till 2035, influenced by strict government regulations on emissions and cost-effectiveness.

Key Growth Trends:

- Increasing demand for space heating

- Rising need for energy efficient boilers

Major Challenges:

- Economic Fluctuations

- Technological Adaptations

Key Players: Alfa Laval AB, Babcock and Wilcox Enterprises Inc., Bosch Industriekessel GmbH, Cleaver-Brookes, Inc., Harbin Electric Corporation, Hurst Boiler and Welding Inc.

Global Boiler Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 77.43 billion

- 2026 Market Size: USD 83.35 billion

- Projected Market Size: USD 175.07 billion by 2035

- Growth Forecasts: 8.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 17 September, 2025

Boiler Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing demand for space heating - The demand for heating in cold places is driving the demand for boilers. This isn't just because of the cold weather; the way buildings are made plays a major role in this. Keeping a space heated uses a lot of a building's energy, and since the world's total building space is expected to be twice as big by 2070, even more heat will be needed for these spaces. Most of this new space will be in cold areas, meaning an increased need for effective and efficient space heating. This is where boilers come in handy. They offer a strong solution for the increasing need for effective and steady heating.

-

Rising need for energy efficient boilers - The boiler market is on the rise, pushed by a growing need for heating systems that save more energy. This trend comes from a desire to cut costs, protect the environment, and meet government initiatives and rules. The commercial boiler sector is moving towards more energy-saving options to match the increased demand for cost-effective and green heating solutions. High-efficiency boilers, like condensing boilers, are becoming popular in the gas boiler market because they work better and pollute less. There’s a big move in the boiler industry towards green solutions, aiming to cut down on harmful gas emissions and support clean energy technologies.

-

Government initiatives - Government actions are key in guiding the boiler industry's growth. Efforts to draw in foreign investment through quick industrial growth are pushing the industrial boilers market ahead. In Asia Pacific, conducive government rules and low-cost production elements are pulling top makers to grow their plants, which increases the need for industrial boilers. Governments are putting money into industrial heaters to answer the growing call for a steady power supply, a big push for the global boilers market growth. The US Energy Department has set rules for saving energy for water heater makers, which could boost the boiler market by pushing for the making of more energy-saving systems.

Challenges

-

Economic Fluctuations - Fuel prices and economic ups and downs are a significant challenge for the boiler industry. Higher costs from inflation, changing fuel prices, and events like the COVID-19 crisis have the potential to reduce profits for boiler manufacturers. Along with these issues, manufacturers need to maintain and even upgrade the quality of their products to maintain strong footing in the boiler market

-

Technological Adaptations - Meeting evolving needs and demands like the level of steam purity needed across sectors and applications poses a technological challenge for the industry. For example, energy and food-making businesses require very high-quality steam. Boiler producers must build adaptable systems to serve a wide range of customer demands.

Boiler Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.5% |

|

Base Year Market Size (2025) |

USD 77.43 billion |

|

Forecast Year Market Size (2035) |

USD 175.07 billion |

|

Regional Scope |

|

Boiler Market Segmentation:

Fuel Segment Analysis

Biomass segment in the boiler market is expected to register lucrative growth till 2035. This rise comes from strict rules by governments to cut down on emissions and the cost benefits of gas boilers for home heating. The coal segment is likely to stay second to the biomass segment due to the easy access to cheap coal, especially in places with many coal power stations. The market for coal-fired boilers is projected to surge by 11.2% yearly. Key factors pushing growth in the coal area include a higher need for energy, growing industrial activities, and the low cost of coal as a fuel option.

Application Segment Analysis

The power generation sub segment is estimated to gain the largest market share in the year 2035. The rising need for power generation due to urbanization and industrialization help this sector lead the market. Boilers are key in producing power, by turning water into steam which is one of the most significant sources of energy. This steam is powerful enough to then move turbines to make electricity. There is a mix of boilers being used, like those that run on coal, gas, or biomass, based on what kind of fuel is available and what the power plant needs.

Boiler Type Segment Analysis

Steam boilers segment is expected to capture boiler market share of over 42% by 2035. The segment growth can be attributed to their superior efficiency. Supercritical boilers work at higher heat and pressure compared to other types of boilers, leading to better efficiency. Their efficiency rate is around 45-47%. This means they use less fuel and cost less to operate. These boilers, along with others, are key in coal power as well. Looking ahead, it's expected that the subcritical type will still be most common due to more coal power projects, especially in growing countries.

Our in-depth analysis of the boiler market includes the following segments:

|

Fuel |

|

|

Application |

|

|

Boiler Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Boiler Market Regional Analysis:

North America Market Insights

North America region in boiler market is projected to account for around 35% revenue share by 2035. The growth of the market in North America is due to the fast growth in industries, mainly in the U.S., Canada, and Mexico. This along with an increasing number of old people living in the area needing care and a shifting focus on green energy usage by all industries help the North American region maintain its dominance in the boiler industry. The market for home boilers in North America was worth USD 4.2 Billion at the start of 2024 and will likely grow at a rate of 2.51% during the time looked at.

The U.S. leads in this market in the area. Here, the market for gas boilers is expected to grow at a rate of 4.8% from 2023 to 2032. In 2023, the market in the U.S. was about 4 Billion.

In Canada, the boiler industry amounted to USD 1.0bn in 2023. The key reason for the boiler market growth in Canada is the profitable value of value of nonresidential construction. Increasing government and private expenditure on building and fixing homes, along with a growing trend for smart homes, are seen to help the market grow in Canada.

European Market Insights

Europe region is expected to register significant growth till 2035. The market in Europe is set to grow by over 7.89% yearly from 2023 to 2032. This growth is mainly due to the need to cut down on greenhouse gas emissions. The demand for energy-saving boilers has increased because of the energy crisis and high tensions over carbon emissions in the area. The cut in gas supplies from Russia, due to the energy crisis, has lowered natural gas prices, making energy-saving gas boilers more crucial than ever. Also, increased expenditure on eco-friendly building projects is boosting the market for home boilers. Action by governments to reduce greenhouse gas emissions and efforts to support eco-friendly living are making the Europe boiler market grow.

The UK's home boiler market is set to grab over 26.5% of Europe's share by 2035. This rise comes from strict policies and rules by the government and a push for more energy-saving options, including support for condensing boilers.

In Germany, oil and gas boilers lead the market with record numbers. In the past year, 66.8 percent of all new heating units were oil or gas-powered (5.8 percent oil, 61 percent gas) according to reports. Heat pumps had a 24.1 percent share, with biomass systems at 9.1 percent.

Boiler Market Players:

- Alfa Laval AB

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Babcock and Wilcox Enterprises Inc

- Bosch Industriekessel GmbH

- Cleaver-Brookes, Inc.

- Harbin Electric Corporation

- Hurst Boiler and Welding Inc.

- IHI Corporation

- Siemens Energy AG

- WorleyParsons

The global boiler market is fueled by competition between leading companies that compete with each other to bring the best and most effective boiler solutions for different requirements. Some companies specialize in a specific type of boiler production or service, whereas others have more diversified boiler types to offer.

Recent Developments

- Alfa Laval - Alfa Laval is pushing the marine world forward with its new tech. The company now offers methanol-ready Aalborg boiler systems, expanding its eco-friendly fuel solutions. This move marks a big step in the marine field as it's the first time a ship has used a methanol boiler. The Aalborg boiler systems are designed with a sharp focus on cutting down carbon emissions and moving towards cleaner fuel options. Besides working with fuels like low-sulphur options, biofuels, and LNG, they are made to work well with methanol and other low-emission fuels. Alfa Laval's smart "ready boiler" idea sets up a solid base for the future, making it easy to update the burner and boiler pressure part when needed.

- Babcock and Wilcox Enterprises Inc. - Babcock & Wilcox (B&W) (NYSE: BW) has made an announcement that its branch, Babcock & Wilcox Renewable Service A/S (B&W Renewable Service), has secured a deal worth over USD 7 million. This contract is for making three different types of boilers that burn trash and their burning gear at a power plant that turns waste into energy in Southeast Asia.

This deal comes right after the Front-End Engineering Design (FEED) study done by B&W Renewable Service in 2023. The scope of the project includes the provision of new pressure parts, water-cooled wear zones, water soot cleaning equipment, a secondary air system, and associated equipment to boost the plant's steam production capacity and efficiency, while simultaneously reducing emissions. These upgrades aim to make more steam, make the plant work better, and cut down on air pollution. B&W Renewable Service will also help the customer during the building and start-up parts of the project.

- Report ID: 6128

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Boiler Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.