Steam Boiler Market Outlook:

Steam Boiler Market size was valued at USD 17.8 billion in 2025 and is likely to cross USD 25.35 billion by 2035, registering more than 3.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of steam boiler is estimated at USD 18.38 billion.

The steam boiler industry is fostering significantly owing to the expanding industrialization, research and developments, and rising demand for energy. For instance, in July 2024, in partnership with Flogas, researchers at the Net Zero Innovation Institute started testing a novel low-carbon ammonia boiler on-site at Cardiff University. The research aims at exploring new areas of sustainable and greener energy solutions.

Moreover, the increasing penetration of sustainable energy practices and the urgency for more energy-efficient system designs is fueling the growth. For instance, the pledge by the union in Europe to reach net-zero emissions by 2050 is putting a demand to embrace energy-efficient and low-emission steam boiler technology. Thus, it is a dominant factor driving the steam boiler market growth in Europe. In addition, industries are focusing on optimizing their operational costs and cutting down on their environmental footprints. For instance, in May 2023, the Nouryon facility, in Sweden partnered with Adven and installed a new steam boiler using locally sourced forestry industry residual products. The new steam boiler is expected to reduce carbon dioxide (CO2) emissions by 90% by using biofuel in place of liquefied petroleum gas (LPG).

Furthermore, the new technologies in boiler systems focus more on alternative fuel and the integration of smart monitoring systems that meet steam boiler market as well as regulatory demands. Infrastructure development in emerging economies and implementation of clean energy solutions will fuel growth in future years ahead. To meet the diversified needs of various industries such as manufacturing, pharmaceuticals, and oil and gas the need for sustainable, efficient, and cost-effective boiler systems is exponentially booming.

Key Steam Boiler Market Market Insights Summary:

Regional Highlights:

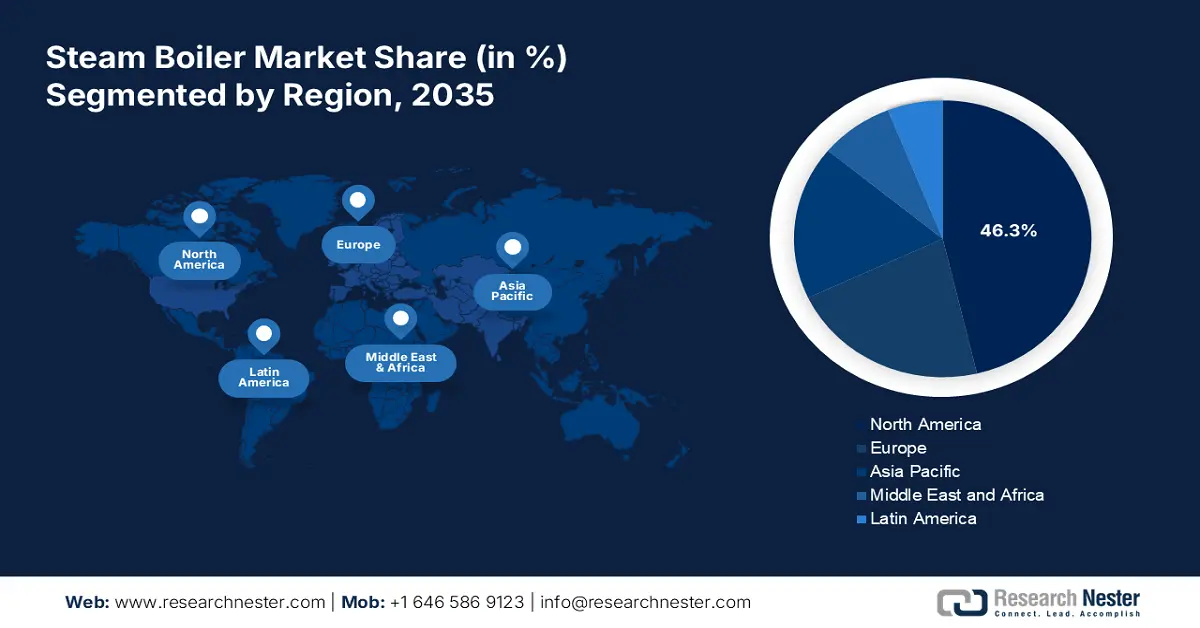

- North America dominates the Steam Boiler Market with a 46.3% share, driven by the development of NOx standards, technological advancements, and a strong infrastructure, ensuring robust growth through 2026–2035.

- The Asia Pacific Steam Boiler Market expects the fastest growth by 2035, driven by the trend of automation and IoT, which aids in identifying energy losses and improving boiler efficiency.

Segment Insights:

- The High-Pressure Boilers segment is expected to secure over 51.1% market share by 2035, propelled by electricity and industrial steam demand in manufacturing and chemical industries.

Key Growth Trends:

- Replacements and retrofitting of older systems

- Increase focus on industrial decarbonization

Major Challenges:

- Competition from alternative technologies

- Fuel supply and cost fluctuations

- Key Players: GE, Bosch, Thermax, Cleaver-Brooks, Byworth Boilers, Forbes Marshall, Parker Boiler..

Global Steam Boiler Market Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 17.8 billion

- 2026 Market Size: USD 18.38 billion

- Projected Market Size: USD 25.35 billion by 2035

- Growth Forecasts: 3.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (46.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 14 August, 2025

Steam Boiler Market Growth Drivers and Challenges:

Growth Drivers

- Replacements and retrofitting of older systems: Most of the industrial facilities are found to operate with aging boilers which are less efficient and more likely to break down. Thus, it allows business organizations to enhance the existing systems with modern technologies such as improved combustion control, advanced heat recovery, and emission-reducing features. For instance, in April 2021, at VA Hospital, steam boilers supplied by Cleaver-Brooks were replaced by new boilers to reduce fuel consumption and render expected efficiency. This demand for advanced, energy-efficient steam boilers to stay ahead in a sustainable and energy-optimal future.

- Increase focus on industrial decarbonization: Growing interest in industrial decarbonization worldwide, wherein all nations have committed towards carbon-emission cuts and achievement of net-zero targets is finding its way into the steam boiler market. The companies are moving toward cleaner fuels such as hydrogen, biomass, and waste heat recovery systems and replacing traditional fossil fuel-depending boilers by complementing their carbon capture technologies. For instance, in June 2023, AtmosZero designed the world's first modular electrified boiler to drop-in replace fossil-fueled industrial boiler systems. This solution has created the most cost-effective, scalable, and secure way to decarbonize steam and electrify the boiler room.

Challenges

- Competition from alternative technologies: Emerging technologies experience rapid development that affects established industries. Companies must be constantly innovative, develop business models, and invest in research and development to remain competitive. Furthermore, steam boiler market fragmentation would result, leading companies to face the challenges of inability to hold a prime position in business for an extended period and reduced margins. The increasing speed of technological change and changing consumer preferences will continually require organizations to be poised and visionary enough to avoid the dangers of these alternative solutions.

- Fuel supply and cost fluctuations: Supply disruptions, geopolitical tensions, or variations in emissions regulations create uncertainty in pricing, challenging predictability for boiler users about the costs of running their boilers. According to this trend toward renewable energies and carbon-reduction obligations, the pressure on traditional fuel-based systems is mounting. The said uncertainties are affecting not only the budget for operations but also making it challenging to plan for long-term investments as well as optimize the efficiency of steam boiler systems.

Steam Boiler Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.6% |

|

Base Year Market Size (2025) |

USD 17.8 billion |

|

Forecast Year Market Size (2035) |

USD 25.35 billion |

|

Regional Scope |

|

Steam Boiler Market Segmentation:

Pressure (High-Pressure Boilers, Low-Pressure Boilers, Medium-Pressure Boilers)

High-pressure boilers segment is expected to hold over 51.1% steam boiler market share by the end of 2035. The major growth drivers of high-pressure boilers are electricity and industrial steam demand as industries such as manufacturing and chemicals, allow for good cycles and productivity in operations. Improvement in material technology has increased performance and factors of safety in high-pressure boilers with greater efficiencies. For instance, in February 2023, TOMRA Food, installed a Babcock Wanson VAP600RR coil-type steam boiler in Dublin, Ireland, to carry out tests and demonstrations for food peeling applications. The VAP600RR is operated at a pressure of 29 bar to generate steam used in the peeling of potatoes and other vegetables.

Furthermore, regulatory drivers to reduce carbon content also have hastened the adoption of high-pressure, efficient steam systems, which support cleaner and more sustainable energy. The new infrastructure upgrade both in developed and emerging markets continues to drive demand for high-pressure boiler systems, which also support improved fuel utilization and integration with renewable energy sources like biomass and solar thermal. These factors, with the overall industrial thrust towards efficient energy use, position high-pressure boilers as the strongest and fastest-growing steam boiler segment.

Fuel (Coal-fired Steam Boiler, Gas-fired Steam Boiler, Electric Steam Boiler, Oil-fired Steam Boiler)

Coal-fired steam boilers gain a significant proportion of the steam boiler market due to the presence of massive coal reserves in various areas and industries requiring a reliable, low-cost method of energy generation. Some of the factors that contribute to the growth of coal-fired boilers include the relatively low cost of coal compared with other fossil fuels and an already existing infrastructure related to the extraction, transportation, and burning of coal. For instance, in April 2023, ZOZEN delivered DZL series high-performance coal-fired steam boilers to the well-known local feed factory AQUA in Kazakhstan, becoming a reliable supplier for the factory and attracting wider attention in the industry.

The coal-fired boilers are thus favored in heavy industries such as cement, steel, and mining, which require large-scale generation of steam, as well as in power generation. This potential to retrofit the existing coal-fired systems with advanced pollution control technologies, such as flue gas desulfurization and particulate removal systems, has made them more environmentally friendly, therefore, the operators are able to ensure cost efficiency while satisfying the increasingly stringent emissions standards. Coal remains a preeminent fuel in developing economies where energy security and affordability supplant decarbonization trends across the globe.

Our in-depth analysis of the steam boiler market includes the following segments:

|

Pressure |

|

|

Type |

|

|

Fuel |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Steam Boiler Market Regional Analysis:

North America Market Statistics

North America steam boiler market is set to capture revenue share of over 46.3% by 2035. The growth is stimulated owing to the NOx standards being developed to be used to avoid or minimize the unwanted effects of NOx gases on the environment. Moreover, in fueling this growth, the infrastructural base of the region and technological advancement play a pivotal role.

The major characteristic of the Canada landscape for the steam boiler market is the strong spurring investment in advanced and energy-efficient steam boiler technologies. For instance, in April 2023, Canada and BC Hydro invested USD 32.7 million into decarbonization projects. This investment will support the decarbonization of the creative energy district energy steam plant where the existing gas boilers will be replaced with new electric steam boilers.

The U.S. landscape is transforming towards a sustainability approach in utilizing environment-friendly steam boilers. For instance, in September 2024, Skyven Technologies, and Western New York Energy (WNYE) announced the commissioning of Skyven Arcturus, the first industrial steam-generating heat pump in the country. Thus, inaugurating a new era toward achieving a greener industrial world. The WNYE Medina facility will abate more than 20,000 metric tons of CO2 annually owing to this industrial decarbonization effort.

Asia Pacific Market Analysis

Asia Pacific is the most rapidly growing region in the steam boiler market, driven by the trend of automation and IoT, which would help boiler operators and attendants quickly identify the possible losses in energy and prescribe concrete measures to address these losses. The energy assistant can even be able to detect critical situations and inspect the condition of components based on their operation mode.

The primary growth driver for the steam boiler market in China is its robustly growing industrialization and increasing energy requirements in industries. The key factor driving its expansion is the country's strong focus on modernizing its industrial base while strictly following environmental regulations to curb pollution. For instance, in October 2023, Pingshan Phase II is a cutting-edge 1.35-GW ultra-supercritical coal-fired boiler achieved a phenomenal net efficiency of 49.37%.

The steam boiler market in India is evolving at a steady pace as it embraces its expanding industrial base. The key players are focusing on innovation to explore sustainable options. For instance, in September 2024, Atlas Copco Specialty Rental launched its revolutionary modular steam rental solutions at the BOILER INDIA 2024 Expo. Consisting of a plug-and-steam design, these modular steam rental solutions offer capacities from 0.6 tons/hour to 8.0 tons/hour. They can be installed and commissioned quickly with minimum downtime and guarantee a consistent supply of steam.

Key Steam Boiler Market Players:

- Bosch

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GE

- Thermax

- Cleaver-Brooks

- Byworth Boilers

- Forbes Marshall

- Parker Boiler

- Fulton Boiler

- Fentech Boilers

The top-notch key players in the steam boiler market with a myriad of competence, skills, and expertise make the landscape of companies innovative and sustaining. The continuous innovation and development assist in catering to the scattered needs in a streamlined manner throughout multiple industries. For instance, In May 2022, Fulton launched the classic steam boiler with a long-lasting vertical design and versatile fuel options to meet the rapid steam needs of diverse industries. Built on robust technology, it embodies efficient, reliable operation, exempting costly SBG01 testing.

Here’s the list of some key players:

Recent Developments

- In September 2024, Thermax, demonstrated innovative clean energy, air, and water technologies at Boiler India 2024. It introduced the new Greenpac biograte boiler, Thermeon 2.0, with advanced biogas and carbon capture solutions in the heating range for the energy transition.

- In March 2024, Volta Aluminium Company (VALCO) inaugurated a state-of-the-art steam boiler to improve the factory's power generation capabilities. This new machinery is set to increase the production of carbon anodes to make aluminum.

- In March 2022, Vyonas inaugurated a state-of-the-art hydrogen-fired steam boiler system at its facility in Belgium. This boiler is aimed at reducing Vynova's CO2 emissions by 10,000 tonnes annually.

- Report ID: 6679

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Steam Boiler Market Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.